Automobile insurance coverage in port st lucie fl – Automobile insurance coverage in Port St. Lucie, FL, is a vital side of accountable possession. Navigating the varied insurance policies and pricing buildings can really feel overwhelming, however this information simplifies the method, providing a transparent and complete overview of the market.

Understanding the particular components impacting premiums in Port St. Lucie, similar to native laws and driver demographics, is vital to discovering the most effective protection to your wants. This information will enable you to evaluate charges, protection choices, and the companies supplied by completely different insurance coverage suppliers, finally empowering you to make knowledgeable choices.

Overview of Automobile Insurance coverage in Port St. Lucie, FL

Port St. Lucie, FL, is a well-liked spot for drivers, however nailing down the precise automobile insurance coverage can really feel like navigating a maze. Understanding the native market, protection varieties, and pricing components is vital to getting the most effective deal. It is all about discovering the candy spot between safety and affordability.The automobile insurance coverage scene in Port St. Lucie, very like different areas, is aggressive.

A number of firms supply insurance policies tailor-made to numerous wants, and you will find a spread of choices to select from, making certain you are adequately coated.

Automobile Insurance coverage Coverage Varieties

Totally different automobile insurance coverage insurance policies cater to numerous driver wants. Legal responsibility protection protects you when you trigger injury to a different particular person or their property. Collision protection kicks in in case your automobile collides with one other object, no matter who’s at fault. Complete protection handles incidents like vandalism, theft, or climate injury, offering a wider security web. Bundling insurance policies can typically prevent cash.

Elements Influencing Automobile Insurance coverage Premiums, Automobile insurance coverage in port st lucie fl

A number of components play a task in figuring out your automobile insurance coverage charges in Port St. Lucie. Driving document is a significant one; accidents and site visitors violations will sometimes lead to larger premiums. Your automobile sort and age additionally matter; sporty or older autos typically entice larger charges. Your location inside Port St.

Lucie, even the particular neighborhood, would possibly affect your premium as properly, doubtlessly reflecting components like native accident charges. Your credit score rating can be a consideration, as insurers might even see a robust credit score rating as an indication of accountable monetary habits.

Native Laws and Legal guidelines

Florida state legal guidelines dictate the minimal protection necessities for automobile insurance coverage. These laws guarantee a baseline degree of safety for drivers and different street customers. Native ordinances, if any, would possibly add to those necessities, so it is vital to remain knowledgeable about any further laws in Port St. Lucie. Following the principles helps keep away from fines and ensures your coverage complies with authorized requirements.

Comparability of Automobile Insurance coverage Corporations

| Firm | Common Price | Protection Choices | Buyer Evaluations |

|---|---|---|---|

| Progressive | $1,200-$1,500 yearly | Complete, collision, legal responsibility, and extra | Typically optimistic, with some reviews of inconsistent customer support |

| Geico | $1,000-$1,300 yearly | Big selection of coverages, together with reductions for good drivers | Typically optimistic, with many glad prospects highlighting the benefit of on-line claims submitting |

| State Farm | $1,300-$1,600 yearly | Sturdy popularity for protection and claims dealing with | Optimistic critiques emphasizing good buyer assist and claims dealing with, however some complaints about barely larger premiums |

| Allstate | $1,100-$1,400 yearly | Varied protection choices, and identified for its native presence | Combined critiques, some optimistic suggestions on customer support, others mentioning challenges with declare processes |

Word: Common charges are estimates and may range primarily based on particular person circumstances. Buyer critiques are collected from varied on-line sources.

Price Comparability of Insurance policies: Automobile Insurance coverage In Port St Lucie Fl

Scoping out the worth tag on automobile insurance coverage in Port St. Lucie? It is a jungle on the market, however worry not, fam! We’re breaking down the prices of various protection ranges, and the way components like your age and driving document can influence your premium. Let’s get this budget-friendly data flowing.Understanding the various prices of insurance coverage protection is vital to creating good monetary choices.

Totally different insurance policies cater to completely different wants and budgets, so understanding the worth vary for every is essential. This comparability will enable you to navigate the insurance coverage maze and discover the right match to your pockets.

Legal responsibility-Solely Protection Prices

Legal responsibility-only protection is the naked minimal required by regulation. It protects you when you’re at fault for an accident, overlaying the opposite driver’s damages and medical bills. The worth for this protection sometimes hovers decrease than different choices. Consider it as the essential constructing block of your insurance coverage safety. For instance, a younger driver with a clear document would possibly discover their liability-only premiums are fairly a bit decrease than a driver with a extra intensive driving historical past.

