Low-cost automotive insurance coverage Pueblo CO is a vital concern for drivers within the space. Navigating the Pueblo insurance coverage market can really feel overwhelming, however discovering the precise coverage does not need to be a headache. This information will stroll you thru the elements influencing premiums, spotlight inexpensive suppliers, and supply actionable tricks to safe the absolute best deal.

From understanding the varied coverage varieties, equivalent to legal responsibility, collision, and complete protection, to evaluating quotes from respected suppliers, this useful resource is your complete companion. Learn to establish cost-effective choices, and uncover methods to barter decrease charges.

Introduction to Low-cost Automotive Insurance coverage in Pueblo, CO

Discovering inexpensive automotive insurance coverage in Pueblo, CO, like in every other space, requires understanding the market dynamics and your particular wants. The price of automotive insurance coverage is influenced by numerous elements, making a one-size-fits-all strategy ineffective. This information offers insights into the Pueblo automotive insurance coverage panorama, serving to you make knowledgeable choices for securing an appropriate coverage.The Pueblo, CO, automotive insurance coverage market is a aggressive one, with a number of insurance coverage suppliers vying for patrons.

This competitors, whereas helpful for customers, additionally necessitates cautious analysis of various choices to make sure you are getting the very best worth on your cash. Components impacting premium charges are usually not all the time apparent, and recognizing these influences may help you safe a extra inexpensive coverage.

Components Influencing Automotive Insurance coverage Premiums in Pueblo, CO

A number of key components considerably affect automotive insurance coverage premiums in Pueblo, CO, together with:

- Driving Document: A clear driving report, freed from accidents and visitors violations, usually leads to decrease premiums. For instance, drivers with a historical past of dashing tickets or at-fault accidents will possible face increased premiums.

- Automobile Sort: The make, mannequin, and 12 months of your car have an effect on your insurance coverage prices. Luxurious automobiles or these with excessive theft charges usually have increased premiums. As an illustration, a sports activities automotive with a high-value engine and specialised options may incur a better premium than a primary financial system automotive.

- Location: Pueblo’s particular location and its demographics can affect insurance coverage charges. Areas with increased crime charges or accident concentrations usually see increased premiums. For instance, a automotive insured in a high-risk space like a metropolis with a excessive variety of reported accidents will usually have a better premium.

- Age and Gender: Age and gender are sometimes used as proxies for threat evaluation, as youthful drivers and male drivers usually have increased accident charges, that are factored into premiums. This isn’t a assure however is usually a statistical actuality, and insurance coverage corporations base charges on these elements. As an illustration, a youthful driver will usually pay a better premium than a driver with a big quantity of expertise.

- Protection Decisions: The extent of protection chosen immediately impacts the premium. A complete coverage with increased protection ranges will often price greater than a primary legal responsibility coverage. For instance, a coverage that covers complete and collision harm might be costlier than one with solely legal responsibility protection.

Widespread Misconceptions about Low-cost Automotive Insurance coverage

There are a number of frequent misconceptions about low-cost automotive insurance coverage, which may result in suboptimal selections.

- Low-cost is all the time finest: Whereas affordability is essential, prioritizing the bottom worth with out contemplating protection could be dangerous. A coverage with minimal protection could not adequately defend your monetary pursuits within the occasion of an accident.

- One firm matches all: Completely different insurance coverage corporations have various pricing buildings and protection choices. Evaluating quotes from a number of suppliers is important for locating the very best match.

- Reductions are irrelevant: Reductions for protected driving, a number of automobiles, or sure insurance coverage bundles can considerably scale back your premium. Failing to benefit from these reductions may end up in pointless expense.

Significance of Evaluating Quotes for Reasonably priced Automotive Insurance coverage

Evaluating quotes from a number of insurance coverage suppliers is essential for securing probably the most inexpensive automotive insurance coverage in Pueblo, CO. This course of helps establish probably the most aggressive charges and appropriate protection choices.

Completely different Varieties of Automotive Insurance coverage Insurance policies

| Coverage Sort | Description | Typical Protection | Price Concerns |

|---|---|---|---|

| Legal responsibility | Covers damages you trigger to others. | Bodily harm legal responsibility, property harm legal responsibility. | Typically the bottom price. |

| Collision | Covers harm to your car in an accident, no matter fault. | Repairs or alternative of your car. | Can add to the price considerably. |

| Complete | Covers harm to your car from non-collision occasions (e.g., vandalism, theft, climate). | Repairs or alternative of your car. | Provides price to the general coverage. |

Figuring out Reasonably priced Insurance coverage Suppliers in Pueblo, CO

Discovering the precise automotive insurance coverage in Pueblo, CO, can really feel like navigating a maze. Many elements affect charges, out of your driving report to the particular protection you want. Understanding the choices accessible and examine them successfully is vital to securing an inexpensive coverage.

