Automotive insurance coverage for imported vehicles japanese is a vital consideration for any fanatic buying a beloved Japanese import. Navigating the intricacies of insurance coverage insurance policies for these automobiles can really feel daunting, however this information gives a transparent roadmap to understanding the distinctive elements of protection, premiums, and laws. From understanding the traits of Japanese fashions to evaluating insurance coverage insurance policies and claims procedures, this complete useful resource empowers you to make knowledgeable choices.

This detailed information explores the various world of insuring imported Japanese vehicles, highlighting the precise components that set them aside from domestically produced automobiles. We’ll analyze the intricacies of insurance coverage insurance policies, discover the influence of car options and historical past on premiums, and study regional variations in laws. This detailed exploration equips you with the data essential to safe acceptable protection in your prized Japanese import.

Introduction to Imported Japanese Automobiles

Imported Japanese vehicles are famend for his or her reliability, gas effectivity, and superior expertise. Nevertheless, these attributes can generally translate into distinctive insurance coverage issues. Understanding these components is essential for acquiring acceptable protection at aggressive charges.

Traits Affecting Insurance coverage Wants

Japanese automobiles typically exhibit a mixture of high-quality parts and modern security options. This will affect insurance coverage premiums, as demonstrated by research displaying greater restore prices for some fashions in comparison with home counterparts. Moreover, the potential for distinctive components sourcing and specialised restore procedures could play a task within the insurance coverage course of.

Frequent Options Influencing Insurance coverage Charges

A number of widespread options of Japanese automobile fashions influence insurance coverage prices. These embrace: high-tech security options, typically requiring specialised restore procedures; smaller components inventories, resulting in doubtlessly greater restore prices; and, in some instances, decrease general collision frequency. This final issue just isn’t common and might range by mannequin and area.

Variations in Insuring Japanese vs. Home Automobiles

Insurance coverage insurance policies for imported Japanese automobiles typically differ from these for domestically produced vehicles on account of components like restore prices, components availability, and potential specialised experience wanted for repairs. Understanding these variations permits for knowledgeable choices relating to protection choices and premium quantities. The worth of the car and its age additionally performs a major function.

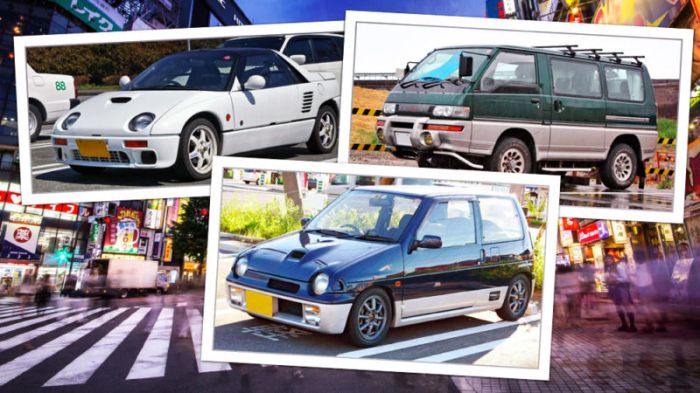

Kinds of Imported Japanese Automobiles and Their Insurance coverage Implications

The varied vary of imported Japanese automobiles, together with sedans, SUVs, sports activities vehicles, and luxurious fashions, brings distinctive insurance coverage issues. For instance, high-performance sports activities vehicles would possibly command greater premiums on account of their elevated danger of harm. Conversely, a well-maintained compact sedan could entice decrease premiums.

Insurance coverage Premium Comparability

| Model | Typical Insurance coverage Premium (Illustrative Instance) | Elements Affecting Premium |

|---|---|---|

| Toyota | $1,200-$1,800 yearly | Mannequin 12 months, car sort (e.g., SUV vs. sedan), protection stage, driver historical past |

| Honda | $1,100-$1,700 yearly | Mannequin 12 months, car sort, protection stage, driver historical past |

| Nissan | $1,000-$1,600 yearly | Mannequin 12 months, car sort, protection stage, driver historical past |

| Mazda | $900-$1,500 yearly | Mannequin 12 months, car sort, protection stage, driver historical past |

Be aware: These are illustrative examples and precise premiums could range considerably based mostly on particular person circumstances. Elements resembling driver profile, car historical past, and particular protection add important variability.

