Long run care insurance coverage North Carolina: navigating the complexities of future care. This information breaks down the important features of LTCI within the Tar Heel State, from prices and protection choices to eligibility standards and selecting the best coverage.

Understanding your long-term care wants is essential. This information explores the precise wants of North Carolina residents, analyzing the prevalent kinds of care required and the rising prices related to them. It additionally highlights the significance of proactive planning in your future.

Introduction to Lengthy-Time period Care Insurance coverage in North Carolina

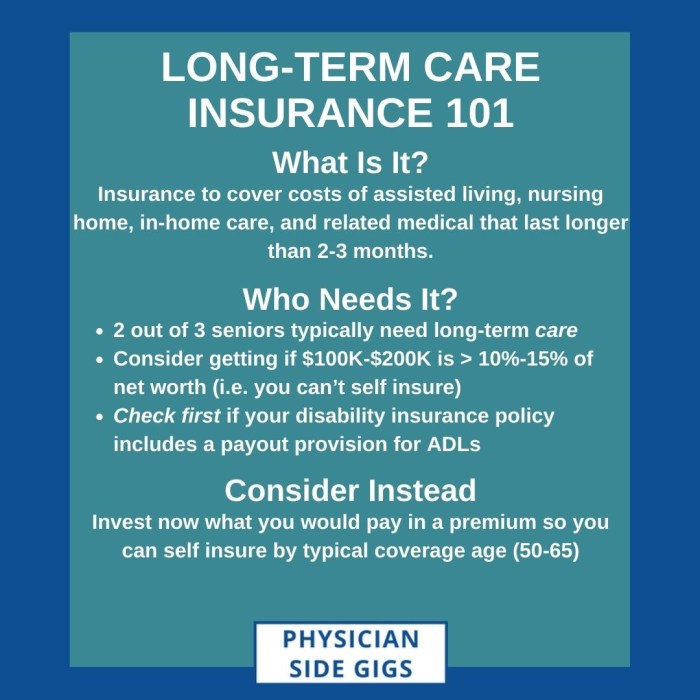

Lengthy-term care insurance coverage (LTCI) in North Carolina, like in lots of different states, is an important but usually missed part of complete healthcare planning. It safeguards people in opposition to the substantial monetary burden of long-term care companies, which can be wanted for prolonged durations resulting from sicknesses or disabilities. Understanding the nuances of LTCI choices in North Carolina is crucial for making knowledgeable choices.North Carolina’s healthcare panorama necessitates a proactive method to long-term care planning.

Because the inhabitants ages, the demand for assisted dwelling, nursing dwelling care, and residential healthcare companies is predicted to extend. LTCI offers a security web, permitting people to take care of their monetary stability whereas receiving needed care. That is particularly essential given the rising prices of long-term care companies within the state.

Overview of Lengthy-Time period Care Insurance coverage in North Carolina

Lengthy-term care insurance coverage in North Carolina gives a wide range of plans designed to fulfill particular person wants and monetary conditions. These plans sometimes cowl a spread of companies, together with expert nursing care, assisted dwelling, and residential healthcare. The plans differ considerably in protection quantities, premiums, and ready durations.

Key Variations Between LTCI Plans

The market gives a various array of LTCI plans, with various ranges of protection. Key distinctions embody the utmost profit quantity payable over a time period, the every day or month-to-month cost quantities, and the kinds of care companies lined. Plans could differ within the particular kinds of care included, reminiscent of in-home care, assisted dwelling amenities, or nursing houses.

Frequent Misconceptions About LTCI in North Carolina

One prevalent false impression is that LTCI is simply needed for these with important property. Nevertheless, even people with average monetary sources can profit from LTCI to guard themselves from potential monetary wreck within the occasion of a protracted sickness or incapacity. One other false impression is that LTCI is simply too costly. Whereas premiums can differ, many plans supply versatile choices to align with numerous budgets.

