Surety bond as a substitute of automobile insurance coverage is an intriguing risk, opening a brand new avenue for car homeowners. It is not a easy swap, although, and understanding the specifics is vital. This exploration dives into the elements that make surety bonds a possible various, contrasting them with conventional automobile insurance coverage. From protection variations to price implications and authorized issues, we’ll unravel the intricacies of this monetary resolution.

This complete information offers a transparent overview of the standards to think about when exploring surety bonds as a substitute for automobile insurance coverage. We’ll study particular conditions the place surety bonds may be a greater match, evaluating and contrasting the 2 choices to equip you with the required information for knowledgeable decision-making.

Introduction to Surety Bonds and Automobile Insurance coverage Alternate options

Salam, semoga hari ini baik-baik saja. Kita akan membahas alternatif jaminan kendaraan selain asuransi mobil, yaitu jaminan fidusia. Memahami perbedaan dan kondisi yang tepat untuk menggunakan jaminan fidusia akan membantu kita mengambil keputusan yang tepat. Mari kita mulai.Surety bonds, or jaminan fidusia, are a kind of contract the place a 3rd celebration, often called a surety, ensures the efficiency of an obligation by one other celebration.

In essence, the surety guarantees to satisfy the obligations if the principal (the particular person needing the surety) fails to take action. That is typically used as a type of assurance, significantly in monetary transactions or authorized issues. This idea is usually utilized to car possession.

Function and Perform of Automobile Insurance coverage

Automobile insurance coverage is designed to guard people and companies from monetary losses arising from vehicle-related incidents. This contains damages to the car, accidents to others, and legal responsibility for property injury. It offers a security web for unexpected circumstances, reminiscent of accidents or vandalism. The perform is to supply a monetary cushion in case of accidents, thefts, or damages.

Circumstances for Surety Bonds as Automobile Insurance coverage Alternate options

Surety bonds will be thought-about as an alternative choice to automobile insurance coverage in particular circumstances. For instance, when the price of automobile insurance coverage is prohibitive or when the protection supplied by automobile insurance coverage doesn’t absolutely handle particular wants. This would possibly apply to companies working with a number of autos or these working in high-risk areas.

Frequent Sorts of Surety Bonds for Car Operation

A number of forms of surety bonds are related to car operation. One widespread kind is a efficiency bond, which ensures the completion of a venture or contract associated to car upkeep or operation. One other kind is a cost bond, which assures cost to subcontractors or suppliers concerned in vehicle-related work. These are essential for making certain transparency and adherence to contracts in industrial car operations.

Examples of Appropriate Alternate options

Surety bonds may be an acceptable various in conditions the place a enterprise must display monetary accountability for vehicle-related actions. For instance, a trucking firm would possibly use a efficiency bond to ensure the well timed supply of products. Equally, a fleet proprietor would possibly use a surety bond to make sure compliance with regulatory necessities.

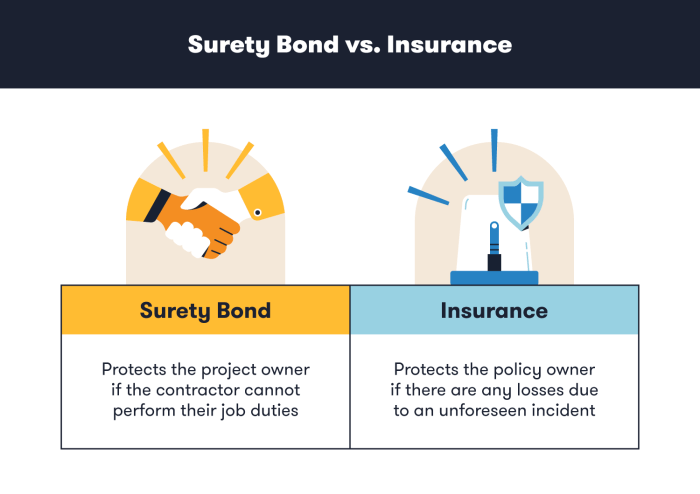

Comparability of Automobile Insurance coverage and Surety Bonds

| Characteristic | Automobile Insurance coverage | Surety Bond |

|---|---|---|

| Protection | Broader protection, together with legal responsibility, collision, complete, and uninsured/underinsured motorist protection. | Focuses on particular obligations, reminiscent of completion of a venture, cost of money owed, or compliance with laws. Protection is tailor-made to the precise contract. |

