Ought to I purchase hole insurance coverage on a used automobile? This significant query arises for a lot of potential used automobile consumers. Understanding the nuances of normal used automobile insurance coverage, the potential dangers related to proudly owning a used automobile, and the worth proposition of hole insurance coverage is essential to creating an knowledgeable determination. This information offers a complete overview, exploring numerous components that can assist you decide if hole insurance coverage is correct in your state of affairs.

Normal used automobile insurance coverage usually covers harm and theft, however usually has limitations. Hole insurance coverage steps in to bridge the monetary hole between the automobile’s worth and what you owe on the mortgage. By assessing the dangers, the worth of hole insurance coverage, and the influencing components, you can also make a well-reasoned determination.

Understanding Used Automobile Insurance coverage Fundamentals

Used automobile insurance coverage, like another type of auto insurance coverage, protects you financially if one thing goes incorrect. It is a essential part of accountable automobile possession, safeguarding your funding and your private legal responsibility. Understanding the usual protection, exclusions, and declare processes is significant for making knowledgeable selections.

Normal Used Automobile Insurance coverage Protection

Normal used automobile insurance coverage insurance policies usually cowl damages to your automobile brought on by accidents or different occasions, reminiscent of theft, vandalism, or weather-related harm. The particular protection offered relies on the coverage and the chosen add-ons. It is necessary to completely evaluation the coverage particulars to grasp the scope of your safety.

Exclusions and Limitations

Insurance coverage insurance policies usually have exclusions and limitations. These are particular circumstances or conditions that the coverage doesn’t cowl. Widespread exclusions may embody pre-existing harm, put on and tear, harm from regular use, or harm induced deliberately by the policyholder. Understanding these exclusions helps keep away from disappointment when making a declare.

Position of Deductibles in Claims

Deductibles play a big position in used automobile insurance coverage claims. A deductible is a predetermined sum of money that the policyholder should pay out-of-pocket earlier than the insurance coverage firm steps in to cowl the remaining prices. This quantity varies primarily based on the coverage and the chosen protection stage. The next deductible usually leads to decrease premiums. For instance, a $500 deductible means the policyholder pays the primary $500 of any restore or alternative price, and the insurance coverage firm pays the remaining.

Comparability of Protection Varieties

| Protection Sort | Description | Instance |

|---|---|---|

| Legal responsibility | Covers damages you trigger to different individuals’s property or accidents to different individuals. It doesn’t cowl your individual automobile’s harm. | Should you crash into one other automobile, legal responsibility insurance coverage would cowl the damages to the opposite automobile and any accidents to the opposite driver. |

| Complete | Covers damages to your automobile brought on by occasions not involving collisions, reminiscent of vandalism, fireplace, hail, theft, or climate occasions. | In case your automobile is stolen or broken by a storm, complete insurance coverage would cowl the damages. |

| Collision | Covers damages to your automobile in a collision, no matter who’s at fault. | In case you are concerned in a automobile accident, collision insurance coverage would cowl the damages to your automobile, even when you weren’t at fault. |

Understanding the nuances of every protection kind is crucial to choosing the proper coverage in your wants. Totally different circumstances necessitate totally different protection ranges.

Evaluating the Dangers of Proudly owning a Used Automobile

Shopping for a used automobile could be a sensible monetary transfer, however it’s important to grasp the potential dangers. These dangers aren’t simply concerning the automobile’s situation; in addition they contain the monetary repercussions of sudden occasions. Realizing these dangers empowers you to make knowledgeable selections about insurance coverage, upkeep, and general possession.

Elements Rising the Danger of Injury or Theft

Used automobiles, not like new ones, usually have a historical past of use. This historical past can considerably affect the probability of harm or theft. Elements reminiscent of earlier accidents, poor upkeep, and even the automobile’s mannequin and 12 months can have an effect on its vulnerability. For example, older fashions could be extra vulnerable to mechanical failures resulting in accidents.

- Prior Accidents: A automobile with a historical past of accidents, even minor ones, might have hidden structural harm. This harm won’t be obvious throughout a visible inspection, however it could possibly result in pricey repairs or perhaps a full loss if not addressed.

- Excessive-Theft Areas: Automobiles parked in areas with a excessive incidence of automobile theft are naturally at a better threat. Understanding the native crime statistics will help assess the potential menace.

- Poor Upkeep Historical past: A automobile that hasn’t been correctly maintained over time may be extra susceptible to mechanical failures, resulting in accidents or costly repairs. Neglecting routine upkeep can result in a breakdown, which may end up in harm to the automobile and even to different autos in a collision.