Comparability of LTCI Plan Sorts

| Plan Kind | Protection Quantity | Premiums | Ready Interval |

|---|---|---|---|

| Primary | Covers elementary care wants for a restricted time. | Typically decrease premiums because of the decreased protection. | Ready interval may be shorter to encourage earlier enrollment. |

| Complete | Supplies a considerable quantity of protection for a variety of long-term care wants. | Greater premiums reflecting the broader protection. | Ready interval could also be longer to account for the upper degree of protection. |

| Hybrid | Combines components of fundamental and complete plans, providing a stability between protection and price. | Premiums sometimes fall between fundamental and complete plans. | Ready durations usually are adjusted accordingly, relying on the precise protection included. |

Prices and Premiums Related to LTCI in North Carolina: Lengthy Time period Care Insurance coverage North Carolina

Lengthy-term care insurance coverage (LTCI) premiums in North Carolina, like elsewhere, are influenced by a large number of things, making exact generalizations difficult. Nevertheless, understanding the standard prices and related variables is essential for knowledgeable decision-making. Particular person circumstances and desired protection ranges considerably influence premium quantities.

Common Prices and Premiums

LTCI premiums in North Carolina, like elsewhere, differ significantly relying on components reminiscent of age, well being standing, desired protection quantities, and profit durations. Premiums are usually increased for youthful candidates and people with pre-existing well being circumstances. Whereas particular common prices aren’t available for North Carolina, nationwide averages supply a common understanding.

Components Influencing LTCI Premiums in North Carolina

A number of key components contribute to the premium construction of LTCI insurance policies in North Carolina. Age is a major determinant, with premiums rising as people become old. Well being circumstances, reminiscent of pre-existing medical points, considerably have an effect on premiums, as these people usually tend to want long-term care companies. The chosen protection quantity and profit interval straight influence the premium price.

Insurance policies providing increased protection quantities and longer profit durations usually command increased premiums. Lastly, the precise coverage options and profit buildings of various insurers play a task in premium calculations. The monetary power and status of the insurance coverage firm additionally contribute to the premium construction.

Comparability Based mostly on Protection Quantities and Profit Intervals

The desk under presents a common illustration of potential premium ranges for various protection quantities, protecting in thoughts that these are estimates and precise premiums will differ considerably. Precise premiums depend upon the precise coverage options and the insurer.

| Protection Quantity | Premium Vary (Annual) |

|---|---|

| $50,000 | $1,000 – $3,000 |

| $100,000 | $1,500 – $4,500 |

| $200,000 | $2,500 – $7,000 |

Potential Price-Saving Methods

A number of methods can assist mitigate the price of LTCI in North Carolina. Buying protection at a youthful age usually ends in decrease premiums. Rigorously contemplating the specified protection quantity and profit interval can assist to keep away from pointless bills. Evaluating insurance policies from a number of insurers can permit for figuring out insurance policies with related protection at completely different worth factors. Evaluating the monetary stability of the insurance coverage firm is crucial, as this will have an effect on future premium changes.

Lastly, benefiting from obtainable reductions, reminiscent of these for wholesome people or those that full well being assessments, can cut back premium prices.

Availability and Choices for LTCI in North Carolina

Navigating the panorama of long-term care insurance coverage (LTCI) in North Carolina requires understanding the varied suppliers and coverage choices obtainable. This information empowers people to make knowledgeable choices aligning with their particular wants and monetary conditions. A radical exploration of those choices is essential for securing ample safety in opposition to future long-term care bills.A variety of insurance coverage corporations supply LTCI in North Carolina, every with various coverage buildings and premiums.

This selection permits people to check completely different advantages and prices to discover a plan that most closely fits their private circumstances. Understanding the obtainable coverage options and advantages is crucial for choosing probably the most applicable protection.

LTCI Suppliers in North Carolina

A mess of respected insurance coverage corporations supply long-term care insurance coverage insurance policies in North Carolina. These corporations present numerous choices, catering to varied budgets and care wants. Selecting a supplier requires cautious consideration of their monetary stability, status, and the precise advantages supplied inside their insurance policies.

- A number of main nationwide insurance coverage corporations function in North Carolina, offering a variety of long-term care insurance policies.

- Regional insurance coverage corporations additionally supply LTCI, usually with tailor-made choices for the native market.

- Direct-response corporations supply aggressive premiums, typically with less complicated coverage buildings.