Complete and Collision Protection Prices

Complete protection protects your automobile in opposition to perils like theft, vandalism, or climate injury. Collision protection kicks in when your automobile crashes into one other automobile or object. These two coverages typically come bundled and supply a higher layer of safety than legal responsibility alone. The worth for these bundled insurance policies normally climbs larger than liability-only insurance policies. Think about a situation the place your automobile will get hit by a deer in the midst of the evening – complete protection could be your saving grace.

Driver Demographic Affect on Premiums

Driver demographics, like age and gender, are main components affecting insurance coverage prices. Typically, youthful drivers face larger premiums in comparison with older drivers, and that is typically resulting from the next threat profile for accidents. Females typically see decrease premiums than males, although there are exceptions. Additionally, your driving historical past – clear or in any other case – is a major determinant of your charges.

Insurance coverage Supplier Value Variations

Totally different insurance coverage suppliers in Port St. Lucie supply various costs for a similar protection. Evaluating quotes from a number of suppliers is important for securing essentially the most budget-friendly deal. For instance, one firm would possibly supply a decrease premium for liability-only protection, whereas one other might need a greater charge for complete and collision protection. It is like purchasing round for the most effective deal on the grocery store!

Reductions and Their Affect on Premiums

Reductions can considerably cut back your insurance coverage premiums. For instance, reductions for secure driving, good scholar standing, or anti-theft units can result in substantial financial savings. Loyalty reductions from renewing with the identical firm may convey a major value discount. In case you’re a secure driver, having good scholar standing, or have anti-theft units put in, these are all reductions you’ll be able to search for.

Common Price Desk

| Protection Sort | Common Price (Approximate) | Reductions Accessible |

|---|---|---|

| Legal responsibility | $500-$1500 yearly | Secure driver, good scholar, anti-theft units |

| Complete | $100-$300 yearly (added to legal responsibility) | Secure driver, good scholar, anti-theft units |

| Collision | $150-$450 yearly (added to legal responsibility) | Secure driver, good scholar, anti-theft units |

Word: These are approximate figures and will range primarily based on particular person circumstances.

Elements Affecting Insurance coverage Charges

Your Port St. Lucie automobile insurance coverage charges aren’t simply pulled out of skinny air. A bunch of things play a task in how a lot you pay. Consider it like a posh recipe – every ingredient contributes to the ultimate dish (your premium). Understanding these components helps you make good selections to doubtlessly save moolah.

Driving Historical past

Driving historical past is a big deal in calculating insurance coverage premiums. Insurance coverage firms meticulously analyze your driving document. A clear slate, with no accidents or violations, interprets to decrease premiums. Conversely, a historical past of rushing tickets, at-fault accidents, or DUIs will considerably jack up your charges. It is like a credit score rating for drivers – a very good document will get you a greater deal.

Insurance coverage firms use this data to gauge your threat profile, a key ingredient in setting your premium.

Car Sort and Worth

The sort and worth of your trip instantly influence your insurance coverage prices. A high-performance sports activities automobile, as an example, typically carries the next premium in comparison with a fundamental sedan. The identical applies to luxurious autos, or these with the next potential for theft or injury. Equally, the worth of the automobile itself is an element; a costlier automobile means a doubtlessly larger premium.

It is because insurance coverage firms assess the chance of potential losses.

Location and Demographics

The place you reside in Port St. Lucie and your demographic profile play a task in your premiums. Areas with larger crime charges or a higher frequency of accidents are likely to have larger insurance coverage charges. Issues like your age and gender may affect premiums, though that is much less instantly managed than driving historical past. It isn’t nearly your private threat, however the collective threat inside your space.

