Can they repo your automobile for not having insurance coverage? Yeah, it is a severe difficulty, particularly should you’re making an attempt to maintain your journey. This ain’t some random avenue battle, it is concerning the authorized aspect of issues, and the way lenders can seize your wheels if you do not have insurance coverage. Totally different states have completely different guidelines, and it is all tied to your automobile mortgage settlement.

So, what are your rights, and what are you able to do should you’re dealing with repo? Let’s dive in, cuz this ain’t no joke.

Insurance coverage is vital to maintaining your automobile. It is a essential a part of any automobile mortgage settlement, and lenders typically embrace clauses about sustaining insurance coverage. When you fall behind on funds or fail to maintain insurance coverage, they may repossess your automobile. This Artikel breaks down the authorized aspect of repossessions, your rights, and the steps you possibly can take to keep away from shedding your journey.

Understanding the Legality of Repossession

Navigating the complexities of auto repossession for non-payment, notably regarding insurance coverage lapses, requires a deep understanding of authorized frameworks. State legal guidelines range considerably, and the specifics of a automobile mortgage settlement play an important function in figuring out the lender’s rights and the borrower’s duties. This exploration will delve into the authorized grounds for repossession, contemplating state variations, contractual clauses, and the lender’s function within the course of.An important facet of understanding repossession is recognizing the authorized foundation for the motion.

Usually, a lender can repossess a automobile if the borrower defaults on their mortgage settlement, together with failure to keep up required insurance coverage protection. This proper stems from the phrases Artikeld within the mortgage settlement, typically supported by state legal guidelines that grant particular recourse to lenders in such conditions. The precise authorized pathways range significantly throughout states.

Authorized Grounds for Repossession

Lenders sometimes have the authorized proper to repossess a automobile if the borrower fails to keep up the required insurance coverage protection, as stipulated within the mortgage settlement. This proper is continuously enshrined in state legal guidelines, offering authorized backing to the repossession process. These legal guidelines typically specify the situations underneath which a automobile could be repossessed and the steps that lenders should comply with.

State-Particular Legal guidelines on Automobile Repossession

State legal guidelines considerably affect the method of auto repossession for lack of insurance coverage. Some states have stricter laws than others relating to the notification necessities, the timing of repossession, and the procedures for addressing the borrower’s issues.

- Totally different states have various timelines for notifying the borrower of the intent to repossess the automobile.

- Some states might require particular documentation, like proof of insurance coverage lapses, earlier than repossession can happen.

- Different states might require a courtroom order earlier than repossession, even in instances of insurance coverage non-compliance.

Variations in state legal guidelines typically have an effect on the repossession course of. These variations spotlight the necessity for a complete understanding of the related state laws.

Insurance coverage Necessities in Automobile Mortgage Agreements

Mortgage agreements continuously Artikel particular insurance coverage necessities for the automobile. These clauses are vital, as they outline the lender’s rights and the borrower’s duties. Failing to satisfy these necessities might result in repossession, as Artikeld within the settlement.

- Insurance coverage protection ranges could also be mandated by the mortgage settlement, with minimal protection necessities specified.

- The settlement might Artikel the implications of failing to keep up the required insurance coverage, together with potential repossession.

- Particular provisions may element the lender’s rights relating to insurance coverage declare proceeds in case of an accident.

Understanding the specifics of insurance coverage necessities throughout the automobile mortgage settlement is paramount to avoiding potential repossession.

Lender’s Position within the Repossession Course of

Lenders have an important function within the repossession course of, notably when insurance coverage is just not maintained. They have to adhere to established authorized procedures and guarantee compliance with state legal guidelines. This entails notifying the borrower of the intent to repossess and offering avenues for addressing any issues.

- Lenders should guarantee they adjust to state legal guidelines relating to discover intervals and strategies of communication.

- The lender wants to keep up information of all communications and steps taken within the repossession course of.

- Documentation of the mortgage settlement and insurance coverage necessities is vital within the occasion of a dispute.

The lender’s adherence to authorized protocols throughout the repossession course of is important for each events.

