Do I would like full protection insurance coverage to finance a automobile? This complete evaluate examines the connection between insurance coverage sorts and automobile mortgage approval, exploring lender necessities, protection choices, and potential options. Understanding these components is essential for securing the absolute best mortgage phrases and avoiding potential pitfalls.

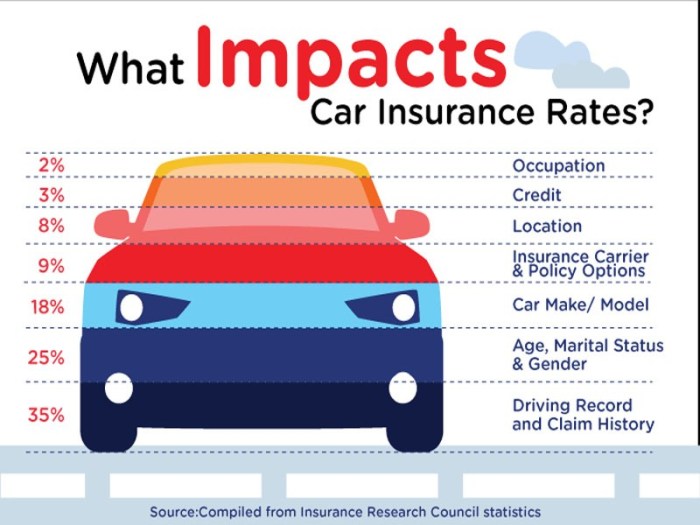

Lenders assess numerous components when evaluating a automobile mortgage utility, together with credit score rating, down fee quantity, and the kind of insurance coverage protection. Several types of insurance coverage, like legal responsibility, collision, and complete, have various impacts on mortgage approval and rates of interest. This evaluation delves into the nuances of those interactions, providing a sensible information for navigating the complexities of automobile financing.

Understanding Mortgage Necessities

The auto mortgage panorama is riddled with complexities designed to favor lenders. Navigating these necessities calls for a vital eye, because the seemingly simple course of usually conceals hidden prices and unfavorable phrases. Understanding the components lenders scrutinize is essential to securing a good and advantageous mortgage.

Elements Lenders Contemplate, Do i want full protection insurance coverage to finance a automobile

Lenders meticulously consider quite a few components when assessing automobile mortgage purposes. This course of isn’t arbitrary; it is a calculated danger evaluation. Key issues embrace:

- Credit score historical past: A big issue, credit score scores instantly affect approval odds and rates of interest. A robust credit score historical past demonstrates accountable monetary administration, whereas a poor one alerts potential danger.

- Debt-to-income ratio (DTI): This ratio measures the proportion of an applicant’s month-to-month debt obligations to their month-to-month revenue. Excessive DTI ratios recommend a possible pressure on the borrower’s skill to handle further debt, making them much less enticing to lenders.

- Down fee quantity: A bigger down fee reduces the mortgage quantity, thereby decreasing the lender’s danger and doubtlessly main to higher rates of interest and phrases.

- Mortgage-to-value ratio (LTV): This ratio compares the mortgage quantity to the automobile’s appraised worth. A decrease LTV signifies much less danger for the lender.

- Automobile sort and situation: The age, make, mannequin, and situation of the automobile considerably affect the mortgage quantity and rate of interest. Extra worthwhile or newer autos usually command higher phrases.

Impression of Credit score Scores

Credit score scores are an important determinant in mortgage approval and rates of interest. Lenders use credit score scores to gauge the borrower’s creditworthiness. Decrease scores translate to increased danger, resulting in much less favorable mortgage phrases.

- Excessive credit score scores (e.g., 750+) usually grant entry to essentially the most favorable rates of interest and mortgage phrases. These debtors usually qualify for decrease rates of interest, quicker approvals, and extra versatile mortgage choices.

- Medium credit score scores (e.g., 650-749) usually yield average rates of interest and phrases. The mortgage course of may take barely longer, and mortgage phrases is perhaps much less favorable than these of high-credit-score debtors.

- Low credit score scores (e.g., beneath 650) usually result in important hurdles in securing favorable mortgage phrases. Excessive rates of interest, longer mortgage phrases, and potential mortgage denial are frequent outcomes for debtors on this class. Debtors with low credit score scores might have to discover different financing choices or enhance their credit score standing earlier than making use of for a mortgage.

