Low-cost automobile insurance coverage in lancaster ca – Low-cost automobile insurance coverage in Lancaster, CA is an important side of accountable automobile possession. Understanding the market dynamics, out there choices, and supplier comparisons is important for securing probably the most reasonably priced and appropriate protection. This complete information explores numerous methods and assets that can assist you navigate the method successfully and make knowledgeable choices.

Lancaster, CA’s automobile insurance coverage panorama presents a wide range of choices, from conventional insurers to on-line comparability instruments. Components resembling driving historical past, car kind, and protection decisions considerably affect premiums. This information offers a transparent understanding of those components to help you to find probably the most cost-effective answer.

Understanding the Lancaster, CA Automotive Insurance coverage Market

Navigating the automobile insurance coverage panorama in Lancaster, CA, requires understanding the distinctive market dynamics and components influencing premiums. The aggressive nature of the market usually results in fluctuations in charges, making it essential to check quotes and perceive the components behind them. This understanding might help people make knowledgeable choices to safe probably the most appropriate and reasonably priced protection for his or her wants.The Lancaster, CA automobile insurance coverage market is influenced by numerous components, together with the world’s demographics, site visitors patterns, and the sorts of autos continuously pushed.

These components collectively form the chance profile, in the end impacting the insurance coverage charges provided by totally different suppliers. Understanding these components empowers shoppers to evaluate the cost-effectiveness of varied insurance coverage insurance policies.

Automotive Insurance coverage Charges in Lancaster, CA

Lancaster, CA, like many different areas, sees a variation in insurance coverage charges based mostly on car kind and driving profile. Components such because the car’s make, mannequin, and 12 months of manufacture play a task in figuring out the potential danger related to the car. Equally, the driving force’s age, driving historical past, and placement of residence affect the chance profile and in the end the insurance coverage charges.

Larger-risk drivers, these with a historical past of accidents or violations, usually face increased premiums in comparison with these with a clear driving document.

- Sport Utility Autos (SUVs): SUVs, whereas usually perceived as secure, might need increased insurance coverage premiums in comparison with smaller autos attributable to their dimension and potential for harm in accidents. This increased potential for restore prices, even in minor accidents, contributes to the elevated charges. Take into account {that a} broken or totaled SUV would necessitate considerably increased restore prices than a compact automobile, instantly affecting the premium.

- Luxurious Autos: Excessive-end autos, recognized for his or her superior options and potential for increased restore prices, usually include increased insurance coverage premiums. The price of alternative elements and specialised restore companies can contribute to this disparity.

- Younger Drivers: Younger drivers, usually inexperienced and doubtlessly much less cautious, usually have increased insurance coverage premiums. This is because of their increased accident danger in comparison with extra skilled drivers. Their inexperience in dealing with advanced conditions on the highway usually contributes to this danger issue.

Insurance coverage Supplier Choices in Lancaster, CA

A number of insurance coverage suppliers cater to the Lancaster, CA market, every with its personal pricing construction and protection choices. Evaluating totally different suppliers is essential to discovering probably the most appropriate and reasonably priced coverage. Completely different insurance coverage corporations might use totally different ranking fashions and contemplate numerous components, resembling driving historical past and car traits, in setting their premiums.

- Nationwide vs. Regional Suppliers: Nationwide suppliers, with a broader presence, might provide extra standardized insurance policies, however their charges won’t all the time mirror the particular wants of a neighborhood market. Conversely, regional suppliers usually have a deeper understanding of the native market and should provide tailor-made protection choices.

- Reductions and Incentives: Insurance coverage corporations usually provide reductions to advertise safety-conscious driving and buyer retention. These reductions might embody reductions for good scholar standing, anti-theft gadgets, or accident-free driving information. Understanding the out there reductions might help people doubtlessly get monetary savings on their premiums.

