Automotive insurance coverage for EVs Ontario navigates the distinctive panorama of electrical car possession within the province. Not like conventional automobiles, EVs current distinct insurance coverage concerns, from battery know-how to potential dangers. This information delves into protection choices, components impacting premiums, insurance coverage suppliers, claims procedures, and future traits, providing a whole image of insuring your electrical car in Ontario.

Understanding the intricacies of automobile insurance coverage for EVs in Ontario is essential for accountable possession. This complete information unravels the complexities, offering sensible insights for each new and seasoned EV drivers.

Introduction to EV Insurance coverage in Ontario: Automotive Insurance coverage For Evs Ontario

Ontario’s automobile insurance coverage panorama is present process a big transformation with the growing reputation of electrical automobiles (EVs). Whereas the elemental rules of insurance coverage stay the identical—masking damages and liabilities—the specifics of insuring EVs current distinctive concerns that differ from conventional gasoline-powered automobiles. This shift necessitates a nuanced understanding of the evolving insurance coverage market and the distinctive elements of EV possession.Insuring an electrical car in Ontario requires a cautious evaluation of the particular dangers and advantages, distinct from conventional automobiles.

The distinctive elements of an EV, significantly the battery pack, contribute to a distinct set of potential dangers. Elements like battery fireplace danger, greater restore prices for electrical elements, and the altering panorama of the restore business should be taken into consideration when evaluating insurance coverage premiums.

Distinctive Facets of EV Insurance coverage

Electrical car batteries, whereas superior and environment friendly, are advanced and doubtlessly hazardous. A major side of EV insurance coverage is the protection for battery harm or failure. Whereas conventional automobiles have inner combustion engines which might be extra readily accessible for restore, EVs have intricate battery methods that require specialised experience for prognosis and restore. This usually results in greater restore prices.

Frequent Misconceptions about EV Insurance coverage

A standard false impression is that EV insurance coverage is routinely dearer than conventional insurance coverage. Whereas there could also be some variations in premiums, components just like the car’s make, mannequin, driver profile, and the chosen insurance coverage plan can considerably affect the ultimate value. One other widespread false impression is that EV batteries are inherently extra vulnerable to fires. Whereas there have been cases of battery fires, these incidents are sometimes remoted and don’t mirror the overall security report of EV batteries.

Accountable upkeep and correct charging practices considerably scale back these dangers.

Comparability of Insurance coverage Prices

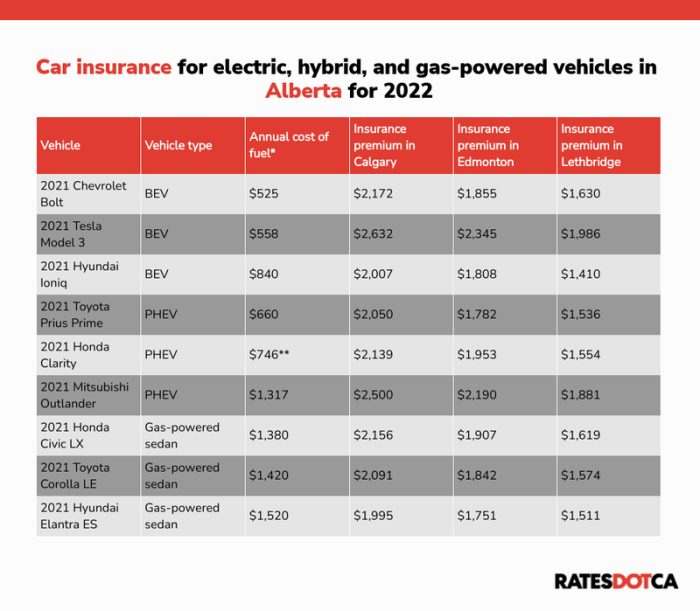

Understanding the potential variations in insurance coverage prices between EVs and conventional automobiles is essential. The next desk offers a basic comparability of typical insurance coverage prices for related fuel and electrical automobiles in Ontario, assuming a normal driver profile. Word that these figures are estimates and precise prices might fluctuate.

| Automobile Kind | Estimated Insurance coverage Price (Annual) |

|---|---|

| Comparable Fuel-Powered Automobile | $1,500 – $2,500 |

| Comparable Electrical Automobile | $1,600 – $2,700 |

These estimates spotlight that, in some circumstances, insurance coverage prices for EVs is likely to be akin to or barely greater than these for comparable fuel automobiles. The variations are sometimes small, and the general value will depend upon particular person circumstances. The components that decide premiums stay the identical: driver historical past, location, car options, and chosen insurance coverage protection.