| Price | Premiums based mostly on elements like driver historical past, car kind, and placement. Premiums will be substantial. | Price depends upon the quantity of the bond and the surety’s evaluation of danger. Typically, prices will be extra predictable, doubtlessly decrease than automobile insurance coverage for particular conditions. |

| Utility Course of | Utility with an insurance coverage firm, submission of paperwork, and ready for approval. | Utility with a surety firm, submission of economic and operational info, and analysis of danger. |

Protection Variations and Similarities

Baiklah, mari kita bahas lebih lanjut tentang perbedaan dan kesamaan cakupan antara asuransi mobil dan surety bond. Kita akan melihat jenis-jenis perlindungan yang ditawarkan masing-masing, dan bagaimana mereka membedakan diri dalam konteks operasi kendaraan. Semoga penjelasan ini membantu Anda memahami mana yang paling tepat untuk kebutuhan Anda.Surety bonds, berbeda dengan asuransi mobil, umumnya tidak dirancang untuk melindungi individu dalam setiap kejadian kecelakaan.

Mereka lebih fokus pada jaminan atas kewajiban finansial yang mungkin timbul dari suatu kontrak atau perjanjian. Namun, dalam konteks operasi kendaraan, surety bond bisa memberikan perlindungan tertentu, yang terkadang berbeda dengan cakupan asuransi mobil.

Sorts of Automobile Insurance coverage Protection

Asuransi mobil biasanya menawarkan berbagai jenis perlindungan, seperti perlindungan terhadap kerusakan materiil kendaraan Anda sendiri (Complete dan Collision), perlindungan terhadap kerugian yang Anda sebabkan pada pihak lain (Bodily Damage Legal responsibility dan Property Injury Legal responsibility), dan perlindungan terhadap kerusakan yang Anda alami karena kesalahan pihak lain (Uninsured/Underinsured Motorist). Ketiga jenis ini merupakan bagian penting dari proteksi finansial.

Sorts of Surety Bond Protection Related to Car Operation

Surety bond, dalam konteks operasional kendaraan, biasanya fokus pada perlindungan terhadap tanggung jawab finansial yang timbul dari kontrak tertentu. Contohnya, jika Anda memiliki kontrak untuk mengangkut barang menggunakan kendaraan Anda, surety bond bisa melindungi pihak yang memesan jasa transportasi Anda dari kerugian finansial jika terjadi pelanggaran kontrak, seperti keterlambatan pengiriman atau kerusakan barang. Penting untuk diingat bahwa cakupan ini lebih spesifik daripada cakupan asuransi mobil yang lebih luas.

Comparability of Protection, Surety bond as a substitute of automobile insurance coverage

Perbedaan utama antara asuransi mobil dan surety bond terletak pada fokus perlindungan. Asuransi mobil lebih luas, mencakup beragam risiko yang terkait dengan operasi kendaraan, seperti kecelakaan, kerusakan materiil, dan tanggung jawab hukum. Surety bond, di sisi lain, lebih terfokus pada kewajiban finansial yang timbul dari kontrak atau perjanjian yang terkait dengan penggunaan kendaraan, seperti kontrak transportasi.

Conditions The place Surety Bonds Provide Broader Protection

Surety bond dapat menawarkan cakupan yang lebih luas dalam situasi tertentu, terutama yang berkaitan dengan kontrak atau perjanjian. Misalnya, jika Anda memiliki kontrak khusus untuk mengangkut barang berharga, surety bond dapat melindungi pihak lain dari kerugian finansial jika terjadi kerusakan atau keterlambatan. Hal ini mungkin tidak dijamin oleh asuransi mobil.

Conditions The place Surety Bonds Provide Narrower Protection

Surety bond tidak mencakup hal-hal yang biasa ditanggung oleh asuransi mobil, seperti kecelakaan yang tidak terkait dengan kontrak. Dalam kasus kecelakaan lalu lintas biasa, surety bond tidak memberikan perlindungan terhadap cedera pribadi atau kerusakan properti yang diakibatkan oleh kecelakaan.

