Safety Nationwide Insurance coverage Firm automotive insurance coverage offers complete protection tailor-made to your wants. Understanding how nationwide insurance coverage impacts your premiums, protection choices, and declare processes is essential. This information will delve into the specifics of Safety Nationwide Insurance coverage Firm automotive insurance coverage, from coverage particulars to supplier comparisons, serving to you make knowledgeable choices.

Navigating the complexities of automotive insurance coverage, notably when nationwide insurance coverage components in, may be daunting. This information simplifies the method, providing a transparent and accessible overview of the assorted facets that affect your insurance coverage prices and claims. We’ll look at every little thing from the influence of driving historical past to the various kinds of protection out there.

Nationwide Insurance coverage and Automobile Insurance coverage Protection

Nationwide insurance coverage contributions play a major position in figuring out automotive insurance coverage premiums. This affect stems from the truth that insurers assess the chance profile of drivers, and nationwide insurance coverage data present priceless insights into driving historical past and monetary stability. Understanding the interaction between these two components is essential for customers looking for to handle their automotive insurance coverage prices successfully.Insurers make the most of nationwide insurance coverage contributions to gauge a driver’s monetary scenario and potential declare historical past.

Drivers with greater nationwide insurance coverage contributions, usually indicating a steady employment document, might qualify for decrease premiums. Conversely, drivers with decrease contributions, notably those that are self-employed or unemployed, might face greater premiums resulting from perceived elevated threat.

Affect of Nationwide Insurance coverage on Automobile Insurance coverage Premiums

Nationwide insurance coverage data present a key indicator of economic stability and potential declare frequency. Insurers use this information to evaluate the probability of a driver making a declare. Drivers with a constant document of nationwide insurance coverage contributions are sometimes seen as lower-risk, resulting in decrease premiums. It’s because a constant contribution historical past suggests a extra steady monetary scenario, doubtlessly decreasing the probability of economic difficulties that may result in claims.

Conversely, these with gaps in contributions or inconsistent data could be seen as greater threat, doubtlessly resulting in greater premiums.

Kinds of Automobile Insurance coverage Protection Choices

Complete automotive insurance coverage protection choices are designed to cater to quite a lot of wants and budgets. These choices sometimes embody third-party legal responsibility, which covers damages to different events within the occasion of an accident the place the driving force is at fault. Past this, some insurance policies supply complete protection, encompassing injury to the insured automobile no matter who’s at fault.

Collision protection offers safety towards injury to the insured automobile within the occasion of a collision. Further choices embody uninsured/underinsured motorist protection, which safeguards towards damages brought on by drivers with out sufficient insurance coverage.

Value Comparability of Automobile Insurance coverage Insurance policies

The price of automotive insurance coverage insurance policies varies considerably relying on a number of components, together with the chosen protection choices, the driving force’s age, driving document, and automobile sort. Nationwide insurance coverage standing is a key ingredient in figuring out the price of insurance coverage. Insurance policies with complete protection, together with injury to the insured automobile, sometimes include the next premium in comparison with insurance policies with restricted protection.

Typical Exclusions in Automobile Insurance coverage Insurance policies Associated to Nationwide Insurance coverage

Automobile insurance coverage insurance policies usually exclude particular occasions or circumstances associated to nationwide insurance coverage contributions. For instance, insurance policies might not cowl damages ensuing from intentional acts, reckless driving, or driving inebriated or medicine, no matter the nationwide insurance coverage standing. Moreover, some insurance policies might exclude damages arising from accidents involving automobiles with expired or invalid nationwide insurance coverage.

Particular exclusions ought to be reviewed rigorously within the coverage paperwork.

