Automotive insurance coverage North Little Rock is essential for drivers within the space, providing safety in opposition to monetary dangers. This information delves into the specifics of the market, from pricing tendencies and protection choices to native suppliers and declare procedures. Understanding your insurance coverage wants is paramount, and this useful resource offers a transparent and concise overview of every part you might want to know.

Navigating the complexities of automotive insurance coverage can really feel overwhelming. This complete information goals to simplify the method, equipping you with the information and instruments to decide on the suitable coverage on your wants and finances in North Little Rock. We discover the native insurance coverage panorama, analyzing prices, protection varieties, and priceless ideas to economize.

Overview of Automotive Insurance coverage in North Little Rock: Automotive Insurance coverage North Little Rock

Navigating the intricate panorama of automotive insurance coverage in North Little Rock, Arkansas, requires understanding the particular wants and issues of drivers within the space. This overview delves into the nuances of the market, analyzing pricing tendencies, and highlighting the essential position of particular person elements in figuring out insurance coverage prices. A transparent understanding empowers drivers to make knowledgeable choices and safe probably the most appropriate safety.The automotive insurance coverage market in North Little Rock, like different areas, is influenced by numerous elements.

A good portion of drivers face the frequent challenges of sustaining inexpensive premiums whereas guaranteeing complete protection. This typically necessitates cautious consideration of various coverage varieties and the elements impacting premiums.

Typical Insurance coverage Wants and Considerations

Drivers in North Little Rock, like these nationwide, sometimes prioritize complete protection to guard their automobiles and monetary well-being. Considerations typically middle across the rising value of repairs and the potential for important monetary loss within the occasion of an accident. The necessity for legal responsibility protection, which protects in opposition to claims arising from injury to different folks’s property or accidents to others, is paramount.

Moreover, many drivers within the space search to know the particular protection choices accessible, resembling collision and complete protection, to safeguard their funding of their automobiles.

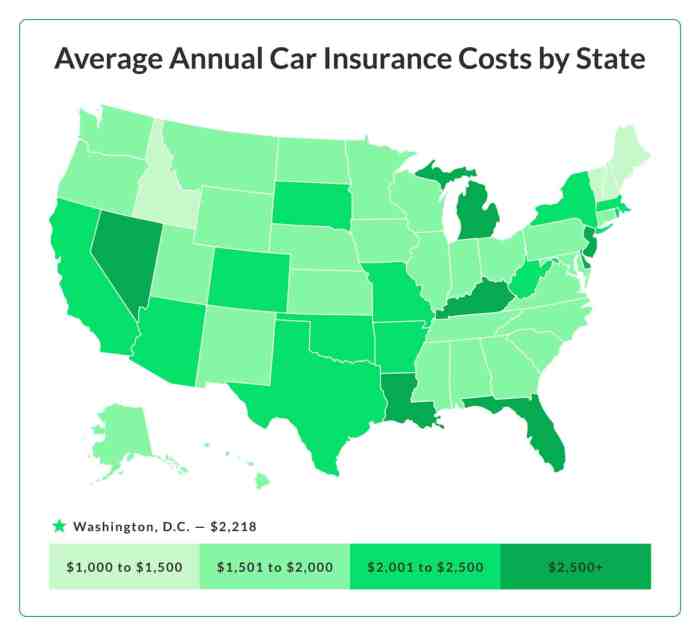

Pricing Developments In comparison with Different Areas

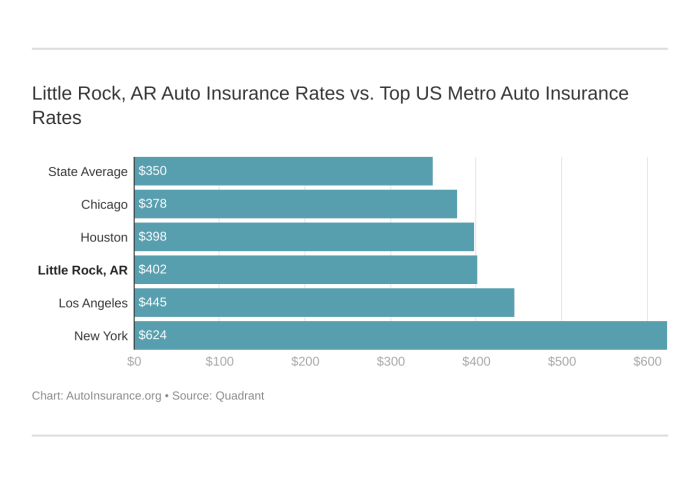

Pricing tendencies in North Little Rock automotive insurance coverage typically mirror nationwide averages, with slight variations based mostly on native elements. For example, the frequency of accidents and claims inside the area, mixed with the price of dwelling and restore companies, influences the general premium construction. Evaluating North Little Rock to different Arkansas cities or neighboring states will reveal relative variations, and this may be additional nuanced by contemplating the regional financial local weather and the particular rules governing the insurance coverage business in every location.