Conditions The place Surety Bonds Could Not Cowl the Identical Liabilities as Automobile Insurance coverage

Surety bond tidak dirancang untuk mencakup tanggung jawab yang muncul dari pelanggaran hukum yang tidak terkait dengan kontrak. Surety bond tidak dapat digunakan sebagai pengganti asuransi mobil untuk mengklaim ganti rugi atas kecelakaan atau kerusakan akibat operasi kendaraan secara umum.

Desk: Protection Comparability

| Facet | Automobile Insurance coverage | Surety Bond |

|---|---|---|

| Protection Focus | Kerusakan materiil, cedera pribadi, dan tanggung jawab hukum dalam operasi kendaraan. | Tanggung jawab finansial yang timbul dari kontrak atau perjanjian yang terkait dengan penggunaan kendaraan. |

| Contoh Situasi Tertanggung | Kecelakaan lalu lintas, kerusakan mobil akibat kecelakaan, cedera pribadi, kerusakan properti. | Keterlambatan pengiriman barang, kerusakan barang yang diangkut, pelanggaran kontrak transportasi. |

| Contoh Situasi Tidak Tertanggung | Tidak ada | Kecelakaan lalu lintas biasa, tanggung jawab hukum akibat pelanggaran lalu lintas. |

Price and Monetary Implications

Baiklah, mari kita bahas lebih lanjut mengenai implikasi finansial dari memilih surety bond sebagai alternatif asuransi kendaraan. Memilih antara asuransi mobil dan surety bond tidak hanya soal perlindungan, tapi juga pertimbangan biaya dan dampak jangka panjang. Kita akan melihat struktur biaya masing-masing, bagaimana biaya dihitung, dan perbandingannya dalam berbagai skenario.Surety bond dan asuransi mobil, meskipun keduanya menawarkan perlindungan, memiliki mekanisme biaya yang berbeda.

Memahami seluk beluk ini akan membantu kita membuat keputusan yang tepat sesuai dengan kebutuhan dan situasi keuangan kita.

Typical Price Construction of Automobile Insurance coverage Premiums

Premi asuransi mobil dipengaruhi oleh banyak faktor, termasuk riwayat pengemudi, jenis kendaraan, lokasi tinggal, dan jenis perlindungan yang dipilih. Beberapa faktor utama yang memengaruhi biaya adalah:

- Riwayat pengemudi: Premi lebih tinggi untuk pengemudi dengan catatan kecelakaan atau pelanggaran lalu lintas yang buruk. Sejarah bebas kecelakaan memberikan diskon yang signifikan.

- Jenis kendaraan: Mobil sport atau kendaraan mewah biasanya memiliki premi yang lebih tinggi dibandingkan mobil keluarga atau sedan standar. Jenis kendaraan juga berpengaruh pada potensi kerugian jika terjadi kecelakaan.

- Lokasi tinggal: Daerah dengan tingkat kejahatan atau kecelakaan yang tinggi cenderung memiliki premi asuransi yang lebih tinggi.

- Jenis perlindungan: Perlindungan yang lebih luas, seperti perlindungan kerusakan complete atau perlindungan kecelakaan pribadi, akan meningkatkan premi.

- Sejarah klaim: Semakin banyak klaim yang diajukan, semakin tinggi premi asuransi akan menjadi.

Surety Bond Premium Willpower

Premi surety bond ditentukan berdasarkan beberapa faktor yang berbeda dari asuransi mobil. Faktor-faktor kunci yang menentukan biaya surety bond meliputi:

- Jenis pekerjaan: Profesional yang memiliki risiko tinggi, seperti kontraktor atau pengemudi truk, mungkin memiliki premi yang lebih tinggi.

- Nilai obligasi: Besarnya obligasi yang diperlukan memengaruhi premi yang dibayarkan. Obligasi yang lebih besar berarti premi yang lebih tinggi.

- Riwayat pembayaran: Riwayat pembayaran yang konsisten dan baik dapat memengaruhi premi.