Comparability of Protection Choices Based mostly on Nationwide Insurance coverage Standing

| Nationwide Insurance coverage Standing | Typical Premium Affect | Protection Issues |

|---|---|---|

| Employed | Typically decrease premiums resulting from constant contributions and perceived decrease threat. | Complete protection choices could also be extra inexpensive. |

| Self-Employed | Doubtlessly greater premiums resulting from variability in earnings and contributions. | May have to think about greater deductibles or restricted protection choices to mitigate prices. |

| Unemployed | Typically greater premiums resulting from perceived greater threat and potential for monetary difficulties. | Could require further protection to mitigate the upper threat profile. |

Elements Influencing Nationwide Insurance coverage Automobile Insurance coverage Prices

Automobile insurance coverage premiums are complicated, influenced by a large number of things past merely the kind of automobile. Understanding these components is essential for each customers and insurance coverage suppliers to make sure truthful and correct pricing. This evaluation delves into the important thing parts that form nationwide insurance coverage automotive insurance coverage prices, encompassing driving historical past, demographics, location, and automobile traits.Nationwide insurance coverage standing, driving historical past, and automobile sort all considerably have an effect on automotive insurance coverage premiums.

These components, alongside location and age, contribute to the general threat evaluation undertaken by insurers. This evaluation instantly impacts the premiums charged to policyholders.

Affect of Driving Historical past on Automobile Insurance coverage Prices

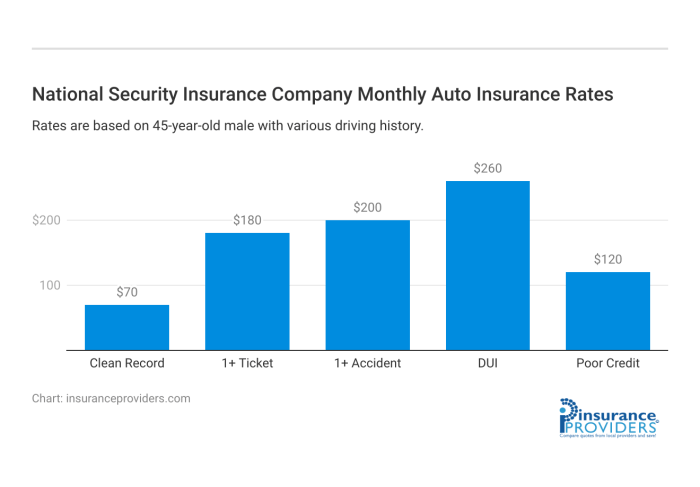

Driving historical past is a major determinant of automotive insurance coverage premiums. A clear driving document, devoid of accidents or site visitors violations, sometimes interprets to decrease premiums. Conversely, a historical past of accidents or violations alerts greater threat, resulting in elevated premiums. Insurers make the most of statistical information and actuarial fashions to evaluate threat based mostly on driving habits. For instance, a driver with a number of rushing tickets or at-fault accidents will face considerably greater premiums in comparison with a driver with no infractions.

Affect of Age on Automobile Insurance coverage Prices

Age is a major issue influencing automotive insurance coverage premiums. Youthful drivers are sometimes thought of greater threat resulting from their inexperience and perceived greater probability of accidents. This greater threat evaluation leads to greater premiums for youthful drivers. Conversely, older drivers, notably these with a confirmed monitor document of secure driving, might qualify for decrease premiums. That is usually as a result of decrease accident charges related to drivers with extra expertise.

Function of Location in Figuring out Automobile Insurance coverage Premiums

Geographic location performs an important position in automotive insurance coverage prices. Areas with greater accident charges, elevated site visitors density, or particular sorts of climate circumstances are related to greater premiums. Insurers modify premiums based mostly on components like accident frequency and severity, which differ significantly throughout numerous geographical areas. For instance, areas susceptible to extreme climate occasions, similar to hailstorms or flooding, may need greater insurance coverage prices as a result of elevated probability of auto injury.