Voluntary vs. Involuntary Repossession

Voluntary repossession happens when the borrower surrenders the automobile to the lender, whereas involuntary repossession entails the lender taking the automobile with out the borrower’s consent. In instances of uninsured driving, the repossession course of is commonly involuntary, pushed by the phrases of the mortgage settlement and relevant state legal guidelines.

- Voluntary repossession may happen when a borrower anticipates default and seeks to attenuate additional monetary injury.

- Involuntary repossession typically entails a authorized course of, together with notices and potential courtroom intervention.

- Understanding the excellence between voluntary and involuntary repossession is vital for debtors dealing with potential repossession.

The kind of repossession considerably impacts the borrower’s rights and duties.

Notification Procedures for Repossession

Thorough notification procedures are essential to make sure the automobile proprietor is conscious of the lender’s intent to repossess the automobile. These procedures range by state, however they sometimes contain written discover, typically with particular deadlines. Failing to stick to those procedures might invalidate the repossession course of.

- Written notification is commonly a authorized requirement, detailing the explanations for repossession and the timeframe for motion.

- The discover have to be clear, concise, and simply comprehensible by the automobile proprietor.

- Particular deadlines for responding to the discover are sometimes stipulated, providing the automobile proprietor a chance to handle the scenario.

Correct notification is a key part of a legally sound repossession course of.

Rights of the Automobile Proprietor

Dealing with the potential repossession of your automobile as a result of unpaid insurance coverage is a demanding scenario. Understanding your rights and accessible choices is essential. Understanding these steps will help you navigate this course of successfully and probably keep away from shedding your automobile.Automobile homeowners have particular authorized protections when dealing with repossession for non-payment of insurance coverage. These rights are designed to make sure equity and due course of, permitting you to grasp the process and defend your pursuits.

Moreover, understanding these rights empowers you to make knowledgeable selections to guard your automobile.

Accessible Authorized Protections

Authorized protections for automobile homeowners dealing with repossession range relying on the precise jurisdiction and the phrases of your mortgage settlement. Nonetheless, typically, automobile homeowners have the appropriate to learn of the repossession course of and the explanations behind it. They’re additionally typically entitled to a listening to to contest the repossession, ought to they consider it’s unjustified or unfair.

Steps to Keep away from Repossession

Taking proactive steps can typically forestall repossession. Promptly addressing the insurance coverage lapse is vital.

- Contact your insurance coverage supplier instantly to reinstate protection. Clarify the scenario and request expedited reinstatement. A fast reinstatement can forestall repossession if the lender has not already initiated the method. This typically entails fee of any excellent premiums and related charges.

- Contact your lender as quickly as you understand the insurance coverage lapse. Clarify your scenario and inquire about potential fee preparations or extensions. Open communication with the lender can typically result in options that keep away from repossession.

- Discover various financing choices in case your insurance coverage lapse is because of monetary hardship. If potential, discover different financing choices, akin to short-term loans or strains of credit score. These choices will help you get again on monitor financially, and this will forestall your automobile from being repossessed.

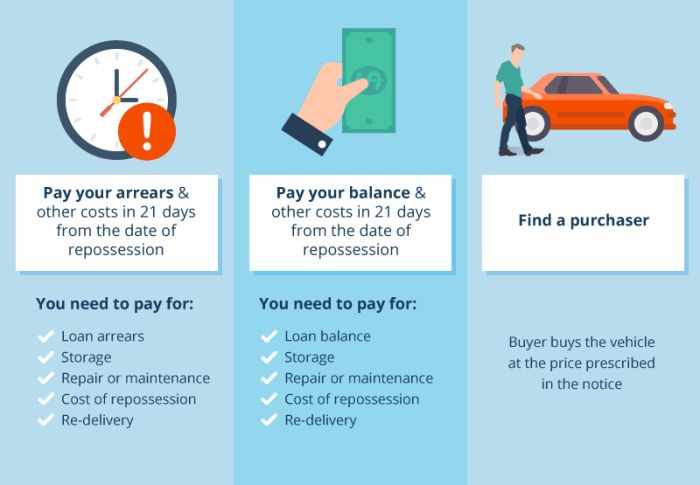

Choices if Repossession is Initiated

If repossession proceedings have already begun, a number of choices can be found to the automobile proprietor.