Function of Down Funds

Down funds instantly affect mortgage phrases and approval odds. A bigger down fee reduces the mortgage quantity, lowering the lender’s danger.

- A better down fee usually leads to a decrease mortgage quantity. This instantly reduces the danger for the lender, which regularly results in higher rates of interest and extra favorable phrases. It additionally might shorten the mortgage time period, lowering the general value of the mortgage.

- Conversely, a smaller down fee leads to a bigger mortgage quantity, growing the danger for the lender. This usually results in increased rates of interest, doubtlessly longer mortgage phrases, and extra stringent mortgage necessities.

Financing Choices

Varied financing choices can be found, every with its personal set of necessities.

- Auto loans: These are conventional loans the place the borrower pays again the principal quantity plus curiosity over a set interval. Necessities usually embrace a credit score examine, debt-to-income ratio evaluation, and down fee.

- Leases: A lease settlement permits the borrower to make use of a automobile for a specified interval. Leases usually have decrease upfront prices however might have increased month-to-month funds in comparison with loans, relying on the automobile and phrases. Leases additionally usually have restrictions on mileage and utilization.

Mortgage Comparability Desk

| Credit score Rating | Mortgage Time period (years) | Curiosity Charge (%) | Month-to-month Cost ($) |

|---|---|---|---|

| Excessive (750+) | 5 | 4.5 | 400 |

| Medium (650-749) | 6 | 5.5 | 450 |

| Low (<650) | 7 | 7.5 | 550 |

Be aware: These figures are estimates and may differ based mostly on particular mortgage situations, market components, and particular person circumstances.

Insurance coverage Protection Varieties: Do I Want Full Protection Insurance coverage To Finance A Automobile

The automotive financing business is rife with hidden prices and complexities, usually designed to learn the establishments quite than the patron. One such space of manipulation is the requirement for numerous varieties of auto insurance coverage. Lenders, pushed by a revenue motive, usually leverage these necessities to extend the chance of compensation and decrease their very own danger, irrespective of the particular want or affordability for the patron.The different types of automobile insurance coverage protection, from the deceptively easy legal responsibility insurance policies to the extra complete packages, considerably affect the phrases of a automobile mortgage.

Understanding these nuances is vital for navigating the often-complex panorama of automotive finance and avoiding doubtlessly expensive traps.

Legal responsibility Protection

Legal responsibility protection is essentially the most primary type of auto insurance coverage. It protects you in case you are at fault in an accident, protecting the opposite celebration’s damages and authorized charges. It’s usually the minimal protection required by legislation and the most cost effective choice, however this minimal safety presents little monetary safeguard for the insured. This protection usually leaves important monetary gaps ought to an accident happen, and is a basic component in mortgage agreements.

Lenders steadily demand legal responsibility protection as a baseline for approval, usually viewing it because the naked minimal to forestall the loaner from being financially uncovered to potential authorized prices from accidents.

Collision Protection

Collision protection protects your automobile whether it is broken in an accident, no matter who’s at fault. This protection considerably reduces the monetary burden if the insured’s automobile is broken in an accident. Lenders steadily see collision protection as a obligatory part to guard their funding within the automobile. Failure to acquire this protection could make mortgage approval considerably tougher.

That is as a result of lender’s concern in regards to the worth of the automobile declining whether it is broken. Within the occasion of an accident the place the insured is at fault, the lender is doubtlessly uncovered to a considerable monetary loss, which is why it is usually demanded.

Complete Protection

Complete protection goes past collision, defending your automobile in opposition to non-collision harm, akin to vandalism, fireplace, or theft. This complete safety, whereas seemingly helpful, is usually perceived by lenders as a luxurious, quite than a necessity. The lender’s curiosity is primarily in securing their funding, and complete protection is considered as an added layer of safety. The presence of this protection is usually seen as an indication of accountable monetary administration.

Lenders might require or desire this protection to mitigate their danger in instances of great damages, particularly theft or fireplace.

Impression on Mortgage Purposes

Lenders usually require particular varieties of insurance coverage protection to mitigate their danger. Legal responsibility protection is often a baseline requirement, however collision and complete protection are sometimes most well-liked. The dearth of satisfactory protection may end up in mortgage denial or considerably extra stringent mortgage phrases. A mortgage applicant with out complete insurance coverage is considered as doubtlessly jeopardizing the lender’s funding, particularly if the automobile is considerably broken or stolen.