Insurance coverage Protection for Imported Automobiles: Automotive Insurance coverage For Imported Automobiles Japanese

Securing the suitable insurance coverage in your imported Japanese automobile is essential. Completely different nations have various laws, and insurance policies for imported automobiles typically differ from these for domestically produced vehicles. Understanding these nuances ensures you are adequately protected.Imported Japanese vehicles, with their distinctive engineering and potential specialised components, demand tailor-made insurance coverage issues. Navigating insurance coverage choices for these automobiles will be advanced, so it is necessary to pay attention to the protection, exclusions, and the precise procedures for acquiring quotes.

Essential Insurance coverage Facets for Imported Japanese Automobiles

Imported Japanese vehicles typically include distinctive upkeep and restore wants. This necessitates insurance coverage that addresses potential points associated to components availability, restore prices, and specialised labor. Understanding the protection choices and their limitations is essential.

Evaluating Completely different Insurance coverage Insurance policies for Imported Automobiles

Varied insurance coverage insurance policies cater to imported vehicles, every with its personal set of options. Insurance policies would possibly differ by way of legal responsibility protection, complete safety, and non-compulsory add-ons. Elements just like the automobile’s age, mannequin, and worth affect the premium quantity.

Frequent Exclusions or Limitations in Imported Automotive Insurance coverage

Some insurance coverage insurance policies have exclusions or limitations in relation to imported automobiles. These exclusions can range broadly, impacting the scope of protection. Potential limitations embrace particular components not coated, greater deductibles, or exclusions for repairs utilizing non-OEM components.

Elaborating on the Means of Acquiring Insurance coverage Quotes for Imported Japanese Automobiles

Getting quotes for imported Japanese vehicles sometimes entails offering detailed details about the car, together with its make, mannequin, 12 months, mileage, and any modifications. Insurers typically require documentation just like the car’s import papers, registration, and any vital permits. Utilizing on-line comparability instruments or contacting insurers specializing in imported automobiles can streamline this course of.

Typical Protection Choices for Imported Japanese Automobiles

| Protection Kind | Description | Instance |

|---|---|---|

| Legal responsibility Protection | Covers damages you trigger to others’ property or accidents to others. | In the event you’re concerned in an accident and injury one other automobile, this protection will assist pay for the repairs. |

| Complete Protection | Covers injury to your car from numerous perils, together with accidents, theft, vandalism, and pure disasters. | In case your automobile is stolen, complete protection will assist substitute it. |

| Collision Protection | Covers injury to your car attributable to a collision with one other car or object. | In the event you collide with a parked automobile, collision protection pays in your car’s repairs. |

| Uninsured/Underinsured Motorist Protection | Covers damages or accidents in case you’re concerned in an accident with an uninsured or underinsured driver. | In the event you’re hit by a driver with no insurance coverage, this protection will assist compensate in your losses. |

| Glass Protection | Covers injury to the car’s glass, together with home windows and windshields. | If a rock breaks your windshield, glass protection pays for the restore. |

Elements Affecting Insurance coverage Premiums

Imported Japanese vehicles, identified for his or her high quality and reliability, typically include distinctive insurance coverage issues. Understanding the components influencing premiums is essential for correct budgeting and knowledgeable choices. These components, starting from the car’s age and mannequin to its historical past and options, all play a major function in figuring out the price of insurance coverage.

Automobile Age, Mannequin, and Situation

Automobile age, mannequin, and general situation immediately influence insurance coverage prices. Older automobiles, missing superior security options, could have greater premiums. Extra fashionable fashions, with superior security expertise, could command decrease charges. The situation of the car, together with its upkeep historical past and present put on and tear, can be assessed. A well-maintained, low-mileage car is usually perceived as decrease danger, leading to a doubtlessly decrease insurance coverage premium.

For example, a meticulously maintained 2015 Honda Civic would doubtless have decrease premiums than a equally geared up, however poorly maintained, 2015 mannequin.

