Low-cost automotive insurance coverage Fort Lauderdale FL: Navigating the colourful metropolis’s roadways should not break the financial institution. Discovering the proper coverage requires cautious comparability and understanding the nuances of the native market. Components like your car kind, driving file, and even your location inside Fort Lauderdale considerably influence your premium. This information delves into the complexities of acquiring inexpensive automotive insurance coverage, empowering you to make knowledgeable choices and safe the protection you want with out emptying your pockets.

Uncover the secrets and techniques to attaining your dream of a worry-free drive within the sun-drenched metropolis of Fort Lauderdale.

Fort Lauderdale’s automotive insurance coverage panorama is an interesting mix of things. From the bustling roads to the distinctive traits of the realm, understanding these features is essential to discovering the appropriate match in your wants. This exploration will reveal the hidden gems and pitfalls, serving to you to check and distinction insurance policies and suppliers, main you to probably the most appropriate protection on the most tasty worth.

Introduction to Inexpensive Automotive Insurance coverage in Fort Lauderdale, FL

The automotive insurance coverage market in Fort Lauderdale, Florida, like many different areas, is influenced by varied components. These components influence premiums and make discovering inexpensive protection a vital consideration for residents. Understanding these components and customary misconceptions is important for securing the absolute best charges.The price of automotive insurance coverage in Fort Lauderdale is affected by components corresponding to the driving force’s age, driving file, car kind, location, and chosen protection choices.

Excessive visitors areas, like Fort Lauderdale, typically lead to greater premiums as a result of elevated accident dangers. Understanding these influences is significant for securing probably the most applicable protection at a worth that aligns with particular person wants.

Components Influencing Automotive Insurance coverage Premiums

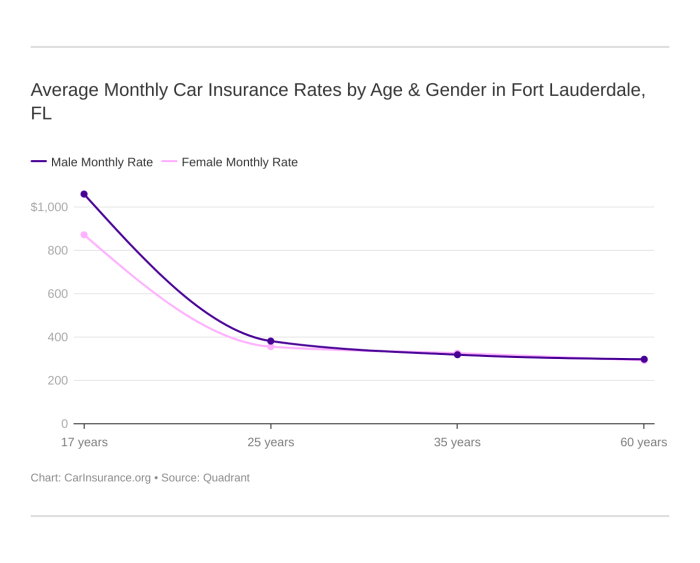

A number of components contribute to the price of automotive insurance coverage in Fort Lauderdale. A driver’s age is a major determinant, with youthful drivers sometimes dealing with greater premiums as a result of statistically greater accident charges. A clear driving file, conversely, demonstrates accountable driving habits and sometimes results in decrease premiums. The kind of car, together with its make, mannequin, and security options, performs a job in figuring out the insurance coverage value.

Location inside Fort Lauderdale additionally impacts premiums, with areas experiencing greater accident charges typically having greater insurance coverage prices.

Frequent Misconceptions about Low-cost Automotive Insurance coverage

A standard false impression is that low cost automotive insurance coverage equates to insufficient protection. This isn’t essentially true. Evaluating quotes from a number of suppliers is important to discover a stability between value and protection. One other false impression is that one particular insurer all the time provides the most cost effective charges. Purchasing round is essential to find the perfect offers.

Moreover, some consider that greater deductibles mechanically translate to decrease premiums, however this isn’t all the time the case. Rigorously evaluating the trade-offs between deductible and protection is significant.