Components Influencing Automotive Insurance coverage Premiums in Lancaster, CA

A number of components affect the automobile insurance coverage premiums in Lancaster, CA. These components, mixed, form the ultimate premium quantity for every coverage. Understanding these components might help people make extra knowledgeable decisions when deciding on a coverage.

- Automobile Use: The frequency and sort of auto use can have an effect on insurance coverage charges. Commuting autos used primarily for day by day commutes might need decrease charges than autos used for intensive leisure functions or industrial use. This distinction displays the various danger profiles.

- Driving Historical past: A driver’s historical past of accidents, violations, and claims instantly impacts their insurance coverage charges. A clear driving document usually results in decrease premiums, whereas a historical past of accidents or violations ends in increased charges. That is because of the elevated danger related to these drivers.

- Protection Selections: The sorts of protection chosen, resembling legal responsibility, collision, and complete, instantly affect the premium quantity. The extent of protection chosen considerably impacts the premium.

Comparability of Insurance coverage Corporations in Lancaster, CA

The next desk offers a comparability of three fashionable insurance coverage corporations working in Lancaster, CA. It highlights their common charges and out there protection choices. This data permits for a preliminary comparability to help within the decision-making course of.

| Insurance coverage Firm | Common Fee (Estimated) | Protection Choices |

|---|---|---|

| Firm A | $1,500 – $2,000 per 12 months | Legal responsibility, Collision, Complete, Uninsured Motorist, Medical Funds |

| Firm B | $1,200 – $1,800 per 12 months | Legal responsibility, Collision, Complete, Uninsured Motorist, Medical Funds, Private Damage Safety (PIP) |

| Firm C | $1,400 – $1,900 per 12 months | Legal responsibility, Collision, Complete, Uninsured Motorist, Medical Funds, Roadside Help |

Figuring out Inexpensive Insurance coverage Choices: Low-cost Automotive Insurance coverage In Lancaster Ca

Searching for reasonably priced automobile insurance coverage in Lancaster, CA, usually entails a considerate strategy, very like a cautious pilgrimage towards a cherished purpose. Understanding the market’s nuances and exploring out there choices can considerably affect your monetary well-being. By diligently evaluating numerous methods and reductions, you could find a coverage that aligns along with your price range and wishes.Exploring avenues for decreasing premiums is paramount in attaining monetary stability.

A prudent strategy to insurance coverage entails contemplating components resembling driving historical past, car kind, and chosen protection ranges. These components will affect the price of your coverage.

Methods for Decreasing Automotive Insurance coverage Premiums

Lancaster, CA automobile insurance coverage premiums are influenced by a mess of things. Implementing proactive methods might help decrease these prices. This consists of sustaining a clear driving document, as accidents and violations can considerably enhance premiums. Protected driving habits, resembling avoiding rushing and aggressive driving, are additionally useful.

Reductions Accessible for Drivers in Lancaster, CA

Insurance coverage suppliers continuously provide numerous reductions to incentivize accountable driving and buyer loyalty. These reductions are designed to reward drivers who display secure practices.

- Protected Driving Reductions: Many insurance coverage corporations provide reductions for drivers who keep a clear driving document, take part in defensive driving programs, or set up anti-theft gadgets of their autos. For instance, a driver with a spotless document for 5 years may qualify for a considerable low cost.

- Multi-Coverage Reductions: Bundling your auto insurance coverage with different insurance coverage insurance policies, resembling owners or renters insurance coverage, usually earns a reduction. This will streamline administrative duties and result in financial savings for patrons.

- Automobile-Particular Reductions: Insurance coverage suppliers usually present reductions for drivers who personal sure sorts of autos, resembling fuel-efficient or safety-equipped autos. As an illustration, a driver of a hybrid car might obtain a reduction.

- Loyalty Reductions: Drivers who’ve maintained a constant relationship with an insurance coverage supplier might qualify for reductions. This can be a manner for insurance coverage corporations to reward loyal prospects.

- Anti-theft Machine Reductions: Drivers who set up anti-theft gadgets of their autos might qualify for reductions. This incentivizes drivers to prioritize car safety.