Impression of Automobile Options

Security options considerably have an effect on insurance coverage premiums. Automobiles geared up with superior driver-assistance techniques (ADAS), like lane departure warning or automated emergency braking, usually qualify for decrease premiums. These options scale back the chance of accidents, making the car much less of a legal responsibility to the insurance coverage firm. For instance, a Toyota Camry with a collection of ADAS options might need a decrease premium in comparison with the same mannequin with out these options.

Automobile Historical past

A car’s historical past, together with earlier accidents and repairs, considerably impacts insurance coverage prices. Automobiles with a historical past of accidents or intensive repairs are perceived as greater danger. The severity of previous injury and the character of repairs immediately have an effect on the premiums. For instance, a automobile concerned in a minor fender bender would doubtless have a decrease premium than one concerned in a extra severe collision requiring intensive repairs.

Moreover, a car with a documented historical past of well-maintained repairs could not see a major premium enhance.

Correlation Between Automobile Options and Insurance coverage Prices

| Automobile Characteristic | Impression on Insurance coverage Prices | Instance |

|---|---|---|

| Superior Driver-Help Methods (ADAS) | Decrease premiums | A 2020 Subaru Outback with lane departure warning and adaptive cruise management |

| Excessive-theft-risk fashions | Greater premiums | A 2018 Nissan GTR |

| Poor Upkeep Historical past | Greater premiums | A 2010 Mazda 3 with documented neglect |

| Earlier Accidents (Minor) | Average premium enhance | A 2017 Toyota Corolla concerned in a minor fender bender |

| Earlier Accidents (Main) | Vital premium enhance | A 2012 Honda Accord concerned in a collision requiring intensive repairs |

Variations in Insurance coverage Laws

Navigating the world of imported automobile insurance coverage will be difficult, particularly when coping with various laws throughout completely different areas. Understanding these variations is essential for guaranteeing your imported Japanese car is correctly protected and legally compliant. Insurance coverage necessities typically depend upon components like the precise nation, the car’s age and mannequin, and the kind of protection desired.Insurance coverage laws for imported Japanese vehicles typically differ considerably from these for domestically produced automobiles.

These variations stem from various authorized frameworks, technical requirements, and even cultural nuances in every area. Understanding these variations is crucial to keep away from expensive errors and guarantee your car is roofed in keeping with native legal guidelines.

Insurance coverage Laws Throughout Areas

Insurance coverage laws for imported automobiles range significantly. International locations could have completely different necessities for the kinds of protection wanted, the quantity of protection required, and the documentation wanted to show the car’s legality. These variations can considerably influence insurance coverage premiums and the general price of proudly owning an imported car.

Authorized Necessities for Imported Japanese Automobiles

To make sure authorized compliance and safe correct insurance coverage protection, imported Japanese automobiles should meet particular authorized necessities. These range vastly relying on the vacation spot nation and sometimes embrace the car’s registration, import documentation, and compliance with native security requirements.

Insurance coverage Protection for Imported Japanese Automobiles

Complete insurance coverage protection for imported Japanese automobiles typically entails extra than simply legal responsibility. It regularly contains protection for injury to the car, theft, and potential medical bills for these concerned in accidents. Insurance coverage firms could have particular necessities relating to the car’s historical past, upkeep information, and present situation.

Particular Documentation Wanted

Correct documentation is significant for securing insurance coverage protection for imported Japanese vehicles. This typically contains import paperwork, registration certificates, upkeep information, and proof of possession. The particular paperwork required can range between nations.

Comparability of Insurance coverage Laws in Completely different International locations

| Nation | Import Laws | Insurance coverage Necessities | Particular Documentation |

|---|---|---|---|

| United States | Requires import documentation, registration, and compliance with US security requirements. | Complete protection required for legal responsibility, collision, and complete injury. | Import paperwork, registration, upkeep information, and proof of possession. |

| United Kingdom | Requires import documentation, registration, and compliance with UK security requirements. | Legal responsibility protection is a minimal, however complete protection is extremely really useful. | Import paperwork, registration, upkeep information, and proof of possession. |

| Japan (for re-importing to Japan) | Particular laws for re-importing, requiring proof of possession, and compliance with Japanese security requirements. | Just like home automobile insurance coverage necessities. | Import paperwork, registration, upkeep information, and proof of possession, doubtlessly together with authentic Japanese paperwork. |

Instance: Variations in US and UK

The US typically requires extra intensive documentation for imported automobiles in comparison with the UK. This would possibly embrace car historical past studies and particular emissions compliance certifications. The UK, whereas demanding import documentation, might need extra relaxed necessities for the comprehensiveness of insurance coverage protection in comparison with the US.

