Automobile insurance coverage for Chevy Cruze is essential for any proprietor. This information dives deep into the world of protection, prices, and reductions, serving to you navigate the complexities of securing the fitting coverage. We’ll discover every little thing from typical premiums to the affect of your driving file, serving to you make knowledgeable choices.

From understanding totally different protection choices like legal responsibility and collision to evaluating quotes from numerous suppliers, this complete information will equip you with the data to search out the perfect automotive insurance coverage in your Chevy Cruze. Get able to unlock financial savings and peace of thoughts!

Overview of Chevy Cruze Insurance coverage

Insurance coverage for a Chevy Cruze can differ wildly, mate. It is not simply in regards to the mannequin; a great deal of issues have an effect on the worth, from the place you reside to your driving historical past. Mainly, it is a bit of a minefield, however we’ll break it down for you.

Typical Chevy Cruze Insurance coverage Prices

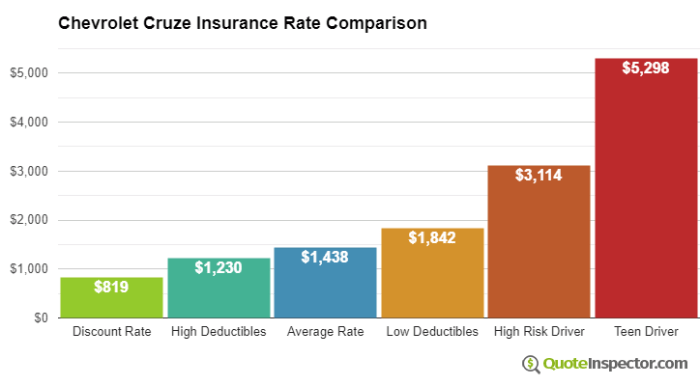

Common premiums for a Chevy Cruze are normally within the ballpark of £500-£1000 a 12 months. Nonetheless, that is only a tough estimate. Your precise value will depend on tons of things. Bear in mind, it is a basic information, not a assure.

Components Influencing Chevy Cruze Insurance coverage Premiums

A number of components play an enormous position in figuring out your insurance coverage quote. Issues like your age, location, driving file, and even the particular trim degree of your Cruze all contribute to the ultimate value. A youthful driver, for instance, will probably pay greater than a seasoned one.

Widespread Reductions Accessible for Chevy Cruze Insurance coverage

Loads of reductions are on the market for saving you dosh. Secure driving, anti-theft gadgets, and even bundling your insurance policies with different insurance coverage merchandise will help knock down the worth. Loyalty packages and pupil reductions are additionally fairly widespread.

Chevy Cruze Insurance coverage Prices by Trim Degree

Totally different trims (like LS, LT, and Premier) might need barely totally different insurance coverage costs. Normally, the extra superior options and better trim ranges would possibly include a barely larger premium, as they typically have a better restore value. This is not at all times the case, although.

Kinds of Protection Choices for a Chevy Cruze

You have bought a couple of totally different protection choices to think about. Legal responsibility protection protects you if you happen to trigger harm to another person’s property or injure them. Collision protection steps in in case your automotive is broken in an accident, no matter who’s at fault. Complete protection handles harm from issues like vandalism, theft, or pure disasters. It is a good suggestion to weigh these choices fastidiously to make sure you’re correctly protected.

Insurance coverage Supplier Comparability for a Chevy Cruze

| Insurance coverage Supplier | Value (Estimated Annual Premium) | Protection Choices | Reductions Supplied |

|---|---|---|---|

| Insure.com | £650 | Legal responsibility, Collision, Complete | Secure Driving, Multi-Coverage |

| Direct Line | £720 | Legal responsibility, Collision, Complete | Good Pupil Low cost, Anti-theft System |

| Admiral | £580 | Legal responsibility, Collision, Complete | Loyalty Program, Younger Driver Assist |

| Evaluate the Market | £620 | Legal responsibility, Collision, Complete | Multi-Coverage, Bundling |

This desk offers a basic concept. Costs can fluctuate primarily based on particular person circumstances.