Comparability of Insurance coverage Protection Choices and Value Implications

Completely different protection choices present various ranges of safety and value accordingly. The choice of the correct protection is essential to managing danger and minimizing monetary burdens.

- Legal responsibility Protection: This protection protects you if you’re at fault in an accident, overlaying the opposite occasion’s damages. Legal responsibility protection is commonly probably the most fundamental type of protection, and the price is often decrease than different choices. For instance, a fundamental legal responsibility coverage may cost lower than $100 monthly.

- Collision Protection: This protection protects you in case your car is broken in an accident, no matter who’s at fault. The price of collision protection can differ significantly based mostly on components such because the car’s worth and the insurer’s phrases. It is very important consider your particular wants earlier than buying collision protection.

- Complete Protection: This protection protects your car from harm brought on by occasions aside from collisions, resembling vandalism, fireplace, or climate. Complete protection is usually a essential safeguard for drivers, notably in areas susceptible to excessive climate or vandalism. It’s important to find out whether or not the price of complete protection aligns along with your car’s worth and danger profile.

Kinds of Automotive Insurance coverage Insurance policies and Their Prices

Understanding the various kinds of automobile insurance coverage insurance policies out there is essential for making knowledgeable choices. The price of every coverage is dependent upon numerous components, together with the chosen protection ranges and the driving force’s profile.

| Coverage Kind | Description | Value Implications |

|---|---|---|

| Legal responsibility | Covers damages to others in an accident the place you’re at fault. | Usually the bottom value possibility. |

| Collision | Covers harm to your car in an accident, no matter fault. | Value varies relying on car make, mannequin, and worth. |

| Complete | Covers harm to your car from occasions aside from collisions, resembling vandalism, fireplace, or hail. | Value varies based mostly on components resembling car make and mannequin. |

Analyzing Insurance coverage Suppliers for Low-cost Charges

Discovering reasonably priced automobile insurance coverage in Lancaster, CA can really feel like trying to find a needle in a haystack. Nevertheless, with cautious comparability and understanding of the market, discovering aggressive charges is achievable. This course of requires navigating the assorted insurance coverage suppliers, understanding their distinctive approaches to pricing, and in the end selecting the one which greatest aligns along with your wants and price range.Insurance coverage suppliers make use of totally different methods to draw prospects and keep profitability.

Some deal with particular demographics or driving behaviors, whereas others prioritize intensive protection packages. The hot button is to know these variations and apply that information to your scenario.

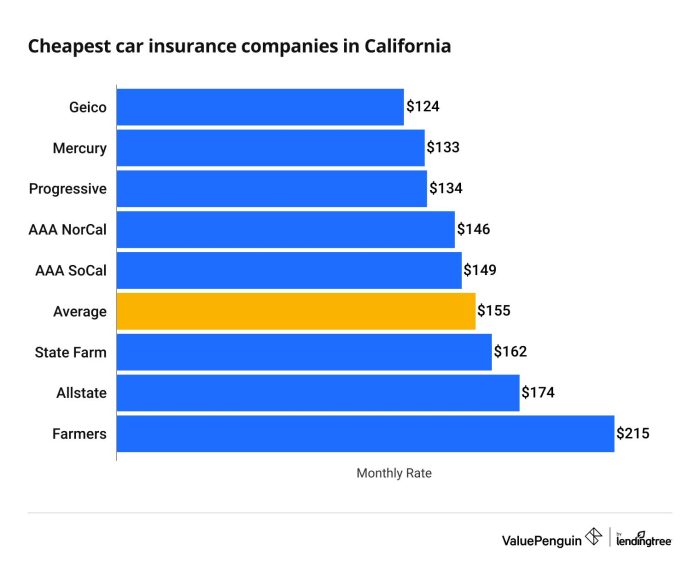

Insurance coverage Suppliers Identified for Aggressive Charges

A number of insurance coverage corporations persistently obtain constructive suggestions for his or her aggressive charges in Lancaster, CA. Components resembling claims dealing with, customer support, and the general market worth of the corporate affect their competitiveness. Researching and evaluating these corporations is an important step find the absolute best price.