Affect of Nationwide Insurance coverage Standing on Automobile Insurance coverage Prices

Nationwide insurance coverage standing, notably in international locations with complete social security nets, can affect the price of automotive insurance coverage. People with a confirmed document of accountable contributions to nationwide insurance coverage schemes could also be perceived as decrease threat by insurers, doubtlessly resulting in decrease premiums. Conversely, these with a historical past of non-compliance or low contribution could be seen as greater threat.

It’s because insurers usually assess total monetary accountability and reliability, together with components associated to compliance with nationwide insurance coverage laws.

Relationship Between Accident Historical past and Nationwide Insurance coverage Premiums

Accident historical past instantly correlates with nationwide insurance coverage automotive insurance coverage premiums. A historical past of accidents, notably at-fault accidents, considerably will increase the price of automotive insurance coverage. Insurers use historic accident information to mannequin the probability of future accidents for particular drivers. This evaluation is essential for figuring out applicable premiums. Accidents with extreme accidents or property injury result in considerably greater premiums as a result of elevated monetary legal responsibility for the insurer.

Affect of Car Sort and Worth on Automobile Insurance coverage Premiums

Car sort and worth are key components in figuring out automotive insurance coverage premiums. Excessive-performance sports activities vehicles or automobiles with superior options are sometimes perceived as greater threat resulting from their potential for injury or theft. Likewise, costly automobiles sometimes command greater premiums as a result of elevated monetary loss if the automobile is broken or stolen. Insurance coverage firms issue within the worth of the automobile when calculating premiums.

A luxurious automotive, for example, carries the next premium than a typical compact automotive, even with equivalent driving histories.

Desk Illustrating the Affect of Elements on Automobile Insurance coverage Premiums

| Issue | Description | Affect on Premium |

|---|---|---|

| Driving Historical past | Clear document, accidents, violations | Decrease premiums for clear data, greater for accidents/violations |

| Age | Younger driver, mature driver | Increased premiums for younger drivers, doubtlessly decrease for mature drivers |

| Location | Excessive-accident areas, site visitors density | Increased premiums in high-accident/site visitors areas |

| Nationwide Insurance coverage Standing | Compliance, non-compliance | Decrease premiums for compliance, greater for non-compliance |

| Car Sort | Sports activities automotive, customary automotive | Increased premiums for high-performance automobiles |

| Car Worth | Excessive-value automotive, low-value automotive | Increased premiums for high-value automobiles |

Claims and Nationwide Insurance coverage Automobile Insurance coverage

The method of submitting a automotive insurance coverage declare, notably when nationwide insurance coverage is implicated, includes particular procedures and concerns. Understanding these nuances is essential for each claimants and insurance coverage suppliers to make sure a good and environment friendly decision. Nationwide insurance coverage implications can considerably have an effect on the declare’s settlement and future premiums.The settlement of a automotive insurance coverage declare involving nationwide insurance coverage is ruled by established authorized frameworks and insurance coverage coverage provisions.

The specifics of those frameworks differ relying on the jurisdiction and the character of the declare. Insurance coverage firms meticulously consider the declare’s validity, the extent of damages, and the involvement of nationwide insurance coverage to find out applicable compensation.

Declare Course of Overview

The declare course of for automotive insurance coverage, when nationwide insurance coverage is an element, requires cautious documentation and adherence to particular protocols. Claimants ought to meticulously doc all facets of the incident, together with witness statements, pictures, and police studies if relevant. This complete document is essential for the insurance coverage firm’s evaluation.

Affect on Declare Settlement

Nationwide insurance coverage considerably influences declare settlement. If a celebration concerned in a automotive accident holds nationwide insurance coverage, the specifics of the coverage and the phrases of the accident might have an effect on the quantity of compensation and the legal responsibility for damages. The insurer’s analysis of legal responsibility based mostly on the proof and authorized framework will dictate the settlement quantity.