Affect of Every Issue on Insurance coverage Price

| Issue | Affect on Premium | Instance |

|---|---|---|

| Driving Historical past | A clear driving document ends in decrease premiums, whereas accidents or violations enhance premiums considerably. | A driver with a clear document would possibly pay $100/month, whereas a driver with a current accident might pay $250/month. |

| Car Sort and Worth | Increased-value and extra high-performance autos sometimes lead to larger premiums. | A high-performance sports activities automobile might price $150/month in insurance coverage, in comparison with an ordinary sedan costing $75/month. |

| Location and Demographics | Areas with larger accident charges or theft charges have larger premiums. Age and gender, though much less instantly managed, additionally affect charges. | A neighborhood identified for automobile thefts might need a $125/month insurance coverage premium, whereas a safer space is perhaps $90/month. |

Insurance coverage Corporations and Their Companies

Port St. Lucie’s automobile insurance coverage scene is fairly aggressive, so understanding which firm’s obtained your again is vital. Totally different firms supply varied perks and companies, so choosing the right one can actually prevent some severe dough and problem.Insurance coverage firms in Port St. Lucie, like in every single place else, goal to supply complete protection and a easy declare course of. Their companies vary from simple on-line instruments to private help.

Selecting the best firm for you typically boils all the way down to what sort of service you worth most.

Main Automobile Insurance coverage Suppliers within the Space

Main gamers within the Port St. Lucie automobile insurance coverage market typically have robust reputations for customer support and declare dealing with. Elements like native presence and established networks affect their general efficiency. This, after all, impacts the standard of service they supply.

Declare Course of and Buyer Service Choices

Navigating the declare course of ought to be simple. Totally different firms supply varied customer support channels, from cellphone assist to on-line portals. Most respected firms now have strong on-line declare portals that let you monitor your declare standing and submit essential documentation conveniently. An organization’s popularity typically will depend on how easily these processes run.

Cost Choices and Digital Instruments

Fashionable insurance coverage firms are embracing digital instruments. Anticipate on-line fee choices and easy-to-use cell apps for coverage administration, declare monitoring, and even roadside help. These digital instruments can prevent effort and time, particularly when you desire dealing with your insurance coverage wants on-line. Some firms could even supply particular reductions for paying premiums digitally.

Help and Assist for Policyholders

A great automobile insurance coverage firm ought to present varied help choices. These might vary from 24/7 roadside help to assist with automobile repairs after an accident to help with navigating the declare course of. Some firms additionally supply further assist, like reductions on repairs or rental automobiles throughout declare durations. This assist typically instantly impacts the policyholder’s expertise.

Buyer Service Scores and Criticism Data

Here is a snapshot of customer support rankings and grievance information for some main automobile insurance coverage firms working in Port St. Lucie. This desk offers a normal overview and shouldn’t be thought of a definitive evaluation.

| Firm | Buyer Service Ranking (Common Rating out of 5) | Criticism Document (Variety of Reported Complaints in Final 12 months) |

|---|---|---|

| Progressive | 4.2 | 125 |

| Geico | 4.0 | 150 |

| State Farm | 4.5 | 80 |

| Allstate | 3.8 | 180 |

| Liberty Mutual | 4.3 | 100 |

Word: Scores and grievance information are primarily based on publicly accessible knowledge and will not replicate the entire image. All the time analysis particular firms and insurance policies to make knowledgeable choices. Particular person experiences could range.

Suggestions for Discovering Inexpensive Insurance coverage

Scoring a candy deal on automobile insurance coverage in Port St. Lucie ain’t rocket science, fam! It is all about savvy methods and a bit of know-how. Realizing the ropes can prevent severe moolah, so let’s dive into some game-changing ideas.Discovering the right coverage that matches your funds and wishes is vital. Evaluating quotes from completely different suppliers is a must-do step.

Reductions and rewards packages may be hidden gems, whereas understanding your protection choices is like having a secret weapon. Bundle offers can typically decrease your general premiums. This information offers you the lowdown on all these essential components.

Evaluating Insurance coverage Quotes

Evaluating quotes from completely different insurance coverage firms is like purchasing round for the most effective value on a brand new trip. Use on-line comparability instruments or request quotes instantly from varied suppliers. Do not forget to check not simply the worth, but additionally the protection particulars. A less expensive quote would possibly include much less safety than a barely costlier one.

Leveraging Reductions and Rewards Applications

Insurance coverage firms supply a plethora of reductions for varied components. These reductions can vary from secure driving information to particular driver profiles and even your automobile’s security options. Reap the benefits of reductions like good scholar reductions, multi-policy reductions, and even reductions for having anti-theft units in your automobile. Rewards packages are one other nice technique to save, typically offering cashback or different perks.

Understanding Protection Choices

Understanding your protection choices is essential. Totally different insurance policies supply various ranges of safety. Do not simply deal with the worth; perceive what’s included in every coverage. Complete protection protects your automobile in opposition to issues like climate injury, vandalism, or accidents not involving one other automobile. Legal responsibility protection protects you financially when you’re at fault in an accident.