- Geico: Identified for its intensive community of brokers and aggressive pricing buildings, Geico usually emerges as a best choice for these looking for reasonably priced insurance coverage choices. Their effectivity in processing claims and customer support responsiveness contribute to their fame.

- State Farm: A protracted-standing and well-recognized title within the insurance coverage business, State Farm boasts a big buyer base and a robust presence in Lancaster, CA. Their complete protection packages and accessible claims procedures contribute to their enchantment.

- Progressive: Progressive gives a spread of services and products that cater to numerous driving wants. Their digital platforms and on-line instruments are sometimes praised for ease of use. Additionally they continuously run promotions, which may considerably decrease premiums.

- Farmers Insurance coverage: Farmers Insurance coverage is a neighborhood participant in Lancaster, CA, providing personalised service and tailor-made insurance coverage options. Their fame for sturdy group ties and responsiveness to native wants can usually result in favorable charges for native drivers.

- Mercury Insurance coverage: Mercury Insurance coverage stands out with its deal with value-based insurance coverage choices, aiming to supply high quality protection at reasonably priced charges. Their customer support and accessibility are sometimes highlighted as strengths.

Acquiring Quotes from Completely different Insurance coverage Suppliers

Acquiring quotes from a number of insurance coverage suppliers is a elementary step find the absolute best deal. This course of entails offering correct and full details about your car, driving historical past, and desired protection to obtain personalised estimates. The extra suppliers you seek the advice of, the higher your possibilities of discovering probably the most aggressive price.

- Instantly contacting suppliers: This strategy entails utilizing the insurance coverage firm’s web site or calling them instantly. Some corporations might require filling out a web based kind, whereas others may ask for particular paperwork.

- Utilizing on-line quote comparability instruments: These instruments combination quotes from a number of insurance coverage suppliers, simplifying the comparability course of. Enter your data as soon as and obtain a comparability of charges from a number of suppliers.

- Visiting an insurance coverage agent: Working with a neighborhood insurance coverage agent can streamline the method. They’ll present personalised steering and provide useful insights based mostly on native market tendencies.

Components Contributing to Aggressive Insurance coverage Suppliers

A number of components contribute to an insurance coverage supplier’s competitiveness in Lancaster, CA. These embody pricing methods, customer support requirements, and the general fame of the corporate.

- Pricing fashions: Insurance coverage suppliers use numerous strategies to find out premiums. Components resembling the kind of car, the driving force’s age and historical past, and the placement of residence play a big function.

- Claims dealing with: Environment friendly and efficient claims dealing with procedures are important for buyer satisfaction. Suppliers who deal with claims promptly and pretty contribute to a constructive fame.

- Customer support: Glorious customer support is a key differentiator. Suppliers who prioritize buyer communication and deal with considerations successfully earn belief and constructive opinions.

Evaluating Quotes Successfully

Efficient comparability of quotes entails contemplating not simply the premium value, but in addition the protection particulars and buyer opinions. Analyzing numerous components permits you to make an knowledgeable choice.

- Premium prices: Examine the full value of premiums throughout totally different suppliers. This could embody all relevant charges.

- Protection particulars: Be certain that the chosen coverage offers sufficient protection based mostly in your wants and danger profile. Take into account legal responsibility, collision, and complete protection.

- Buyer opinions: Analysis on-line opinions to realize perception into the supplier’s fame. This might help gauge buyer satisfaction and claims dealing with procedures.

