Automobile insurance coverage benefit score 3 particulars how driving historical past impacts your premiums. Understanding this score helps you handle your insurance coverage prices successfully. This score displays a selected degree of driving conduct and its implications in your insurance coverage coverage are important.

This information will clarify what a benefit score of three means, the way it impacts your premiums, and techniques to keep up or enhance this score. We’ll cowl the elements influencing this score, evaluating it to different rankings, and illustrating the implications with eventualities.

Understanding Benefit Ranking 3

Understanding your automobile insurance coverage benefit score is essential for managing your premiums and guaranteeing you are receiving essentially the most applicable protection in your driving habits. A benefit score of three signifies a degree of driving that falls between these with decrease threat and people with larger threat, typically reflecting a historical past of accountable driving with occasional minor infractions. It is a level of stability the place you need to preserve your present low-risk standing whereas additionally acknowledging the potential for enchancment.A benefit score of three typically signifies a driver who has demonstrated driving file, avoiding severe accidents and violations, however who might have dedicated minor infractions or had some incidents that weren’t extreme sufficient to warrant the next score.

These incidents, whereas not main, might have contributed to a slight improve in threat. It is necessary to do not forget that this score shouldn’t be a judgment of character however moderately an evaluation of driving historical past and threat.

Elements Influencing a Benefit Ranking of three

Drivers with a benefit score of three sometimes have a mix of things of their driving historical past that affect their score. These typically embrace a mixture of accountable conduct and minor infractions. As an illustration, a driver with a clear file may need one or two minor visitors violations, akin to rushing tickets or parking infractions, over a time frame.

The frequency and severity of those incidents, in addition to the driving force’s general driving file, are all taken into consideration by the insurance coverage firm.

Traits of Drivers with a Benefit Ranking of three

Drivers assigned a benefit score of three typically show traits of accountable drivers who perceive the significance of secure driving practices. They’re often conscious of the foundations of the highway and attempt to adhere to them constantly. Nonetheless, they may have skilled conditions the place they made errors or confronted unexpected circumstances that led to minor infractions. This typically factors to a driver who is usually cautious and compliant, however human error or sudden conditions can generally end in such a score.

Potential Advantages and Drawbacks of a Benefit Ranking of three

A benefit score of three affords a stability between premium value and threat evaluation. The advantages typically embrace a extra favorable insurance coverage premium in comparison with drivers with larger benefit rankings. Nonetheless, the potential drawbacks are associated to the chance elements that contributed to this score. For instance, a driver with a benefit score of three may need to keep up a constant file of secure driving to forestall an extra improve of their score, and to keep up the favorable premium.

Driving Conduct Classes and Corresponding Benefit Scores

Sustaining a constantly secure driving file is essential to sustaining a good benefit score.

| Driving Conduct Class | Description | Instance Scores (Illustrative) | Corresponding Benefit Ranking |

|---|---|---|---|

| Glorious | Constantly follows visitors legal guidelines, avoids dangerous maneuvers, and demonstrates exemplary defensive driving. | 95-100 | 1 |

| Good | Principally follows visitors legal guidelines, occasional minor infractions (e.g., minor rushing, minor parking violations). | 85-94 | 2 |

| Truthful | Occasional infractions, some lapses in secure driving practices. | 75-84 | 3 |

| Poor | Frequent infractions, dangerous driving habits, and a historical past of accidents. | 0-74 | 4 or larger |

The desk above gives illustrative examples of driving conduct classes and their related benefit rankings. These scores are illustrative and will differ by insurance coverage firm. Observe that the examples usually are not a exact measurement however moderately a normal information.

Influence on Insurance coverage Premiums

Understanding your automobile insurance coverage premiums is essential for efficient monetary administration. A benefit score system, just like the one used for automobile insurance coverage, assigns a numerical worth based mostly in your driving historical past, influencing your premium prices. This part will delve into the specifics of how a benefit score of three impacts your insurance coverage prices and compares it to different rankings.A benefit score of three signifies a reasonable driving historical past.

It falls between a extra favorable score (like a 1) and a much less favorable one (like a 5). This score is probably going the results of a mixture of secure driving and some minor infractions, which might impression your premium, however not as considerably as a extra problematic driving file. Understanding this nuance is crucial for proactive administration of your insurance coverage prices.