Protection Choices for EVs

Navigating the world of electrical car (EV) insurance coverage in Ontario requires understanding the distinctive elements of those automobiles. Not like conventional combustion engine vehicles, EVs current particular concerns concerning potential harm and the character of their elements. This part will discover the assorted protection choices out there to EV house owners in Ontario, highlighting the significance of complete safety and the intricacies of legal responsibility protection.

Forms of Protection Accessible for EVs

EVs, like conventional automobiles, require a mix of coverages to make sure monetary safety in case of accidents or harm. These coverages sometimes embrace legal responsibility, collision, and complete. Legal responsibility protection protects you from monetary duty for those who trigger harm to a different particular person or their property. Collision protection pays for harm to your EV if it is concerned in an accident, no matter who’s at fault.

Complete protection goes past collision, addressing damages attributable to occasions apart from accidents, comparable to theft, vandalism, fireplace, or hail. These completely different coverages mix to type a complete insurance coverage package deal.

Significance of Complete Protection for EVs

Complete protection is especially essential for EVs because of the distinctive vulnerabilities of their battery packs. Harm to the battery pack can result in important restore prices and even whole car loss. Complete protection extends to guard in opposition to incidents that will trigger battery harm, comparable to fireplace, flooding, or vandalism. This complete safety is important to mitigate the excessive prices related to battery pack substitute or restore.

Moreover, a complete coverage usually covers harm from sudden occasions like storms or falling objects.

Specifics of Legal responsibility Protection for EV Drivers

Legal responsibility protection, a elementary part of any insurance coverage coverage, capabilities equally for EVs because it does for conventional automobiles. It protects the motive force and the car from monetary duty in case of an accident the place the motive force is at fault. The quantity of legal responsibility protection sometimes depends upon the coverage limits chosen. Guaranteeing enough legal responsibility protection is essential to keep away from private monetary burden within the occasion of an accident.

A typical legal responsibility protection will sometimes embrace protection for property harm and bodily harm.

Examples of Add-on Protection Choices Related to EVs

A number of add-on protection choices can be found to boost the safety of EV house owners. These may embrace roadside help, which offers assist in case of a breakdown, or rental automobile reimbursement, which may offset the price of a brief rental car whereas your EV is being repaired. Further protection for harm from excessive climate occasions or particular environmental hazards may additionally be thought-about, relying on the world of operation.

Safety for harm from electrical surges, or from harm to charging tools is also thought-about.

Key Variations Between EV and Conventional Automobile Protection

| Protection Kind | Conventional Autos | Electrical Autos (EVs) |

|---|---|---|

| Legal responsibility | Covers harm to different folks or property for those who’re at fault. | Covers harm to different folks or property for those who’re at fault. |

| Collision | Covers harm to your car in an accident, no matter fault. | Covers harm to your car in an accident, no matter fault. Could have particular clauses addressing battery pack harm. |

| Complete | Covers harm to your car from occasions apart from accidents, like theft, vandalism, or climate harm. | Covers harm to your car from occasions apart from accidents, together with particular protection for battery pack harm and electrical system harm. |

| Add-on Coverages | Roadside help, rental automobile reimbursement. | Roadside help, rental automobile reimbursement, doubtlessly specialised coverages for EV-specific points like charging station harm or electrical surges. |

Elements Influencing EV Insurance coverage Premiums

Ontario’s burgeoning electrical car (EV) market presents distinctive insurance coverage concerns. Whereas EVs provide important environmental advantages and doubtlessly decrease working prices, the components impacting insurance coverage premiums are distinct from these of conventional gasoline-powered automobiles. Understanding these components is essential for each EV house owners and insurers to make sure truthful and correct pricing fashions.EV insurance coverage premiums are influenced by a posh interaction of things, usually exceeding the straightforward comparability of comparable gasoline-powered automobiles.

The particular traits of every EV, the motive force’s historical past, and the geographical location all play pivotal roles in figuring out the ultimate premium.