Affect on Future Premiums

A declare involving nationwide insurance coverage can doubtlessly influence future automotive insurance coverage premiums. The character of the declare, the extent of damages, and the diploma of fault assigned to the events concerned can all affect the premiums. Insurance coverage firms analyze declare historical past to evaluate threat profiles. For example, a declare involving important damages or a number of accidents might end in the next premium for the claimant.

Documentation Required

Complete documentation is important when submitting a declare that includes nationwide insurance coverage. This contains, however isn’t restricted to: the police report (if relevant), medical data, witness statements, restore estimates, and the related nationwide insurance coverage particulars. Accuracy and completeness are paramount to make sure a easy declare processing.

Declare Submitting Steps

- Preliminary Reporting: Instantly report the accident to the insurance coverage firm and any related authorities. This includes offering obligatory particulars of the incident, together with the opposite driver’s data and the situation of the accident. This step is essential for initiating the declare course of and preserving proof.

- Gathering Proof: Acquire all pertinent proof, together with pictures of the injury to the automobiles, witness statements, and medical data. This ensures a whole document of the incident for the insurance coverage firm’s evaluation.

- Declare Type Submission: Full and submit the declare type to the insurance coverage firm, offering all obligatory particulars and supporting documentation. This step includes correct and thorough reporting to keep away from delays.

- Evaluation and Analysis: The insurance coverage firm assesses the declare based mostly on the supplied proof and coverage phrases. The evaluation includes evaluating legal responsibility and damages.

- Settlement Negotiation: The insurance coverage firm negotiates a settlement quantity based mostly on the evaluation and coverage phrases. This course of includes discussions with each events concerned to succeed in a mutually agreeable decision.

- Cost and Finalization: The settlement quantity is paid to the events entitled to compensation, and the declare is finalized. This step concludes the declare course of.

Instance State of affairs

A driver with nationwide insurance coverage is concerned in a fender-bender collision. The declare course of includes reporting the accident to their insurer, gathering proof (e.g., pictures, witness statements), and submitting the declare type. The insurer assesses the declare, together with the nationwide insurance coverage coverage, and negotiates a settlement based mostly on the diploma of harm and fault. This settlement might have an effect on future premiums for each events concerned.

| Step | Description |

|---|---|

| Preliminary Reporting | Report accident to insurer and related authorities. |

| Gathering Proof | Acquire pictures, witness statements, medical data. |

| Declare Type Submission | Full and submit the declare type with supporting paperwork. |

| Evaluation and Analysis | Insurer assesses declare, together with nationwide insurance coverage facets. |

| Settlement Negotiation | Negotiate settlement based mostly on evaluation and coverage phrases. |

| Cost and Finalization | Settlement paid, declare finalized. |

Insurance coverage Supplier Comparisons

Insurance coverage suppliers play an important position in figuring out the fee and protection of automotive insurance coverage insurance policies, notably when contemplating nationwide insurance coverage standing. Understanding how totally different suppliers modify their premiums and insurance policies based mostly on this standing is important for customers to make knowledgeable choices. This part examines the varied choices of varied insurance coverage suppliers, specializing in their approaches to nationwide insurance coverage.Comparative evaluation of automotive insurance coverage insurance policies reveals variations in protection, premiums, and customer support responsiveness, particularly when nationwide insurance coverage is an element.

This necessitates a cautious analysis of supplier strengths and weaknesses to establish essentially the most appropriate coverage for particular person wants and circumstances. Completely different suppliers might supply various ranges of protection and advantages, impacting the general price and safety provided to policyholders.

Coverage Variations Concerning Nationwide Insurance coverage Standing, Safety nationwide insurance coverage firm automotive insurance coverage

Understanding how totally different insurance coverage suppliers modify premiums based mostly on nationwide insurance coverage standing is essential. Insurance policies might supply differing ranges of protection and advantages, doubtlessly impacting the general price and safety provided. Some suppliers might supply particular reductions or incentives for people with exemplary nationwide insurance coverage data. Conversely, others would possibly modify premiums based mostly on perceived threat related to a selected nationwide insurance coverage standing.