Prime 3 Insurance coverage Suppliers Comparability

| Insurance coverage Supplier | Common Premium Value (USD) | Protection Particulars | Buyer Evaluations (Ranking/General Sentiment) |

|---|---|---|---|

| Geico | $1,200 | Complete legal responsibility, collision, and complete protection. | 4.5/Glorious (Customer support praised, quick claims) |

| State Farm | $1,350 | Intensive protection choices, together with further add-ons like roadside help. | 4.2/Good (Lengthy-standing fame, recognized for buyer assist) |

| Progressive | $1,150 | Worth-oriented protection, digital platform accessible. | 4.3/Very Good (On-line platform straightforward to make use of, promotions are a plus) |

Exploring On-line Sources for Lancaster, CA Insurance coverage

Searching for reasonably priced automobile insurance coverage in Lancaster, CA usually leads us to discover numerous avenues. On-line assets provide a handy and doubtlessly cost-effective technique to evaluate totally different insurance policies and suppliers. This exploration will illuminate the digital panorama of insurance coverage comparability instruments, inspecting their advantages and downsides, and offering sensible recommendation on utilizing them successfully.

On-line Comparability Instruments for Lancaster, CA Automotive Insurance coverage

A plethora of on-line platforms present instruments for evaluating automobile insurance coverage quotes. These platforms act as digital marketplaces, connecting potential prospects with insurance coverage suppliers providing numerous plans. This course of streamlines the comparability course of, saving effort and time.

- Insurify, Policygenius, and others: These on-line platforms facilitate the comparability of a number of insurance coverage suppliers, permitting customers to research protection choices and charges. They current a structured and complete overview, which permits knowledgeable decision-making within the seek for reasonably priced insurance coverage.

Professionals and Cons of On-line Comparability Instruments

On-line comparability instruments current quite a few benefits and downsides. Understanding these nuances is essential for navigating the digital panorama successfully.

- Professionals: These instruments usually present prompt quotes, enabling fast comparisons throughout a number of suppliers. Additionally they continuously provide useful insights into numerous protection choices, doubtlessly uncovering hidden financial savings. The comfort of evaluating totally different choices from the consolation of 1’s house is a big benefit.

- Cons: Whereas prompt quotes are enticing, the accuracy of those quotes hinges on the person’s offered data. Inaccurate information can result in inaccurate quotes. Moreover, some on-line comparability instruments might not symbolize each out there insurance coverage supplier, limiting the scope of the comparability.

Important Data for On-line Quotes

To acquire correct quotes on-line, offering correct and full data is paramount.

- Automobile Data: This consists of the 12 months, make, mannequin, and car identification quantity (VIN). These particulars are essential for correct danger evaluation and pricing.

- Driver Data: Age, driving historical past (together with accidents and violations), and placement of residence are important components thought of by insurers.

- Protection Preferences: Particulars concerning desired protection ranges, together with legal responsibility, collision, and complete protection, will instantly affect the ultimate value of the coverage.

Credibility and Reliability of On-line Platforms

Assessing the reliability of on-line comparability platforms is essential for choosing reliable sources. Respected platforms normally keep transparency concerning their partnerships with insurance coverage corporations, guaranteeing unbiased comparisons.

- Evaluating Platform Credibility: Search for platforms with clear licensing and regulatory data, guaranteeing compliance with business requirements. Verify for testimonials or opinions from earlier customers, and confirm the platform’s fame.

Evaluating On-line Insurance coverage Comparability Web sites

This desk compares three fashionable on-line insurance coverage comparability web sites based mostly on person expertise, ease of use, and accuracy of quotes.

| Web site | Consumer Expertise | Ease of Use | Accuracy of Quotes |

|---|---|---|---|

| Insurify | Usually constructive, intuitive navigation | Excessive, easy course of | Usually correct, however might differ based mostly on particular person circumstances |

| Policygenius | Properly-regarded, user-friendly interface | Excessive, clear presentation of data | Usually correct, however potential for slight variations in quotes |

| Examine.com | Stable person expertise, responsive design | Reasonable, some minor complexities | Correct, however might require extra guide enter |

Suggestions for Acquiring the Finest Offers on Lancaster, CA Automotive Insurance coverage

Discovering probably the most reasonably priced automobile insurance coverage in Lancaster, CA, requires strategic planning and proactive steps. Understanding the native market and using negotiation strategies can considerably cut back your premiums. This course of is akin to looking for divine steering, however with earthly, sensible steps.Acquiring one of the best automobile insurance coverage offers entails greater than merely selecting the primary quote. It is about diligently evaluating, asking insightful questions, and punctiliously deciding on the correct protection.