Recognized Insurance coverage Suppliers in Pueblo, CO

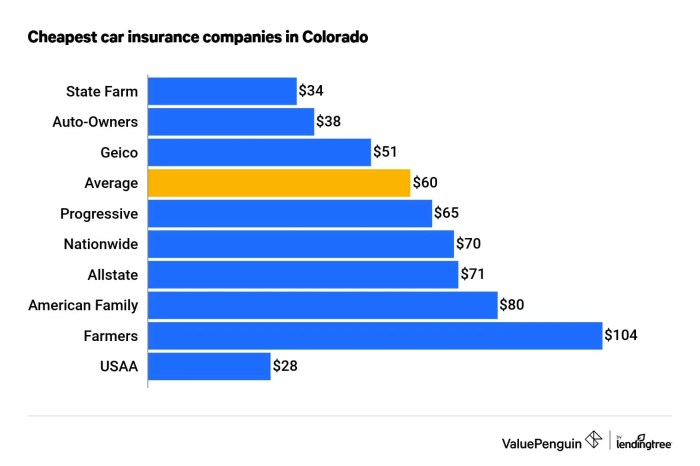

Quite a few insurance coverage suppliers function in Pueblo, Colorado, catering to numerous wants and budgets. Recognizing established gamers alongside rising choices is essential for knowledgeable decision-making. Nicely-known nationwide corporations like State Farm, Allstate, and Geico usually have in depth native presence, offering familiarity and accessibility. Nevertheless, smaller, locally-based corporations can typically supply aggressive charges and personalised service.

Evaluating Common Coverage Prices

The typical price of automotive insurance coverage varies considerably between suppliers. This distinction is pushed by a number of elements, together with the insurer’s operational construction, threat evaluation fashions, and pricing methods. Whereas a exact common price per coverage can’t be said definitively, common estimations can be found. It is vital to assemble quotes from a number of suppliers to get a transparent image of the potential bills related to numerous protection choices.

For instance, a younger driver with a clear report may see decrease premiums from one firm in comparison with one other.

Native Insurance coverage Companies

Working with an area insurance coverage company could be helpful. These companies usually have in-depth data of the Pueblo market, understanding native visitors patterns and customary claims. They will present personalised suggestions, tailor-made to particular person wants and circumstances. Nevertheless, the price of utilizing an area agent could be barely increased than going on to an internet supplier.

Significance of On-line Critiques and Scores

On-line critiques and scores can supply invaluable insights into the expertise of different policyholders with totally different insurance coverage suppliers. Buyer suggestions may help you perceive the strengths and weaknesses of every firm, offering a way of the general reliability and responsiveness of their customer support. Learn critiques to grasp how rapidly claims are processed, the general satisfaction degree, and any frequent points.

You’ll want to search for consistency within the suggestions reasonably than a single, robust or weak evaluation.

Supplier Comparability Desk

| Supplier | Common Premium (Estimate) | Buyer Critiques (Abstract) | Protection Choices |

|---|---|---|---|

| State Farm | $1,500 – $2,500 yearly (Estimate) | Typically constructive, recognized for dependable service and in depth protection. | Complete protection, together with legal responsibility, collision, and complete. |

| Progressive | $1,200 – $2,000 yearly (Estimate) | Constructive suggestions on ease of on-line claims submitting, combined critiques on customer support. | Big selection of protection choices, together with reductions for protected driving. |

| Allstate | $1,300 – $2,200 yearly (Estimate) | Customer support experiences differ, some report difficulties in declare processing. | Complete protection, recognized for bundling choices. |

| Rocky Mountain Insurance coverage | $1,000 – $1,800 yearly (Estimate) | Constructive critiques concerning native data and personalised service. | Aggressive protection choices with potential for tailor-made reductions. |

Notice: These are estimated common premiums. Precise premiums will differ primarily based on particular person elements equivalent to driving report, car kind, and protection selections.

Components Affecting Automotive Insurance coverage Prices in Pueblo, CO: Low-cost Automotive Insurance coverage Pueblo Co

Understanding the elements influencing automotive insurance coverage premiums in Pueblo, CO, empowers you to make knowledgeable choices and doubtlessly decrease your prices. Numerous components, together with your driving report, the kind of car you personal, and even your location, play vital roles in figuring out your insurance coverage charges.

Driving Historical past

Driving historical past is a vital determinant of automotive insurance coverage premiums. A clear driving report, freed from accidents and visitors violations, often interprets to decrease premiums. Conversely, accidents and violations, particularly critical ones, end in increased premiums. Insurance coverage corporations assess the chance related together with your driving historical past to find out your premium. This evaluation considers the frequency and severity of previous incidents.