- Negotiate with the lender to succeed in a mutually agreeable answer. This may contain negotiating a fee plan that accommodates your present monetary scenario, thus avoiding repossession.

- Search authorized counsel. A lawyer can present steerage in your rights and choices underneath the regulation. That is essential to grasp your authorized standing within the repossession course of.

- Contest the repossession should you consider it’s unjustified. This typically entails presenting proof to assist your declare. You have got the appropriate to contest the repossession, if it is unwarranted.

Authorized Recourse

Understanding your authorized choices is significant. This may embrace submitting a lawsuit to problem the repossession, or looking for authorized support to grasp your rights and cures underneath state regulation.

- File a lawsuit to problem the repossession. This generally is a complicated course of, however it’s an possibility for many who consider the repossession is illegal. Documentation of the scenario and related legal guidelines is important in a lawsuit.

- Search authorized support. Authorized support organizations can present steerage and assist for many who can not afford authorized illustration. It is a vital useful resource for automobile homeowners dealing with repossession.

Reinstating Insurance coverage Protection

Reinstatement of insurance coverage protection is essential. Immediate reinstatement can typically forestall repossession.

- Contact your insurance coverage supplier instantly. Speaking together with your insurance coverage firm about reinstatement will make sure the automobile stays coated.

- Guarantee all excellent premiums and costs are paid promptly. Be certain that any excellent premiums and costs are addressed instantly. This could forestall delays in reinstating the protection.

Negotiating with the Lender

Negotiation is commonly a viable strategy to keep away from repossession.

- Clearly articulate your monetary scenario. Clarify your monetary constraints and suggest a fee plan. A transparent and concise presentation of your scenario to the lender will enable them to evaluate your scenario pretty.

- Provide a fee plan tailor-made to your monetary capability. Counsel a fee plan that works for you, and be ready to justify the plan. An in depth fee plan is important for negotiating.

- Be ready to compromise. Be open to compromises that will forestall repossession. Be ready to compromise to discover a answer.

Documentation and Procedures

Navigating the repossession course of, particularly when it entails the essential aspect of lack of insurance coverage, requires meticulous consideration to element and adherence to authorized procedures. Understanding the documentation wanted and the precise steps concerned can considerably ease the stress and uncertainty surrounding this vital scenario. A transparent comprehension of the required paperwork, the repossession course of itself, and the steps following repossession are important for each the lender and the borrower.The next sections element the essential documentation and procedures associated to automobile repossession as a result of lack of insurance coverage, highlighting the significance of every step and the potential penalties of non-compliance.

Key Paperwork Required for Repossession, Can they repo your automobile for not having insurance coverage

Thorough documentation is the bedrock of a respectable repossession course of. A complete assortment of paperwork is important to legally justify the repossession motion. This ensures equity and protects the rights of all events concerned.

| Doc Sort | Description | Required Data |

|---|---|---|

| Mortgage Settlement | This doc Artikels the phrases of the mortgage settlement, together with the mortgage quantity, rate of interest, compensation schedule, and different essential particulars. | Mortgage quantity, mortgage quantity, excellent stability, date of settlement, and all phrases and situations associated to default |

| Insurance coverage Coverage | The lender wants proof that the automobile is just not coated by any legitimate insurance coverage coverage. That is a necessary doc confirming the absence of present insurance coverage. | Coverage quantity, policyholder identify (matching the mortgage settlement), coverage expiration date. Affirmation of non-renewal or cancellation is essential. |

| Proof of Non-Cost | Proof that the borrower has not made funds as agreed upon within the mortgage settlement, particularly associated to the non-payment of insurance coverage. | Missed fee notices, fee historical past information, late fee charges, or any related correspondence between the lender and borrower relating to the missed funds. |

Steps Concerned within the Repossession Course of

Following a predetermined set of steps ensures a easy and lawful repossession course of. This structured strategy ensures that the repossession is executed based on the regulation and protects the rights of each events.

