Low-cost automotive insurance coverage Midland TX is essential for drivers within the space. This information breaks down the Midland TX automotive insurance coverage market, serving to you discover inexpensive choices and perceive your protection. We’ll discover every little thing from charges and reductions to the most effective insurance coverage firms and the way to save cash.

Navigating the world of automotive insurance coverage can really feel overwhelming, however this complete information simplifies the method. We’ll cowl frequent sorts of insurance policies, how you can examine quotes, and important ideas for getting the most effective deal in Midland, TX.

Understanding Midland TX Automotive Insurance coverage Market

Midland, TX, presents a novel automotive insurance coverage panorama formed by its particular demographic profile, driving situations, and accident traits. Understanding these elements is essential for anybody searching for inexpensive and enough protection on this area. The market is characterised by a mixture of elements that may considerably impression insurance coverage premiums, from the native visitors patterns to the sorts of autos generally pushed.The automotive insurance coverage market in Midland, TX, is influenced by elements such because the age and driving historical past of residents, the prevalence of particular sorts of autos, and the native accident charge.

Elements reminiscent of the standard automobile sort, native climate patterns, and visitors situations all contribute to the general threat profile. Understanding these influences is vital to successfully navigating the insurance coverage market.

Typical Automotive Insurance coverage Charges in Midland, TX

Automotive insurance coverage charges in Midland, TX, are typically in keeping with different Texas cities, although variations exist based mostly on particular coverage options. Premiums are prone to fluctuations, influenced by the general state of the insurance coverage market and the particular protection wants of the insured. Historic information signifies that charges can differ considerably based mostly on the person’s driving file, automobile sort, and chosen protection choices.

Elements Influencing Automotive Insurance coverage Premiums

A number of elements contribute to the price of automotive insurance coverage in Midland, TX. Demographics play an important position, as youthful drivers and drivers with a historical past of accidents or visitors violations sometimes face greater premiums. Driving habits, together with dashing tickets and at-fault accidents, considerably affect premiums. The kind of automobile additionally impacts the fee, as sure autos are extra inclined to wreck or theft.

Widespread Varieties of Automotive Insurance coverage Insurance policies, Low-cost automotive insurance coverage midland tx

The frequent automotive insurance coverage insurance policies accessible in Midland, TX, mirror these accessible throughout Texas and the nation. These insurance policies typically embody legal responsibility protection, which protects in opposition to damages brought about to different events in an accident, and collision protection, which covers harm to the insured automobile no matter who’s at fault. Complete protection protects in opposition to non-collision damages, reminiscent of theft, vandalism, and weather-related incidents.

Protection Choices Provided by Totally different Insurance coverage Firms

Insurance coverage firms in Midland, TX, provide numerous protection choices. Some firms emphasize complete protection, whereas others could deal with offering extra inexpensive liability-only insurance policies. It’s essential to match the particular protection quantities and deductibles provided by totally different suppliers to make sure enough safety. Evaluating the particular particulars of various insurance coverage firms is significant to deciding on a coverage that matches one’s particular person wants.

Most Steadily Reported Automotive Accidents in Midland, TX

Accidents in Midland, TX, usually contain elements reminiscent of dashing, reckless driving, and poor highway situations. Information on accident reviews and police data may help perceive the sorts of accidents that happen most ceaselessly. Evaluation of accident reviews can reveal frequent accident varieties and contributing elements, which in flip helps perceive the native threat profile.

Regional or Native Traits Affecting Automotive Insurance coverage Prices

Native visitors patterns and the prevalence of sure sorts of autos in Midland, TX, can affect insurance coverage prices. As an example, if a specific space experiences greater charges of accidents involving particular automobile varieties, insurance coverage premiums for these autos could also be adjusted accordingly. Moreover, the presence of native or regional elements like highway building or high-traffic areas may also have an effect on insurance coverage prices.