For instance, a driver with a number of dashing tickets may face increased premiums in comparison with a driver with no violations.

Automobile Sort and Mannequin

The sort and mannequin of your car considerably affect your automotive insurance coverage premiums. Autos perceived as higher-risk, equivalent to sports activities automobiles or luxurious automobiles, usually include increased premiums. These automobiles are regularly related to increased accident charges or costlier restore prices, growing the monetary threat for insurance coverage corporations. Consideration is given to the car’s make, mannequin, 12 months, and options.

As an illustration, a high-performance sports activities automotive is mostly assigned a better threat profile than a compact sedan, impacting the premium.

Location and Demographics

Location in Pueblo, CO, and demographics, equivalent to age and gender, play a job in automotive insurance coverage prices. Areas with increased crime charges or accident-prone roads usually have increased insurance coverage premiums. The native visitors situations, accident charges, and claims frequency in a selected neighborhood affect the chance evaluation. Moreover, demographic elements, equivalent to age and gender, are additionally taken into consideration.

For instance, youthful drivers usually face increased premiums on account of their perceived increased threat profile in comparison with older, extra skilled drivers.

Security Options

Autos geared up with superior security options, equivalent to airbags, anti-lock brakes, and digital stability management, usually qualify for decrease insurance coverage premiums. These options demonstrably scale back the chance of accidents and accidents, decreasing the insurance coverage firm’s monetary burden. Insurance coverage corporations acknowledge the constructive affect of those security options on accident avoidance and severity. As an illustration, a car with superior security expertise like computerized emergency braking is more likely to have a decrease premium than a comparable car with out these options.

Age and Gender

Age and gender are elements thought of in figuring out automotive insurance coverage premiums. Youthful drivers are sometimes assigned increased premiums than older drivers. It’s because statistically, youthful drivers have a better chance of accidents on account of a mix of inexperience and risk-taking behaviors. Equally, gender-based pricing isn’t all the time current however could be a consider some circumstances, though it isn’t usually a serious one.

For instance, youthful male drivers may face increased premiums in comparison with their feminine counterparts of comparable age and driving expertise.

Automobile Sort Premium Comparability

| Automobile Sort | Common Premium (Estimate) | Security Options | Danger Evaluation |

|---|---|---|---|

| Sports activities Automotive | $450 | Excessive-performance options, doubtlessly superior security options | Larger threat on account of potential for increased accident charges and costlier repairs. |

| Compact Sedan | $300 | Customary security options | Reasonable threat |

| SUV | $350 | Various ranges of security options primarily based on the particular mannequin | Reasonable threat, usually related to increased restore prices |

Suggestions for Acquiring Cheaper Automotive Insurance coverage in Pueblo, CO

Securing inexpensive automotive insurance coverage in Pueblo, CO, requires a proactive strategy. Understanding the elements influencing premiums and using methods to decrease them is vital to saving cash. This part particulars sensible ideas to assist Pueblo residents receive cheaper automotive insurance coverage.

Bundling Insurance coverage Insurance policies

Bundling your automotive insurance coverage with different insurance policies, equivalent to residence insurance coverage, can usually result in vital reductions. Insurance coverage suppliers regularly supply bundled reductions as a result of it represents a better monetary dedication from the client. This technique usually reduces the executive prices and dangers related to a number of insurance policies. For instance, a house owner with a automotive insurance coverage coverage by way of the identical supplier can count on a reduction for the bundled coverage.

Reductions Obtainable for Automotive Insurance coverage in Pueblo, CO, Low-cost automotive insurance coverage pueblo co

Quite a few reductions can be found for Pueblo residents in search of cheaper automotive insurance coverage. These reductions can differ by supplier, so exploring totally different choices is important.

- Multi-Automotive Reductions: Proudly owning a number of automobiles with the identical supplier can usually earn a reduction. This displays the elevated monetary dedication and diminished administrative burden for the insurance coverage firm.

- Secure Driver Reductions: Sustaining a clear driving report, free from accidents and visitors violations, is essential. This demonstrates accountable driving habits, decreasing threat for the insurance coverage supplier and doubtlessly resulting in decrease premiums.

- Defensive Driving Programs: Finishing a defensive driving course can qualify for a reduction. This demonstrates a dedication to protected driving practices and doubtlessly reduces the chance of accidents, resulting in decrease insurance coverage premiums.

- Scholar Reductions: College students who’re insured and are enrolled in highschool or school can usually qualify for reductions. The diminished threat of accidents is often an element on this low cost.