| Step | Description | Timeline |

|---|---|---|

| 1 | Discover of Default: The lender offers a proper discover to the borrower informing them of their default on the mortgage settlement and the implications, together with potential repossession. | Sometimes inside an outlined interval after missed funds. Check with the mortgage settlement for particular timelines. |

| 2 | Demand for Remedy: The lender offers an additional alternative for the borrower to rectify the default. This normally entails bringing the mortgage present and guaranteeing correct insurance coverage protection. | Normally follows the discover of default and offers an inexpensive timeframe. |

| 3 | Repossession: If the borrower fails to treatment the default, the lender can authorize an expert repossession company to get well the automobile. | Can range considerably, relying on the state’s legal guidelines and the repossession company’s availability. |

Steps to Comply with After Repossession

After the repossession, the borrower should perceive their rights and obligations. This ensures a transparent path ahead and mitigates any additional problems.

- Contact the lender: The borrower ought to contact the lender to grasp the following steps relating to the repossession, together with the phrases of the repossession settlement, the sale course of, and the borrower’s rights.

- Seek the advice of with an lawyer: It is advisable for the borrower to seek the advice of with an lawyer to debate their authorized rights and choices relating to the repossession course of.

- Evaluate mortgage paperwork: Totally evaluate the mortgage settlement and all related paperwork to make sure a transparent understanding of the phrases and situations, together with the clause on repossession for lack of insurance coverage.

Insurance coverage and Protection

Navigating the complexities of auto insurance coverage can really feel overwhelming. Understanding the varied forms of protection and their particular clauses is essential for each defending your belongings and fulfilling your authorized obligations. This part delves into the specifics of insurance coverage, highlighting its function in safeguarding your automobile and, critically, the lender’s pursuits.

Forms of Insurance coverage Protection

Automobile insurance coverage insurance policies sometimes embody a number of essential coverages. Legal responsibility protection, for example, protects you from monetary duty should you trigger injury to a different individual’s automobile or property. Collision protection, alternatively, pays for damages to your automobile ensuing from an accident, no matter who was at fault. Complete protection extends additional, protecting damages attributable to occasions aside from collisions, akin to vandalism, theft, or weather-related incidents.

Understanding these distinctions is important for choosing the appropriate coverage.

Uninsured/Underinsured Motorist Protection

Uninsured/underinsured motorist protection is a vital part of any complete coverage. This protection protects you if you’re concerned in an accident with a driver who lacks insurance coverage or whose insurance coverage coverage limits are inadequate to cowl your damages. With out this safety, you can be left to shoulder the monetary burden of serious losses. For instance, a driver with out insurance coverage inflicting a $10,000 accident might depart the injured social gathering with substantial monetary legal responsibility.

This protection helps mitigate such dangers.

Significance of Sustaining Insurance coverage Protection

Sustaining sufficient automobile insurance coverage isn’t just a matter of non-public duty; it is a authorized requirement in most jurisdictions. Failure to keep up insurance coverage may end up in vital penalties, together with hefty fines, suspension of driving privileges, and even the potential for authorized motion from these you might have injured. Sustaining insurance coverage protection demonstrates your dedication to protected driving practices and your duty in direction of others on the street.

Insurance coverage and Lender’s Curiosity

When financing a automobile, the lender has a vested curiosity in your insurance coverage protection. Many mortgage agreements stipulate that the borrower should keep insurance coverage protection to guard the lender’s funding. If the automobile is broken or totaled, sufficient insurance coverage ensures the lender receives compensation, decreasing the monetary influence on their portfolio. With out this protection, the lender faces vital threat and should provoke authorized motion to recoup losses.

Sources for Studying Extra About Insurance coverage

Quite a few assets will help you discover varied insurance coverage choices and perceive the intricacies of insurance policies. Seek the advice of your state’s Division of Motor Automobiles web site for particular laws and necessities. Insurance coverage comparability web sites assist you to examine insurance policies from completely different suppliers, serving to you discover the perfect worth. Moreover, monetary advisors and insurance coverage brokers can present customized steerage primarily based in your particular wants and circumstances.