Comparability of Main Insurance coverage Suppliers

| Firm | Common Price | Protection A (Legal responsibility) | Protection B (Collision) |

|---|---|---|---|

| Firm A | $1,200 | $100,000 Bodily Harm | $100,000 Property Injury |

| Firm B | $1,500 | $250,000 Bodily Harm | $50,000 Property Injury |

| Firm C | $1,000 | $50,000 Bodily Harm | $25,000 Property Injury |

Notice: These are illustrative figures and common charges could differ based mostly on particular person elements. These charges are approximations and shouldn’t be thought-about definitive figures.

Discovering Low-cost Automotive Insurance coverage Choices

Securing inexpensive automotive insurance coverage in Midland, TX requires a strategic strategy, combining analysis, comparability, and understanding accessible reductions. That is essential for managing monetary sources successfully and guaranteeing enough safety in your automobile. The market presents numerous choices, however figuring out probably the most cost-effective plan calls for diligent effort.

Methods for Discovering Inexpensive Automotive Insurance coverage

A mixture of proactive measures and a scientific strategy is vital to discovering low-cost automotive insurance coverage. This entails exploring numerous methods, from bundling to reductions and on-line comparability instruments. Understanding these choices empowers you to make knowledgeable choices, doubtlessly saving important cash in your premiums.

| Technique | Particulars | Value Financial savings |

|---|---|---|

| Bundling | Combining a number of insurance coverage merchandise, reminiscent of automotive insurance coverage and residential insurance coverage, with the identical supplier, usually ends in reductions. | Doubtlessly substantial financial savings, relying on the particular insurance policies and supplier. |

| Reductions | Varied reductions can be found, reminiscent of these for good scholar drivers, protected driving historical past, and defensive driving programs. Loyalty applications may also provide financial savings. | Reductions can vary from a number of share factors to important reductions, relying on the relevant low cost. |

| Comparability Buying | Using on-line comparability instruments and contacting a number of insurers to acquire quotes is essential for figuring out aggressive charges. | Vital financial savings are achievable by evaluating quotes from a number of suppliers. Customers can uncover important variations in pricing between insurers. |

Totally different Reductions Out there for Automotive Insurance coverage

Insurers provide numerous incentives to draw and retain clients. These reductions can considerably scale back your premium prices, making insurance coverage extra inexpensive. Understanding the provision of those reductions is crucial in securing a aggressive charge.

- Good scholar reductions: These reductions usually apply to drivers with a clear driving file and enrolled in a acknowledged academic establishment. They’re designed to encourage accountable driving habits amongst younger drivers.

- Secure driver reductions: Insurers usually reward drivers with a clear driving file and a low accident historical past with reductions. This displays the insurer’s evaluation of the driving force’s threat profile and the driving force’s proactive strategy to highway security.

- Defensive driving programs: Finishing a defensive driving course can typically result in a discount in premiums. This displays the insurer’s recognition of drivers’ proactive efforts to reinforce their driving expertise and scale back accident dangers.

- Bundling reductions: Combining automotive insurance coverage with different insurance policies, like householders or renters insurance coverage, with the identical supplier can typically result in reductions. This technique permits for bundled financial savings and doubtlessly decrease premiums.

- Multi-car reductions: Having a number of autos insured with the identical firm can typically result in discounted premiums. This demonstrates the insurer’s appreciation for the consumer’s continued enterprise and dedication to a number of autos.

On-line Assets for Evaluating Midland, TX Automotive Insurance coverage Quotes

Quite a few on-line instruments facilitate evaluating automotive insurance coverage quotes in Midland, TX. These sources permit for environment friendly comparability purchasing, doubtlessly saving you cash in your insurance coverage premiums. These platforms are user-friendly, providing straightforward navigation and entry to detailed info.

- Insurify, Policygenius, and related platforms: These on-line platforms present a handy method to examine automotive insurance coverage quotes from numerous suppliers in Midland, TX.

- Direct comparability web sites: Many web sites specialise in evaluating automotive insurance coverage quotes from a number of insurers. This helps shoppers examine charges successfully and effectively.