Impact of Benefit Ranking 3 on Premiums

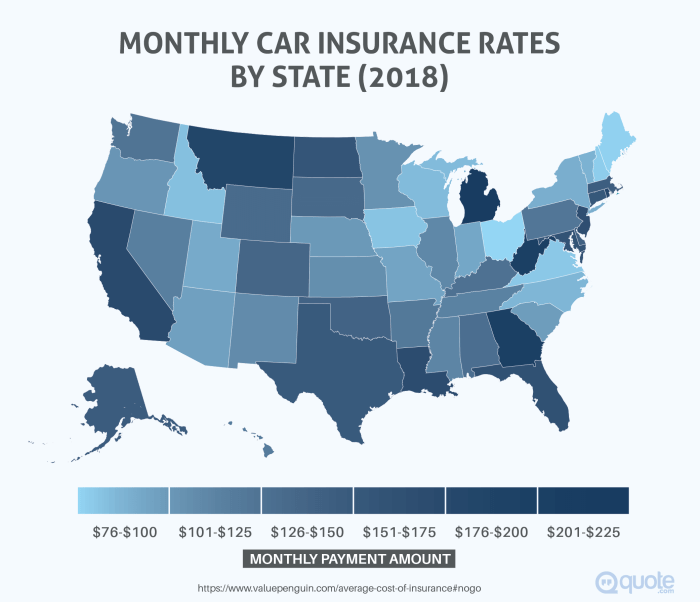

A benefit score of three typically ends in a premium that’s larger than a score of 1, however decrease than a score of 5. The exact quantity is dependent upon varied elements, together with your particular insurer, the situation you reside in, and the kind of car you drive. The insurer’s threat evaluation considers elements just like the frequency and severity of previous accidents or visitors violations.

The upper the score, the higher the chance the insurer perceives, thus influencing the premium quantity.

Comparability to Different Benefit Scores

Insurance coverage premiums for a driver with a benefit score of three will sometimes be larger than a driver with a benefit score of 1, reflecting a decrease perceived threat profile for the driving force with a score of 1. Conversely, a driver with a benefit score of 5 will seemingly face considerably larger premiums, representing the next threat profile for the insurer.

Influence of Driving Historical past on Premium Changes

A driver’s driving historical past instantly influences their benefit score and subsequent premium changes. A constant file of secure driving contributes to a good score, reducing the premium. Conversely, accidents or violations improve the perceived threat, resulting in larger premiums and probably the next benefit score.

Potential Premium Variations Primarily based on Benefit Ranking

| Benefit Ranking | Potential Premium Influence (Illustrative Instance) |

|---|---|

| 1 | Lowest premium as a result of a constantly secure driving file. |

| 3 | Mid-range premium, reflecting a reasonable driving historical past. |

| 5 | Highest premium as a result of a major variety of accidents or violations. |

Observe: These examples are illustrative and will differ based mostly on particular person circumstances.

Examples of Premium Will increase or Decreases

A driver with a benefit score of three who has a clear driving file for a yr would possibly see a slight lower of their premium. Conversely, if they’ve a minor visitors violation, their premium would possibly improve barely. A driver with a benefit score of three who’s concerned in a minor accident may see a major improve of their premium and a corresponding benefit score adjustment.

Insurance coverage corporations use advanced algorithms to evaluate threat, and the particular impression on premiums shouldn’t be simply predicted with out a thorough overview of the person’s driving historical past.

Sustaining and Enhancing a Benefit Ranking of three

Sustaining a benefit score of three in your automobile insurance coverage signifies accountable driving conduct. This score displays a decrease threat profile, resulting in probably decrease insurance coverage premiums. Understanding the elements that affect this score and actively working to protect it’s essential for long-term monetary stability. By constantly adhering to secure driving practices, you may preserve and even enhance your score.Preserving a benefit score of three hinges on constantly demonstrating secure driving habits.

A proactive method to avoiding accidents and violations is crucial for sustaining a optimistic driving file. This proactive method helps in lowering the probability of destructive occasions impacting your score.