Respected Insurance coverage Corporations Providing LTCI

Deciding on a good insurance coverage firm is paramount when buying LTCI. The monetary power and observe file of the corporate considerably affect the reliability of the coverage. Insurance coverage corporations with a confirmed historical past of honoring coverage commitments are a safer alternative.

- Aetna

- Cigna

- Humana

- MetLife

- North Carolina-based insurance coverage corporations

Coverage Choices and Options

Lengthy-term care insurance coverage insurance policies in North Carolina current numerous choices, encompassing completely different profit buildings and protection quantities. Care wants, private monetary circumstances, and desired ranges of protection needs to be fastidiously evaluated. Particular options like inflation safety, inflation changes, and elective add-ons for particular care wants are key issues.

| Coverage Function | Description |

|---|---|

| Profit Quantity | The every day or month-to-month quantity payable for long-term care companies. |

| Elimination Interval | The ready interval earlier than advantages start after the insured turns into eligible for care. |

| Profit Interval | The utmost size of time advantages might be paid. |

| Inflation Safety | Changes to profit quantities to account for rising care prices over time. |

| Coordination of Advantages | How the coverage interacts with different present advantages (e.g., Medicare, Medicaid). |

| Respite Care Protection | Supplies protection for short-term care to permit caregivers a break. |

Incessantly Requested Questions (FAQ)

Understanding the nuances of LTCI insurance policies is significant for knowledgeable decision-making. These questions handle frequent issues about choices obtainable in North Carolina.

- What kinds of long-term care are lined? LTCI insurance policies in North Carolina usually cowl a big selection of companies, together with expert nursing care, assisted dwelling, and residential well being care.

- How do I examine completely different insurance policies? Evaluate coverage options, premiums, profit quantities, and elimination durations to determine the most suitable choice.

- What are the standard premiums for LTCI in North Carolina? Premiums differ relying on the coverage’s protection, the insured’s age and well being, and the chosen profit quantity.

- How do I select an insurance coverage firm? Consider the corporate’s monetary power, status, and the precise advantages supplied inside their insurance policies.

Eligibility and Necessities for LTCI in North Carolina

Navigating the complexities of long-term care insurance coverage (LTCI) in North Carolina requires a transparent understanding of eligibility standards and the underwriting course of. These components considerably affect the premiums and availability of protection. LTCI insurance policies are designed to supply monetary help during times of long-term care wants, and understanding the pre-requisites is crucial for making knowledgeable choices.

Eligibility Standards for LTCI Insurance policies

The eligibility standards for LTCI insurance policies in North Carolina differ relying on the precise insurance coverage supplier. Typically, these standards embody components like age, well being standing, and pre-existing circumstances. Candidates sometimes want to fulfill minimal age necessities, usually within the 50s or 60s, though some insurance policies could have decrease age limits. This variation is essential to contemplate when evaluating completely different suppliers.

Moreover, well being assessments play a crucial position in figuring out eligibility.

Underwriting Course of for LTCI Functions

The underwriting course of for LTCI functions in North Carolina includes an intensive analysis of the applicant’s well being historical past and monetary scenario. This course of goals to evaluate the chance related to offering long-term care protection. Insurance coverage corporations fastidiously scrutinize medical information, conduct interviews, and will require extra medical checks to judge the applicant’s well being standing. A complete understanding of this course of empowers potential policyholders to organize for the appliance successfully.

Medical Historical past Disclosure and Its Affect on LTCI Charges

Sincere and full disclosure of medical historical past is paramount throughout the LTCI software course of. Correct reporting of previous and current well being circumstances is essential. This transparency impacts the insurer’s threat evaluation and, consequently, the premiums charged. Misrepresentation or omission of data can result in coverage denial or considerably increased premiums. Full disclosure demonstrates accountable decision-making and permits insurers to precisely assess the dangers related to offering protection.

Comparability of Eligibility Necessities Throughout LTCI Suppliers

Eligibility necessities differ throughout completely different LTCI suppliers in North Carolina. Some suppliers could have extra stringent age necessities, whereas others could supply protection to a broader vary of candidates. Variations in underwriting requirements additionally contribute to those variations. Rigorously evaluating coverage particulars, together with the age vary lined, particular medical circumstances excluded, and the kinds of care included in the advantages bundle, is crucial to determine the coverage that most closely fits particular person wants.