Automobile Make and Mannequin

EVs fluctuate considerably of their building, know-how, and security options. Completely different producers make use of various ranges of battery know-how and security methods, impacting each the car’s general worth and the potential for danger in an accident. A high-end, refined EV with superior security options might need a decrease premium than a much less technologically superior mannequin. Examples embrace the Tesla Mannequin S, identified for its refined security options, doubtlessly commanding a decrease premium in comparison with a extra primary EV mannequin.

Driver Historical past

Driver historical past, an important think about conventional insurance coverage, performs a essential position in EV insurance coverage. A driver with a historical past of accidents or visitors violations will typically have greater premiums, whatever the car sort. Insurance coverage firms assess driving data utilizing information evaluation to judge danger. This evaluation contains accident frequency, violation varieties, and driving habits.

Location

Geographic location considerably influences EV insurance coverage premiums. Areas with greater charges of accidents, theft, or particular climate patterns that will impression EV operation (e.g., excessive chilly affecting battery efficiency) might result in greater premiums. As an illustration, areas vulnerable to extreme winters may see EVs going through elevated danger of injury from excessive chilly.

Automobile Options and Expertise

Particular car options and know-how can impression insurance coverage premiums. Superior driver-assistance methods (ADAS) in EVs, comparable to computerized emergency braking or lane departure warnings, can contribute to decrease premiums. These methods scale back accident danger, making the car much less vulnerable to accidents.

Electrical Automobile Charging Stations

The supply of charging stations in a selected space may have an effect on insurance coverage premiums. Areas with considerable charging stations might face a diminished danger related to breakdowns or vary anxiousness. Conversely, areas with restricted charging infrastructure might even see the next premium because of the potential danger of breakdowns.

Desk of Elements Affecting EV Insurance coverage Premiums

| Issue | Potential Influence on Premiums |

|---|---|

| Automobile Make and Mannequin | Greater-end EVs with superior security options might have decrease premiums. |

| Driver Historical past | Accidents and violations lead to greater premiums, no matter car sort. |

| Location | Areas with excessive accident charges or excessive climate circumstances might have greater premiums. |

| Automobile Options and Expertise | Superior driver-assistance methods (ADAS) can result in decrease premiums. |

| Electrical Automobile Charging Stations | Areas with considerable charging stations might have decrease premiums. |

Insurance coverage Suppliers and Their EV Insurance policies

Navigating the world of electrical car (EV) insurance coverage in Ontario can really feel a bit like charting a brand new course. Thankfully, a number of main insurance coverage suppliers at the moment are providing specialised insurance policies tailor-made to the distinctive wants of EVs. This part dives into the specifics of those insurance policies, serving to you examine protection and prices.Understanding the completely different EV insurance coverage insurance policies out there is essential to discovering the perfect match in your wants.

Insurance coverage suppliers aren’t simply providing the identical protection as for conventional automobiles; they’re usually adapting to the distinct options and dangers related to EVs.

Main Insurance coverage Suppliers in Ontario

A number of outstanding insurance coverage suppliers function in Ontario, every with their very own strategy to EV insurance coverage. This record highlights a number of the key gamers out there. Recognizing the suppliers can be helpful while you begin evaluating insurance policies and prices.

- Aviva Canada: Aviva Canada affords numerous insurance coverage merchandise, together with choices for EVs. Their insurance policies usually embrace options tailor-made to the particular wants of electrical automobiles, doubtlessly providing incentives for environmentally aware drivers.

- Intact Insurance coverage: Intact Insurance coverage, a big participant within the Ontario market, offers complete insurance coverage choices, together with EV-specific insurance policies. Their protection might embody elements comparable to specialised battery safety or different components pertinent to electrical car possession.

- The Co-operators: The Co-operators, identified for his or her dedication to community-focused insurance coverage, doubtless has EV-specific insurance policies designed to assist electrical car house owners. They may emphasize environmentally pleasant initiatives of their protection.

- Desjardins Insurance coverage: Desjardins Insurance coverage is a well-established participant with a broad vary of insurance coverage merchandise. Their insurance policies for EVs might incorporate options associated to the distinctive upkeep and restore necessities of electrical automobiles.

- Canada Life Insurance coverage Firm: Canada Life Insurance coverage Firm, a big insurance coverage supplier, affords insurance coverage merchandise, together with choices for EVs. Their insurance policies might provide complete protection for {the electrical} elements and particular wants related to electrical automobiles.