Methods for Sustaining a Benefit Ranking of three

Constant secure driving is paramount in sustaining a benefit score of three. This entails adhering to hurry limits, avoiding distractions, and sustaining a secure following distance. Repeatedly reviewing your driving habits and figuring out areas for enchancment is essential.

Actions to Enhance Your Driving Report and Ranking

To enhance your driving file and score, actively establish and tackle potential dangers. Prioritize defensive driving methods, which contain anticipating potential hazards and taking preventive measures. This consists of being conscious of your environment and different highway customers. Repeatedly reviewing your driving habits and figuring out areas for enchancment is essential. In search of skilled driving instruction, if crucial, may help you refine expertise and tackle any areas of weak spot.

Protected Driving Practices to Cut back Accident Danger

Protected driving practices considerably cut back the chance of accidents. These practices embody varied elements of accountable driving. Sustaining a secure following distance permits for faster response time in sudden conditions. Adhering to hurry limits and avoiding distractions like cellular phone use are important for accident prevention. Recognizing and avoiding fatigue is important.

Common breaks and relaxation may help to keep up alertness and cut back the probability of errors.

Figuring out and Avoiding Widespread Driving Errors

Figuring out and avoiding widespread driving errors is crucial for sustaining a optimistic driving file. Widespread errors embrace rushing, distracted driving (utilizing a telephone or different gadgets), tailgating, and aggressive driving. Creating a conscious method to driving may help you keep away from these pitfalls. A key aspect is to concentrate on your environment and anticipate potential hazards. Repeatedly training defensive driving methods can additional improve your driving security.

Reporting and Dealing with Site visitors Violations or Accidents

Immediate and correct reporting of visitors violations or accidents is crucial. Understanding the method and procedures for reporting these incidents is crucial. Following the directions of regulation enforcement and cooperating with investigations is paramount. This proactive method to dealing with violations and accidents helps to attenuate any destructive impacts in your driving file.

Implications for Insurance coverage Insurance policies

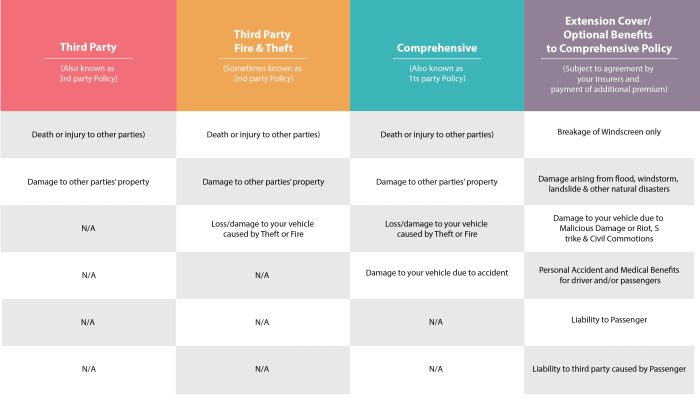

Understanding your insurance coverage coverage’s phrases and circumstances, notably when contemplating a benefit score of three, is essential for efficient threat administration. A benefit score of three signifies a reasonable threat profile, and insurance coverage corporations modify their insurance policies accordingly to mirror this. This adjustment can impression the forms of protection provided, the related premiums, and potential exclusions. It is important to fastidiously overview these implications to make sure you’re adequately protected.

Phrases and Situations Related to a Benefit Ranking of three

Insurance coverage insurance policies typically incorporate clauses associated to benefit rankings. These clauses sometimes Artikel how the score impacts protection, premium changes, and potential limitations. Understanding these specifics is essential to managing your insurance coverage successfully.

Protection Limitations Tied to Benefit Ranking 3

Insurance policies designed for drivers with a benefit score of three might embrace particular limitations on protection. These limitations is likely to be associated to the quantity of protection for specific perils, the length of protection, or the forms of automobiles insured. For instance, complete protection may need the next deductible for a driver with a benefit score of three in comparison with a driver with a decrease benefit score.

This can be a widespread apply to handle threat and premiums.