- Sejarah dan reputasi perusahaan: Reputasi perusahaan yang baik dapat memberikan diskon atau premi yang lebih rendah.

- Nilai risiko yang ditanggung: Faktor risiko yang terkait dengan pekerjaan atau proyek yang dilindungi akan menentukan premi.

Price Comparability in Varied Situations

Untuk membandingkan biaya, mari kita lihat beberapa skenario. Meskipun tidak ada angka pasti, perbandingan ini akan memberikan gambaran umum.

| Situation | Automobile Insurance coverage Premium (estimasi) | Surety Bond Premium (estimasi) |

|---|---|---|

| Pengemudi baru, kendaraan standar, daerah dengan tingkat kecelakaan sedang | Rp 2.000.000 – Rp 3.000.000 per tahun | Rp 500.000 – Rp 1.000.000 per tahun |

| Pengemudi berpengalaman, kendaraan mewah, daerah dengan tingkat kecelakaan rendah | Rp 1.000.000 – Rp 1.500.000 per tahun | Rp 250.000 – Rp 500.000 per tahun |

| Kontraktor dengan proyek besar, obligasi tinggi | Tidak berlaku | Rp 2.000.000 – Rp 5.000.000 per tahun |

Components Influencing Price

Seperti yang sudah dijelaskan sebelumnya, banyak faktor yang memengaruhi biaya asuransi mobil dan surety bond. Faktor-faktor ini saling terkait dan memengaruhi biaya secara kompleks. Perlu diingat bahwa perkiraan ini dapat bervariasi berdasarkan kondisi spesifik.

Lengthy-Time period Monetary Implications

Memilih surety bond sebagai pengganti asuransi mobil bisa memiliki dampak finansial jangka panjang. Jika Anda memilih surety bond, pastikan Anda memahami risiko dan tanggung jawab yang akan ditimbulkan. Hal ini penting untuk memastikan kestabilan finansial jangka panjang.

Authorized and Regulatory Concerns

Sustaining street security and making certain monetary accountability for accidents are basic facets of driving. Completely different jurisdictions have particular laws relating to car insurance coverage, and understanding these nuances is essential for making knowledgeable selections. Understanding the authorized and regulatory landscapes surrounding surety bonds as an alternative choice to automobile insurance coverage is equally vital.The authorized frameworks governing automobile insurance coverage and surety bonds range considerably throughout completely different areas.

These variations dictate the necessities, implications, and liabilities related to every choice. This part will element the authorized necessities for automobile insurance coverage, the implications of utilizing a surety bond, and the regulatory our bodies concerned.

Authorized Necessities for Automobile Insurance coverage

Varied jurisdictions have established obligatory automobile insurance coverage necessities to guard people and different street customers. Failure to adjust to these necessities typically results in penalties, together with fines and suspension of driving privileges. The precise necessities, reminiscent of minimal protection limits and forms of protection, differ based mostly on the jurisdiction.

- Many states mandate legal responsibility insurance coverage, masking damages to others in case of an accident. This safety is crucial to make sure that victims of accidents can recuperate monetary compensation for his or her losses. Examples embrace property injury and private damage.

- Some states require uninsured/underinsured motorist protection, safeguarding people towards accidents attributable to drivers with out satisfactory insurance coverage.

- Uninsured/underinsured motorist protection gives a security web, defending victims from monetary hardship when an accident entails a driver missing ample protection.

Authorized Implications of Utilizing a Surety Bond

Using a surety bond as a substitute of automobile insurance coverage carries authorized implications. It is vital to know {that a} surety bond acts as a monetary assure, however it would not all the time cowl all facets of a car accident. The bond usually covers the obligations specified within the bond settlement.

- A surety bond’s scope of protection might not align with the excellent safety afforded by automobile insurance coverage. This distinction can result in monetary liabilities exceeding the bond’s protection.

- Jurisdictions might have particular legal guidelines relating to the acceptance of surety bonds as an alternative choice to automobile insurance coverage. Some jurisdictions won’t allow it in any respect, or have strict limitations on its use.

- Understanding the precise phrases and circumstances of the surety bond is essential. The protection limits and exclusions should align with the authorized necessities of the jurisdiction.