Premium Changes Based mostly on Nationwide Insurance coverage

Premiums are sometimes adjusted based mostly on components like nationwide insurance coverage standing. Suppliers might use historic information and threat assessments to find out the probability of a declare, influencing the premium calculation. This can be a complicated course of, contemplating the varied vary of nationwide insurance coverage conditions and particular person threat profiles. A better threat profile, as perceived by the insurance coverage supplier, will doubtless end in greater premiums.

Conversely, a decrease threat profile would possibly yield a decrease premium. For instance, a driver with a constant and optimistic nationwide insurance coverage document might obtain a decrease premium in comparison with a driver with a historical past of violations.

Buyer Service for Nationwide Insurance coverage-Associated Points

Environment friendly and responsive customer support is essential when coping with nationwide insurance-related points. A supplier’s fame for dealing with these conditions can considerably influence the policyholder expertise. A well-regarded supplier will supply clear communication channels and supply immediate help for coverage inquiries or claims involving nationwide insurance coverage. This may occasionally embody devoted customer support representatives educated about nationwide insurance-related insurance policies.

Furthermore, a supplier’s dealing with of claims involving nationwide insurance coverage is a key side of evaluating their total customer support high quality.

Comparative Evaluation of Main Insurance coverage Suppliers

| Insurance coverage Supplier | Premium Adjustment for Nationwide Insurance coverage | Protection Particular to Nationwide Insurance coverage | Buyer Service Strategy for Nationwide Insurance coverage Points | Strengths | Weaknesses |

|---|---|---|---|---|---|

| Firm A | Premiums adjusted based mostly on nationwide insurance coverage rating, with reductions for optimistic data. | Particular protection add-ons for drivers with distinctive nationwide insurance coverage historical past. | Devoted nationwide insurance coverage claims crew with 24/7 assist. | Aggressive pricing for sturdy data. | Restricted protection choices for these with much less favorable data. |

| Firm B | Premiums differ based mostly on nationwide insurance coverage class, providing tiered reductions. | Customary protection for all nationwide insurance coverage lessons. | Complete on-line portal with FAQs particular to nationwide insurance coverage. | Wide selection of protection choices. | Could not supply important reductions for exemplary data. |

| Firm C | Premiums adjusted in line with nationwide insurance coverage rating and driving historical past. | Specialised nationwide insurance coverage help for claims. | Devoted cellphone line for nationwide insurance coverage inquiries. | Customized strategy to threat evaluation. | Potential for greater premiums in comparison with different suppliers. |

Nationwide Insurance coverage and Younger Drivers: Safety Nationwide Insurance coverage Firm Automobile Insurance coverage

Younger drivers face distinctive challenges in securing inexpensive automotive insurance coverage, usually leading to greater premiums in comparison with older drivers. Nationwide Insurance coverage, an important element of a complete insurance coverage coverage, performs a major position in figuring out these premiums. This part examines the interaction between nationwide insurance coverage and automotive insurance coverage for younger drivers, outlining influencing components and out there assist.

Affect of Nationwide Insurance coverage on Younger Driver Premiums

Nationwide Insurance coverage contributions mirror a person’s employment historical past and tax contributions. This document, accessed via the driving force’s nationwide insurance coverage quantity, offers insurers with a measure of economic stability and threat evaluation. Younger drivers, usually with restricted or no employment historical past, could also be perceived as greater threat, resulting in elevated insurance coverage premiums. Insurers use this information to guage the probability of claims, and this issue can considerably have an effect on premiums.

Elements Influencing Premiums for Younger Drivers

A number of components contribute to the insurance coverage premiums for younger drivers, with nationwide insurance coverage standing being a distinguished one. These components embody, however will not be restricted to, driving expertise, automobile sort, location of residence, and the driving force’s claims historical past. Younger drivers with no or restricted nationwide insurance coverage contributions would possibly face greater premiums as a result of perceived greater threat. Conversely, these with a steady employment historical past and corresponding nationwide insurance coverage contributions would possibly see decrease premiums.