Potential Exclusions or Limitations

Insurance coverage insurance policies for drivers with a benefit score of three might have particular exclusions. These exclusions can differ extensively by insurer, however they sometimes contain sure forms of automobiles, driving behaviors, or geographic areas. As an illustration, a coverage would possibly exclude protection for automobiles used for industrial functions or for drivers who’ve frequent shifting violations. Some insurance policies might have larger deductibles for claims arising from accidents.

Tailoring Insurance policies for Drivers with a Benefit Ranking of three, Automobile insurance coverage benefit score 3

Insurance coverage corporations tailor their insurance policies to mirror the chance profile of the driving force. Drivers with a benefit score of three might expertise totally different premium buildings, and limitations on protection or exclusions. Premiums for such drivers are sometimes decrease than for these with larger threat profiles, however they may face limitations on protection quantities or sure forms of claims.

Coverage changes are designed to stability value and threat.

Coverage Protection and Exclusions Comparability Primarily based on Benefit Scores

| Benefit Ranking | Protection (Common Description) | Potential Exclusions/Limitations |

|---|---|---|

| 1 (Glorious) | Complete protection, larger limits, decrease premiums | Restricted exclusions; fewer restrictions on driving historical past |

| 3 (Average) | Complete protection, however with potential limitations; reasonable premiums | Potential exclusions for particular automobiles, driving behaviors, or geographic areas; larger deductibles for sure claims. |

| 5 (Excessive Danger) | Restricted protection; larger premiums | Intensive exclusions for particular automobiles, driving historical past, and geographic areas; larger deductibles and probably larger premiums. |

Comparisons with Different Benefit Scores

Understanding your automobile insurance coverage benefit score is essential for managing your premiums and sustaining a optimistic driving file. This part will assist you to differentiate between totally different benefit rankings, particularly evaluating rankings 1, 3, and 5, to raised grasp the implications of every. A transparent understanding of those variations will let you proactively modify your driving habits to keep up a good score and keep away from potential monetary repercussions.

Evaluating Benefit Scores 1, 3, and 5

Benefit rankings mirror your driving historical past and security file, impacting your insurance coverage premiums. A decrease score sometimes means a safer driving file and a decrease premium. Conversely, the next score signifies a much less favorable file, correlating with the next premium. Let’s look at the important thing variations between rankings 1, 3, and 5.

Key Variations Between Scores

Ranking 1 signifies a constantly secure driving file. This sometimes means a minimal or no historical past of accidents, violations, or claims. Ranking 3, conversely, signifies a reasonably secure driving file, with a possible historical past of minor infractions or accidents. Lastly, score 5 sometimes displays a much less secure driving file, with the next frequency of accidents, violations, or claims.

These distinctions are very important in figuring out your insurance coverage premiums.

Driving Behaviors Resulting in a Benefit Ranking of three

A benefit score of three typically outcomes from particular driving behaviors. These would possibly embrace rushing tickets, at-fault accidents involving minor harm, or different minor violations that don’t represent a extreme infraction. A single severe incident, like an accident with important harm or a significant violation, would possibly end in the next score. Constant secure driving habits, coupled with avoiding minor infractions, are important to keep up a benefit score of three.

Influence of Completely different Benefit Scores

This desk illustrates the potential penalties of various benefit rankings in your insurance coverage premiums, protection, and circumstances:

| Benefit Ranking | Premium | Protection | Situations |

|---|---|---|---|

| 1 | Decrease | Customary | Sometimes no restrictions or limitations on protection |

| 3 | Average | Customary | Probably minor restrictions or limitations (e.g., larger deductibles for sure damages) |

| 5 | Increased | Customary, with potential limitations | Vital restrictions or limitations (e.g., larger deductibles, exclusion of particular coverages, elevated premiums) |

Sustaining a benefit score of three or decrease is crucial for minimizing insurance coverage premiums and sustaining favorable protection. Proactively avoiding violations and training secure driving habits can significantly impression your long-term insurance coverage prices.

Historic Context and Traits: Automobile Insurance coverage Benefit Ranking 3

Understanding the historic evolution of automobile insurance coverage benefit score programs gives precious context for appreciating their present construction and potential future developments. This angle permits us to see how societal adjustments, technological developments, and evolving driving behaviors have formed the programs we use right now. By inspecting previous practices, we are able to higher perceive the rationale behind present insurance policies and anticipate potential changes.The preliminary benefit score programs in automobile insurance coverage have been rudimentary, typically counting on elements like the driving force’s age and driving file.