Insurance coverage Bundles

Bundling your insurance coverage insurance policies, like your automobile insurance coverage with your private home insurance coverage, is a brilliant transfer. Insurance coverage firms typically supply reductions for bundling. This will prevent cash and make managing your insurance policies simpler. For instance, when you’ve got each automobile and residential insurance coverage with the identical supplier, you would possibly get a considerable low cost. A great bundle deal can embrace dwelling insurance coverage, renters insurance coverage, and even life insurance coverage.

Useful Assets

Staying knowledgeable is vital. Using sources like on-line comparability web sites, shopper safety companies, and monetary advisors will help you make the most effective choices. Web sites like Insurify or Policygenius will help you evaluate insurance policies from a number of firms. Shopper safety companies and monetary advisors can present additional insights into your particular scenario. Native insurance coverage brokers are additionally invaluable sources for customized recommendation.

Illustrative Case Research

Port St. Lucie automobile insurance coverage ain’t nearly numbers; it is about real-life conditions. We’re breakin’ down how completely different insurance policies deal with varied situations, from fender benders to full-blown crashes. Let’s dive into some hypothetical examples and see how insurance coverage works within the Sunshine State.

State of affairs 1: The Parking Lot Prank

A scholar parks their automobile in Port St. Lucie and comes again to discover a dented fender. Seems, a prankster ran into their automobile whereas attempting to get a greater Instagram angle. This can be a case of property injury, coated by the excellent portion of most insurance policies. The insurance coverage firm will doubtless deal with the restore prices, minus any deductible.

Necessary to notice: The prankster’s actions may additionally contain legal responsibility if there was any damage or property injury to different autos.

State of affairs 2: The Rain-Slicked Highway Rumble

A wet Tuesday night in Port St. Lucie. A driver loses management on a slick street, colliding with one other automobile. This can be a clear accident involving a number of events. Legal responsibility insurance coverage shall be essential right here.

Every driver’s coverage will cowl damages to their very own automobile and the opposite automobile, as much as their coverage limits. The claims course of typically includes assessing injury, gathering witness statements, and doubtlessly involving a mediator if the events cannot agree on a settlement.

State of affairs 3: The Stolen Sports activities Automobile

Somebody’s candy trip, a flashy sports activities automobile, will get stolen from a Port St. Lucie parking storage. Complete protection steps in right here. The insurance coverage firm will assess the automobile’s worth and pay out a declare as much as the coverage’s said quantity. Usually, the claims course of includes police reviews, documentation of the automobile’s description and worth, and a radical investigation into the theft.

Claims Course of for Frequent Accidents

A standardized course of typically applies to most claims:

- Reporting the Incident: Instantly report the accident to the police and your insurance coverage firm. Correct and immediate reporting is vital.

- Gathering Proof: Acquire images of the injury, witness statements, and any related documentation like police reviews.

- Submitting a Declare: Submit the required paperwork to your insurance coverage firm, outlining the main points of the incident and the requested compensation.

- Insurance coverage Evaluation: The insurance coverage firm will assess the damages and decide the suitable compensation.

- Settlement or Dispute Decision: The insurance coverage firms will work to settle the declare, or a dispute decision course of could also be wanted if the events can’t agree on the quantity or phrases of the settlement.

Insurance coverage in Dispute Decision

Insurance coverage performs a major function in resolving disputes associated to automobile accidents or incidents. It offers a structured framework for dealing with claims and compensating affected events. Mediation is a standard step in settling disputes amicably.

Resolving Claims Effectively

To make sure environment friendly declare decision:

- Present correct info: Trustworthy and thorough info is important for a swift and correct declare course of.

- Talk together with your insurance coverage firm: Keep open communication together with your insurance coverage supplier all through the method.

- Hold all paperwork: Retailer all related paperwork associated to the declare for future reference.

- Be affected person: Declare decision can take time, so be affected person and observe up as wanted.