Regulatory Our bodies

Completely different governmental businesses are answerable for regulating automobile insurance coverage and surety bonds. These our bodies guarantee compliance with laws and defend the pursuits of policyholders and the general public.

- State Departments of Insurance coverage are sometimes answerable for overseeing automobile insurance coverage insurance policies, making certain they meet the required requirements. Additionally they monitor insurers to keep up monetary stability and client safety.

- Regulatory our bodies overseeing surety bonds might range by jurisdiction. Some states have particular departments or businesses devoted to surety bond oversight. They typically monitor bond issuers and implement bond necessities.

Potential Authorized Liabilities and Duties

Utilizing a surety bond as an alternative choice to automobile insurance coverage carries particular authorized liabilities and obligations. An intensive understanding of those implications is crucial earlier than making such a call.

- The legal responsibility for damages exceeding the surety bond’s protection falls on the bondholder. This could result in important monetary implications if the damages exceed the bond quantity.

- A surety bond would not routinely fulfill all authorized necessities for car operation in a selected jurisdiction. Failure to fulfill these necessities can lead to penalties or different authorized penalties.

Comparability of Authorized and Regulatory Frameworks

Evaluating the authorized and regulatory frameworks for automobile insurance coverage and surety bonds requires analyzing the precise necessities of various jurisdictions. Understanding the variations in protection, legal responsibility, and regulatory oversight is significant.

Desk: Authorized Necessities for Automobile Insurance coverage and Surety Bonds in Completely different Jurisdictions

A desk showcasing the comparability could be in depth and require important analysis to incorporate all jurisdictions. The next instance offers a primary construction. Additional particulars would necessitate a particular jurisdiction focus.

| Jurisdiction | Automobile Insurance coverage Necessities | Surety Bond Necessities (if permitted) |

|---|---|---|

| Instance State 1 | Legal responsibility, Uninsured/Underinsured Motorist Protection | Restricted acceptance, particular circumstances |

| Instance State 2 | Legal responsibility, Collision, Complete | No acceptance instead |

| Instance State 3 | Legal responsibility, Property Injury | Particular protection necessities, restricted use instances |

Utility and Declare Processes

Baiklah, mari kita bahas lebih lanjut mengenai proses aplikasi dan klaim untuk asuransi mobil dan surety bond. Memahami perbedaan dalam proses ini sangat penting untuk memilih opsi yang tepat untuk kebutuhan Anda.Masing-masing metode memiliki alur kerja yang unik, mulai dari pengajuan aplikasi hingga penanganan klaim. Pemahaman yang jelas tentang langkah-langkah ini akan membantu Anda dalam membuat keputusan yang bijak.

Acquiring a Automobile Insurance coverage Coverage

Proses mendapatkan polis asuransi mobil biasanya melibatkan beberapa langkah. Pertama, Anda perlu memilih perusahaan asuransi dan produk yang sesuai dengan kebutuhan dan anggaran Anda. Kemudian, Anda perlu mengisi aplikasi dengan informasi pribadi dan element kendaraan. Selanjutnya, perusahaan asuransi akan melakukan penilaian risiko berdasarkan informasi yang Anda berikan. Setelah disetujui, Anda akan menerima polis asuransi dan informasi mengenai premi serta cakupan perlindungan.

- Memilih perusahaan asuransi dan produk yang sesuai.

- Mengisi aplikasi dengan element kendaraan dan pribadi.

- Penilaian risiko oleh perusahaan asuransi.

- Penerimaan polis dan informasi premi serta cakupan.

Acquiring a Surety Bond

Proses mendapatkan surety bond melibatkan langkah-langkah yang berbeda dari asuransi mobil. Anda perlu menemukan penjamin yang kredibel dan memenuhi persyaratan mereka. Ini biasanya mencakup penyediaan dokumen yang mendukung, seperti pernyataan keuangan dan informasi proyek. Setelah penjamin menyetujui aplikasi Anda, surety bond akan diterbitkan dan Anda akan menerima salinannya.

- Mencari penjamin surety yang kredibel.

- Memenuhi persyaratan penjamin, seperti dokumen pendukung.

- Pengesahan aplikasi oleh penjamin.

- Penerbitan dan penerimaan surety bond.