Getting ready for an LTCI Utility

Thorough preparation for an LTCI software in North Carolina includes a number of key steps. Gathering related medical information, together with physician’s notes, take a look at outcomes, and hospital discharge summaries, is essential. Sustaining an in depth monetary historical past, together with revenue statements and tax returns, assists in figuring out affordability. Understanding the precise necessities of every supplier is crucial. This consists of consulting with a monetary advisor or insurance coverage skilled to make sure a complete understanding of the method and to make knowledgeable choices.

The proactive gathering of needed paperwork minimizes potential delays or issues throughout the software course of.

Understanding North Carolina’s Lengthy-Time period Care Wants

Navigating the complexities of long-term care necessitates a deep understanding of the precise wants and challenges confronted by North Carolina’s residents. This part delves into the prevalence, demographics, and rising prices related to these wants, offering a complete overview of the panorama for long-term care insurance coverage issues.The spectrum of long-term care wants extends far past conventional institutional settings. It encompasses a variety of help, from fundamental every day dwelling actions to specialised medical care, impacting people throughout numerous age teams and socioeconomic backgrounds.

Understanding these wants is essential for tailoring applicable help programs and insurance coverage methods.

Particular Lengthy-Time period Care Wants of North Carolina Residents

North Carolina residents face a various array of long-term care wants, reflecting the state’s various demographics and well being circumstances. These wants vary from help with actions of every day dwelling (ADLs) like bathing and dressing to extra complicated medical care. Moreover, psychological well being issues, together with dementia and cognitive impairment, are important components influencing long-term care necessities. The prevalence of those wants is commonly linked to the growing older inhabitants and the growing incidence of continual ailments.

Prevalence of Lengthy-Time period Care Wants in North Carolina

Dependable information on the precise prevalence of particular long-term care wants in North Carolina shouldn’t be available in a single, complete report. Nevertheless, nationwide tendencies counsel {that a} substantial portion of the inhabitants would require some type of long-term care sooner or later of their lives. That is more likely to be influenced by the state’s demographic composition and the growing prevalence of continual circumstances.

The influence on the state’s healthcare system and particular person monetary planning is appreciable.

Demographics Related to Lengthy-Time period Care Wants in North Carolina

North Carolina’s demographic profile performs a major position in shaping the long-term care wants panorama. The growing older inhabitants and the rising prevalence of continual circumstances are key components influencing the demand for care. Moreover, the presence of numerous socioeconomic teams and differing entry to healthcare sources additional complicates the scenario. For example, disparities in entry to high quality care could have an effect on the kind and depth of care required.

Rising Prices of Lengthy-Time period Care in North Carolina

The escalating prices of long-term care in North Carolina are a major concern. Inflation, elevated demand for specialised care, and developments in medical expertise contribute to the rising monetary burden. Moreover, the price of expert nursing amenities, dwelling healthcare companies, and different care choices continues to extend, doubtlessly outpacing the sources obtainable for a lot of people.

Abstract Desk of Lengthy-Time period Care Wants in North Carolina

| Want Class | Description | Share of Inhabitants Affected |

|---|---|---|

| Help with Actions of Every day Dwelling (ADLs) | Want for assist with fundamental self-care duties like bathing, dressing, consuming, and transferring. | Estimated, varies by age group. |

| Help with Instrumental Actions of Every day Dwelling (IADLs) | Want for assist with extra complicated duties like managing funds, procuring, cooking, and utilizing transportation. | Estimated, varies by age group. |

| Specialised Medical Care | Want for ongoing medical care, together with bodily remedy, occupational remedy, and drugs administration. | Estimated, varies by age group and well being circumstances. |

Ideas for Selecting the Proper LTCI Coverage in North Carolina

Navigating the world of long-term care insurance coverage (LTCI) can really feel daunting, particularly in a state like North Carolina with its numerous wants and coverage choices. Understanding the important thing components that affect the perfect LTCI coverage in your particular scenario is essential for securing ample safety. This information offers actionable recommendation that will help you make knowledgeable choices.Selecting the best LTCI coverage includes extra than simply evaluating premiums.