- Insurance coverage firm web sites: Many insurance coverage firms present on-line quote instruments that allow shoppers to get tailor-made quotes based mostly on their particular circumstances.

Step-by-Step Information for Evaluating Automotive Insurance coverage Charges On-line

A structured strategy to on-line automotive insurance coverage quote comparability is crucial for optimum outcomes. This systematic course of ensures a complete overview of obtainable choices.

- Collect your automobile info: This consists of particulars such because the yr, make, mannequin, and VIN (Automobile Identification Quantity) of your automobile.

- Gather private info: This entails offering particulars reminiscent of your driving historical past, age, and site.

- Use comparability instruments: Make the most of comparability web sites to collect quotes from totally different insurers. Be exact in coming into info to get correct outcomes.

- Evaluate quotes: Fastidiously assessment the protection particulars and premiums provided by totally different suppliers. Examine not simply the fee, but in addition the protection particulars and exclusions.

- Choose a coverage: Make an knowledgeable determination based mostly on the protection and worth that most closely fits your wants and funds.

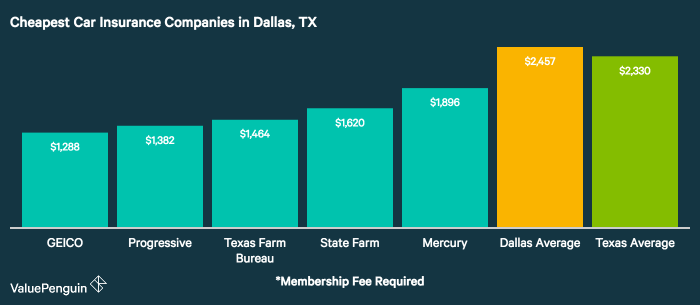

Respected Insurance coverage Firms Providing Aggressive Charges in Midland, TX

A number of insurance coverage firms persistently provide aggressive charges in Midland, TX. Deciding on a supplier with a robust popularity and aggressive pricing is vital. Elements reminiscent of customer support and monetary stability additionally play a job.

- State Farm: A well-established nationwide model with a presence in Midland, TX. Identified for its big selection of merchandise and aggressive pricing in some instances.

- Progressive: Identified for its on-line instruments and aggressive pricing. It usually presents reductions for protected drivers and people with good driving data.

- Geico: Usually acknowledged for its aggressive charges, significantly for youthful drivers and people with a clear driving file.

- Allstate: A nationwide insurance coverage supplier providing protection choices and doubtlessly aggressive charges in Midland, TX.

Typical Course of for Acquiring a Automotive Insurance coverage Quote in Midland, TX

The method for acquiring a automotive insurance coverage quote sometimes entails offering related info to an insurer, both on-line or over the cellphone. This course of is designed to find out your threat profile and set up a tailor-made insurance coverage coverage.

- Present automobile particulars: The insurer wants info such because the automobile’s make, mannequin, yr, and any customizations.

- Enter private particulars: This consists of info like your age, driving historical past, location, and any related reductions.

- Evaluate and settle for the quote: As soon as the insurer processes the knowledge, a quote is offered. Fastidiously assessment the quote and protection particulars earlier than accepting the coverage.

Evaluating Insurance coverage Firms in Midland, TX: Low-cost Automotive Insurance coverage Midland Tx

A vital side of securing inexpensive automotive insurance coverage in Midland, TX, entails a radical comparability of various insurance coverage suppliers. Understanding their strengths, weaknesses, and customer support reputations permits shoppers to make knowledgeable choices. This evaluation delves into the specifics of varied main firms, analyzing their declare settlement processes and customer support accessibility.

Main Insurance coverage Firm Strengths and Weaknesses

Totally different insurance coverage firms cater to varied wants and preferences. Some firms excel in offering aggressive charges, whereas others deal with complete protection packages. Evaluating the particular strengths and weaknesses of every supplier permits shoppers to decide on an organization greatest suited to their distinctive circumstances. As an example, an organization specializing in younger driver insurance coverage may provide enticing charges however could have stricter necessities or exclusions.