Impression of Driving Report, Car Sort, and Protection Selections

A driver’s historical past, together with previous accidents and violations, considerably impacts their insurance coverage premiums. A clear driving report usually interprets to decrease premiums, whereas drivers with a historical past of accidents or violations will face larger charges. The kind of automobile additionally performs a job. For instance, insuring a sports activities automotive or high-performance automobile may be costlier than insuring a regular sedan because of the perceived larger danger of harm or theft.

Totally different protection decisions, resembling the quantity of legal responsibility protection or the addition of extras like roadside help, straight have an effect on the general premium.

Comparability of Automotive Insurance coverage Insurance policies

Understanding the varied kinds of automotive insurance coverage insurance policies accessible is essential for making knowledgeable choices. The desk beneath highlights some key coverage varieties and their traits, providing a concise overview for drivers in North Little Rock.

| Coverage Sort | Description | Typical Protection |

|---|---|---|

| Legal responsibility Protection | Protects in opposition to claims from others. | Bodily harm legal responsibility, property injury legal responsibility. |

| Collision Protection | Covers injury to your automobile no matter who’s at fault. | Repairs or substitute of your automobile. |

| Complete Protection | Covers injury to your automobile from non-collision occasions. | Covers injury from occasions like vandalism, fireplace, or theft. |

| Uninsured/Underinsured Motorist Protection | Offers safety in case you are injured or your automobile is broken by an at-fault driver with inadequate insurance coverage. | Covers medical bills and automobile restore prices. |

Native Insurance coverage Suppliers

Navigating the panorama of automotive insurance coverage in North Little Rock can really feel like charting uncharted territory. Fortuitously, respected corporations are available, providing a spectrum of protection choices tailor-made to numerous wants. Understanding their strengths and weaknesses empowers knowledgeable decision-making, guaranteeing you safe probably the most appropriate safety on your automobile and peace of thoughts.

Main Insurance coverage Corporations in North Little Rock

A number of distinguished insurance coverage suppliers function inside the North Little Rock space. These corporations typically have established monitor information, permitting for a comparability of their companies and buyer experiences. Key gamers embody State Farm, Geico, Allstate, Progressive, and doubtlessly native companies. The selection typically relies on particular wants, desired protection, and buyer preferences.

Firm Popularity and Buyer Opinions

Buyer evaluations and status evaluation present priceless insights into the efficiency of assorted insurance coverage corporations. Constructive evaluations continuously spotlight responsiveness, effectivity, and honest claims dealing with. Conversely, damaging evaluations may level in direction of challenges in communication, delays in declare settlements, or perceived inflexibility. This evaluation is essential when contemplating a supplier.

Protection Choices Provided

Insurance coverage corporations in North Little Rock sometimes provide a spread of protection choices. These choices generally embody legal responsibility protection (defending you from monetary duty in case of accidents), collision protection (reimbursing damages to your automobile no matter fault), complete protection (masking injury to your automobile from occasions apart from collision, like theft or climate), and uninsured/underinsured motorist protection (defending you if one other driver is at fault however lacks ample insurance coverage).

The precise inclusions and exclusions inside every coverage are essential to know.

Buyer Complaints and Reward

Frequent buyer complaints throughout insurance coverage corporations within the area typically contain delays in declare processing or perceived complexities in understanding coverage phrases. Conversely, optimistic suggestions continuously facilities round immediate declare settlements, clear communication, and pleasant customer support interactions. For example, some clients reward State Farm for its sturdy native presence and agent community, whereas others may favor Geico’s on-line accessibility.

Contact Data

| Insurance coverage Firm | Cellphone Quantity | Web site |

|---|---|---|

| State Farm | (Insert Cellphone Quantity) | (Insert Web site) |

| Geico | (Insert Cellphone Quantity) | (Insert Web site) |

| Allstate | (Insert Cellphone Quantity) | (Insert Web site) |

| Progressive | (Insert Cellphone Quantity) | (Insert Web site) |

| [Local Agencies] | (Insert Cellphone Quantity) | (Insert Web site) |

Be aware: Contact info is topic to vary. At all times confirm straight with the corporate.