A considerate method considers your distinctive circumstances, future wants, and monetary objectives. It is about guaranteeing you will have a plan that successfully addresses potential long-term care bills and offers the very best worth.

Evaluating LTCI Insurance policies in North Carolina

A radical analysis of accessible LTCI insurance policies is crucial. Think about the coverage’s protection quantity, profit interval, and particular advantages supplied. Rigorously look at the coverage’s definition of eligible care, guaranteeing it aligns along with your potential wants. Understanding the coverage’s exclusions and limitations is equally essential. Reviewing coverage language fastidiously will allow you to keep away from surprises and make sure the coverage adequately addresses your future wants.

Vital Issues When Evaluating LTCI Insurance policies

A number of crucial components affect the appropriateness of a coverage. Premiums, whereas an element, shouldn’t be the only determinant. The coverage’s profit quantity and size of protection needs to be fastidiously evaluated to match your anticipated wants. Think about the coverage’s particular circumstances and exclusions. A coverage that excludes protection for sure pre-existing circumstances or particular kinds of care might depart you with out ample safety.

Search for insurance policies that present flexibility and choices for adjusting protection as your wants evolve.

Key Components to Search for in an LTCI Coverage

A complete LTCI coverage should handle your distinctive wants. Assess the coverage’s profit construction. Does it present a lump sum cost or a month-to-month allowance? Think about the coverage’s eligibility standards for receiving advantages. Study the precise kinds of care the coverage covers, from expert nursing amenities to dwelling well being care.

The coverage’s ready interval earlier than advantages start is one other essential facet. The longer the ready interval, the larger the potential monetary burden if care is required before anticipated.

Significance of Consulting with a Monetary Advisor, Long run care insurance coverage north carolina

A monetary advisor can present worthwhile insights and steering in selecting the best LTCI coverage. Their experience can assist you analyze your monetary scenario and consider completely different coverage choices to make sure an appropriate match. They’ll help in assessing your particular wants and creating a complete monetary plan. A monetary advisor can assist you perceive the complexities of LTCI, offering customized suggestions based mostly in your distinctive circumstances and objectives.

Guidelines for Evaluating LTCI Insurance policies

This guidelines offers a structured method to evaluating LTCI insurance policies.

- Coverage advantages: Care sorts lined, every day/month-to-month profit quantities, and most profit durations.

- Premiums: Month-to-month prices and any extra charges or fees.

- Ready durations: Time from software to profit graduation.

- Eligibility standards: Circumstances or pre-existing circumstances excluded from protection.

- Coverage exclusions: Particular kinds of care or circumstances not lined by the coverage.

- Coverage phrases and circumstances: Evaluate the nice print totally.

- Coverage supplier status: Analysis the monetary stability and reliability of the insurance coverage firm.

- Monetary advisor session: Search skilled steering for customized suggestions.

By diligently reviewing these features, you may make an knowledgeable choice that aligns along with your future wants.

Final Recap

In conclusion, securing long-term care insurance coverage in North Carolina is an important step in direction of monetary safety and peace of thoughts. By understanding the intricacies of accessible insurance policies, prices, and eligibility, you may make knowledgeable choices to guard your future. This information offers a stable basis in your journey.

Fast FAQs

What are the standard premiums for a $100,000 protection coverage in North Carolina?

Sadly, this data is not obtainable within the Artikel. Premiums differ drastically relying on age, well being, and particular coverage particulars.

What are the frequent misconceptions about long-term care insurance coverage?

Many consider LTCI is just for the rich or that it will not cowl their particular wants. Nevertheless, it may be important for all revenue ranges. It is also essential to notice that plans differ significantly, and it’s essential to be clear in regards to the protection supplied.

How do I examine LTCI insurance policies in North Carolina?

Evaluate protection quantities, premiums, ready durations, and particular advantages supplied. Do not rely solely on price; think about the long-term worth of the coverage. A monetary advisor can assist you.

What are some cost-saving methods for LTCI in North Carolina?

Search for insurance policies with increased protection limits and versatile profit choices. Discover reductions and think about buying insurance policies at a youthful age for decrease premiums.