Submitting a Declare below a Surety Bond

Ketika terjadi peristiwa yang memicu klaim surety bond, seperti kegagalan memenuhi kewajiban kontrak, Anda perlu mengumpulkan bukti yang mendukung klaim Anda. Dokumen-dokumen ini akan diteliti oleh penjamin untuk memastikan kelayakan klaim. Setelah penjamin menyetujui klaim, proses pembayaran akan dilakukan sesuai dengan ketentuan yang tercantum dalam surety bond.

- Pengumpulan bukti yang mendukung klaim.

- Penilaian klaim oleh penjamin.

- Pengesahan klaim oleh penjamin.

- Proses pembayaran sesuai ketentuan.

Evaluating and Contrasting Declare Processes

Perbedaan utama antara proses klaim asuransi mobil dan surety bond terletak pada jenis peristiwa yang diklaim dan proses penilaiannya. Asuransi mobil menangani peristiwa yang melibatkan kerusakan fisik kendaraan atau cedera pribadi, sedangkan surety bond berfokus pada kegagalan memenuhi kewajiban kontrak. Proses penilaian untuk surety bond lebih kompleks dan berfokus pada bukti-bukti terkait kegagalan tersebut.

Situations for Rejecting a Declare below a Surety Bond

Penjamin dapat menolak klaim surety bond jika terdapat pelanggaran ketentuan dalam kontrak atau jika bukti yang diajukan tidak memadai. Contohnya, jika pelanggaran kontrak terjadi karena kesalahan yang disengaja, klaim dapat ditolak. Hal ini berbeda dengan asuransi mobil, di mana penolakan klaim biasanya terkait dengan penyebab kecelakaan atau kerusakan yang tidak tercakup dalam polis.

Desk Illustrating Declare Course of

Berikut ini tabel yang membandingkan langkah-langkah dalam proses klaim untuk asuransi mobil dan surety bond:

| Langkah | Asuransi Mobil | Surety Bond |

|---|---|---|

| Pengajuan Klaim | Melaporkan kecelakaan atau kerusakan ke perusahaan asuransi. | Melaporkan kegagalan memenuhi kewajiban kontrak ke penjamin. |

| Pengumpulan Bukti | Foto kerusakan, laporan polisi, dan dokumen terkait. | Dokumen kontrak, bukti kegagalan, dan bukti kerugian. |

| Penilaian Klaim | Penilaian kerusakan dan kepatuhan terhadap polis. | Penilaian kegagalan dan kepatuhan terhadap kontrak. |

| Keputusan | Disetujui atau ditolak berdasarkan penilaian. | Disetujui atau ditolak berdasarkan penilaian. |

| Proses Pembayaran | Pembayaran sesuai dengan cakupan polis. | Pembayaran sesuai dengan ketentuan surety bond. |

Particular Use Instances and Examples

Surety bonds, a kind of economic assure, provide a novel various to conventional automobile insurance coverage, significantly in specialised conditions. Understanding the distinct benefits and downsides is essential for making an knowledgeable resolution. This part delves into varied situations the place surety bonds may be a extra appropriate alternative, exploring the industries and professions the place they’re generally used.Understanding when a surety bond is a greater match than automobile insurance coverage requires cautious consideration of the precise wants and dangers concerned.

Components like the character of the work, the potential for monetary loss, and the regulatory surroundings play important roles in figuring out essentially the most applicable protection.

Conditions The place Surety Bonds Are Extra Appropriate Than Automobile Insurance coverage

Selecting between surety bonds and automobile insurance coverage depends upon the context. As an illustration, in industries with excessive monetary danger or specialised transportation wants, surety bonds typically present extra complete protection.

- Building Contractors: Building firms regularly make the most of surety bonds to ensure their contractual obligations, reminiscent of well timed venture completion and adherence to specs. Automobile insurance coverage, whereas vital for private autos, would not handle the monetary liabilities inherent in large-scale initiatives.

- Authorities Contractors: Companies working for presidency businesses typically require surety bonds to display their monetary stability and skill to satisfy the phrases of contracts. These bonds mitigate the chance of default or non-compliance, a priority circuitously addressed by automobile insurance coverage.