- State Division of Motor Automobiles web sites

- Insurance coverage comparability web sites

- Monetary advisors

- Insurance coverage brokers

Examples of Insurance coverage Insurance policies and Their Protection

Insurance coverage insurance policies range considerably by way of protection limits and deductibles. A primary coverage may provide legal responsibility protection as much as $25,000 per individual and $50,000 per accident, together with a $500 deductible for collision and complete claims. Extra complete insurance policies might provide greater protection limits and decrease deductibles. As an illustration, a coverage with a better protection restrict would supply a larger monetary cushion within the occasion of a major accident.

Different Options

Dealing with the potential of automobile repossession is demanding. Understanding your choices is essential to navigating this tough scenario. Different options will help keep away from the damaging influence in your credit score historical past and hold you on the street.Different options vary from short-term fixes to long-term methods, and it is important to rigorously weigh your choices primarily based in your particular person circumstances and monetary objectives.

Choosing the proper path could be the distinction between a easy transition and a difficult expertise.

Momentary Insurance coverage Options

Discovering short-term insurance coverage is a crucial step in stopping repossession. This answer buys you time to handle your insurance coverage wants extra completely.Momentary insurance coverage insurance policies can present protection for a particular interval, normally starting from a couple of days to a number of weeks. This offers you time to discover different choices and safe extra everlasting insurance coverage. An important issue is to verify that the short-term insurance coverage coverage meets your state’s minimal necessities to keep away from penalties and additional problems.

Different Financing Choices

Exploring various financing choices is a vital step in resolving your monetary challenges. This might probably deal with the underlying explanation for your incapability to afford insurance coverage.Different financing choices may embrace short-term loans, or a refinancing of your current auto mortgage. These choices can present a approach to bridge the hole when you work on bettering your monetary scenario. Components to think about when wanting into various financing choices embrace the rates of interest, mortgage phrases, and any charges related to the mortgage.

Rigorously evaluating completely different choices is essential to choosing essentially the most appropriate various on your scenario. Think about the potential influence in your general funds and funds earlier than committing to a mortgage.

Reasonably priced Insurance coverage Protection

Securing inexpensive insurance coverage protection is important for sustaining your automobile’s possession. Understanding your insurance coverage choices is an important facet in avoiding repossession.Discovering inexpensive insurance coverage protection can contain exploring completely different insurance coverage suppliers and evaluating charges. Think about reductions that will apply, akin to multi-policy reductions or reductions for protected driving information. A number of insurance coverage corporations provide reductions for good driving information, which may end up in decrease premiums.

This could considerably influence the price of your insurance coverage and could also be a viable answer.

Affect on Credit score Historical past

Understanding the potential influence in your credit score historical past is significant when contemplating short-term options.Momentary insurance coverage and various financing options might have completely different impacts in your credit score historical past. Some short-term insurance coverage choices might not report back to credit score bureaus, whereas others might. Different financing options, akin to short-term loans, can have an effect on your credit score rating if not managed correctly. It is essential to weigh the advantages of those short-term options towards the potential dangers to your credit score rating.

Totally examine the reporting practices of each the insurance coverage supplier and the lender.

Procedures for Different Financing

Understanding the procedures for making use of for various financing choices is essential to securing the mandatory funding.Making use of for various financing sometimes entails submitting an utility, offering crucial documentation, and present process a credit score verify. Lenders might require particular info, akin to revenue verification and proof of employment. Perceive the precise necessities of every lender to make sure a easy utility course of.

Affect on Credit score Rating: Can They Repo Your Automobile For Not Having Insurance coverage

A repossession, sadly, leaves a major and lasting mark in your credit score historical past. This damaging occasion can severely influence your skill to safe loans, lease an house, and even acquire a cellphone contract sooner or later. Understanding the extent of this injury and the methods to mitigate it’s essential for navigating this difficult monetary scenario.The influence of a repossession in your credit score rating is substantial and sometimes long-lasting.