Simply as a clever prophet consults a number of oracles earlier than making a prophecy, you need to seek the advice of a number of insurance coverage suppliers to seek out probably the most appropriate answer.

Negotiating Higher Automotive Insurance coverage Charges

Negotiation is a key side of securing the absolute best charges. Insurance coverage suppliers usually provide reductions for good driving information, secure driving habits, and different components. Actively looking for these reductions and highlighting your constructive attributes is essential. A well-prepared particular person can negotiate the absolute best deal.

Evaluating Quotes from A number of Suppliers

Evaluating quotes from a number of insurance coverage suppliers is important for locating probably the most aggressive charges. This course of permits you to see the variations in pricing from totally different corporations. By evaluating, you acquire a transparent image of the market, very like a clever king seeks counsel from numerous advisors.

Inquiries to Ask Potential Insurance coverage Suppliers

Asking the correct questions can considerably affect your remaining premium. Understanding the particular phrases and circumstances of every coverage is important. Some essential questions embody: What reductions can be found? What are the particular protection particulars? What’s the course of for submitting a declare?

These inquiries let you make knowledgeable choices.

Selecting the Proper Protection Degree and Deductibles

Understanding your wants and deciding on the suitable protection stage and deductibles is essential. Complete protection might present broader safety, whereas liability-only protection might suffice for some people. Selecting the best steadiness is essential, like selecting the best apparel for a spiritual ceremony. Rigorously contemplate your private circumstances and monetary assets. Deductibles are an essential consideration.

Decrease deductibles might result in increased premiums, and better deductibles result in decrease premiums.

Abstract of 5 Suggestions for Getting the Finest Automotive Insurance coverage Deal, Low-cost automobile insurance coverage in lancaster ca

| Tip | Clarification | Instance |

|---|---|---|

| Examine Quotes from A number of Suppliers | Totally evaluate quotes from not less than three totally different insurance coverage suppliers to establish probably the most aggressive charges. | Contact three totally different corporations (e.g., State Farm, Geico, Progressive) and request quotes. Examine the full premiums, protection particulars, and any further charges. |

| Negotiate Reductions | Actively inquire about out there reductions, resembling these for good driving information, anti-theft gadgets, or bundled companies. | Ask if reductions can be found for secure driving, accident-free driving, or utilization of a telematics system. Spotlight any related components to doubtlessly qualify for a reduction. |

| Ask Particular Questions | Ask particular questions on protection particulars, deductibles, and declare procedures to know the coverage’s phrases and circumstances. | Inquire concerning the specifics of collision protection, complete protection, and the method for submitting a declare. |

| Select Acceptable Protection | Consider your particular wants and select the protection stage that greatest balances safety and value. | Take into account components like your driving habits, the worth of your car, and your monetary scenario. Assess whether or not you want complete protection or liability-only protection. |

| Perceive Deductibles | Rigorously contemplate the connection between deductible quantities and insurance coverage premiums. Decrease deductibles sometimes imply increased premiums, and better deductibles imply decrease premiums. | Weigh the trade-offs between paying increased premiums for decrease deductibles versus paying decrease premiums with increased deductibles. |

Understanding Insurance coverage Claims and Insurance policies in Lancaster, CA

Navigating the world of automobile insurance coverage can really feel like deciphering a fancy scripture. Understanding the method of submitting a declare and the intricacies of your coverage is paramount to making sure your monetary well-being within the occasion of an accident or harm. Allow us to delve into these important points of automobile insurance coverage in Lancaster, CA, drawing parallels to religious steering in navigating life’s surprising turns.The act of submitting an insurance coverage declare is an important step within the strategy of recovering from a loss or harm.