- Transportation Corporations (Specialised): Corporations transporting hazardous supplies or high-value items usually want surety bonds to guard towards potential accidents or injury. Automobile insurance coverage typically would not cowl the excellent dangers related to such specialised transport.

- Actual Property Brokers/Builders: In sure actual property transactions, surety bonds may be required to make sure that builders or brokers fulfill their contractual commitments. These commitments are past the scope of typical automobile insurance coverage protection.

Industries Generally Utilizing Surety Bonds As an alternative of Automobile Insurance coverage

Surety bonds are a prevalent type of safety in varied industries. Their utility typically stems from the distinctive nature of the enterprise actions and the potential monetary publicity.

- Building: Building firms typically want surety bonds to ensure venture completion, cost to subcontractors, and adherence to contract phrases. The substantial monetary danger related to development initiatives makes surety bonds a essential ingredient of their operations.

- Authorities contracting: Authorities businesses demand surety bonds to make sure contractors’ potential to satisfy their obligations. The stringent regulatory surroundings necessitates this type of monetary assurance.

- Transportation: Companies transporting items, significantly these involving hazardous supplies, typically require surety bonds to guard towards potential legal responsibility arising from accidents or damages. The excessive danger inherent in these operations makes surety bonds an important security web.

Situations The place Utilizing a Surety Bond As an alternative of Automobile Insurance coverage Would possibly Be Riskier

Whereas surety bonds present various safety, they don’t seem to be all the time the best choice. The choice depends upon the precise circumstances and potential dangers.

- Private Legal responsibility: Surety bonds primarily handle enterprise liabilities. If a enterprise proprietor makes use of a surety bond as a substitute of automobile insurance coverage for private autos, their private property could also be in danger in case of accidents involving these autos.

- Restricted Protection: Surety bonds won’t cowl all forms of private legal responsibility, reminiscent of accidents sustained in a car accident. Automobile insurance coverage, in distinction, offers a broader scope of safety.

- Lack of Consciousness: Not absolutely understanding the circumstances and limitations of a surety bond may lead to surprising monetary implications. A complete understanding of the bond’s phrases is essential for minimizing dangers.

Case Research: A Building Firm

A development firm, “Dependable Builders,” was awarded a contract to construct a bridge. The contract required a efficiency bond, making certain the venture’s completion. Whereas automobile insurance coverage was in place for firm autos, a surety bond particularly assured the venture’s monetary accountability, making certain that Dependable Builders would full the venture and pay subcontractors, thereby lowering potential monetary losses for the shopper.

Desk: Particular Use Instances The place Surety Bonds Could Be Extra Appropriate

| Use Case | Cause for Surety Bond Desire |

|---|---|

| Building Initiatives | Ensures venture completion and cost to subcontractors. |

| Authorities Contracts | Ensures compliance with contract phrases and monetary stability. |

| Transportation of Hazardous Supplies | Mitigates potential legal responsibility in case of accidents. |

| Actual Property Transactions | Ensures developer/agent compliance with contractual obligations. |

Concerns for Completely different Car Sorts

Selecting between surety bonds and automobile insurance coverage to your car relies upon closely on the kind of car you personal. Understanding the nuances of every kind, from a easy private automobile to a industrial truck, is essential for making the fitting alternative. This part delves into the distinctive issues for varied car varieties, offering a transparent image of which choice is extra appropriate.

Influence of Car Kind on Surety Bond Applicability

The applicability of surety bonds versus normal automobile insurance coverage varies considerably based mostly on the car’s goal and traits. Business autos, for instance, typically require completely different protections than private autos. Basic automobiles, with their historic worth and potential for restoration, additionally current distinctive issues.

- Business Automobiles: Business autos, reminiscent of vehicles, supply vans, and buses, regularly require surety bonds to cowl particular obligations. These bonds usually assure the car proprietor’s potential to satisfy contractual agreements, reminiscent of these associated to freight transport or development initiatives. Automobile insurance coverage typically doesn’t handle these contractual liabilities. As an illustration, a trucking firm hauling items throughout state traces would possibly want a bond to make sure compliance with laws and to ensure the security of the cargo and public.