Value of Automotive Insurance coverage

The price of automotive insurance coverage in North Little Rock, like some other metropolitan space, is a dynamic issue influenced by a mess of interconnected variables. Understanding these components empowers you to navigate the panorama of insurance coverage choices and safe probably the most appropriate protection at a aggressive worth. This journey in direction of knowledgeable decision-making is important for accountable automobile possession.The value of automotive insurance coverage in North Little Rock is not a set quantity; it is a reflection of assorted elements, from the particular protection you select to your particular person driving historical past.

The excellent news is that with diligent analysis and a eager eye for element, you’ll be able to uncover probably the most favorable charges accessible within the area.

Common Value in North Little Rock

The common value of automotive insurance coverage in North Little Rock fluctuates. Components resembling the kind of automobile, driver profile, and the chosen protection packages considerably impression the premium. Current business experiences point out a spread of common premiums, however this must be seen as a common guideline. The precise value could differ significantly based mostly on the particular components detailed beneath.

Components Influencing Value

A number of crucial elements decide the price of your automotive insurance coverage. Understanding these components offers perception into the best way to doubtlessly decrease your premiums.

- Protection Wanted: The extent of protection straight impacts the associated fee. Complete protection, together with collision, legal responsibility, and uninsured/underinsured motorist safety, sometimes leads to a better premium in comparison with insurance policies with restricted protection. The extra safety you search, the upper the associated fee will probably be. For instance, a coverage masking complete damages, collision, and substantial legal responsibility protection will usually value greater than a coverage solely together with primary legal responsibility protection.

This displays the elevated danger and potential payouts.

- Car Sort: The make, mannequin, and yr of your automobile play a job. Sure fashions are statistically extra vulnerable to accidents or theft, thus growing insurance coverage prices. For instance, a high-performance sports activities automotive may need a better insurance coverage premium than a compact automotive resulting from perceived danger.

- Driver Profile: Your driving historical past, age, and site considerably affect premiums. A youthful driver with a restricted driving report will sometimes pay greater than an older driver with a clear report. Moreover, drivers residing in areas with larger accident charges will normally face larger insurance coverage prices.

- Credit score Rating: Whereas not universally utilized, some insurers take into account your credit score historical past as a consider figuring out premiums. A very good credit score rating may correlate with decrease premiums, whereas a poor credit score historical past could end in larger prices. That is because of the perception that people with good credit score administration habits could also be much less more likely to interact in dangerous behaviors.

- Deductibles: The quantity you conform to pay out-of-pocket earlier than your insurance coverage kicks in influences the premium. A better deductible leads to decrease premiums, however you may must cowl a bigger portion of bills in case of an accident.

Demographic Variations

The price of automotive insurance coverage can differ based mostly on demographic elements. For example, youthful drivers continuously face larger premiums resulting from their larger accident danger. Equally, people residing in high-risk areas could pay extra because of the elevated likelihood of accidents of their location. These variations replicate the insurer’s evaluation of the chance related to completely different demographic teams.

Discovering Aggressive Charges

Discovering probably the most aggressive charges includes a multi-faceted strategy.

- Comparability Purchasing: Do not accept the primary quote you obtain. Examine quotes from a number of insurance coverage suppliers to determine the most effective worth on your wants. Utilizing on-line comparability instruments and contacting native brokers are wonderful methods for this course of.

- Bundle Reductions: When you have different insurance coverage merchandise, resembling householders or renters insurance coverage, search for bundled reductions, as these can considerably cut back your total prices.

- Reductions for Secure Driving: Some insurers provide reductions to secure drivers. Preserve a clear driving report and take into account defensive driving programs to qualify for these potential financial savings.

- Reductions for Particular Demographics: Inquire about any reductions based mostly in your age, occupation, or different related elements.

Protection Choices and Prices

This desk offers approximate prices for various protection choices. Remember that these are estimations and precise costs could differ based mostly on particular person circumstances.

| Protection Sort | Approximate Value (Instance) |

|---|---|

| Legal responsibility Solely | $750 – $1200 yearly |

| Legal responsibility + Collision | $1200 – $2000 yearly |

| Legal responsibility + Collision + Complete | $1500 – $2500 yearly |

Claims and Dispute Decision

Navigating the complexities of a automotive accident or a declare can really feel overwhelming. Nevertheless, understanding the claims course of and dispute decision avenues empowers you to guard your rights and obtain a passable end result. This part will illuminate the everyday procedures, offering readability and confidence in these often-challenging conditions.Insurance coverage claims, whereas typically needed, is usually a supply of frustration if not approached with a transparent understanding of the steps concerned.