Help for Younger Drivers

Varied organizations and initiatives present assist to younger drivers relating to nationwide insurance coverage and automotive insurance coverage. Authorities-funded schemes and insurance coverage suppliers usually supply particular packages designed for younger drivers, making an allowance for their restricted driving expertise and monetary scenario. These assist packages might embody discounted charges or tailor-made insurance coverage choices.

Insurance coverage Choices for Younger Drivers Contemplating Nationwide Insurance coverage

A number of insurance coverage choices can be found to younger drivers, contemplating their nationwide insurance coverage standing. These choices can vary from fundamental cowl to complete packages. Particular packages or reductions tailor-made for younger drivers with restricted nationwide insurance coverage contributions could also be out there. Insurers usually supply tailor-made packages for college students or these with restricted employment historical past, which could mirror the drivers’ particular monetary and driving expertise profiles.

Desk: Insurance coverage Choices and Pricing for Younger Drivers

| Nationwide Insurance coverage Standing | Insurance coverage Possibility | Estimated Premium (Instance) |

|---|---|---|

| Low/No Nationwide Insurance coverage Contributions | Fundamental Automobile Insurance coverage with Younger Driver Low cost | £1,200 – £1,500 per 12 months |

| Restricted Nationwide Insurance coverage Contributions | Complete Automobile Insurance coverage with Younger Driver Bundle | £1,500 – £1,800 per 12 months |

| Secure Nationwide Insurance coverage Report | Complete Automobile Insurance coverage with Multi-Driver Low cost | £1,000 – £1,200 per 12 months |

Word: Premiums are estimates and may differ considerably based mostly on particular automobile, location, and different components. This desk offers illustrative examples and shouldn’t be thought of definitive pricing.

Nationwide Insurance coverage and Particular Automobile Varieties

Nationwide insurance coverage standing performs a major position in figuring out the price of automotive insurance coverage, and this relationship is additional nuanced by the kind of automobile. Completely different automotive sorts current various ranges of threat, impacting premiums. This part examines how nationwide insurance coverage standing interacts with the pricing for numerous automotive sorts, from on a regular basis automobiles to high-performance fashions.

Elements Influencing Insurance coverage Prices for Particular Automobile Varieties

Insurance coverage premiums for particular automotive sorts are influenced by a number of key components, with nationwide insurance coverage standing enjoying a major position. The inherent threat related to totally different automobile sorts is a major driver.

- Sports activities Vehicles: Excessive-performance sports activities vehicles, resulting from their potential for greater accident severity and related restore prices, sometimes command greater insurance coverage premiums. That is usually compounded by the truth that drivers of those automobiles might have the next propensity for risk-taking behaviors.

- Luxurious Autos: Luxurious vehicles, steadily focused by theft and vandalism, usually have greater insurance coverage premiums than comparable fashions in a lower cost bracket. The elevated worth of those automobiles instantly correlates with the price of substitute or restore within the occasion of harm or theft.

- Basic Vehicles: Basic vehicles, usually that includes distinctive or uncommon options, current a novel insurance coverage problem. Their rarity and doubtlessly excessive worth necessitate specialised insurance coverage insurance policies that usually embody greater premiums to account for potential injury, theft, or restoration prices.

- On a regular basis Autos: Insurance coverage prices for on a regular basis automobiles are usually decrease than for higher-risk automobiles. This is because of their decrease potential for injury and restore prices, usually related to their extra frequent designs and manufacturing requirements.

Interplay of Nationwide Insurance coverage Standing with Automobile Sort Pricing

Nationwide insurance coverage standing instantly influences insurance coverage premiums for all automotive sorts. A driver with the next threat profile (e.g., a latest rushing ticket or accident) can pay the next premium for any automobile, however this impact is amplified when mixed with the inherent threat of a particular automotive sort.