- Lack of Correct Documentation: Incomplete or lacking information concerning the automobile’s historical past can obscure important data, like earlier harm or repairs. This lack of transparency provides to the uncertainty surrounding the automobile’s situation.

Potential Monetary Affect of Main Accidents or Theft

The monetary implications of a significant accident or theft may be substantial. The worth of the used automobile will probably lower, and the price of repairs or alternative elements may be important. That is significantly true for older autos with restricted resale worth.

- Decreased Resale Worth: A automobile concerned in an accident or theft will inevitably depreciate in worth. Restore prices can considerably impression the automobile’s price, particularly if the harm is in depth.

- Restore Prices: Repairing important harm may be fairly costly. Components for older fashions could be exhausting to search out or unusually pricey. Estimating these prices is essential earlier than committing to a purchase order.

- Complete Loss: In extreme accidents, a automobile could also be deemed a complete loss, that means its restore price exceeds its present market worth. This implies the proprietor loses your complete funding.

Comparability of Accident and Injury Probability, Ought to i purchase hole insurance coverage on a used automobile

Used automobiles have a better probability of accidents and harm in comparison with new automobiles, that are usually in higher situation and have fewer miles on the odometer. Nevertheless, this probability relies upon considerably on the precise automobile’s historical past.

- Larger Mileage: Used automobiles usually have extra miles than new automobiles. Elevated mileage correlates with a better threat of wear and tear and tear, resulting in extra potential points.

- Earlier Accidents: A used automobile’s historical past of accidents considerably impacts its threat profile. A automobile with a documented accident historical past has a better chance of needing pricey repairs or replacements.

Potential for Mechanical Points and Repairs

Used automobiles are extra vulnerable to mechanical points than new ones. The longer a automobile has been in use, the extra probably it’s to expertise issues requiring repairs. This may dramatically have an effect on the automobile’s worth and the proprietor’s price range.

- Elevated Upkeep Wants: Used automobiles usually require extra frequent upkeep in comparison with new ones. Ignoring upkeep can result in important issues, additional decreasing the automobile’s worth and rising restore prices.

- Anticipated Repairs: An intensive inspection by a mechanic will help determine potential mechanical issues. Understanding these potential points is crucial for planning and budgeting.

Widespread Used Automobile Damages and Restore Prices

Predicting the exact price of repairs is tough. Nevertheless, a common overview of widespread damages and their potential impression may be useful.

| Injury Sort | Potential Restore Prices |

|---|---|

| Minor fender bender | $500 – $2000 |

| Engine harm | $1000 – $5000+ |

| Transmission failure | $1000 – $3000+ |

| Body harm | $1000 – $10,000+ |

| Electrical system points | $200 – $1000+ |

Assessing the Worth of Hole Insurance coverage

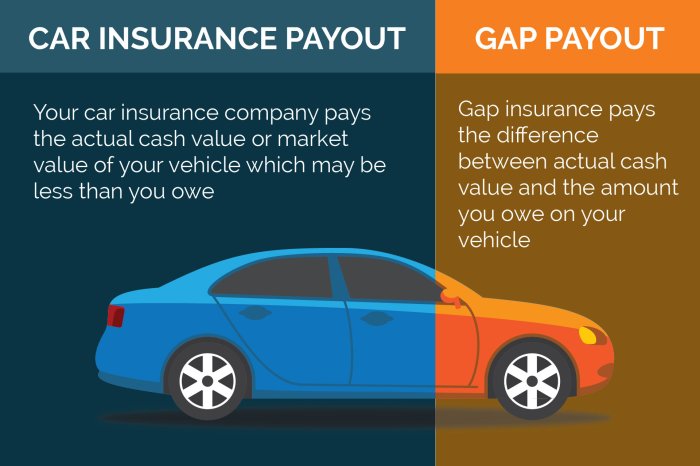

Hole insurance coverage, usually ignored, could be a essential part of used automobile possession. It protects you from a big monetary hit in case your automobile is totaled or severely broken, particularly when the worth of the mortgage or lease exceeds the automobile’s present market price. Understanding when it is worthwhile will help you make knowledgeable selections about defending your funding.Hole insurance coverage primarily bridges the “hole” between what you owe in your mortgage and the automobile’s market worth after an accident or complete loss.

This safety is especially related for used automobiles, as their depreciation means the worth usually falls beneath the excellent mortgage quantity.

Hole Insurance coverage Protection for Used Automobiles

Hole insurance coverage kicks in when the precise money worth of your used automobile, after a complete loss or important harm, is lower than what you continue to owe on the mortgage. This distinction, the hole, is roofed by the insurance coverage. For instance, in case you owe $10,000 on a used automobile price $8,000 after an accident, hole insurance coverage would pay the $2,000 distinction.