Significance of Evaluating Quotes

Evaluating quotes from a number of insurance coverage suppliers is paramount to discovering probably the most cost-effective protection. Insurance coverage firms use completely different algorithms and pricing fashions, leading to variations in quoted premiums. Drivers ought to actively solicit quotes from a number of insurers to establish probably the most aggressive charges. This course of permits drivers to check protection choices and establish the perfect worth. By exploring completely different quotes, drivers can choose the perfect match for his or her monetary state of affairs and desired degree of protection.

Function of Reductions in Lowering Insurance coverage Prices, Low-cost automotive insurance coverage fort lauderdale fl

Reductions can considerably cut back insurance coverage prices for drivers in Fort Lauderdale. Many insurers supply reductions for secure driving practices, corresponding to accident-free driving information, defensive driving programs, and car anti-theft gadgets. Reductions will also be accessible for bundling insurance coverage insurance policies, corresponding to combining automotive insurance coverage with householders insurance coverage. By leveraging accessible reductions, drivers can successfully decrease their insurance coverage premiums.

Sorts of Automotive Insurance coverage Insurance policies

| Coverage Sort | Protection | Value | Further Info |

|---|---|---|---|

| Legal responsibility | Covers damages to others in case of an accident the place the policyholder is at fault. | (Placeholder – Varies considerably primarily based on components talked about above) | Minimal protection required by regulation in Florida. |

| Collision | Covers injury to your car no matter who’s at fault in an accident. | (Placeholder – Varies considerably primarily based on components talked about above) | Supplies complete safety in your car. |

Figuring out Components Affecting Fort Lauderdale Automotive Insurance coverage Charges

Quite a few components affect automotive insurance coverage premiums in Fort Lauderdale, Florida, impacting the price of protection for residents. Understanding these components is essential for making knowledgeable choices about insurance coverage choices and doubtlessly decreasing premiums. Insurance coverage firms meticulously assess varied standards to find out the danger related to every driver and car, finally shaping the ultimate worth.The advanced interaction of things affecting automotive insurance coverage charges goes past easy demographics.

Insurance coverage firms use refined algorithms to calculate threat profiles, contemplating not only a driver’s historical past but in addition the car’s traits, location, and even creditworthiness. This complete analysis goals to supply a good and correct evaluation of potential claims, making certain monetary stability for the insurance coverage supplier.

Automobile Sort

The precise make, mannequin, and yr of a car play a major position in figuring out insurance coverage premiums. Excessive-performance sports activities vehicles and luxurious autos typically include greater insurance coverage prices as a result of their elevated threat of harm and theft. Conversely, economical and fundamental fashions might need decrease premiums. Components corresponding to security options, anti-theft expertise, and total car worth additionally contribute to the calculated threat.

Driving Document

A clear driving file is essential for securing favorable automotive insurance coverage charges. Accidents and visitors violations instantly influence premiums, rising them considerably. The frequency and severity of those incidents affect the premium quantity. Insurance coverage firms assess not solely the variety of incidents but in addition the character of the violations, corresponding to dashing, reckless driving, or DUI offenses.

Insurance coverage firms use this info to guage the danger of future claims.

Location inside Fort Lauderdale

Completely different areas inside Fort Lauderdale can have various insurance coverage prices. Components like crime charges, visitors density, and accident historical past in particular neighborhoods can affect premiums. Excessive-risk areas, recognized for greater accident charges, usually have greater insurance coverage premiums.

Age and Gender

Statistical information means that youthful drivers and male drivers are inclined to have greater insurance coverage premiums in comparison with older drivers and feminine drivers. This is because of components like statistically greater accident charges related to sure demographics. Nonetheless, particular person driving habits stays a vital determinant, and a secure driving file can offset these common developments.

Credit score Historical past

Insurers now more and more take into account credit score historical past as a think about figuring out automotive insurance coverage premiums. A powerful credit score historical past typically interprets to decrease premiums, reflecting accountable monetary administration. Conversely, poor credit score scores would possibly result in greater premiums, suggesting a doubtlessly greater threat of economic difficulties. Insurance coverage firms consider this issue can point out accountable habits, each in monetary administration and probably driving habits.

Insurance coverage Reductions

A number of reductions can be found to residents of Fort Lauderdale, serving to to scale back automotive insurance coverage premiums. These embrace reductions for secure driving, car security options, and multi-policy holders. Firms typically supply reductions for good college students, accident-free driving, and anti-theft gadgets. It’s helpful to discover and inquire about any accessible reductions to doubtlessly decrease premiums.