Credit score bureaus document the occasion, which displays negatively in your creditworthiness. This may end up in a major drop in your credit score rating, making it more durable to acquire favorable mortgage phrases or safe different credit score sooner or later. It is important to acknowledge the severity of this consequence and take proactive steps to mitigate the injury.

Detrimental Affect of Repossession on Credit score Historical past

Repossession, notably for lack of insurance coverage, is a severe credit score occasion that considerably reduces your credit score rating. It’s because lenders and credit score bureaus view it as an indication of your incapability to handle your monetary obligations. The damaging influence is commonly extra pronounced than different fee defaults, akin to late funds, because it immediately signifies a failure to satisfy the phrases of a mortgage settlement.

It is a key distinction that always results in a extra substantial credit score rating drop.

Mitigating the Harm to Credit score

Proactively managing your funds and constructing optimistic credit score historical past will help to offset the damaging influence of a repossession. Methods embrace paying all money owed on time, sustaining a low credit score utilization ratio (the quantity of accessible credit score you’re utilizing), and actively looking for alternatives to enhance your creditworthiness. Constructing a optimistic fee historical past over time will step by step enhance your credit score rating.

Usually monitoring your credit score report and disputing any inaccuracies can be essential.

Comparability to Different Cost Defaults

Whereas late funds and missed funds additionally negatively have an effect on credit score, a repossession typically ends in a extra extreme influence. The fast and tangible lack of the asset related to repossession makes it a extra severe violation of the phrases of settlement than merely lacking funds. A repossession demonstrates a better diploma of economic irresponsibility and thus receives a extra substantial penalty within the eyes of credit score reporting companies.

Methods for Bettering Credit score Rating After Repossession

After a repossession, rebuilding your credit score takes time and constant effort. Begin by paying all of your payments on time, even when they aren’t associated to the repossession. Keep a low credit score utilization ratio. Apply for a secured bank card or a small mortgage to ascertain a brand new optimistic credit score historical past. Making use of for a bank card and paying it off on time, or using a secured credit score account, can exhibit accountable monetary conduct.

Lengthy-Time period Implications of a Repossession

The long-term penalties of a repossession prolong past a brief dip in your credit score rating. A poor credit score rating can have an effect on your skill to safe housing, buy a automobile, or acquire favorable rates of interest on loans for vital purchases. This could influence future monetary selections and restrict your entry to varied alternatives.

Potential Affect on Credit score Rating for Totally different Repossession Varieties

| Repossession Sort | Potential Credit score Rating Affect |

|---|---|

| Lack of Insurance coverage | Vital drop, probably impacting the credit score rating by 100 factors or extra, relying on the creditworthiness previous to the repossession. |

Final Conclusion

So, can they repo your automobile for no insurance coverage? Most likely. However you’ve got obtained rights and choices. Understanding the legal guidelines, your rights, and potential options is essential. This information offers a transparent overview of the method, from the authorized grounds to the potential influence in your credit score rating.

Keep insured, and keep knowledgeable – it might prevent a complete lot of hassle down the street. Bear in mind, being proactive is vital. Do not wait ’til the final minute to type this out.

Q&A

Can a lender repossess my automobile if I’ve a brief insurance coverage coverage?

It is determined by the phrases of your mortgage settlement. Some lenders might settle for short-term insurance coverage, however others may not. It is best to verify your mortgage paperwork or contact your lender immediately.

What occurs if I am in an accident with out insurance coverage?

Relying in your state’s legal guidelines, you can face severe penalties, together with fines and potential jail time, together with the chance of repossession. Getting insurance coverage is essential to guard your self and your automobile.

How does a repossession have an effect on my credit score rating?

A repossession for lack of insurance coverage is a major damaging mark in your credit score report, probably reducing your rating and making it more durable to get loans or lease sooner or later. It is a severe difficulty that you simply need to keep away from.

What if I am unable to afford insurance coverage?

Discover choices like short-term insurance coverage or various financing. Lenders may provide extensions or work with you to seek out inexpensive options to maintain your automobile. It is value exploring the probabilities.