Claims Course of and Documentation

Navigating the claims course of in your imported Japanese automobile will be smoother with correct preparation. Understanding the precise documentation and procedures will help you keep away from delays and guarantee a swift decision. This thread Artikels the crucial elements of submitting a declare in your imported Japanese car.

Declare Submitting Process

The declare course of for imported automobiles typically differs from customary home claims. This is because of various laws, documentation necessities, and potential complexities in verifying the car’s historical past. It is essential to meticulously doc all interactions and keep clear information all through the method.

Important Documentation

Complete documentation is significant for a clean declare. Failure to supply the required paperwork can result in delays or rejection. The required documentation typically contains:

- Insurance coverage coverage particulars: Coverage quantity, protection sort, and the efficient dates are important for verifying your protection.

- Automobile registration and import paperwork: Proof of possession, import permits, and registration particulars are vital to ascertain car possession and compliance with laws.

- Accident report: An in depth police report, if relevant, is essential for precisely documenting the incident.

- Pictures of harm: Clear and detailed pictures of the injury to the car are very important for assessing the extent of the loss.

- Restore estimates: A licensed restore estimate from a licensed mechanic is required for calculating the price of repairs.

- Proof of fee for any earlier repairs: Any prior repairs or upkeep information will be crucial for evaluating the declare.

Typical Steps within the Claims Course of

The steps concerned in submitting a declare for an imported Japanese automobile normally observe the same sample.

- Report the incident: Instantly notify your insurance coverage supplier and the suitable authorities, if vital.

- Collect documentation: Compile all required paperwork as Artikeld within the earlier part. Guarantee accuracy and completeness to expedite the method.

- File the declare: Submit the declare type and supporting documentation to your insurance coverage firm.

- Evaluation of the declare: The insurance coverage firm will assess the validity of the declare and the extent of the injury.

- Approval or denial: The insurance coverage firm will both approve the declare or deny it, offering an in depth clarification for the choice.

- Restore authorization: If accepted, the insurance coverage firm will authorize the required repairs.

- Restore and settlement: The restore store will full the repairs, and the insurance coverage firm will settle the declare in keeping with the agreed phrases.

Potential Problems

A number of components can complicate claims involving imported Japanese automobiles.

- Variations in restore requirements: Restore requirements and availability of components could differ from these within the nation of origin, doubtlessly impacting the restore course of.

- Language boundaries: Communication challenges could come up if the insurance coverage supplier or restore store doesn’t have fluency within the language used within the documentation.

- Verification of car historical past: Verifying the car’s historical past and compliance with import laws will be time-consuming.

- Discovering licensed restore outlets: Finding licensed restore outlets with experience in imported Japanese automobiles can generally be difficult.

Instance Steps Desk

This desk gives a structured overview of the steps concerned in submitting a declare.

| Step | Description |

|---|---|

| Report Incident | Notify insurance coverage firm and authorities (if relevant). |

| Collect Documentation | Compile all vital paperwork (coverage, registration, accident report, and so forth.). |

| File Declare | Submit declare type and supporting documentation. |

| Evaluation | Insurance coverage firm assesses declare and injury. |

| Determination | Insurance coverage firm approves or denies the declare. |

Insurance coverage Firms and Their Providers

Discovering the suitable insurance coverage in your imported Japanese automobile can really feel like navigating a maze. However understanding the panorama of suppliers and their providers can streamline the method. This part dives into evaluating insurance coverage firms, their specializations, and the monetary issues concerned.

Evaluating Insurance coverage Firms

Completely different insurance coverage firms cater to varied wants and danger profiles. To search out one of the best match, evaluate insurance policies based mostly on protection particulars, premium prices, and customer support critiques. Think about components like the precise options and add-ons every coverage presents. This comparability means that you can choose one of the best insurance coverage plan, balancing price and complete safety.