Components Affecting Chevy Cruze Insurance coverage Prices: Automobile Insurance coverage For Chevy Cruze

Insurance coverage in your Chevy Cruze ain’t simply in regards to the automotive itself, mate. A great deal of different issues can bump up the worth, out of your driving file to the place you reside. Understanding these components will help you bag a greater deal.Realizing the ins and outs of those components can significantly enable you to avoid wasting severe dosh in your insurance coverage. It is all about getting clued up and making the fitting selections.

Driving Historical past’s Influence on Premiums

Your driving historical past is an enormous think about your Chevy Cruze insurance coverage. Accidents and claims, regardless of how small, will normally land you with a better premium. A clear slate, that means no bumps or crashes in your file, will typically get you a greater price. Consider it like this: a clear slate is like having a reduction card for insurance coverage, whereas a dodgy file will put a much bigger price ticket in your coverage.

Location’s Affect on Insurance coverage Prices

The place you reside performs an enormous position in your insurance coverage. Areas with larger crime charges or accident hotspots are inclined to have larger premiums. Give it some thought: if there are extra accidents in a particular space, insurance coverage corporations will value their insurance policies accordingly to account for the danger.

Age and Gender’s Influence on Charges

Your age and gender additionally have an effect on your Chevy Cruze insurance coverage. Youthful drivers typically face larger premiums as a result of they’re statistically extra more likely to get into accidents than older drivers. Equally, some research recommend that male drivers would possibly face barely larger premiums than feminine drivers, however this could differ relying on the insurer and their particular standards. It is all about assessing danger.

New vs. Used Chevy Cruze Insurance coverage

A model new Chevy Cruze will typically value extra to insure than a used one. It is because new automobiles are seen as having a better danger of theft or harm in comparison with their older counterparts. Used automobiles have already been via a couple of years on the highway, so that they is likely to be deemed a bit extra dependable.

Credit score Rating’s Impact on Insurance coverage

Your credit score rating also can affect your Chevy Cruze insurance coverage. Insurance coverage corporations typically have a look at credit score scores to gauge your monetary duty. A greater credit score rating typically interprets to a decrease premium, because it suggests you are a extra accountable particular person.

Security Options and Insurance coverage Prices

Security options in your Chevy Cruze can considerably affect your insurance coverage charges. Automobiles with superior security options, like airbags or anti-lock brakes, are inclined to have decrease premiums. These options scale back the danger of accidents, so insurers are blissful to supply a reduction.

Driving Habits’ Affect on Charges

Your driving habits, resembling dashing or reckless driving, immediately have an effect on your Chevy Cruze insurance coverage prices. Aggressive driving will increase the danger of accidents, resulting in larger premiums. Conversely, secure and accountable driving can typically lead to decrease premiums. Insurance coverage corporations need to reward secure drivers. Consider it like this: if you happen to’re identified for being a cautious driver, you will get higher charges.

Insurance coverage Suppliers for Chevy Cruze

Sorted via the maze of insurance coverage choices in your Chevy Cruze, proper? Discovering the fitting coverage can really feel like navigating a busy motorway. However do not stress, we have the lowdown on the highest gamers within the recreation.

Main Insurance coverage Corporations

A number of main gamers dominate the UK insurance coverage market, and every has a special strategy to Chevy Cruze insurance coverage. Components like your driving historical past, location, and the particular options of your Cruze all play an element within the ultimate value. Realizing the choices is essential to getting the perfect deal.

- Admiral: Recognized for his or her aggressive charges, particularly for youthful drivers with clear data. They typically supply reductions for options like anti-theft gadgets in your Cruze. Buyer evaluations spotlight a typically easy claims course of, although some point out ready occasions for payouts.