Evaluating EV Insurance coverage Insurance policies

Evaluating EV insurance coverage insurance policies from completely different suppliers is essential to securing the perfect worth. Look past the bottom worth and delve into the particular options and protection choices.

- Protection Particulars: Rigorously study the main points of every coverage’s protection, together with legal responsibility, complete, and collision. Make sure that protection aligns together with your particular wants and driving habits. For instance, some insurance policies may provide enhanced safety for the high-value battery methods.

- Price Comparability: Acquire quotes from a number of suppliers to check prices. Think about components comparable to your driving historical past, car mannequin, and placement when evaluating quotes.

- Reductions and Incentives: Many suppliers provide reductions for environmentally aware drivers or for these with a protected driving report. You’ll want to discover out there reductions to doubtlessly decrease your premiums.

Discovering Reductions and Incentives

Discovering out there reductions and incentives can considerably scale back your EV insurance coverage premiums. Make the most of alternatives to economize in your insurance coverage.

- Secure Driving File: A clear driving report is usually rewarded with reductions on insurance coverage premiums. Sustaining a protected driving report is a helpful asset for decreasing your general insurance coverage prices.

- Bundled Insurance coverage Merchandise: Combining your EV insurance coverage with different insurance coverage merchandise, comparable to dwelling or renters insurance coverage, may yield reductions.

- Environmental Initiatives: Some suppliers provide reductions for environmentally pleasant decisions, comparable to buying an electrical car. That is an incentive to encourage the adoption of electrical automobiles.

Evaluating Suppliers and Their EV Insurance policies

A tabular comparability can simplify the method of evaluating completely different insurance coverage suppliers.

| Insurance coverage Supplier | Key Options of EV Insurance policies | Potential Reductions |

|---|---|---|

| Aviva Canada | Tailor-made protection for EV battery methods, doubtlessly providing incentives for environmentally aware drivers. | Secure driving report, bundled insurance coverage merchandise, environmental initiatives. |

| Intact Insurance coverage | Complete protection choices, doubtlessly with specialised battery safety. | Secure driving report, bundled insurance coverage merchandise, and doubtlessly particular reductions for EV possession. |

| The Co-operators | Group-focused insurance policies, doubtlessly with options supporting electrical car house owners. | Secure driving report, bundled insurance coverage merchandise, and potential reductions for environmentally pleasant decisions. |

| Desjardins Insurance coverage | Broad vary of insurance coverage merchandise, together with insurance policies tailor-made to EV upkeep wants. | Secure driving report, bundled insurance coverage merchandise, doubtlessly particular reductions for EV possession. |

| Canada Life Insurance coverage Firm | Complete protection for {the electrical} elements and particular wants related to electrical automobiles. | Secure driving report, bundled insurance coverage merchandise, and doubtlessly reductions for environmentally pleasant decisions. |

Claims and Disputes Concerning EV Insurance coverage

Navigating the world of electrical car (EV) insurance coverage claims can typically really feel like a distinct language. Understanding the procedures, potential pitfalls, and determination methods is essential to a clean expertise. Ontario’s insurance coverage panorama, whereas aiming for equity, can current complexities particular to EVs. This part particulars these nuances.Submitting a declare for harm to your EV, whether or not from an accident or one other occasion, requires cautious consideration to element.

Understanding the particular steps concerned may also help forestall delays or problems. Potential disputes, arising from disagreements on protection, duty, or restore prices, will be successfully addressed by following a structured strategy.

Declare Submitting Procedures in Ontario

Ontario’s EV insurance coverage declare procedures intently mirror these for conventional automobiles. Nonetheless, particular elements associated to EV know-how and distinctive restore necessities ought to be thought-about. Insurance coverage firms typically require complete documentation, together with police stories, witness statements, and detailed harm assessments. Photographing the harm totally is essential for precisely documenting the extent of the harm and serving to insurers perceive the extent of the restore.

Potential Points and Disputes

A number of points can result in disputes through the EV insurance coverage declare course of. Variations in the price of components particular to EVs can typically result in disagreements about restore prices. As an illustration, the price of changing a selected EV battery module can differ considerably from changing a conventional inner combustion engine part. Additional, establishing legal responsibility in an accident involving an EV can current distinctive challenges.

The presence of superior driver-assistance methods (ADAS) and the interpretation of their operate in an accident state of affairs might have clarification.