Components Rising Automotive Insurance coverage Prices

| Issue | Rationalization | Influence on Value |

|---|---|---|

| Driving Document | Variety of accidents or visitors violations | Elevated value |

| Automobile Sort | Particular automotive mannequin and options (e.g., high-performance sports activities vehicles) | Elevated or decreased value |

| Location | Crime charges, visitors density, and accident historical past in particular areas | Elevated value |

| Age and Gender | Statistical information on accident charges for sure age teams and genders | Elevated value |

| Credit score Historical past | Accountable monetary administration mirrored in credit score rating | Decreased or elevated value |

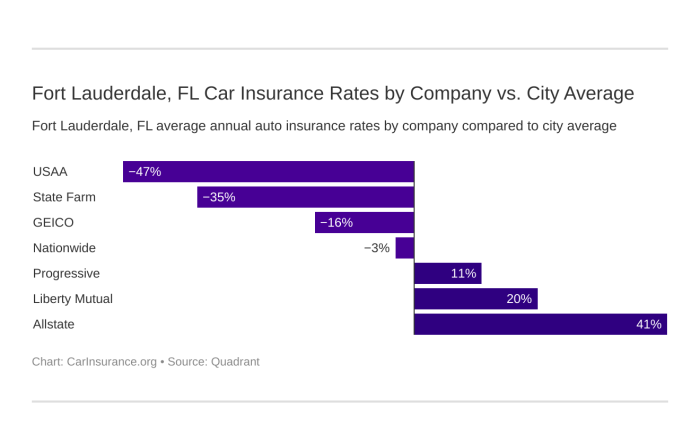

Evaluating Insurance coverage Suppliers in Fort Lauderdale

Selecting the best automotive insurance coverage supplier in Fort Lauderdale is essential for shielding your belongings and monetary well-being. Completely different firms supply various ranges of protection, pricing constructions, and customer support experiences. Understanding these nuances permits you to make an knowledgeable resolution that aligns along with your particular wants and price range.Quite a few components affect the price of automotive insurance coverage, and these components can differ considerably throughout varied suppliers.

Insurance coverage firms weigh quite a lot of components, corresponding to driving historical past, car kind, location, and claims historical past, to find out your premium. Analyzing these parts is significant for comprehending how every supplier calculates and adjusts charges.

Insurance coverage Firm Strengths and Weaknesses

Completely different insurance coverage firms cater to numerous buyer preferences and desires. Understanding their strengths and weaknesses is important for selecting the right match. Some firms excel in offering complete protection choices, whereas others prioritize affordability. Every supplier could emphasize particular features of their companies, corresponding to digital platforms or claims dealing with processes.

Buyer Service Popularity

Customer support performs a pivotal position within the total insurance coverage expertise. An organization’s fame for responsiveness, helpfulness, and effectivity considerably impacts buyer satisfaction. A constructive customer support expertise might be essential throughout claims processing or when needing help with coverage modifications. It is vital to analysis the customer support rankings and critiques of assorted firms to gauge their effectiveness.

Comparative Evaluation of Common Charges

Evaluating common charges throughout completely different insurance coverage firms helps establish potential value financial savings. This evaluation considers components corresponding to coverage varieties, protection ranges, and driver profiles. It is vital to keep in mind that these are averages and particular person charges could differ. Evaluating charges is only one facet of the decision-making course of; different components like customer support and protection choices are equally vital.

| Insurance coverage Firm | Common Price | Buyer Service Score | Protection Choices |

|---|---|---|---|

| Firm A | $1,500 | 4.5 out of 5 stars (primarily based on buyer critiques) | Complete protection, together with collision, legal responsibility, and uninsured/underinsured motorist safety. Gives varied add-on choices like roadside help. |

| Firm B | $1,250 | 4.2 out of 5 stars (primarily based on buyer critiques) | Customary protection choices together with legal responsibility, collision, and complete. Gives a simplified on-line platform for coverage administration. |

| Firm C | $1,700 | 4.7 out of 5 stars (primarily based on buyer critiques) | Focuses on high-value protection choices for luxurious and high-performance autos. Gives concierge service for claims dealing with. |

Methods for Acquiring Low-cost Automotive Insurance coverage in Fort Lauderdale

Securing inexpensive automotive insurance coverage in Fort Lauderdale requires proactive methods. Understanding the components influencing charges and using efficient negotiation techniques are key to attaining cost-effective protection. This part particulars varied approaches for acquiring decrease insurance coverage premiums.Methods for acquiring decrease automotive insurance coverage premiums typically contain a mixture of things, together with sustaining an excellent driving file, bundling insurance coverage insurance policies, and using comparability instruments.