Early strategies lacked the sophistication of contemporary programs, resulting in disparities in premiums. Nonetheless, they served as the inspiration for the extra advanced and nuanced approaches that adopted.

Growth of Benefit Ranking Techniques

Early automobile insurance coverage corporations relied closely on intuitive assessments of threat, typically incorporating easy elements akin to age and gender. This led to important inconsistencies and potential for bias. As the auto grew to become extra prevalent, insurance coverage corporations acknowledged the necessity for extra structured strategies to handle threat and set premiums pretty.

Evolution of Benefit Ranking Elements

The evolution of benefit score programs is instantly tied to developments in knowledge assortment and evaluation. Initially, elements like age and driving expertise have been paramount. Nonetheless, as insurance coverage corporations collected extra knowledge, they included extra refined variables. Examples embrace accident historical past, claims frequency, and even driving conduct as assessed by telematics. These developments mirror a transfer in the direction of a extra complete and data-driven method to threat evaluation.

Influence of Security Rules and Driving Behaviors

Security rules have performed an important function in shaping benefit score programs. The introduction of seat belt legal guidelines, stricter DUI rules, and superior car security options all influenced the best way insurance coverage corporations assess threat. Enhancements in driver conduct, coupled with higher security options, are mirrored in lowering accident charges and decrease premiums for safer drivers.

Affect of Know-how on Trendy Techniques

Technological developments have profoundly impacted fashionable benefit score programs. Telematics, which makes use of knowledge from vehicle-installed gadgets, permits for real-time monitoring of driving habits. This data-driven method permits for a extra exact analysis of particular person threat profiles, probably resulting in extra correct premium calculations. The usage of predictive modeling methods additional enhances the sophistication of those programs.

Timeline of Key Occasions and Modifications

| Yr | Occasion/Change |

|---|---|

| Twenties-Thirties | Early benefit score programs based mostly on driver traits. |

| Forties-Nineteen Fifties | Introduction of accident historical past as a score issue. |

| Nineteen Sixties-Seventies | Rising consciousness of the significance of security and driving conduct. |

| Eighties-Nineties | Emergence of telematics as a possible knowledge supply. |

| 2000s-present | Intensive use of telematics knowledge, superior analytics, and predictive modeling. |

Illustrative Situations

Understanding your benefit score is essential for managing your automobile insurance coverage premiums. This part gives life like eventualities for instance the sensible implications of a Benefit Ranking 3 and the way totally different actions can have an effect on your insurance coverage. These examples intention that will help you perceive how your driving file and decisions impression your monetary well-being.

State of affairs 1: Sustaining a Benefit Ranking of three

A driver with a Benefit Ranking 3 has demonstrated accountable driving habits, avoiding accidents and visitors violations. Their premium displays this accountable conduct. This steady score signifies a decrease threat profile for the insurance coverage firm, which interprets to a extra favorable premium.

Influence of Actions on Ranking and Premiums

Sustaining a Benefit Ranking 3 requires constant accountable driving. Accidents, rushing tickets, or different violations can negatively impression the score and consequently improve insurance coverage premiums. A constant historical past of accountable driving, nonetheless, will assist preserve this favorable score.

State of affairs 2: Enhancing a Benefit Ranking

A driver with a Benefit Ranking 3 who desires to additional enhance their score can deal with proactive measures. For instance, finishing a defensive driving course can improve their data and expertise, probably resulting in the next score and decrease premiums. Constant secure driving practices, like adhering to hurry limits and avoiding distractions, additional contribute to a optimistic driving file.

Impact on Completely different Insurance coverage Insurance policies

A Benefit Ranking 3 impacts varied insurance coverage insurance policies otherwise, relying on the protection. For instance, complete protection would possibly see a extra substantial discount in premiums in comparison with collision protection, reflecting the decreased threat related to accountable driving. The precise impression on every coverage will rely upon the particular insurance coverage supplier.