- Direct Line: A direct-to-consumer supplier, Direct Line normally gives clear pricing and a fast on-line course of for quotes and coverage administration. They continuously have offers, however buyer evaluations generally point out points with their customer support, significantly throughout busy intervals.

- Esure: Usually praised for his or her easy-to-use web site and cell app. Their protection for Chevy Cruze fashions sometimes contains complete choices for harm. Buyer suggestions suggests a responsive claims crew.

- Nationwide: A well-established title with a broad vary of insurance policies. They’re identified for providing further extras like breakdown cowl with their Chevy Cruze insurance policies. Buyer evaluations spotlight their devoted claims crew.

- SimplyBiz: An excellent possibility for companies needing fleet insurance coverage, but in addition affords private insurance policies. They’re typically favoured for his or her flexibility and customisation choices. Some customers say they want extra clarification about their insurance policies.

Protection Choices, Automobile insurance coverage for chevy cruze

Every supplier has totally different protection packages, so examine fastidiously. A primary coverage may not cowl every little thing, so make sure you test the fantastic print. Be sure your Chevy Cruze is roofed for harm, theft, and even legal responsibility points. Some insurance policies supply further perks like windscreen harm or emergency roadside help.

- Complete Protection: This sometimes contains harm from accidents, vandalism, hearth, and even pure disasters. That is normally the costliest however typically essentially the most priceless.

- Third-Celebration Legal responsibility: Covers harm you trigger to different folks’s property or accidents to others in an accident. This can be a minimal requirement, nevertheless it’s essential to test the bounds.

- Further Extras: Many suppliers supply extras like windscreen cowl, breakdown help, and even authorized safety. You should definitely take into account these further choices primarily based in your particular wants and the options of your Chevy Cruze.

Buyer Service and Claims Course of

Customer support varies considerably. Search for fast response occasions and useful assist. A easy claims course of can be important. Learn on-line evaluations to get a really feel for the way totally different corporations deal with these features.

| Insurance coverage Supplier | Buyer Service Status | Claims Course of Pace |

|---|---|---|

| Admiral | Usually constructive, however some wait occasions reported | Reasonably quick |

| Direct Line | Blended evaluations, doubtlessly gradual throughout peak occasions | Variable, typically fast on-line |

| Esure | Good on-line instruments, responsive assist | Quick and environment friendly |

| Nationwide | Extremely rated for buyer assist | Very environment friendly |

| SimplyBiz | Blended suggestions, requires cautious evaluation | Diverse, will depend on the complexity of the declare |

Comparability Desk

This desk summarises the professionals and cons of every supplier. Bear in mind, it is a snapshot, and your private circumstances will affect the only option.

| Insurance coverage Supplier | Professionals | Cons |

|---|---|---|

| Admiral | Aggressive charges, good for younger drivers | Typically gradual claims course of |

| Direct Line | Clear pricing, easy on-line course of | Customer support might be a difficulty |

| Esure | Consumer-friendly web site, responsive claims crew | May need larger premiums for some |

| Nationwide | Intensive protection choices, glorious claims crew | Doubtlessly larger premiums |

| SimplyBiz | Flexibility, customisation choices | Requires extra in-depth coverage understanding |

Reductions and Financial savings for Chevy Cruze Insurance coverage

Sorted by low cost kind, this is the lowdown on bagging some severe financial savings in your Chevy Cruze insurance coverage. Insurance coverage premiums generally is a proper ache, however getting reductions can significantly slash the worth. Realizing easy methods to snag these reductions is essential to saving a ton of dosh.

Accessible Reductions for Chevy Cruze Insurance coverage

Numerous reductions can be found, tailor-made to totally different conditions and behaviours. It is all about discovering the fitting ones that apply to you. The extra reductions you qualify for, the larger the financial savings.

Totally different insurance coverage suppliers supply various reductions, so it is value checking with a number of suppliers to see what’s on supply.