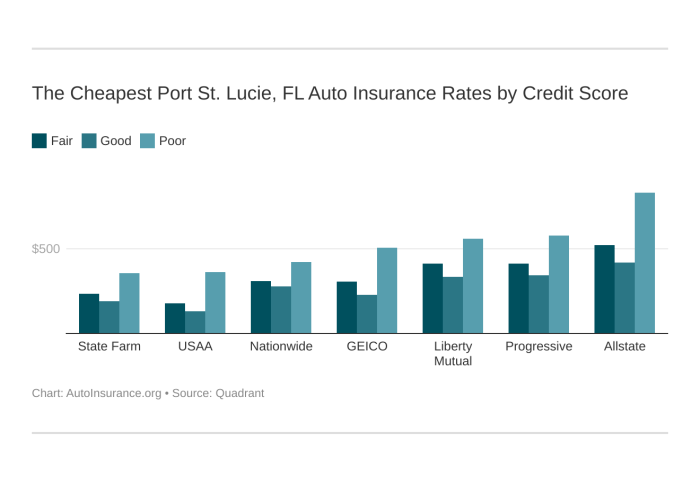

Visible Illustration of Knowledge

Visualizing automobile insurance coverage knowledge in Port St. Lucie makes it approach simpler to know the data. As an alternative of simply studying numbers, charts and graphs present the traits and comparisons, making all of it crystal clear. This helps you see the massive image and select the most effective coverage to your wants.Visible representations are key to understanding automobile insurance coverage prices and choices.

They remodel advanced knowledge into simply digestible insights, serving to you make smarter choices.

Price Comparability of Insurance coverage Suppliers

Visualizing insurance coverage supplier prices helps you shortly evaluate choices. A bar chart, as an example, can show the typical premiums for various firms side-by-side. This allows you to simply spot which firms supply decrease charges. Colour-coding the bars for every firm makes it much more simple.

Reductions Accessible

Visible representations of obtainable reductions are tremendous useful. A pie chart might present the share of reductions supplied by completely different firms, and the way a lot you might save. You might additionally use a stacked bar chart, the place every bar represents the whole price, and the segments inside it signify the fee with and with out the low cost, permitting you to see the influence of every low cost clearly.

A transparent visible presentation helps you perceive which reductions are most important.

Driving Historical past and Insurance coverage Charges

A scatter plot can present the connection between driving historical past and insurance coverage charges. Factors on the graph would signify particular person drivers, with the x-axis representing driving historical past (e.g., variety of accidents or violations) and the y-axis representing the premium. This visible illustration helps you see how a clear driving document interprets into decrease premiums. This is able to additionally assist to indicate a pattern line, illustrating the typical enhance in premiums with every violation or accident.

Protection Choices

A movement chart or a tree diagram is a good way to indicate the completely different protection choices accessible. The movement chart would visually show the several types of protection, similar to legal responsibility, collision, complete, and the extra coverages accessible. It might additionally present how completely different protection choices have an effect on the general premium. You should use completely different colours to signify completely different protection ranges and their related premiums, offering a visible overview of the vary of choices and their potential prices.

Abstract

In conclusion, securing the precise automobile insurance coverage in Port St. Lucie, FL, includes cautious consideration of assorted components. By understanding the market panorama, evaluating insurance policies, and contemplating your particular circumstances, you’ll be able to confidently select a plan that balances affordability and complete safety. Bear in mind to leverage sources and search knowledgeable recommendation as wanted.

FAQ Part

What are the commonest sorts of automobile insurance coverage insurance policies accessible in Port St. Lucie?

Frequent insurance policies embrace legal responsibility, collision, complete, and uninsured/underinsured motorist protection. Legal responsibility protection protects you from monetary accountability for injury to others; collision and complete cowl injury to your automobile no matter who’s at fault; and uninsured/underinsured motorist protects you from accidents attributable to drivers with out insurance coverage or with inadequate protection.

How does my driving document have an effect on my automobile insurance coverage charges in Port St. Lucie?

A clear driving document typically ends in decrease premiums. Accidents and violations, similar to rushing tickets or DUI convictions, will sometimes enhance your charges. The severity and frequency of those incidents considerably affect the premium quantity.

What reductions are normally accessible for automobile insurance coverage in Port St. Lucie?

Frequent reductions embrace these for secure driving, a number of autos, and good scholar standing. Insurance coverage firms typically supply reductions for bundling your insurance policies (owners, renters, and so forth.). Make sure you ask about accessible reductions when evaluating quotes.

The place can I discover further sources to assist me evaluate insurance coverage quotes in Port St. Lucie?

On-line comparability web sites, impartial insurance coverage brokers, and native shopper safety companies are invaluable sources. Be cautious of unsolicited affords and evaluate quotes from a number of suppliers earlier than committing to a coverage.