It’s because lenders are required to account for the danger of monetary loss if the automobile is broken.

Insurance coverage Protection Comparability

| Protection Sort | Description | Impression on Mortgage | Instance Situation |

|---|---|---|---|

| Legal responsibility | Covers damages to others in an accident the place you’re at fault. | Typically a minimal requirement for mortgage approval. | A borrower is at fault in an accident, inflicting $10,000 in damages to a different celebration. Legal responsibility insurance coverage covers the damages. |

| Collision | Covers harm to your automobile in an accident, no matter fault. | Typically most well-liked by lenders to guard their funding. | A borrower’s automobile is broken in a collision, no matter who was at fault. Collision insurance coverage covers the repairs. |

| Complete | Covers harm to your automobile from occasions apart from collision, akin to vandalism, fireplace, or theft. | Lenders usually view it as an added layer of safety. | A borrower’s automobile is vandalized, leading to important harm. Complete insurance coverage covers the repairs. |

Full Protection and Mortgage Approval

The auto mortgage business, usually a labyrinth of opaque phrases and situations, steadily pits customers in opposition to predatory lending practices. Full protection insurance coverage, usually introduced as a prerequisite for mortgage approval, is an important component on this energy dynamic. Understanding the intricacies of this relationship is paramount for navigating the complexities of securing a automobile mortgage.The connection between full protection insurance coverage and mortgage approval is a basic facet of the financing course of.

Lenders view full protection insurance coverage as a type of safety in opposition to monetary losses in case of an accident or harm to the automobile. This safety internet, nevertheless, is usually wielded by lenders to exert strain on debtors, doubtlessly exploiting their monetary vulnerability.

Full Protection Insurance coverage Necessities

Lenders usually prioritize full protection insurance coverage to mitigate their danger. This safety shields them from substantial monetary burdens within the occasion of a automobile accident or harm, safeguarding their funding within the mortgage. The lender’s place is considered one of self-preservation, a rational response in a enterprise surroundings the place danger administration is paramount. Nevertheless, this rationale might be exploited in a market the place transparency and shopper protections are missing.

Comparability of Insurance coverage Protection Varieties

- Complete Protection: This protects in opposition to damages not associated to collisions, akin to vandalism, fireplace, or hail. Its inclusion in a mortgage bundle usually serves as an important safeguard for the lender, and failure to take care of this protection can jeopardize the mortgage.

- Collision Protection: This covers damages ensuing from collisions with different autos or objects. Lenders usually contemplate this protection important to safe their funding, and its absence might result in mortgage denial or unfavorable rates of interest.

- Legal responsibility Protection: This solely covers damages you trigger to others. It’s usually inadequate to satisfy lender necessities for mortgage approval, signaling a better danger to the lender.

The various ranges of insurance coverage protection instantly have an effect on the phrases and situations of the mortgage, together with rates of interest and mortgage approval. Increased ranges of protection, like full protection, translate to decrease perceived danger for the lender, which can lead to extra favorable rates of interest. This relationship underscores the inherent energy imbalance between the lender and the borrower.

Penalties of Missing Full Protection

Failing to take care of full protection insurance coverage can have critical penalties for mortgage approval. Lenders might reject mortgage purposes altogether or impose considerably increased rates of interest, successfully penalizing debtors who fail to satisfy their minimal danger evaluation standards. This usually displays a flawed system the place lenders prioritize their very own monetary safety over the potential hardships of debtors.

Mortgage Approval and Curiosity Charges

The extent of insurance coverage protection instantly impacts mortgage approval and rates of interest. Full protection, demonstrating a dedication to accountable automobile possession and mitigating monetary danger, usually leads to decrease rates of interest and a better chance of mortgage approval. Conversely, insufficient protection may end up in increased rates of interest and potential mortgage denial, additional exacerbating the monetary burden on the borrower.

Situation: Full Protection Requirement

A state of affairs the place full protection insurance coverage is required for mortgage approval includes a high-risk automobile mannequin, like a luxurious sports activities automobile, or a automobile that requires a excessive deductible for insurance coverage claims. Lenders on this occasion are sometimes unwilling to tackle the added danger of a collision or harm with out the safety of full protection insurance coverage. This illustrates how the monetary panorama of the automotive business usually disproportionately burdens customers.