- Increased Threat Drivers: Drivers with a historical past of accidents or site visitors violations face considerably greater premiums for all automotive sorts, with sports activities vehicles and luxurious automobiles experiencing a good higher premium enhance resulting from their related dangers.

- Decrease Threat Drivers: Conversely, drivers with a clear driving document sometimes see decrease premiums for all automobiles, though this profit continues to be moderated by the precise automotive sort.

Evaluating Insurance coverage Prices for Related Fashions with Differing Nationwide Insurance coverage Statuses

Insurance coverage firms use numerous standards to evaluate threat. The nationwide insurance coverage standing of the driving force is a major factor in figuring out the premiums.

- Instance: A driver with a clear driving document insuring a typical sedan will doubtless have decrease premiums than a driver with a number of rushing tickets insuring the identical mannequin. The influence of the nationwide insurance coverage standing on the value is extra pronounced for higher-risk automobiles. For example, a driver with a clear document insuring a sports activities automotive can pay lower than a driver with a number of violations insuring the identical automotive.

Insurance coverage Value Comparability Desk

The next desk illustrates the potential variation in insurance coverage prices based mostly on automotive sort and nationwide insurance coverage standing. Word that these figures are illustrative and will differ relying on the precise insurer, location, and particular person circumstances.

| Automobile Sort | Nationwide Insurance coverage Standing (Instance) | Estimated Insurance coverage Premium (Illustrative) |

|---|---|---|

| Customary Sedan | Clear Report | $1,000 – $1,500 per 12 months |

| Customary Sedan | A number of Violations | $1,500 – $2,500 per 12 months |

| Sports activities Automobile | Clear Report | $1,500 – $2,500 per 12 months |

| Sports activities Automobile | A number of Violations | $2,500 – $4,000 per 12 months |

| Luxurious SUV | Clear Report | $1,800 – $2,800 per 12 months |

| Luxurious SUV | A number of Violations | $2,800 – $4,500 per 12 months |

Illustrative Eventualities for Nationwide Insurance coverage and Automobile Insurance coverage

Nationwide insurance coverage contributions, an important ingredient of an individual’s monetary profile, can considerably influence automotive insurance coverage premiums. This part presents illustrative eventualities highlighting numerous sides of this relationship, encompassing price implications, claims procedures, insurer comparisons, and the precise challenges confronted by younger drivers and homeowners of specific automobile sorts. These eventualities goal to offer a sensible understanding of how nationwide insurance coverage interacts with automotive insurance coverage insurance policies.Understanding the correlation between nationwide insurance coverage and automotive insurance coverage prices is essential for knowledgeable decision-making.

Insurance coverage suppliers make the most of nationwide insurance coverage data to evaluate threat profiles, thereby impacting premiums. The next examples element how this interaction impacts totally different conditions.

State of affairs: Nationwide Insurance coverage Affecting Automobile Insurance coverage Prices

Nationwide insurance coverage contributions instantly affect a driver’s threat evaluation. A driver with a constantly excessive nationwide insurance coverage document, demonstrating accountable monetary administration and a decrease probability of non-payment, will usually qualify for a decrease automotive insurance coverage premium. Conversely, a driver with a historical past of inconsistencies or non-payment would possibly face greater premiums as a result of perceived greater threat. This displays the insurance coverage business’s observe of associating monetary accountability with a decrease likelihood of claims.

Insurers make the most of nationwide insurance coverage data as one issue amongst many to guage the potential for future claims.

State of affairs: Claims Course of with Nationwide Insurance coverage as a Issue

In a state of affairs the place a declare is filed, nationwide insurance coverage data play an important position within the claims course of. If a driver has a historical past of great and constant nationwide insurance coverage contributions, this would possibly favorably affect the declare’s dealing with. Conversely, if the driving force’s data point out inconsistent or low contributions, it might barely influence the claims course of. The insurance coverage firm would possibly require further documentation or scrutiny of the declare, reflecting the perceived greater threat.