Providers Supplied by Insurance coverage Firms

Insurance coverage firms provide a variety of providers past fundamental protection. These can embrace roadside help, rental automobile protection throughout repairs, and even help with car import documentation points. Understanding these further providers will help you make a well-informed determination.

Respected Insurance coverage Firms for Imported Japanese Automobiles

Many insurance coverage suppliers provide specialised protection for imported automobiles, recognizing the distinctive traits and potential complexities of those vehicles. Researching and figuring out respected firms specializing in imported Japanese automobiles is essential. Think about components like their expertise dealing with comparable automobiles, claims processing velocity, and the general repute inside the trade.

Desk of Respected Insurance coverage Firms

| Insurance coverage Firm | Specialization | Key Providers | Popularity |

|---|---|---|---|

| InsCo1 | Imported Japanese vehicles, complete protection | Roadside help, 24/7 claims hotline, rental automobile protection | Wonderful buyer critiques, fast declare processing |

| InsCo2 | Luxurious and high-performance automobiles, together with Japanese imports | Premium concierge service, devoted claims handlers, international community of restore outlets | Robust repute for dealing with advanced claims |

| InsCo3 | Common insurance coverage, with imported car packages | Commonplace protection with import-specific add-ons, aggressive pricing | Large community, available coverage choices |

Be aware: This desk gives examples; particular firms and providers could range. Thorough analysis is important for choosing essentially the most acceptable insurer.

Monetary Facets of Automotive Insurance coverage

The price of imported Japanese automobile insurance coverage depends upon a number of components, together with the car’s make, mannequin, 12 months, and worth. Premiums typically mirror the automobile’s potential restore prices, its security options, and the insurer’s evaluation of danger. Think about your price range and desired stage of protection when evaluating insurance coverage choices. Elements like your driving historical past and the car’s utilization frequency additionally influence the premium.

Insurance coverage premiums are dynamic and mirror the car’s potential restore prices and related dangers.

For example, a high-performance sports activities automobile will sometimes have the next premium than an ordinary sedan. Additionally, drivers with a historical past of accidents could face greater premiums.

Suggestions for Selecting the Proper Insurance coverage

Discovering the right automobile insurance coverage in your imported Japanese experience can really feel like navigating a maze. However with the suitable strategy, you may confidently select a coverage that gives one of the best worth and peace of thoughts. This entails understanding the nuances of imported automobile insurance coverage and using good methods to match quotes.

Methods for Evaluating Quotes

Evaluating quotes from a number of insurers is essential. Do not accept the primary quote you see. Use on-line comparability instruments to assemble quotes from numerous suppliers. Think about insurers specializing in imported automobiles, as they typically have extra in-depth data of particular fashions and laws. An intensive comparability helps determine potential financial savings and ensures you are getting a aggressive price.

Elements to Think about When Evaluating Protection Choices

Evaluating protection choices is crucial. Past fundamental legal responsibility, think about complete protection that protects in opposition to injury from accidents, vandalism, or pure disasters. Collision protection, which covers injury to your automobile from an accident, can be necessary. Consider the deductibles related to every protection stage to search out one of the best steadiness between price and safety. For example, the next deductible would possibly decrease your premium however require a bigger out-of-pocket fee within the occasion of a declare.

Important Factors When Shopping for Imported Automotive Insurance coverage

Understanding the precise wants of your imported Japanese automobile is essential. This contains components just like the automobile’s make, mannequin, 12 months, and any modifications. Evaluate the coverage’s phrases and circumstances rigorously, paying shut consideration to exclusions, limitations, and the claims course of. Understanding the precise laws in your location, in addition to the specifics of your imported car, is essential.

- Automobile Specs: Precisely file the make, mannequin, 12 months, and VIN of your imported automobile. This element is important for correct premium calculations and protection.

- Protection Sorts: Make sure the coverage contains complete protection for injury from accidents, theft, or pure disasters. Think about extra protection for particular wants, like roadside help or rental automobile bills.

- Deductibles: Select a deductible that balances the premium price together with your monetary capability to pay for repairs. Think about your price range and danger tolerance.

- Claims Course of: Completely assessment the claims course of Artikeld within the coverage. Perceive the required documentation and the timeframe for declare settlement.