Options to Full Protection

The automotive financing business is a battleground of conflicting pursuits. Lenders, pushed by danger mitigation, usually demand full protection insurance coverage as a prerequisite for loans. Nevertheless, this blanket requirement can unfairly burden customers and, in some instances, be pointless. This evaluation explores situations the place full protection won’t be the only acceptable answer, analyzing options and their implications for mortgage purposes.The strain to take care of full protection insurance coverage generally is a monetary burden, particularly for customers who may face important upfront prices or might not be capable to afford it.

This usually results in a fancy dance between affordability and the calls for of lenders.

Conditions The place Full Protection May Be Pointless

A full protection coverage is usually a expensive requirement, significantly in areas with decrease accident charges or the place autos are older or much less worthwhile. Lenders, of their pursuit of revenue and danger mitigation, usually impose a standardized requirement for full protection. Nevertheless, this standardization might not at all times be justified. Elements like low-accident areas, the automobile’s age and situation, and the general danger profile of the borrower can all contribute to the appropriateness of other protection choices.

Acceptable Options to Full Protection

A number of insurance coverage choices can fulfill lenders’ danger necessities with out the total value of complete protection. These might embrace collision protection solely, or a mixture of legal responsibility and complete protection. The selection usually is dependent upon components such because the borrower’s driving file, the automobile’s situation, and the particular mortgage phrases. These different choices are sometimes extra reasonably priced and could also be extra acceptable for explicit circumstances.

Evaluating Insurance coverage Choices

An important step in understanding options is evaluating the professionals and cons of various protection sorts. A complete desk illustrating the assorted choices is beneath:

| Protection Sort | Execs | Cons |

|---|---|---|

| Full Protection | Offers most safety in opposition to all varieties of damages. | Highest premiums, doubtlessly pointless for some debtors. |

| Collision Protection Solely | Decrease premiums than full protection. | Does not cowl harm from incidents like vandalism or climate occasions. |

| Legal responsibility-Solely Protection | Lowest premiums. | Provides minimal safety. Excessive danger of monetary loss if an accident happens. |

| Complete Protection | Protects in opposition to harm from incidents not lined by collision, akin to vandalism, theft, or pure disasters. | Nonetheless increased than liability-only, however decrease than full protection. |

Mortgage Software Course of with Different Protection

The mortgage utility course of might differ relying on the chosen different protection. Lenders usually have particular necessities for different insurance coverage insurance policies. Documentation and verification procedures are important to make sure compliance with these necessities. A lender might require proof of insurance coverage protection, particulars of the coverage, and a press release of any exclusions or limitations within the protection.

Potential Dangers and Advantages of Different Insurance coverage

Selecting an alternate insurance coverage sort can have a number of implications for debtors.

- Potential Threat 1: Increased out-of-pocket bills in case of an accident or harm not lined by the choice coverage.

- Potential Threat 2: Rejection of the mortgage utility if the choice protection doesn’t meet the lender’s minimal necessities.

- Potential Profit 1: Vital financial savings on insurance coverage premiums, releasing up funds for different monetary wants.

- Potential Profit 2: Elevated flexibility in selecting an insurance coverage coverage that most closely fits the borrower’s particular person wants and circumstances.

Understanding Lender Necessities

The monetary business, significantly automobile lending, usually presents a maze of rules and necessities, usually designed to reduce danger for lenders. Understanding these necessities is essential for securing a automobile mortgage, and navigating these complexities can usually really feel like navigating a political minefield. Lenders, pushed by their very own revenue motives and danger assessments, aren’t at all times clear about their standards, leaving customers weak to hidden pitfalls.

Widespread Lender Necessities Concerning Insurance coverage Protection

Lenders meticulously consider insurance coverage protection to evaluate the danger related to mortgage defaults. A vital part of this evaluation is the extent of protection and the monetary stability of the insurance coverage supplier. That is usually extra advanced than merely verifying a coverage exists.

- Minimal Protection Necessities: Lenders usually mandate a selected minimal degree of legal responsibility protection, typically even complete and collision protection. These differ significantly relying on the lender and the perceived danger profile of the borrower.