Insurers are sure to observe particular regulatory frameworks relating to claims dealing with and are prohibited from discriminatory practices based mostly on nationwide insurance coverage data.

State of affairs: Insurance coverage Supplier Comparisons Concerning Nationwide Insurance coverage

Evaluating insurance coverage suppliers based mostly on nationwide insurance coverage concerns is a key consider securing essentially the most appropriate coverage. Insurance coverage firms usually make use of totally different algorithms and weighting techniques when evaluating nationwide insurance coverage data. A driver with a powerful nationwide insurance coverage historical past would possibly discover one insurer provides a extra aggressive premium than one other. Comparative evaluation throughout numerous suppliers, contemplating their particular insurance policies and nationwide insurance coverage evaluation strategies, is essential to optimize insurance coverage prices.

State of affairs: Affect of Nationwide Insurance coverage on Insurance coverage for Younger Drivers

Younger drivers usually face greater insurance coverage premiums resulting from their perceived greater threat profile. Nonetheless, a younger driver with a constantly optimistic nationwide insurance coverage document would possibly doubtlessly safe a extra favorable premium. A historical past of accountable monetary habits and constant contributions might point out a decrease probability of future claims. This showcases the potential for nationwide insurance coverage to mitigate the sometimes greater threat related to younger drivers.

State of affairs: Nationwide Insurance coverage Affecting Insurance coverage for Particular Automobile Varieties

Insurance coverage prices for particular automotive sorts may be influenced by nationwide insurance coverage. A driver with a powerful nationwide insurance coverage document would possibly safe a extra aggressive premium for a high-performance automobile. It’s because insurers would possibly understand a accountable driver as much less more likely to have interaction in dangerous behaviors whereas driving a high-performance automobile. The insurance coverage supplier’s evaluation of the driving force’s threat profile, which incorporates their nationwide insurance coverage document, influences premium calculation for all automotive sorts.

For prime-risk automobiles, insurers will doubtless use a extra stringent evaluation based mostly on driver profiles and nationwide insurance coverage data.

Remaining Wrap-Up

In conclusion, Safety Nationwide Insurance coverage Firm automotive insurance coverage provides a variety of choices to swimsuit numerous wants. Understanding the affect of nationwide insurance coverage, driving historical past, and automobile sort in your premiums is essential to securing the absolute best protection. This information offers an in depth overview, empowering you to match insurance policies and make knowledgeable choices. Keep in mind to totally analysis and examine totally different insurance coverage suppliers earlier than selecting a coverage.

Detailed FAQs

What components affect automotive insurance coverage premiums moreover nationwide insurance coverage?

Driving historical past, age, location, and automobile sort all contribute to the general price of your automotive insurance coverage coverage. A clear driving document usually leads to decrease premiums, whereas older drivers and people in high-risk areas would possibly face greater prices. The worth and sort of your automobile additionally have an effect on your premiums.

How does my nationwide insurance coverage standing have an effect on my automotive insurance coverage declare course of?

Your nationwide insurance coverage standing would possibly affect the declare course of by impacting your protection limits or the required documentation. Make sure you perceive the specifics of your coverage in relation to your nationwide insurance coverage.

What sorts of automotive insurance coverage protection choices can be found?

Safety Nationwide Insurance coverage Firm provides numerous protection choices, together with legal responsibility, collision, complete, and uninsured/underinsured motorist protection. Every choice offers totally different ranges of safety towards potential damages.

Are there any reductions out there for automotive insurance coverage with Safety Nationwide Insurance coverage Firm?

Safety Nationwide Insurance coverage Firm would possibly supply reductions for numerous components, similar to secure driving habits, accident-free data, or bundling different insurance coverage merchandise. Contact them on to find out about out there reductions.