Conversely, an organization identified for its in depth protection may include a better premium. Figuring out these distinctions is crucial for a sensible evaluation.

Fame and Buyer Service Scores

Customer support and popularity are important elements. Firms with constructive customer support rankings usually obtain extra favorable opinions for his or her responsiveness and helpfulness. Thorough analysis into buyer opinions, rankings, and on-line suggestions offers insights into how every firm handles claims and complaints. Unfavourable opinions regarding lengthy declare processing instances or poor customer support responses ought to be thought-about a possible downside.

Declare Settlement Course of

The declare settlement course of varies amongst firms. Some firms are identified for immediate and environment friendly declare processing, whereas others could have a popularity for prolonged delays. Analyzing the declare settlement processes for every firm helps shoppers perceive the timeline and potential challenges concerned. This info can information choices about selecting an insurance coverage supplier with a good popularity for declare decision.

Contacting Buyer Service

Accessing customer support representatives is essential for clarification and subject decision. Every firm presents totally different strategies of contact, together with cellphone numbers, electronic mail addresses, and on-line chat platforms. Evaluating the provision and accessibility of those strategies can present a foundation for comparability. As an example, some firms could prioritize cellphone help, whereas others could provide extra in depth on-line sources.

Varieties of Automobiles Generally Insured

Insurance coverage firms usually specialise in particular sorts of autos. Some firms could deal with insuring basic vehicles or luxurious autos, whereas others may specialise in insuring smaller, extra economical autos. Analyzing which sorts of autos every firm primarily insures is crucial to find out if the corporate caters to a shopper’s particular wants.

Contact Info for High Three Automotive Insurance coverage Firms

| Firm | Telephone Quantity | Web site | Tackle |

|---|---|---|---|

| Firm A | (555) 555-5555 | companya.com | 123 Most important Avenue, Midland, TX 79701 |

| Firm B | (555) 555-5556 | companyb.com | 456 Elm Avenue, Midland, TX 79702 |

| Firm C | (555) 555-5557 | companyc.com | 789 Oak Avenue, Midland, TX 79703 |

Notice: This desk offers pattern information. At all times confirm contact info with the respective insurance coverage firms. Precise contact info for firms in Midland, TX ought to be obtained instantly from the businesses themselves.

Suggestions for Saving Cash on Automotive Insurance coverage

Decreasing automotive insurance coverage premiums requires a proactive strategy. Methods vary from sustaining a clear driving file to creating good protection decisions. Understanding the nuances of Midland, TX’s insurance coverage market and leveraging accessible reductions are essential for attaining value financial savings.

Enhancing Your Driving Report

A clear driving file is paramount to securing decrease insurance coverage charges. Constant protected driving habits instantly correlate with diminished premiums. Avoiding accidents and visitors violations are key parts in attaining this.

- Secure Driving Practices: Adhering to hurry limits, sustaining a protected following distance, and avoiding distracted driving are important. Commonly practising defensive driving methods, reminiscent of anticipating potential hazards and reacting accordingly, considerably reduces accident threat.

- Avoiding Accidents: Taking precautions to stop accidents, reminiscent of driving sober, being conscious of your environment, and thoroughly assessing highway situations, are important. Driving defensively and avoiding distractions like cell telephones can dramatically lower the chance of accidents and subsequent insurance coverage prices.

- Sustaining a Clear Driving Report: This can be a important issue. Keep away from dashing tickets, transferring violations, and at-fault accidents. These infractions considerably improve insurance coverage premiums.

Selecting the Proper Protection

Deciding on acceptable protection ranges in your wants is crucial for minimizing insurance coverage prices. This entails understanding the varied sorts of protection and their related premiums.