This ensures you are not left with an excellent mortgage stability you can’t repay.

Situations The place Hole Insurance coverage is Helpful

Hole insurance coverage is most useful when the used automobile’s worth is considerably decrease than the excellent mortgage quantity. That is continuously the case with older fashions, higher-mileage autos, or automobiles which have sustained important put on and tear. Moreover, in case you’ve financed a automobile for an extended interval, the hole between the automobile’s depreciated worth and the excellent mortgage is more likely to widen.

The extra the automobile depreciates, the better the potential hole, therefore the better the advantage of hole insurance coverage.

Defending In opposition to Monetary Loss

Hole insurance coverage instantly mitigates monetary loss from complete loss or extreme harm to your used automobile. By masking the distinction between the mortgage quantity and the automobile’s depreciated worth, it protects you from the monetary burden of an excellent mortgage stability you’ll be able to not repay. This safety is especially necessary for used automobiles as their worth usually decreases over time.

You are shielded from the potential monetary threat of an unpaid mortgage, guaranteeing you are not left with an unmanageable debt after an unlucky occasion.

Evaluating Hole Insurance coverage with Different Protections

Whereas complete automobile insurance coverage covers repairs, it would not usually deal with the hole between the automobile’s worth and your mortgage quantity. Hole insurance coverage, in distinction, particularly covers this hole. Subsequently, hole insurance coverage is distinct from different protections reminiscent of complete or collision insurance coverage. In essence, hole insurance coverage focuses on the monetary facet of automobile possession after a loss, whereas different insurance coverage varieties concentrate on repairs and potential damages.

Examples The place Hole Insurance coverage is Pointless

Hole insurance coverage is not at all times vital. If the used automobile’s worth intently matches the mortgage quantity, the potential hole is minimal. A used automobile not too long ago bought at a worth near its present market worth, with a mortgage quantity that mirrors the present market worth, probably will not necessitate hole insurance coverage. Additionally, in case you’re snug with the potential monetary threat of an unpaid mortgage after an accident, hole insurance coverage won’t be required.

Analyzing Elements Influencing Hole Insurance coverage Choices

Deciding whether or not or to not buy hole insurance coverage for a used automobile is not a one-size-fits-all reply. It hinges on a number of essential components, primarily revolving across the purchaser’s monetary state of affairs, the automobile’s situation and market worth, and the potential for a loss exceeding the automobile’s present price. This evaluation delves into these important parts, offering readability for potential used automobile consumers.

Monetary Circumstances of Potential Consumers

Understanding the customer’s monetary state of affairs is paramount in assessing the necessity for hole insurance coverage. A purchaser with a considerable down cost and a cushty monetary cushion won’t require the safety supplied by hole insurance coverage as a lot as somebody counting on a mortgage with a better loan-to-value ratio. For instance, a money purchaser of a used automobile might need much less want for hole insurance coverage in comparison with a purchaser financing your complete buy.

The financing phrases, the mortgage quantity, and the customer’s current debt load all play a task in assessing the chance tolerance and monetary capability for potential losses.

Used Automobile Buy Situations

Totally different used automobile buy situations current various levels of threat and consequently, totally different wants for hole insurance coverage. Contemplate these examples:

- A budget-conscious purchaser buying a lower-priced, older used automobile might prioritize minimizing upfront prices. On this state of affairs, the potential loss in worth as a result of accident or complete loss could be extra important relative to the cheaper price, making hole insurance coverage probably extra engaging.

- An investor buying a used automobile for resale functions could be extra involved about preserving the automobile’s market worth. If the automobile is meant to be resold within the close to future, any important depreciation might considerably impression their revenue margin, probably making hole insurance coverage a vital safeguard towards sudden occasions that might lower the automobile’s market worth past the mortgage quantity.

Affect of Used Automobile’s Age and Situation

The age and situation of a used automobile instantly correlate to its market worth and potential for a loss exceeding the mortgage quantity. An older or considerably broken automobile faces a better threat of a complete loss exceeding the excellent mortgage stability. The wear and tear and tear on the automobile, the mileage, and the presence of any pre-existing harm are essential components in figuring out the necessity for hole insurance coverage.

Market Worth and Hole Insurance coverage

The market worth of a used automobile performs a important position in hole insurance coverage selections. A used automobile with a big market worth distinction between its buy worth and its mortgage quantity could be much less vulnerable to a spot state of affairs. Conversely, a automobile with a low market worth might simply fall beneath the mortgage quantity, triggering a spot state of affairs, making hole insurance coverage extra related.