Resolving Disputes Effectively

Efficient dispute decision usually begins with a radical assessment of the insurance coverage coverage. Familiarize your self with the coverage’s provisions concerning EV-specific protection. For those who really feel the insurance coverage firm’s evaluation or provide is insufficient, contemplate consulting with a authorized skilled specializing in insurance coverage claims. Mediation, a much less formal strategy, will be explored to facilitate a compromise between the events concerned.

Position of Third-Get together Arbitration

Third-party arbitration can present a impartial and structured platform for resolving advanced disputes. An impartial arbitrator can consider the proof and assist the insurer and the insured attain a mutually agreeable settlement. This course of usually streamlines the declare decision course of and helps forestall protracted authorized battles. Nonetheless, the price of arbitration should be thought-about.

Typical EV Insurance coverage Declare Course of

| Stage | Description |

|---|---|

| Incident Happens | An accident or harm to the EV happens. |

| Preliminary Reporting | Contact your insurance coverage firm and supply particulars of the incident, together with location, time, and witnesses. |

| Evaluation of Harm | The insurance coverage firm assesses the harm and identifies the required repairs. |

| Price Estimation | The insurer offers an estimate for restore prices. |

| Restore Authorisation | If the declare is accredited, the insurer authorizes the required repairs at a restore store. |

| Fee Course of | The insurer pays the restore store for the accredited work, or offers the insured with the required funds to conduct repairs independently. |

| Declare Closure | As soon as repairs are full, the insurer closes the declare. |

Future Developments in EV Insurance coverage

The panorama of electrical car (EV) insurance coverage is quickly evolving, pushed by technological developments, altering driving habits, and the distinctive traits of EVs. This dynamic surroundings necessitates a forward-thinking strategy to understanding future traits, making certain each customers and insurers are ready for the approaching modifications.The way forward for EV insurance coverage can be formed by a number of key components, together with the growing adoption of EVs, the evolution of charging infrastructure, and the combination of superior driver-assistance methods (ADAS).

Insurance coverage suppliers might want to adapt their insurance policies and pricing fashions to mirror these evolving realities.

Anticipated Adjustments in EV Insurance coverage, Automotive insurance coverage for evs ontario

Insurance coverage firms are prone to see a lower in claims associated to mechanical breakdowns, as EV know-how matures and producers enhance battery efficiency and part reliability. Nonetheless, claims associated to accidents and harm to charging infrastructure might enhance. This evolution in claims traits necessitates a cautious evaluation of danger components and an adjustment to premiums and protection choices.

Rising Developments in EV Insurance coverage Protection and Pricing

A number of rising traits are impacting EV insurance coverage protection and pricing. One notable development is the rising significance of complete protection choices that handle the distinctive wants of EV house owners. Moreover, the growing availability of aftermarket components and providers for EVs is resulting in extra complete protection choices. These components are anticipated to drive a extra personalised and adaptable strategy to EV insurance coverage insurance policies.

This personalization is essential to handle the altering wants of the evolving EV market.

Influence of New Applied sciences on EV Insurance coverage

Autonomous driving options and superior driver-assistance methods (ADAS) are quickly evolving. The mixing of those applied sciences into EVs introduces new complexities into insurance coverage fashions. Insurance coverage suppliers should rigorously assess the impression of those applied sciences on danger evaluation and modify their insurance policies accordingly. The introduction of self-driving capabilities and their affect on accident eventualities, legal responsibility, and the need for particular protection are key concerns.

Potential for Insurance coverage Suppliers to Adapt to Future Developments

Insurance coverage suppliers should proactively adapt to the altering panorama of EV insurance coverage. This adaptation requires steady monitoring of rising applied sciences, together with charging infrastructure, battery know-how, and ADAS. Information evaluation and the incorporation of latest danger evaluation fashions are essential to make sure premiums precisely mirror the evolving dangers related to EVs. This proactive strategy permits insurers to supply acceptable and aggressive protection choices for the evolving EV market.

Evolution of EV Insurance coverage Insurance policies Over Time

The preliminary EV insurance coverage insurance policies have been usually much like these for conventional gasoline-powered automobiles, with changes for potential distinctive dangers. As EV know-how matured, and client demand grew, insurers started to supply extra specialised protection choices, specializing in battery-related incidents and charging infrastructure harm. The evolution of insurance policies demonstrates a dedication to adapting to the rising adoption of EVs, providing complete protection tailor-made to their particular wants.