A surety bond, on this case, serves as a type of monetary assurance for the security of the products and compliance with all related laws.

- Basic Vehicles: Basic automobiles typically necessitate a distinct strategy in comparison with fashionable autos. Whereas automobile insurance coverage can cowl injury, a surety bond won’t be essential for traditional liabilities. Nevertheless, if the traditional automobile is used for industrial functions, reminiscent of in parades or exhibitions, a surety bond may be wanted to cowl any potential liabilities related to these actions.

The price of a surety bond for a traditional automobile is mostly decrease than for a industrial truck.

- Leisure Automobiles (RVs): RVs, like motorhomes or campers, can fall below both surety bonds or automobile insurance coverage, relying on their use. If used solely for private journey, normal automobile insurance coverage might suffice. Nevertheless, if the RV is employed for industrial functions, reminiscent of offering excursions or leases, a surety bond could also be essential to cowl potential liabilities.

Particular Car Options Affecting Protection and Price

Particular car options play an important function in figuring out the price and protection of each surety bonds and automobile insurance coverage. Options like engine kind, age, and mileage instantly influence the premium. Equally, the kind of cargo transported (if relevant) in a industrial car can have an effect on surety bond prices.

- Engine Kind: The kind of engine in a car can affect insurance coverage premiums. As an illustration, high-performance engines would possibly include greater insurance coverage prices, whereas surety bonds will not be affected by the engine kind. That is true for each normal automobile insurance coverage and surety bonds.

- Car Age and Mileage: Older or high-mileage autos usually have greater restore prices, doubtlessly leading to elevated insurance coverage premiums. Surety bonds will not be instantly impacted by these elements.

- Cargo Kind (Business Automobiles): The kind of cargo transported in a industrial car considerably impacts the required surety bond quantity. Transporting hazardous supplies necessitates a better bond quantity to cowl potential environmental injury or damage.

Comparability Desk: Surety Bonds vs. Automobile Insurance coverage for Completely different Car Sorts

This desk summarizes the suitability of surety bonds and automobile insurance coverage for varied car varieties.

| Car Kind | Surety Bond Suitability | Automobile Insurance coverage Suitability |

|---|---|---|

| Private Vehicles | Typically not required | Extremely appropriate |

| Business Vehicles | Usually required for contractual obligations and regulatory compliance | Appropriate for damages, however not for contractual liabilities |

| Basic Vehicles | Could also be required for industrial use | Appropriate for damages, however not for industrial use liabilities |

| RVs | Could also be required for industrial use | Appropriate for damages, however not for industrial use liabilities |

Closing Notes: Surety Bond As an alternative Of Automobile Insurance coverage

Finally, the selection between surety bond and automobile insurance coverage depends upon particular person circumstances. This exploration has highlighted the potential benefits and downsides of every, permitting you to weigh the elements related to your state of affairs. By understanding the protection, price, authorized implications, and declare processes, you may confidently select the choice greatest suited to your wants. Bear in mind, thorough analysis and session with professionals are important for making the fitting resolution.

High FAQs

What are the standard causes somebody would possibly take into account a surety bond as a substitute of automobile insurance coverage?

Some people or companies would possibly discover surety bonds extra appropriate for particular circumstances, reminiscent of specialised autos, distinctive operational wants, or decrease legal responsibility exposures. They might even be drawn to the doubtless decrease premiums.

Can a surety bond absolutely change all facets of automobile insurance coverage protection?

No, surety bonds usually don’t cowl all of the liabilities that automobile insurance coverage insurance policies do. Their focus typically lies on particular obligations, and there could also be areas the place automobile insurance coverage offers broader safety.

How do I decide if a surety bond is the fitting alternative for my car kind?

Think about the precise use and nature of your car. Business autos, for example, would possibly necessitate a surety bond for sure facets of operation. Consulting with an insurance coverage skilled is extremely advisable for customized steering.

What are some examples of conditions the place surety bonds may be a greater various than automobile insurance coverage?

Conditions like specialised transportation contracts, skilled legal responsibility exposures, or car operations with explicit authorized necessities may make surety bonds extra applicable. Seek the advice of with knowledgeable for particular recommendation tailor-made to your circumstances.