Understanding the particular procedures, Artikeld inside your coverage, is important to keep away from pointless delays or issues. A well-structured declare course of, like a well-crafted prayer, can result in a swift and constructive decision.

Submitting a Automotive Insurance coverage Declare in Lancaster, CA

The method of submitting a automobile insurance coverage declare in Lancaster, CA, is a scientific process, akin to a structured prayer. Collect all essential paperwork, such because the police report (if relevant), an in depth description of the incident, and images of the harm. Contact your insurance coverage supplier promptly and observe their particular directions for reporting the declare. Sustaining meticulous information and communication along with your insurer all through the method is essential.

This methodical strategy ensures a easy decision, simply as a honest prayer can facilitate divine intervention.

Frequent Causes for Automotive Insurance coverage Claims in Lancaster, CA

Accidents, whether or not minor fender benders or extra severe collisions, are a standard set off for insurance coverage claims. Harm from vandalism, theft, or weather-related occasions are additionally frequent causes for submitting a declare. Every situation requires a diligent and prayerful strategy to restoration.

Examples of Typical Automotive Insurance coverage Declare Situations in Lancaster, CA

A minor fender bender leading to minor harm to each autos, necessitating restore and settlement. A complete declare for whole lack of a car attributable to a significant accident or a theft incident. These are simply two situations of how a declare may come up. These conditions are just like life’s numerous trials and tribulations that require divine intervention for a easy decision.

Significance of Understanding Your Automotive Insurance coverage Coverage in Lancaster, CA

Totally understanding your automobile insurance coverage coverage is akin to understanding the tenets of your religion. Understanding the protection limits, exclusions, and deductibles inside your coverage is important to avoiding any surprises or unexpected issues throughout a declare course of. Data empowers you to navigate the method with readability and confidence.

Kinds of Automotive Insurance coverage Claims and Procedures

| Kind of Declare | Typical Procedures |

|---|---|

| Collision | Claims for harm to your car ensuing from a collision with one other car or object. Normally entails an in depth report, pictures of injury, and doubtlessly a police report. |

| Complete | Claims for harm to your car from non-collision occasions resembling vandalism, theft, fireplace, or weather-related occasions. Documentation of the incident and any supporting proof is essential. |

| Legal responsibility | Claims for harm to a different occasion’s car or damage to a different occasion brought on by your car. This usually entails a police report and communication with the opposite occasion concerned. |

Visible Illustration of Automotive Insurance coverage Prices in Lancaster, CA

Searching for reasonably priced automobile insurance coverage in Lancaster, CA, usually entails understanding the intricate components influencing premiums. This part delves into visible representations, permitting us to know the interaction between numerous points and their affect on the price of your protection. Simply as a cautious shepherd understands their flock, understanding these visible aids permits you to make knowledgeable decisions.The graphic depictions beneath function a roadmap, guiding you thru the labyrinthine world of Lancaster automobile insurance coverage prices.

Every illustration illuminates a distinct aspect of the insurance coverage panorama, enabling a deeper comprehension of how components like car kind, driving document, and protection choices collectively have an effect on your premium.

Typical Automotive Insurance coverage Value Variations

Lancaster, CA, like all area, sees variations in automobile insurance coverage prices. These variations are rooted in a number of components, together with the car’s make and mannequin, the driving force’s age and driving document, and the extent of protection chosen. This visible illustration helps illustrate these key components.

This graph illustrates typical automobile insurance coverage value variations in Lancaster, CA. The horizontal axis represents various factors like car kind, driver profile, and protection choices. The vertical axis represents the corresponding insurance coverage value. This visible aids in understanding the affect of those components on the premium quantity. For instance, a youthful driver with a brand new sports activities automobile may expertise a better premium in comparison with an older driver with a extra economical car and a clear driving document.