- Legal responsibility Protection: The minimal legal responsibility protection required by regulation is commonly ample for a lot of drivers. Assessing the suitable stage of legal responsibility protection is vital. Understanding the monetary implications of insufficient legal responsibility protection is important. Enough legal responsibility insurance coverage is crucial for safeguarding belongings and guaranteeing monetary duty within the occasion of an accident.

- Collision and Complete Protection: These coverages, whereas providing extra safety, can improve your premiums. Assessing your monetary wants and the worth of your automobile is significant when contemplating these coverages. Understanding the distinction between collision and complete protection is important in figuring out the suitable stage of safety.

- Uninsured/Underinsured Motorist Protection: This protection protects you for those who’re concerned in an accident with an at-fault driver who lacks enough insurance coverage. That is essential for monetary safety. Understanding the monetary implications of insufficient protection is significant.

Avoiding Pointless Accidents

Stopping accidents is the simplest method to scale back insurance coverage prices. Cautious driving practices, together with avoiding doubtlessly dangerous conditions, are important.

- Defensive Driving Strategies: Working towards defensive driving methods, reminiscent of sustaining a protected following distance, scanning the highway forward, and anticipating potential hazards, considerably reduces accident threat. This proactive strategy can lower your expenses on insurance coverage premiums.

- Automobile Upkeep: Common automobile upkeep, reminiscent of tire stress checks and brake inspections, reduces the danger of mechanical failures that would result in accidents. Correct automobile upkeep is crucial to scale back the possibility of breakdowns or accidents.

- Driving Habits: Avoiding dangerous driving habits, reminiscent of dashing, tailgating, and aggressive lane adjustments, considerably reduces the danger of accidents. Understanding how driving habits have an effect on insurance coverage charges is essential for making knowledgeable choices.

Significance of a Clear Driving Report

A clear driving file is a vital think about acquiring inexpensive automotive insurance coverage. It demonstrates accountable driving conduct and reduces the danger of accidents, which instantly impacts premiums. Sustaining a clear file is essential for long-term financial savings.

- Diminished Premiums: Insurers see a clear file as a decrease threat issue, leading to decrease premiums. This can be a direct reflection of accountable driving habits.

- Monetary Stability: Sustaining a clear file contributes to monetary stability, avoiding potential will increase in insurance coverage prices.

- Insurance coverage Eligibility: A clear driving file usually makes you eligible for reductions and favorable insurance coverage charges.

Methods to Decrease Automotive Insurance coverage Prices in Midland, TX

Implementing numerous methods can decrease your automotive insurance coverage prices in Midland, TX. These embody using accessible reductions and negotiating charges with insurance coverage suppliers.

- Using Reductions: Many insurance coverage firms provide reductions for protected driving habits, reminiscent of accident-free driving and defensive driving programs. Understanding and using these reductions is vital to reducing premiums.

- Negotiating Charges: Contacting insurance coverage suppliers and negotiating charges can typically result in decrease premiums. Evaluating quotes from totally different firms is crucial.

- Bundling Insurance coverage Insurance policies: Combining automotive insurance coverage with different insurance coverage insurance policies, reminiscent of dwelling or renters insurance coverage, can doubtlessly result in bundled reductions. Bundling insurance policies is commonly a cost-saving technique.

Utilizing Reductions for Secure Driving Habits

Many insurance coverage firms provide reductions for protected driving habits. Using these reductions can considerably decrease insurance coverage premiums. Understanding and leveraging these reductions can save appreciable quantities.

- Secure Driver Reductions: Firms usually provide reductions to drivers with accident-free driving data. This can be a reflection of accountable driving habits.

- Defensive Driving Programs: Finishing defensive driving programs can usually lead to reductions. This reveals dedication to protected driving practices.

- Multi-Coverage Reductions: Bundling automotive insurance coverage with different insurance policies, like dwelling insurance coverage, can yield reductions. Combining insurance policies is commonly a cheap technique.