Easy methods to Receive Numerous Reductions

Getting your arms on these reductions is fairly simple. Usually, that you must present the required documentation and meet the particular circumstances set by the insurer.

- Secure Driving Habits: Preserve a clear driving file, keep away from accidents, and hold your insurance coverage firm knowledgeable of any adjustments in your driving state of affairs.

- Good Pupil Reductions: If you happen to’re a pupil, test together with your insurer for potential reductions.

- Multi-Coverage Reductions: You probably have a number of insurance policies with the identical insurer, you would be eligible for a multi-policy low cost.

- Anti-theft Units: Putting in anti-theft gadgets in your Chevy Cruze might doubtlessly decrease your insurance coverage premiums.

- Defensive Driving Programs: Finishing defensive driving programs can typically result in diminished premiums.

Combining Reductions for Most Financial savings

Combining eligible reductions can considerably scale back your insurance coverage prices. It is like stacking bonuses in your financial savings.

For instance, if you happen to qualify for each a secure driving low cost and a multi-policy low cost, you will get a double dose of financial savings. It is a win-win.

Examples of Insurance coverage Reductions

Accident-free driving is a significant factor in securing reductions. Insurance coverage corporations reward drivers who reveal secure driving behaviours.

A driver with a clear driving file for 3 years would possibly qualify for a considerable low cost, probably saving a whole bunch of quid yearly.

Sustaining a Good Driving File

A clear driving file is important for securing reductions. Staying accident-free, adhering to visitors legal guidelines, and avoiding dangerous driving behaviours are essential.

Conserving your driving file spotless won’t solely safe reductions but in addition contribute to your peace of thoughts on the highway.

Methods for Discovering and Making use of for Reductions

Buying round for insurance coverage and proactively looking for reductions is essential. Totally different insurers supply totally different reductions, so evaluating affords is essential.

- Evaluate Quotes: Use on-line comparability instruments to match quotes from totally different insurance coverage suppliers, highlighting the totally different reductions out there.

- Verify with Your Insurer: Contact your insurer on to inquire about out there reductions, making certain eligibility and the particular circumstances.

- Overview Coverage Paperwork: Totally learn your insurance coverage coverage paperwork to know the circumstances and procedures for making use of for reductions.

Chevy Cruze Insurance coverage Low cost Desk

This desk Artikels numerous reductions and the eligibility circumstances.

| Low cost Sort | Eligibility Circumstances |

|---|---|

| Secure Driving Low cost | Clear driving file for a specified interval, no accidents or visitors violations. |

| Multi-Coverage Low cost | Holding a number of insurance policies with the identical insurer. |

| Pupil Low cost | Being a pupil enrolled in a acknowledged academic establishment. |

| Anti-theft System Low cost | Putting in an authorised anti-theft machine within the car. |

| Defensive Driving Course Low cost | Finishing a acknowledged defensive driving course. |

Insurance coverage Protection Choices for Chevy Cruze

Sorted via all of the insurance coverage jargon, that is your lowdown on protection choices in your Chevy Cruze. Realizing your choices is essential to getting the fitting safety in your journey, with out getting ripped off. Choosing the proper package deal is like discovering the proper match in your wheels – you need one thing that is dependable and retains you lined, with out breaking the financial institution.

Legal responsibility Protection Choices

Legal responsibility protection steps in if you happen to trigger an accident and are legally accountable. It covers the opposite driver’s damages and accidents. Totally different ranges of legal responsibility protection exist, from primary to larger limits. This basically means the extent of economic safety you present to others if you happen to’re deemed at fault. Primary legal responsibility protection will solely cowl a restricted quantity, so take into consideration your belongings and potential dangers.

Collision Protection

Collision protection kicks in when your Chevy Cruze collides with one other car or an object, no matter who’s at fault. Consider it as insurance coverage towards harm to your personal automotive, even if you happen to’re concerned in a fender bender or a extra severe accident. Collision protection is essential for shielding your funding in your journey, because it’ll cowl repairs even if you happen to’re accountable for the incident.