- Coverage Exclusions: Rigorously assessment the coverage exclusions to keep away from misunderstandings and make sure the protection adequately protects your car.

Flowchart for Deciding on Imported Automotive Insurance coverage

This flowchart Artikels the steps in deciding on the suitable automobile insurance coverage in your imported Japanese automobile:

| Step | Motion |

|---|---|

| 1 | Collect car particulars (make, mannequin, 12 months, VIN). |

| 2 | Analysis insurance coverage suppliers specializing in imported automobiles. |

| 3 | Request quotes from a number of suppliers utilizing on-line comparability instruments. |

| 4 | Evaluate protection choices, deductibles, and premium prices. |

| 5 | Consider the claims course of and documentation necessities. |

| 6 | Evaluate coverage phrases and circumstances completely. |

| 7 | Choose the coverage that finest meets your wants and price range. |

Illustrative Examples of Insurance coverage Insurance policies

Understanding the nuances of insurance coverage insurance policies for imported Japanese vehicles is essential. Completely different insurance policies provide various ranges of protection, impacting your monetary safety in case of accidents or injury. This part gives illustrative examples that will help you evaluate and distinction completely different choices.

Coverage Instance 1: Complete Protection

This coverage gives broad safety in opposition to numerous perils.

“Complete protection extends to damages from fireplace, theft, vandalism, hail, and unintended injury. It typically contains glass breakage, and injury attributable to falling objects. Exclusions sometimes embrace put on and tear, injury from pure disasters not coated by separate insurance policies, and pre-existing injury.”

- Protection Limits: USD 50,000 for complete loss or injury. USD 10,000 for windshield alternative. Deductible of USD 500.

- Exclusions: Injury from neglect, put on and tear, modifications not accepted by the insurer, and injury from struggle or acts of terrorism.

- Coverage Phrases: 12-month coverage, requiring annual renewal, and a compulsory inspection by the insurer each 6 months.

Coverage Instance 2: Third-Social gathering Legal responsibility

This coverage primarily covers legal responsibility for injury to different automobiles or people.

“Third-party legal responsibility protection solely pays for damages you trigger to others, not for damages to your individual car. It’s the most simple stage of protection and doesn’t provide safety in your car.”

- Protection Limits: USD 25,000 per accident, USD 100,000 for bodily damage to a 3rd get together.

- Exclusions: Injury to your individual car, injury attributable to your intentional actions, and injury ensuing from a pre-existing situation.

- Coverage Phrases: Covers the driving force and the car solely whereas legally operated, and doesn’t embrace protection for injury from the driving force’s private belongings.

Coverage Instance 3: Collision Protection

This coverage focuses on injury to your car ensuing from collisions.

“Collision protection pays for injury to your car if it collides with one other car, object, or animal. It doesn’t cowl damages to different automobiles or people.”

- Protection Limits: USD 20,000 for restore or alternative. Deductible of USD 200.

- Exclusions: Injury attributable to your negligence or recklessness, injury from accidents involving uninsured drivers, and put on and tear.

- Coverage Phrases: Protection applies when the car is legally operated, and the driving force is legally insured. The coverage phrases are detailed within the coverage doc, together with specifics on protection for car modifications.

Comparability of Coverage Choices, Automotive insurance coverage for imported vehicles japanese

| Coverage Kind | Protection | Price | Suitability |

|---|---|---|---|

| Complete | Broad | Greater | Really useful for these wanting most safety |

| Third-Social gathering Legal responsibility | Restricted | Decrease | Appropriate for many who prioritize legal responsibility protection |

| Collision | Particular | Average | Helpful for safeguarding your car in opposition to collisions |

Insurance coverage Options and Concerns

Securing the suitable insurance coverage in your imported Japanese automobile is essential. Past conventional insurance policies, various options provide numerous benefits and downsides. Understanding these choices permits knowledgeable decision-making, aligning your safety together with your price range and desires.Exploring alternate options to conventional automobile insurance coverage for imported automobiles is a brilliant monetary transfer. Elements just like the automobile’s age, mileage, and particular options, together with native laws and market circumstances, play an important function in selecting one of the best insurance coverage plan.