- Insurance coverage Supplier Repute: Lenders might scrutinize the fame and monetary energy of the insurance coverage firm offering the protection. This can be a essential facet of the danger evaluation. A good insurer with a strong monetary standing is extra more likely to be considered favorably than an insurer with a historical past of monetary troubles.

- Proof of Insurance coverage: Lenders require demonstrable proof of insurance coverage protection. This often includes a duplicate of the insurance coverage coverage or a certificates of insurance coverage, and verification of the insurance coverage firm’s particulars.

- Insurance coverage Historical past: Some lenders will evaluate the applicant’s insurance coverage historical past for claims or lapses in protection, additional evaluating the person’s duty and reliability. A historical past of frequent claims might sign a better danger of future issues.

Various Necessities Throughout Lenders

Totally different lenders have various approaches to evaluating insurance coverage protection. This isn’t a standardized course of. A lender targeted on high-risk loans may need extra stringent necessities than one specializing in low-risk debtors. The lender’s personal inner danger evaluation mannequin, coupled with financial situations, performs a serious function of their insurance coverage necessities.

- Mortgage Sort: Subprime auto loans, for example, usually have increased insurance coverage protection necessities than prime loans, reflecting the better danger related to such loans. This can be a frequent observe to mitigate potential losses.

- Credit score Rating: Lenders with stringent credit score insurance policies usually hyperlink insurance coverage necessities to the borrower’s creditworthiness. A low credit score rating might lead to increased insurance coverage necessities. This can be a direct correlation, as lenders view a decrease credit score rating as a better danger.

- Automobile Worth: The worth of the automobile performs a task in figuring out insurance coverage protection necessities. A costlier automobile usually necessitates a better degree of protection to guard the lender’s monetary curiosity. Lenders wish to make sure the automobile is satisfactorily insured in case of accidents or harm.

Figuring out Particular Insurance coverage Necessities

To establish the exact insurance coverage necessities from a selected lender, contacting the lender instantly is important. This can be a essential step within the mortgage utility course of, because it avoids misinterpretations or misunderstandings.

- Contact the Lender Straight: Speaking with the lender instantly is paramount. They will present the particular particulars of their insurance coverage protection necessities, which are sometimes detailed of their mortgage paperwork. This can be a direct method that ensures accuracy and avoids ambiguity.

Dealing with Rejection On account of Inadequate Protection

A lender’s rejection of an utility because of inadequate insurance coverage protection underscores the significance of meticulous preparation. It is a vital facet of the mortgage course of.

- Evaluation Lender Necessities: Fastidiously study the lender’s particular necessities to establish the hole in protection. This step is essential in understanding why the applying was rejected.

- Modify Insurance coverage Protection: If obligatory, alter insurance coverage protection to satisfy the lender’s necessities. This might contain buying further protection or adjusting the prevailing coverage.

- Search Different Financing Choices: If assembly the lender’s necessities proves unattainable, exploring different financing choices is important. It would contain searching for loans from completely different lenders or discovering different monetary options.

Widespread Lender Insurance policies Concerning Insurance coverage

Lenders usually have established insurance policies concerning insurance coverage protection. These insurance policies differ significantly, highlighting the non-standardized nature of the automobile mortgage course of.

| Lender Sort | Typical Insurance coverage Coverage Necessities |

|---|---|

| Subprime Lenders | Increased minimal protection ranges, stringent checks on insurance coverage suppliers, and thorough evaluate of applicant’s insurance coverage historical past. |

| Prime Lenders | Usually decrease minimal protection ranges, however nonetheless confirm the insurance coverage firm’s fame and the applicant’s historical past. |

| On-line Lenders | Could have automated programs that examine insurance coverage info, and will depend on third-party verification providers. |

Sensible Situations and Illustrations

The monetary panorama surrounding automobile loans usually presents a fancy interaction of things, with insurance coverage protection enjoying an important function in mortgage approval and phrases. Navigating these complexities requires a vital understanding of the motivations behind lender necessities and the potential penalties of insufficient safety. This part supplies illustrative situations to spotlight the significance of rigorously contemplating insurance coverage choices when pursuing a automobile mortgage.