Potential Penalties of Sustaining a Benefit Ranking of three

Sustaining a Benefit Ranking 3 ensures a good premium. This, in flip, permits for higher monetary safety and planning, as the driving force can anticipate constant and predictable insurance coverage prices. A steady score demonstrates a dedication to secure driving practices and a decrease threat profile, which generally is a optimistic think about different areas of life, akin to mortgage functions or rental agreements.

Geographical Variations

Understanding the nuances of automobile insurance coverage benefit score programs throughout totally different areas is essential for a complete understanding. Variations in driving habits, accident charges, and even the bodily traits of roadways can considerably affect how benefit rankings are interpreted and utilized. This may result in premiums that appear disproportionate to threat ranges when considered by way of a nationwide lens.

Potential Variations in Benefit Ranking Techniques

Completely different geographical areas typically expertise various driving circumstances, contributing to discrepancies in accident charges and insurance coverage premiums. City areas, for example, might have larger accident charges as a result of higher visitors density and congestion, resulting in probably larger premiums for drivers in these areas. Conversely, rural areas with fewer automobiles and decrease accident charges might have decrease premiums.

Regional Elements Affecting Benefit Ranking 3

Regional elements like local weather, highway infrastructure, and visitors patterns play a major function in shaping the interpretation and utility of a benefit score of three. In areas with harsh winter climate, for instance, drivers may need the next threat of accidents as a result of icy roads, which could affect how a benefit score of three is assessed. Equally, areas with poorly maintained roads or high-speed highways may additionally affect the interpretation of this score.

Driving Habits and Accident Charges Throughout Areas

Driving habits differ considerably throughout totally different areas. For instance, drivers in sure European nations would possibly exhibit extra cautious driving kinds than drivers in North America, which may very well be mirrored in decrease accident charges and probably decrease premiums. Cultural norms, driving rules, and the general driving surroundings all contribute to those variations. Moreover, accident charges could be influenced by elements like the supply of public transportation, the prevalence of particular forms of automobiles, and the enforcement of visitors legal guidelines.

Comparability of Benefit Ranking Techniques Throughout Nations

Insurance coverage benefit score programs differ considerably throughout nations. In some nations, the emphasis is on points-based programs for infractions, whereas in others, elements like car kind, age of the driving force, and even location of residence would possibly play a job. The specifics of every system are sometimes advanced and differ significantly.

Desk of Variations in Benefit Ranking Techniques

| Area | Key Elements in Benefit Ranking | Typical Strategy |

|---|---|---|

| North America | Automobile kind, driver historical past, accident historical past | Factors-based programs, usage-based packages (telematics) |

| Europe | Driving file, car kind, location of residence | Typically incorporates elements past simply accident historical past, generally factoring in driver conduct |

| Asia | Driver historical past, accident historical past, car kind | Varied approaches, some with important emphasis on factors programs for infractions |

| Australia | Driver historical past, accident historical past, car kind, location | Emphasis on telematics and usage-based insurance coverage packages |

Abstract

In conclusion, automobile insurance coverage benefit score 3 is an important side of managing your car insurance coverage. Understanding the elements affecting your score, its impression on premiums, and techniques for enchancment means that you can make knowledgeable selections about your driving habits and insurance coverage insurance policies. By adhering to secure driving practices, you may positively affect your score and revel in decrease insurance coverage premiums.

FAQ Part

What are the widespread elements that affect a benefit score of three?

A benefit score of three often outcomes from a mix of things, together with minor visitors violations, close to misses, or a historical past of minor accidents. The precise standards and particular particulars will differ by insurance coverage supplier.

How does a benefit score of three have an effect on insurance coverage premiums in comparison with a score of 1?

A score of three will typically end in larger premiums than a score of 1, as a score of 1 often signifies a safer driving file. The distinction in value will differ relying on the insurance coverage firm and different elements.

What are some secure driving practices to keep up a benefit score of three?

Following visitors legal guidelines, sustaining a secure following distance, and avoiding distracted driving are important for sustaining driving file. Taking defensive driving programs may assist.

What are some widespread driving errors that might result in a benefit score of three?

Widespread errors embrace rushing, working crimson lights, and aggressive driving. These are all behaviors that may improve the probability of accidents and lift your benefit score.