- Cost Reductions: Paying premiums on time and in full may end up in a reduction. Immediate cost demonstrates monetary duty and stability, a constructive issue for insurance coverage suppliers.

Sustaining a Good Driving Document

A spotless driving report is paramount for acquiring cheaper automotive insurance coverage. A historical past of accidents or visitors violations considerably impacts insurance coverage premiums. Sustaining a clear report immediately displays accountable driving habits and reduces the chance profile for the insurance coverage firm. For instance, a driver with a clear driving report for 5 years may qualify for a big low cost in comparison with a driver with a latest accident.

Negotiating Charges with Insurance coverage Suppliers

Negotiating insurance coverage charges could be helpful, particularly when evaluating quotes from totally different suppliers. Evaluating quotes from a number of suppliers is usually the best methodology for negotiating. By understanding the market charges and elements that affect premiums, customers can doubtlessly safe extra favorable charges.

Abstract of Methods and Suggestions for Cheaper Insurance coverage

A mixture of things influences automotive insurance coverage prices. Bundle insurance policies, discover accessible reductions, preserve a superb driving report, and contemplate negotiating charges to realize decrease premiums. By actively in search of out reductions, sustaining a clear driving report, and evaluating charges from a number of suppliers, Pueblo residents can considerably scale back their automotive insurance coverage prices.

Understanding Insurance coverage Claims in Pueblo, CO

Navigating the automotive insurance coverage declare course of could be daunting, particularly after an accident. This part offers a sensible information to submitting a declare in Pueblo, CO, guaranteeing a clean and environment friendly decision. Understanding the steps and required documentation will assist you to handle the method successfully.Submitting a automotive insurance coverage declare in Pueblo, CO, includes a structured process that goals to resolve the incident pretty and rapidly.

Realizing the steps concerned and the required paperwork will scale back stress and guarantee a immediate decision.

Submitting a Automotive Insurance coverage Declare

The method of submitting a automotive insurance coverage declare begins instantly after an accident. Immediate motion is essential for a clean course of. A transparent understanding of the required steps, documentation, and your rights might be invaluable.

Required Documentation for a Declare

Enough documentation is important for a profitable and environment friendly declare. Correct and full documentation ensures your declare is processed accurately and promptly. Important paperwork embody, however are usually not restricted to, police experiences, car info, and medical data. An intensive compilation of related info will support the declare adjuster in assessing the scenario.

Declare Submitting Process

The next desk Artikels the frequent steps for submitting a automotive insurance coverage declare in Pueblo, CO:

| Step | Description | Documentation Required |

|---|---|---|

| 1. Contact your insurer | Report the accident and begin the declare course of. Present particulars of the accident, together with the time, location, and concerned events. Your insurer will information you on the following steps. | Police report, car info (VIN, make, mannequin, 12 months), contact info for all events concerned. |

| 2. Collect mandatory paperwork | Gather all related paperwork, together with medical data, restore estimates, and witness statements. | Medical payments, restore estimates, pictures of harm, witness contact info. |

| 3. Present documentation to your insurer | Submit the collected paperwork to your insurance coverage firm. This step ensures the declare is precisely assessed. | All collected paperwork talked about in step 2. |

| 4. Comply with up together with your insurer | Keep in touch together with your insurance coverage firm to watch the declare’s progress. Common communication ensures you are knowledgeable in regards to the standing and any required follow-up actions. | N/A |

| 5. Negotiation and settlement | Your insurer will assess the declare and suggest a settlement. Should you disagree with the settlement quantity, focus on the explanations with the insurer and negotiate a good decision. | N/A |

Ending Remarks

Securing low-cost automotive insurance coverage in Pueblo CO is achievable with cautious analysis and strategic planning. By understanding the elements impacting your premiums, evaluating a number of suppliers, and using sensible saving methods, you may considerably scale back your insurance coverage prices. This information empowers you to make knowledgeable choices and discover the right coverage that fits your wants and finances. Bear in mind to prioritize a superb driving report and discover accessible reductions to maximise financial savings.

FAQ Part

What elements most affect automotive insurance coverage premiums in Pueblo, CO?

Driving historical past, car kind, location, and the presence of security options all contribute to your premium. Your age and gender also can play a job.

How can I examine quotes from totally different insurance coverage suppliers?

Use on-line comparability instruments or contact a number of suppliers on to get quotes. Evaluate not simply the premiums but in addition the protection choices.

What are some reductions accessible for automotive insurance coverage in Pueblo, CO?

Reductions usually embody these for protected driving data, bundling insurance policies, and for sure car varieties. At all times ask your supplier about accessible reductions.

What documentation is usually wanted to file a automotive insurance coverage declare?

Count on to offer a police report, car info, and every other documentation requested by your insurance coverage firm.