The used automobile’s mannequin, 12 months, situation, and mileage instantly impression its present market worth.

Relationship Between Used Automobile Worth, Potential Injury Prices, and Hole Insurance coverage

The next desk illustrates the connection between the used automobile worth, potential harm prices, and the necessity for hole insurance coverage.

| Used Automobile Worth | Potential Injury Prices | Want for Hole Insurance coverage |

|---|---|---|

| Low | Excessive | Excessive |

| Medium | Medium | Medium |

| Excessive | Low | Low |

Be aware: This desk is a simplified illustration and would not embody all components. Particular person circumstances ought to be thought of.

Evaluating Used Automobile Insurance coverage Choices

Deciding whether or not so as to add hole insurance coverage to your used automobile coverage requires cautious consideration of the potential advantages and downsides. This comparability will enable you to perceive the nuances of those choices, weigh the prices towards potential losses, and make an knowledgeable determination. Hole insurance coverage is an important part within the general safety of your automobile, guaranteeing that you simply’re financially coated in case of an accident or theft.Understanding the varied used automobile insurance coverage choices is essential to navigating the complexities of automobile possession.

This course of includes scrutinizing each customary protection and hole insurance coverage to find out one of the best match in your particular wants and monetary state of affairs. Evaluating the prices of hole insurance coverage with the potential loss from a complete loss state of affairs helps to quantify the monetary implications.

Professionals and Cons of Hole Insurance coverage

Hole insurance coverage, when added to your customary used automobile coverage, offers an additional layer of safety towards the distinction between the automobile’s precise money worth (ACV) and its mortgage or excellent stability. This safety is very useful if the automobile is broken past restore or stolen.

- Professionals: Hole insurance coverage protects towards the distinction between the automobile’s worth and excellent mortgage quantity, guaranteeing that you simply’re not answerable for the monetary shortfall if the automobile is totaled or stolen. This significant protection safeguards your monetary pursuits. For example, if a $10,000 automobile with a $12,000 mortgage is totaled, hole insurance coverage would cowl the $2,000 distinction.

- Cons: Hole insurance coverage premiums can add to the general price of your used automobile insurance coverage. It is important to match the price of hole insurance coverage with the potential loss if the automobile is broken or stolen to see if the added price is justified.

Evaluating Prices of Hole Insurance coverage and Potential Losses

A vital step in deciding on hole insurance coverage is evaluating its price to the potential lack of your automobile. A well-informed comparability helps in making a rational determination.

Calculating the potential loss from a complete loss or theft includes figuring out the automobile’s present market worth and the remaining mortgage quantity. The distinction between these figures represents the potential hole that hole insurance coverage can cowl.

For instance, if a used automobile price $8,000 has a remaining mortgage stability of $9,000, the potential loss is $1,000. This comparability ought to be factored into your decision-making course of.

Insurance coverage Supplier Comparability Desk

The desk beneath shows a pattern comparability of insurance coverage suppliers providing hole insurance coverage for used automobiles. This desk showcases the varied choices out there out there.

| Insurance coverage Supplier | Hole Insurance coverage Protection | Premium (Approximate) | Coverage Particulars |

|---|---|---|---|

| Firm A | Covers the hole between ACV and mortgage quantity | $50-$100/12 months | Versatile coverage choices, together with add-ons. |

| Firm B | Covers the hole between ACV and mortgage quantity | $60-$120/12 months | Intensive protection, contains roadside help. |

| Firm C | Covers the hole between ACV and mortgage quantity | $40-$80/12 months | Focuses on affordability, restricted add-ons. |

Be aware: Premiums are approximate and may differ primarily based on automobile age, make, mannequin, and different components.

Hidden Prices of Hole Insurance coverage

Whereas hole insurance coverage is usually introduced as a simple addition, there could be hidden prices. Understanding these hidden prices is essential to keep away from monetary surprises.

- Coverage exclusions: Sure insurance policies might exclude particular sorts of harm or conditions, resulting in gaps in protection. At all times evaluation the advantageous print to grasp the total extent of protection.

- Deductibles: Some insurance policies might embody deductibles, which may scale back the quantity of protection offered.

- Further charges: Sure add-ons or options might include further costs that are not instantly obvious.

Evaluating Hole Insurance coverage Insurance policies

A complete comparability of hole insurance coverage insurance policies from totally different suppliers ought to contain an in depth evaluation of coverage phrases, exclusions, and related prices. This thorough evaluation ensures a sound determination.An in depth comparability of insurance policies includes scrutinizing the protection limits, deductibles, exclusions, and premium constructions. Understanding these points helps in selecting probably the most appropriate coverage.