Illustrative Examples of EV Insurance coverage Situations

Navigating the world of electrical car (EV) insurance coverage can really feel a bit like charting a brand new territory. Understanding the nuances of protection, premium calculations, and potential claims is essential for EV house owners in Ontario. This part delves into sensible eventualities as an example key elements of EV insurance coverage, offering helpful insights into how these components play out in real-world conditions.

Complete Protection for an EV

Complete protection is especially essential for EVs, given their distinctive vulnerabilities. A state of affairs the place complete protection is important includes a parked EV that sustains harm from a falling tree department throughout a extreme storm. Whereas the harm might sound purely unintentional, with out complete protection, the proprietor would bear the total value of repairs. That is completely different from a conventional car, the place the incident may fall underneath collision protection, doubtlessly with a deductible.

Driver Historical past and EV Insurance coverage Premiums

A driver with a historical past of accidents or violations will doubtless see greater EV insurance coverage premiums. Think about a state of affairs the place a driver with a current rushing ticket and an at-fault accident throughout the previous two years is seeking to insure a brand new EV. Their premium is predicted to be considerably greater in comparison with a driver with a clear driving report.

Insurance coverage firms analyze driving historical past to evaluate danger and modify premiums accordingly. Historic information performs a significant position on this evaluation.

Dispute Over an EV Insurance coverage Declare

Disputes over EV insurance coverage claims can come up attributable to differing interpretations of coverage phrases or harm assessments. Think about a state of affairs the place a buyer claims harm to their EV’s battery pack attributable to a defective charging station. The insurance coverage firm disputes the declare, arguing the harm stemmed from improper charging procedures. This case highlights the significance of clear coverage language and a radical investigation of the declare.

Documentation, witness statements, and knowledgeable opinions are essential to resolve such disputes.

Price Comparability: Conventional vs. EV Insurance coverage

Evaluating the price of insuring a conventional car to an EV is essential. A hypothetical instance exhibits a 25-year-old with a clear driving report insuring a compact sedan and a comparable EV. The EV’s insurance coverage premium is likely to be barely greater because of the battery’s worth and potential for specialised repairs. Nonetheless, the full value of possession, together with gas financial savings and diminished upkeep prices, might offset the distinction.

The insurance coverage firm components within the car’s worth, the motive force’s profile, and the potential for distinctive harm.

Particular EV Characteristic Impacting Insurance coverage Premium

Sure EV options can affect insurance coverage premiums. A state of affairs involving an EV with superior driver-assistance methods (ADAS) illustrates this level. ADASTechnology might result in a barely decrease premium due to diminished accident danger. Nonetheless, if the car has a complicated self-driving function, the price of repairs is likely to be considerably greater, doubtlessly impacting the general insurance coverage premium. This demonstrates the multifaceted components affecting insurance coverage premiums.

Concluding Remarks

In conclusion, securing automobile insurance coverage for EVs in Ontario requires a nuanced understanding of the particular components influencing premiums and protection choices. Navigating the complexities of this evolving market necessitates cautious consideration of vehicle-specific options, driver historical past, and placement. This information has offered a framework for knowledgeable decision-making, empowering you to make your best option in your electrical car insurance coverage wants.

FAQ Part

What are the widespread misconceptions about EV insurance coverage in Ontario?

A standard false impression is that EV insurance coverage is considerably dearer than conventional car insurance coverage. Whereas some components may contribute to greater premiums, this is not all the time the case. One other false impression is that complete protection is not as essential for EVs. Nonetheless, battery harm and different potential dangers necessitate complete protection for full safety.

How do charging stations have an effect on EV insurance coverage premiums?

Using electrical car charging stations, significantly public ones, may barely affect insurance coverage premiums relying on the particular location and supplier insurance policies. Elements like potential theft or vandalism at charging stations is likely to be thought-about.

What are the everyday steps in submitting an EV insurance coverage declare in Ontario?

The declare course of for EV insurance coverage incidents sometimes includes reporting the incident, offering documentation (police stories, witness statements, and many others.), and cooperating with the insurance coverage supplier all through the evaluation and restore course of. This often contains evaluations of the harm to the car and the battery pack, if relevant.