Common Insurance coverage Premiums for Completely different Automotive Fashions

Varied automobile fashions exhibit differing insurance coverage prices in Lancaster, CA. That is usually attributable to components such because the car’s security options, its perceived danger of theft or harm, and the price of restore. The next chart showcases these averages.

| Automotive Mannequin | Common Premium (USD/12 months) |

|---|---|

| Toyota Camry | 1,800 |

| Honda Civic | 1,650 |

| Ford F-150 | 2,200 |

| Porsche 911 | 3,500 |

This desk represents common insurance coverage premiums for chosen automobile fashions in Lancaster, CA. Be aware that these are averages and precise premiums might differ based mostly on particular person circumstances.

Comparability of Insurance coverage Protection Prices

Selecting the best protection ranges is paramount. Completely different coverages include various prices. A complete visible illustration helps in making knowledgeable choices.

This chart visually compares the prices of various insurance coverage coverages, together with legal responsibility, collision, complete, and uninsured/underinsured motorist protection. The vertical axis shows the price, and the horizontal axis represents the totally different coverages. This visualization facilitates understanding the price implications of choosing various ranges of protection.

Financial savings Potential from Bundling

Bundling automobile insurance coverage with different companies, resembling house or renters insurance coverage, can yield vital financial savings. That is usually attributable to reductions provided by insurance coverage suppliers to prospects holding a number of insurance policies. The infographic beneath illustrates this potential.

This infographic highlights the potential financial savings from bundling automobile insurance coverage with different companies. The visualization showcases the assorted reductions out there and the way these reductions can considerably cut back your general insurance coverage prices. As an illustration, if in case you have each house and auto insurance coverage with the identical supplier, you may obtain a bundled low cost.

Driving Historical past and Insurance coverage Premiums

A driver’s historical past performs a pivotal function in figuring out insurance coverage premiums. A clear driving document usually ends in decrease premiums, whereas accidents and violations usually result in increased premiums.

This illustration explains the connection between driving historical past and automobile insurance coverage premiums in Lancaster, CA. The horizontal axis represents driving historical past (e.g., variety of accidents, violations, claims), and the vertical axis represents the corresponding premium. The visible demonstrates how a clear driving document corresponds to a decrease premium, and conversely, a historical past of violations or accidents correlates with a better premium.

Last Evaluation

In conclusion, securing low cost automobile insurance coverage in Lancaster, CA entails cautious analysis, comparability purchasing, and understanding your particular wants. By leveraging the insights and assets introduced on this information, you may confidently navigate the insurance coverage market and select one of the best protection on your price range and driving necessities. Keep in mind to all the time evaluate quotes from a number of suppliers to make sure you are getting probably the most aggressive price.

Questions Usually Requested

What are the everyday insurance coverage charges for various automobile varieties in Lancaster, CA?

Insurance coverage charges in Lancaster, CA differ based mostly on components such because the make, mannequin, and 12 months of your car. Usually, newer, safer autos are likely to have decrease premiums in comparison with older, less-safe fashions. Particular charges are influenced by the car’s insurance coverage classification and its historical past.

How can I cut back my automobile insurance coverage premiums in Lancaster, CA?

Methods to cut back premiums embody sustaining a clear driving document, putting in anti-theft gadgets, and contemplating increased deductibles. Bundling insurance coverage with different companies, resembling house insurance coverage, might also provide potential financial savings.

What are some widespread components influencing automobile insurance coverage premiums in Lancaster, CA?

Components like your driving historical past, age, location, and credit score rating affect automobile insurance coverage premiums in Lancaster, CA. Driving infractions, resembling rushing tickets or accidents, will enhance premiums.

What on-line assets can be found for evaluating automobile insurance coverage in Lancaster, CA?

A number of on-line comparability instruments let you simply evaluate quotes from numerous insurers. These platforms present a handy technique to discover aggressive charges tailor-made to your particular wants.