Potential policyholders can acquire vital financial savings by implementing these methods.

Negotiating with Insurance coverage Suppliers

Negotiation with insurance coverage suppliers can result in substantial financial savings. This course of entails presenting your case, highlighting your favorable driving file, and emphasizing any components that would cut back your premium. Understanding the insurer’s pricing fashions and tailoring your request accordingly are important parts of profitable negotiation. By proactively speaking your wants and demonstrating a dedication to secure driving, you’ll be able to enhance your probabilities of attaining a decrease premium.

- Overview your present coverage totally to establish areas the place you could possibly negotiate.

- Talk along with your insurance coverage supplier, expressing your want for a decrease charge and highlighting your constructive driving historical past. Offering documentation supporting a clear driving file, corresponding to accident-free driving information, is vital for a profitable negotiation.

- Contemplate providing a better deductible to doubtlessly decrease your premium. It is a technique to scale back premiums by accepting a better monetary accountability in case of a declare.

- Discover reductions accessible, corresponding to these for secure driving or multi-policy bundling. Actively inquire about all relevant reductions to maximise potential financial savings.

Bundling Insurance coverage Insurance policies

Bundling a number of insurance coverage insurance policies, corresponding to auto, householders, and renters, typically leads to vital financial savings. Insurance coverage firms typically supply discounted charges to clients who mix their insurance coverage wants below one supplier. This technique leverages the connection with a single supplier to attain substantial value reductions.

- Bundling your auto, house, and life insurance coverage insurance policies below one supplier can result in substantial financial savings.

- By bundling your insurance policies, you consolidate your insurance coverage wants with a single supplier, thereby enhancing the probability of securing a reduced charge.

- Combining a number of insurance coverage varieties with a single firm ceaselessly leads to decrease premiums, making this a cheap technique.

Using On-line Instruments for Quote Comparability

On-line comparability instruments are helpful sources for evaluating insurance coverage quotes effectively. These instruments present a platform to shortly collect a number of quotes from varied insurance coverage suppliers. Using these instruments can considerably streamline the method of discovering probably the most appropriate protection at a aggressive worth.

- Leverage on-line comparability instruments to acquire a number of quotes from varied insurance coverage suppliers.

- Make the most of these platforms to effectively evaluate completely different insurance policies and their corresponding premiums.

- On-line instruments can simplify the method of discovering the perfect insurance coverage offers by presenting varied choices from a number of insurers.

Sustaining a Good Driving Document

Sustaining an excellent driving file is essential for securing low automotive insurance coverage charges. A clear driving file demonstrates accountable driving habits, which insurance coverage suppliers typically reward with lowered premiums. By constantly adhering to visitors legal guidelines and secure driving practices, policyholders can profit from decrease insurance coverage prices.

- Sustaining a clear driving file is essential for securing a decrease automotive insurance coverage premium.

- A clear driving file displays accountable driving practices, which insurance coverage suppliers typically acknowledge by offering lowered premiums.

- Adhering to visitors legal guidelines and secure driving practices can considerably influence your insurance coverage prices.

- Examples of cost-saving measures embrace avoiding dashing tickets, avoiding accidents, and making certain well timed insurance coverage renewals.

Understanding Insurance coverage Coverage Protection in Fort Lauderdale: Low-cost Automotive Insurance coverage Fort Lauderdale Fl

Insurance coverage insurance policies in Fort Lauderdale, Florida, supply varied coverages designed to guard drivers and their autos from monetary losses arising from accidents and different unexpected occasions. Understanding these coverages is essential for making knowledgeable choices and making certain enough safety. Selecting the best protection is important to fulfill particular person wants and price range constraints.