Illustrative Case Research

Navigating the world of used automobiles may be tough, particularly relating to insurance coverage. Understanding the potential dangers and advantages of hole insurance coverage is essential for making knowledgeable selections. This part explores real-world situations to light up when hole insurance coverage is a great transfer and when it won’t be as important.Analyzing the precise circumstances of a used automobile buy, contemplating its worth, options, and historical past, permits for a tailor-made evaluation of hole insurance coverage wants.

A well-informed determination minimizes monetary surprises and maximizes your safety.

Situation The place Hole Insurance coverage is Extremely Advisable

A latest instance showcases a 2018 Honda Civic, bought used for $18, Whereas the automobile is in good situation, a big issue influences the necessity for hole insurance coverage: the automobile’s market worth has depreciated considerably as a result of its mannequin 12 months. Even with complete insurance coverage, if the automobile is totaled in an accident, the insurance coverage payout won’t cowl the total mortgage quantity.

This example highlights the potential for a considerable hole between the excellent mortgage stability and the automobile’s recovered worth. Hole insurance coverage would be sure that the mortgage is absolutely repaid, defending the customer from monetary loss.

Situation The place Hole Insurance coverage Could Not Be Essential

Conversely, take into account a 2015 Toyota Camry, bought used for $12,000. The automobile is in glorious situation, and the customer made a big down cost. The automobile’s present market worth is comparatively near the remaining mortgage stability. In such a state of affairs, if the automobile is totaled, the insurance coverage payout is more likely to cowl the mortgage quantity. The client’s important down cost and the shut proximity of the automobile’s worth to the mortgage stability scale back the chance of a big monetary hole.

How Used Automobile Worth Impacts Hole Insurance coverage Choices

The used automobile’s market worth performs a pivotal position in figuring out the necessity for hole insurance coverage. A considerable depreciation in worth, even with a comparatively low mortgage quantity, can result in a big hole. For instance, a 2010 mannequin automobile, with a excessive mortgage stability and low market worth, would require sturdy consideration for hole insurance coverage. A automobile with a decrease mortgage stability and a better present market worth would have a a lot decrease want for the sort of insurance coverage.

Monetary Advantages of Hole Insurance coverage

A 2012 Ford Fusion, bought used for $15,000 with a mortgage of $12,000, exemplifies the monetary advantages of hole insurance coverage. If the automobile have been totaled, the insurance coverage payout may solely cowl $8,000. With out hole insurance coverage, the proprietor could be liable for the remaining $4,000 mortgage stability. Hole insurance coverage would get rid of this monetary burden, guaranteeing the mortgage is absolutely repaid.

Figuring out Want Based mostly on Options and Historical past

Evaluating the used automobile’s options and historical past is crucial in assessing hole insurance coverage wants. Contemplate components just like the automobile’s mannequin 12 months, mileage, upkeep information, and any pre-existing harm. A automobile with a excessive mileage, a historical past of repairs, or important pre-existing harm could be extra susceptible to a complete loss with a ensuing hole within the mortgage worth.

A well-maintained automobile with a decrease mileage, then again, might need a decrease threat of complete loss, probably lessening the necessity for hole insurance coverage.

Finish of Dialogue: Ought to I Purchase Hole Insurance coverage On A Used Automobile

In conclusion, deciding whether or not or to not buy hole insurance coverage on a used automobile includes cautious consideration of a number of components. Weighing the potential dangers towards the monetary safety supplied by hole insurance coverage is essential. This information has offered an intensive examination of the topic, providing insights and assets to empower you to make the only option in your particular circumstances.

Keep in mind to seek the advice of with an insurance coverage skilled for customized recommendation.

FAQ Overview

What’s hole insurance coverage, and the way does it work?

Hole insurance coverage covers the distinction between the precise money worth of a automobile and the excellent mortgage quantity. In case your automobile is totaled, this insurance coverage helps you keep away from a monetary loss. It is significantly related when the automobile’s worth depreciates sooner than the mortgage quantity.

What components affect the necessity for hole insurance coverage?

The age and situation of the used automobile, the market worth, and your monetary circumstances are all necessary issues. A more moderen, higher-value automobile may require much less hole insurance coverage than an older, lower-value mannequin.

How a lot does hole insurance coverage usually price?

The price of hole insurance coverage varies relying on the automobile’s make, mannequin, 12 months, and the quantity of protection. You may usually examine quotes from totally different suppliers to search out one of the best charge.

What are the potential hidden prices related to hole insurance coverage?

Some insurance policies might have added charges or restrictions. At all times evaluation the advantageous print and examine insurance policies from totally different suppliers to keep away from surprises.