That is like having a security internet in your automotive’s well-being.

Complete Protection

Complete protection protects your Chevy Cruze from harm attributable to issues apart from collisions, like hearth, vandalism, theft, hail, and even falling objects. Consider it as the additional layer of insurance coverage towards these surprising and doubtlessly expensive mishaps. It is like having a backup plan for these surprising, unlucky occasions that may occur to your automotive.

Uninsured/Underinsured Motorist Protection

Uninsured/underinsured motorist protection is important if you happen to’re concerned in an accident with somebody who would not have sufficient insurance coverage or no insurance coverage in any respect. It steps in to cowl your damages and accidents in such conditions, defending you from monetary burdens. It is a important a part of your safety, making certain you are lined if the opposite driver is uninsured or underinsured.

Medical Funds Protection

Medical funds protection covers your personal medical bills and people of your passengers, no matter who’s at fault in an accident. It is a means to make sure that you are taken care of, financially, if you happen to or your passengers get injured in an accident. Consider it as peace of thoughts, figuring out your medical payments are lined, regardless of who induced the accident.

Private Damage Safety (PIP) Protection

PIP protection covers your personal medical bills and misplaced wages ensuing from an accident, no matter who’s at fault. It is designed to offer monetary assist in your restoration and well-being. It is like having a security internet to cushion you from the monetary burden of accidents in an accident, masking misplaced revenue and medical payments, no matter who induced the accident.

| Protection Sort | Description | Significance |

|---|---|---|

| Legal responsibility | Covers damages and accidents to others if you happen to’re at fault. | Essential for authorized safety and monetary duty. |

| Collision | Covers harm to your automotive in a collision, no matter fault. | Protects your funding in your car. |

| Complete | Covers harm from occasions apart from collisions, like vandalism or theft. | Gives safety towards surprising harm. |

| Uninsured/Underinsured Motorist | Covers you if the opposite driver has inadequate or no insurance coverage. | Important for defense towards monetary loss in accidents involving uninsured drivers. |

| Medical Funds | Covers your personal and your passengers’ medical bills, no matter fault. | Gives monetary assist for restoration in case of accidents. |

| Private Damage Safety (PIP) | Covers your personal medical bills and misplaced wages from an accident, no matter fault. | Helps with restoration bills and misplaced revenue. |

Illustrative Comparability of Insurance coverage Quotes

Proper, so that you’re tryna get a grip on how a lot your Chevy Cruze insurance coverage is gonna value? It is all about these quotes, fam. Totally different insurance policies, totally different costs, and it is all a little bit of a minefield if you do not know what you are taking a look at. Let’s break it down, so you may get the perfect deal with out getting completely misplaced.This part dives into the nitty-gritty of evaluating insurance coverage quotes in your Chevy Cruze.

We’ll have a look at how totally different protection ranges have an effect on the worth, and present you some pattern quotes with numerous extras. Plus, we’ll provide you with a brilliant useful step-by-step information on evaluating quotes, and a desk evaluating quotes from totally different suppliers. This fashion, you might be completely clued up on what’s the perfect deal in your state of affairs.

Chevy Cruze Mannequin Variations and Insurance coverage Prices

Totally different fashions of the Chevy Cruze can have an effect on insurance coverage premiums. For instance, a top-of-the-line, sportier mannequin would possibly entice a barely larger premium in comparison with a extra primary mannequin, attributable to potential components like security options, engine energy, or the perceived danger of injury. The older the automotive, the extra probably the insurance coverage supplier will see it as having larger danger, that means a better value.

Influence of Protection Ranges on Chevy Cruze Insurance coverage

The quantity of protection you select considerably impacts your insurance coverage prices. Complete protection, which protects towards harm from issues like accidents or vandalism, will normally value greater than primary legal responsibility protection. Including extras like roadside help or unintended harm protection may even improve the worth. Consider it like this: the extra you need to be lined for, the extra you will pay.