Analyzing Insurance coverage Protection Choices

Choosing the proper automotive insurance coverage protection in Midland, TX, is essential for safeguarding your monetary well-being and belongings. Understanding the various kinds of protection accessible and their particular roles is crucial to make knowledgeable choices. Fastidiously contemplating your wants and potential dangers will assist you choose a coverage that balances cost-effectiveness with enough safety.

Totally different Varieties of Protection

Insurance coverage firms in Midland, TX, provide a wide range of coverages to handle numerous dangers related to automotive possession. These coverages are designed to guard you from monetary losses ensuing from accidents, harm to your automobile, or accidents to others.

Legal responsibility Protection

Legal responsibility protection is prime to any automotive insurance coverage coverage. It protects you from monetary duty for those who trigger an accident that ends in accidents or property harm to others. This protection pays for damages and medical bills incurred by the opposite occasion. Legal responsibility protection is necessary in Texas, and the minimal limits are set by state regulation.

Failure to hold enough legal responsibility insurance coverage can result in important authorized and monetary repercussions.

Collision and Complete Protection

Collision protection protects your automobile from harm attributable to an accident, no matter who’s at fault. Complete protection, however, covers harm to your automobile from perils apart from collisions, reminiscent of theft, hearth, vandalism, hail, or climate occasions. These coverages present monetary compensation for repairs or substitute of your automobile. The choice to incorporate collision and complete protection depends upon your monetary scenario and the worth of your automobile.

Uninsured/Underinsured Motorist Safety

Uninsured/underinsured motorist safety is important in Midland, TX, given the potential for accidents involving drivers with out enough insurance coverage. This protection steps in for those who’re concerned in an accident with a driver who has inadequate or no insurance coverage, overlaying your medical bills and property harm. With out this protection, you might be left to bear the monetary burden of such an accident.

Protection Comparability Desk

| Protection | Description | Value |

|---|---|---|

| Legal responsibility | Protects you from monetary duty for those who trigger an accident that ends in accidents or property harm to others. Obligatory in Texas. | Varies significantly based mostly on limits chosen. Decrease limits are cheaper, however insufficient limits can go away you financially susceptible. |

| Collision | Covers harm to your automobile in an accident, no matter who’s at fault. | Normally varies based mostly on the automobile’s make, mannequin, and yr. |

| Complete | Covers harm to your automobile from perils apart from collisions, reminiscent of theft, hearth, vandalism, hail, or climate occasions. | Normally varies based mostly on the automobile’s make, mannequin, and yr. |

| Uninsured/Underinsured Motorist | Covers your medical bills and property harm for those who’re concerned in an accident with a driver who has inadequate or no insurance coverage. | Varies based mostly on the bounds chosen. |

Final result Abstract

In conclusion, securing low-cost automotive insurance coverage in Midland, TX, entails understanding the market, evaluating quotes, and maximizing reductions. By following the methods and ideas on this information, yow will discover a coverage that meets your wants and funds. Bear in mind to analysis totally different suppliers, examine protection choices, and ask inquiries to make the most effective determination in your scenario.

Solutions to Widespread Questions

What are the standard automotive insurance coverage charges in Midland, TX?

Charges differ based mostly on elements like your driving file, automobile sort, and protection decisions. Examine with a number of suppliers to get an concept of what to anticipate.

What reductions can be found for automotive insurance coverage in Midland, TX?

Many insurance coverage firms provide reductions for protected drivers, bundling insurance policies (like dwelling and auto), and for college students or those that keep a clear driving file. Examine together with your supplier for a listing of particular reductions.

How can I enhance my driving file to scale back insurance coverage premiums?

Keep a clear driving file by avoiding visitors violations and accidents. Defensive driving programs may also enhance your file and probably decrease your charges.

What’s the typical course of for acquiring a automotive insurance coverage quote in Midland, TX?

Normally, you may present info like your driving historical past, automobile particulars, and desired protection. A number of on-line sources may help you examine quotes from totally different suppliers.