Full Protection Insurance coverage Advice

Lenders usually prioritize full protection insurance coverage for loans as a result of substantial monetary danger related to automobile harm or theft. Full protection insurance coverage protects each the lender’s monetary curiosity and the borrower’s private property, mitigating potential losses in case of accidents or incidents. A first-rate instance is a high-value luxurious automobile, usually requiring full protection to compensate for potential in depth restore prices or whole loss.

In such instances, the lender wants complete safety to reduce monetary publicity. Moreover, a borrower with a less-than-stellar credit score historical past may discover that full protection considerably improves their possibilities of mortgage approval.

Different Insurance coverage Choices

Different insurance coverage choices is perhaps acceptable for automobile loans in sure circumstances. A younger driver with a pristine driving file and a low-value used automobile might face decrease insurance coverage premiums. On this case, complete protection is perhaps overkill. A rigorously thought-about complete coverage or complete insurance coverage may suffice. The affordability and practicality of other protection choices might be weighed in opposition to the dangers concerned, as Artikeld within the lender’s necessities.

Mortgage Denial On account of Inadequate Protection

Inadequate insurance coverage protection can result in a mortgage denial, particularly for high-value autos or these with a historical past of claims. A borrower with solely legal responsibility insurance coverage and a high-value import, for example, could also be rejected by the lender. The lender’s evaluation of danger, which is closely influenced by insurance coverage protection, is usually the deciding think about mortgage approval. That is significantly true for loans secured by the automobile, the place the lender’s danger publicity is instantly tied to the automobile’s situation and the borrower’s insurance coverage.

Figuring out the Finest Insurance coverage Possibility

Figuring out the most effective insurance coverage choice hinges on a cautious evaluation of private circumstances. Elements such because the automobile’s worth, the motive force’s historical past, the native insurance coverage market situations, and the lender’s necessities should be meticulously evaluated. The potential prices of inadequate protection should be weighed in opposition to the affordability of complete insurance coverage. An sincere appraisal of those variables is essential in avoiding future monetary pitfalls.

Case Examine: Selecting Automobile Insurance coverage

A 25-year-old latest graduate, Sarah, is buying a used compact automobile for her first commute. Her credit score rating is sweet, and he or she has a spotless driving file. Nevertheless, her finances is tight. She explores legal responsibility insurance coverage, which covers the opposite celebration in an accident however not her personal automobile. The lender requires full protection, however legal responsibility insurance coverage is considerably cheaper.

Sarah rigorously assesses the worth of the automobile and her private danger tolerance. She consults with a number of insurance coverage suppliers and compares coverage choices, finally selecting a complete coverage that gives adequate protection at an reasonably priced premium. This choice minimizes her danger and satisfies the lender’s necessities whereas prioritizing her monetary well-being.

Conclusion

In conclusion, the need of full protection insurance coverage for automobile financing relies upon closely on particular person circumstances and lender insurance policies. Whereas full protection usually strengthens mortgage purposes, different choices exist for debtors who can exhibit adequate danger mitigation. Cautious consideration of private monetary conditions and lender necessities is important to make knowledgeable selections concerning insurance coverage protection when financing a automobile.

This information supplies a framework for evaluating numerous insurance coverage choices and understanding lender preferences, finally empowering people to safe favorable mortgage phrases.

In style Questions

Does a low credit score rating mechanically imply I can not get a automobile mortgage?

No, a low credit score rating may affect mortgage approval and rates of interest however does not assure denial. Lenders usually contemplate numerous components past credit score rating, together with down fee, revenue verification, and insurance coverage protection.

What are the potential dangers of utilizing decrease protection insurance coverage?

Utilizing decrease protection insurance coverage choices might improve the danger of monetary loss in case of an accident or harm to the automobile. The lender might require increased down funds or stricter mortgage phrases to mitigate this danger.

How do completely different lenders have various necessities concerning automobile insurance coverage?

Lenders have various necessities based mostly on their danger assessments and insurance policies. Some might require full protection, whereas others may settle for different choices, or particular protection ranges. Direct communication with the lender is important to make clear their exact necessities.

What ought to I do if a lender rejects my utility because of inadequate insurance coverage protection?

If a lender rejects an utility because of inadequate insurance coverage, exploring different protection choices and offering further documentation to exhibit monetary duty could also be obligatory. Contacting the lender for clarification concerning their particular necessities is essential.