Various Insurance coverage Options

Varied choices exist past customary insurance policies. These vary from self-insurance to specialised short-term coverages. Every strategy carries distinct implications that warrant cautious consideration.

- Self-Insurance coverage: This strategy entails assuming the monetary accountability for potential damages. This technique requires a considerable monetary cushion to cowl repairs or replacements. It’s sometimes chosen by people with important property and a powerful understanding of potential dangers. The benefit is price financial savings if no declare is made; nevertheless, potential losses will be substantial if an accident happens.

- Quick-Time period Insurance coverage: Quick-term insurance policies are perfect for particular wants, resembling overlaying a car whereas it is being transported or quickly registered. They provide a extra inexpensive possibility in comparison with a full-coverage coverage for a brief interval. This is likely to be helpful for people who want insurance coverage for a selected occasion, like a highway journey or a commerce present. Nevertheless, short-term insurance policies normally do not present complete protection and might need limitations on the kinds of incidents coated.

Evaluating Insurance coverage Choices

A transparent comparability is important for knowledgeable choices. This desk Artikels the important thing variations between self-insurance, short-term insurance coverage, and conventional insurance coverage.

| Characteristic | Self-Insurance coverage | Quick-Time period Insurance coverage | Conventional Insurance coverage |

|---|---|---|---|

| Price | Probably decrease (no premiums), however excessive danger of economic loss. | Decrease than conventional insurance policies, however with limitations. | Average to excessive premiums relying on protection. |

| Protection | Restricted to none; depends upon the person’s monetary reserves. | Restricted protection, typically excludes sure kinds of damages. | Complete protection choices out there, together with legal responsibility, collision, and complete. |

| Flexibility | Extremely versatile, however depending on private sources. | Versatile for short-term wants. | Average flexibility; coverage changes doable. |

| Threat | Excessive danger of economic loss if a declare is made. | Average danger, as protection is proscribed. | Decrease danger, as a 3rd get together assumes some monetary accountability. |

Concerns Particular to Imported Japanese Automobiles

Sure components associated to imported Japanese automobiles necessitate particular insurance coverage issues. These issues stem from components like car age, potential upkeep wants, and ranging regulatory frameworks in numerous jurisdictions.

- Automobile Age and Situation: Older imported Japanese vehicles could require extra frequent upkeep, doubtlessly growing the probability of repairs and impacting insurance coverage premiums. This necessitates a cautious analysis of the automobile’s situation and upkeep historical past.

- Regulatory Variations: Insurance coverage laws could range between the nation of origin and the vacation spot nation, necessitating thorough analysis to make sure compliance with native necessities. This contains understanding the precise protection wants and potential exclusions associated to importing and registering the automobile.

- Particular Elements and Repairs: Some Japanese automobile components could also be dearer to restore than others. This must be factored into the insurance coverage determination. Think about the potential price of repairs when evaluating the chance related to the car.

Epilogue

In conclusion, securing the suitable automobile insurance coverage for imported Japanese vehicles calls for cautious consideration of varied components. From the distinctive traits of Japanese fashions to regional variations in laws, this information has illuminated the important parts of protection. Finally, the purpose is to empower you with the data to make knowledgeable choices and guarantee your imported Japanese automobile is protected, whatever the complexities of the method.

This thorough exploration ensures you’re geared up with the required data to confidently navigate the insurance coverage panorama in your cherished import.

Useful Solutions

What are the widespread options of Japanese vehicles that affect insurance coverage charges?

Elements resembling security options, engine sort, and general car design can influence insurance coverage premiums for Japanese imports. Fashions with superior security expertise typically entice decrease premiums, whereas older fashions would possibly carry greater prices.

How does the car’s historical past have an effect on insurance coverage premiums?

Earlier accidents, repairs, or injury to the car can considerably affect insurance coverage charges. A clear car historical past usually results in extra favorable premiums.

What are the standard protection choices for imported Japanese vehicles?

Typical protection choices typically embrace legal responsibility, collision, complete, and uninsured/underinsured motorist protection. Particular choices and ranges of protection could range by insurer and particular person wants.

What documentation is required for insurance coverage protection of imported Japanese vehicles?

Import paperwork, car registration, and proof of possession are regularly required. Particular documentation could range by area.