Completely different Sorts of Protection Choices

Varied varieties of protection choices can be found to go well with completely different wants and monetary conditions. These choices sometimes embrace legal responsibility, collision, complete, uninsured/underinsured motorist, and medical funds. The precise choices and ranges of protection could differ relying on the insurance coverage supplier and coverage.

Significance of Complete and Collision Protection

Complete and collision coverages are essential parts of a complete auto insurance coverage coverage. Complete protection protects towards damages from perils apart from accidents, corresponding to vandalism, hearth, theft, or hail. Collision protection, however, pays for damages to your car whether it is concerned in a collision, no matter who’s at fault. With out these coverages, restore or substitute prices for a broken car could possibly be substantial and financially overwhelming.

Examples of Conditions The place Completely different Sorts of Protection Apply

Completely different coverages come into play in varied eventualities. Legal responsibility protection is triggered if you end up at fault in an accident and trigger injury to a different individual’s car or property. Complete protection would apply in case your car is broken by a falling tree throughout a storm, or whether it is stolen. Collision protection is activated in case your car is concerned in a collision, no matter fault.

Uninsured/underinsured motorist protection turns into vital if the driving force at fault in an accident has inadequate insurance coverage to cowl the damages incurred.

Detailed Protection Choices

| Protection Sort | Description | Instance Situations |

|---|---|---|

| Legal responsibility | Covers damages to different individuals or their property if you end up at fault in an accident. This sometimes contains bodily damage legal responsibility and property injury legal responsibility. | You rear-end one other car, inflicting injury to their car and accidents to the occupants. |

| Collision | Covers injury to your car when it is concerned in a collision, no matter who’s at fault. | You’re concerned in a automotive accident, and your car is broken. |

| Complete | Covers injury to your car from perils apart from collision, corresponding to hearth, theft, vandalism, hail, or climate occasions. | Your car is broken by a falling tree throughout a storm, or your automotive is vandalized. |

| Uninsured/Underinsured Motorist | Covers damages to you or your car if you’re concerned in an accident with an uninsured or underinsured driver. | You’re in an accident with a driver who doesn’t have auto insurance coverage or has inadequate protection to compensate in your damages. |

| Medical Funds | Covers medical bills for you and your passengers in an accident, no matter fault. | You’re injured in a automotive accident, and also you want medical remedy. |

Remaining Ideas

In conclusion, securing inexpensive automotive insurance coverage in Fort Lauderdale FL is a journey of exploration and comparability. Understanding the market dynamics, evaluating suppliers, and implementing cost-saving methods are essential steps in attaining your purpose. This information has illuminated the trail in the direction of discovering the absolute best protection, permitting you to drive confidently and benefit from the vibrant ambiance of Fort Lauderdale.

With some research and the appropriate method, you’ll be able to take pleasure in the perfect of town with out the burden of exorbitant insurance coverage premiums.

FAQ Information

What are the most typical misconceptions about low cost automotive insurance coverage in Fort Lauderdale?

Many consider that low cost automotive insurance coverage means sacrificing protection. Nonetheless, there are methods to acquire inexpensive insurance coverage with out compromising on safety. This information will discover the frequent myths and supply a sensible view of the accessible choices.

How does my credit score historical past have an effect on my automotive insurance coverage charges in Fort Lauderdale?

Credit score scores can affect your insurance coverage premiums. credit score historical past typically interprets to decrease charges, whereas a less-than-perfect file would possibly lead to greater premiums. The precise influence varies between suppliers.

Are there any reductions accessible for drivers in Fort Lauderdale?

Sure, varied reductions can considerably cut back your insurance coverage prices. These could embrace reductions for secure driving, bundling insurance policies, and even particular applications tailor-made to Fort Lauderdale residents. The supply and particulars of those reductions will differ amongst insurance coverage suppliers.

What are the several types of automotive insurance coverage protection accessible in Fort Lauderdale, and which of them are important?

Legal responsibility, collision, complete, and uninsured/underinsured motorist protection are typical choices. Whereas legal responsibility is commonly required, complete and collision present helpful safety in your car, and uninsured/underinsured motorist protection protects you towards accidents with drivers missing enough insurance coverage.