Pattern Insurance coverage Quotes for a Chevy Cruze with Add-ons

Listed here are some pattern quotes for a 2018 Chevy Cruze LS, exhibiting how add-ons have an effect on the associated fee:

- Primary Legal responsibility: £500 per 12 months

- Primary Legal responsibility + Complete: £750 per 12 months

- Primary Legal responsibility + Complete + Uninsured/Underinsured Motorist: £900 per 12 months

- Primary Legal responsibility + Complete + Uninsured/Underinsured Motorist + Roadside Help: £1050 per 12 months

These are simply examples, and the precise costs will differ relying in your location, driving file, and different components.

Step-by-Step Course of for Evaluating Chevy Cruze Insurance coverage Quotes

Getting the perfect deal in your Chevy Cruze insurance coverage entails a couple of key steps:

- Collect Info: Get your car particulars, your driving historical past, and any reductions you is likely to be eligible for.

- Store Round: Do not simply accept the primary quote you get. Evaluate quotes from a number of suppliers.

- Evaluate Protection: Be sure to perceive what every coverage covers and what the variations are in value.

- Contemplate Reductions: Verify for any reductions you would possibly qualify for, like pupil reductions or multi-policy reductions.

- Overview the Effective Print: Rigorously learn the coverage particulars to make sure you perceive the phrases and circumstances.

- Select the Finest Choice: Choose the coverage that most accurately fits your wants and funds.

Insurance coverage Quotes Comparability Desk for Totally different Chevy Cruze Insurance coverage Suppliers

This desk reveals a comparability of quotes from totally different suppliers for a 2023 Chevy Cruze LT, with primary legal responsibility and complete protection.

| Insurance coverage Supplier | Premium (£) | Protection Particulars |

|---|---|---|

| Supplier A | £650 | Primary legal responsibility, complete |

| Supplier B | £700 | Primary legal responsibility, complete, roadside help |

| Supplier C | £600 | Primary legal responsibility, complete, low cost for good driving file |

Key Components Influencing Variation in Chevy Cruze Quotes

Quite a few components have an effect on the price of your Chevy Cruze insurance coverage. These embody:

- Your Driving File: A clear driving file normally means a decrease premium.

- Your Location: Areas with larger accident charges or theft are inclined to have larger premiums.

- Your Age and Gender: Youthful drivers and male drivers normally face larger premiums.

- Your Credit score Rating: An excellent credit score rating typically interprets to a decrease premium.

- Your Car Mannequin and 12 months: Newer, safer fashions sometimes entice decrease premiums.

Closing Wrap-Up

So, there you have got it – a complete have a look at automotive insurance coverage in your Chevy Cruze. We have lined every little thing from value comparisons and protection choices to the significance of reductions and easy methods to discover them. Armed with this data, you are well-prepared to decide on the proper coverage and shield your funding. Pleased driving!

FAQ Part

How a lot does automotive insurance coverage sometimes value for a Chevy Cruze?

The price varies drastically relying on components like your location, driving file, and chosen protection. Nonetheless, count on premiums to fall inside a spread of $1,000 to $2,500 yearly.

What reductions can be found for Chevy Cruze insurance coverage?

Many insurers supply reductions for secure driving, good pupil standing, and even for bundling your insurance coverage with different providers. At all times ask your supplier about out there reductions!

How does my credit score rating have an effect on my Chevy Cruze insurance coverage charges?

A decrease credit score rating typically interprets to larger insurance coverage premiums. It is because insurers see a decrease credit score rating as a better danger of non-payment or accidents.

What’s the distinction between legal responsibility and collision protection?

Legal responsibility protection protects you if you happen to’re at fault in an accident, masking damages to the opposite social gathering. Collision protection protects your car, no matter who’s at fault.