A proactive and knowledgeable strategy might help you navigate these processes extra successfully. This part will assist you to perceive the declare course of, potential disputes, and sources accessible for resolving them.

Frequent Claims Processes

Insurance coverage corporations sometimes make use of standardized claims processes to make sure equity and effectivity. These procedures normally contain reporting the incident, gathering documentation, and assessing the injury. This methodical strategy helps insurance coverage corporations consider the declare objectively and guarantee applicable compensation.

Submitting a Declare in North Little Rock

Submitting a declare in North Little Rock sometimes includes contacting your insurance coverage firm straight. Present detailed details about the accident, together with the date, time, location, and contributing elements. Gathering supporting proof, resembling witness statements, images of the injury, and police experiences, is essential. This proof substantiates your declare and aids in a swift decision.

Dealing with Disputes or Dissatisfaction

Disputes with insurance coverage corporations can come up from disagreements concerning the extent of damages or the quantity of compensation provided. When confronted with such dissatisfaction, provoke communication with the insurance coverage firm to specific your issues. Preserve a written report of all communications, together with dates, instances, and the content material of every dialog. This documented report serves as priceless proof in case of escalation.

If preliminary communication is unsuccessful, exploring different dispute decision choices is advisable.

Obtainable Assets for Resolving Disputes

North Little Rock provides numerous sources for resolving disputes with insurance coverage corporations. The state’s Division of Insurance coverage could have mediation or arbitration companies to facilitate a mutually agreeable resolution. Moreover, shopper safety companies can present priceless steerage and assist in navigating the claims course of. Unbiased authorized counsel can provide experience and illustration if the dispute escalates.

Steps to Soak up Case of a Automotive Accident

| Step | Motion |

|---|---|

| 1. Guarantee Security | Instantly assess the scenario and make sure the security of all concerned events. Name emergency companies if wanted. |

| 2. Collect Data | Accumulate particulars concerning the accident, together with the names and call info of all events concerned, witness statements, and descriptions of the injury. Take images of the injury to your automobile and the scene. |

| 3. Report the Accident | Contact your insurance coverage firm and native legislation enforcement to report the accident. Comply with their procedures for reporting the incident. |

| 4. Doc Every little thing | Preserve an in depth report of all communications, bills incurred, and some other related info associated to the accident. |

| 5. Search Medical Consideration | If accidents are sustained, search immediate medical consideration and preserve information of all medical therapy. |

| 6. Overview Coverage Particulars | Rigorously evaluation your insurance coverage coverage to know your protection and obligations. |

| 7. Talk with Insurance coverage | Contact your insurance coverage firm and comply with their directions for submitting a declare. Present all requested paperwork and knowledge. |

| 8. Consider Dispute Decision Choices | In case you are unhappy with the insurance coverage firm’s provide, discover different dispute decision choices, resembling mediation or arbitration. |

Security and Driving Information

Your driving report is an important consider figuring out your automotive insurance coverage premiums in North Little Rock. A clear report, a testomony to accountable driving habits, can result in important financial savings. Conversely, violations and accidents can inflate your insurance coverage prices. Understanding this connection empowers you to make knowledgeable choices about your driving habits and safe the absolute best charges.A well-maintained driving report is not nearly avoiding expensive penalties; it is about fostering a safer neighborhood.

Each accountable alternative on the highway contributes to a smoother, extra predictable stream of site visitors, finally enhancing the general driving expertise for everybody. By adopting secure driving practices, you contribute to a safer and fulfilling surroundings for all highway customers.

Impression of Driving Information on Insurance coverage Charges

Insurance coverage corporations meticulously assess driving information to gauge danger. A clear report signifies a decrease chance of accidents, translating into decrease premiums. Conversely, violations, resembling rushing tickets or reckless driving, increase the perceived danger, resulting in larger premiums. Accidents, no matter fault, normally end in substantial will increase in insurance coverage prices. It is because accidents signify a better potential for claims and payouts.

Site visitors Violations and Accident Impression on Premiums

Site visitors violations, from minor rushing tickets to extra critical infractions, can considerably impression your insurance coverage charges. Every violation provides to your danger profile, growing your premium. Accidents, no matter fault, normally end in substantial will increase in insurance coverage prices. The severity of the accident, the quantity of harm, and whether or not accidents occurred are essential elements thought-about by insurers when assessing the impression in your premiums.

For instance, a fender bender may result in a reasonable enhance, whereas a extra critical accident might end in a considerable premium hike.

Secure Driving Practices to Preserve Low Insurance coverage Prices

Cultivating secure driving habits is essential for sustaining low insurance coverage prices. These practices embody obeying site visitors legal guidelines, sustaining a secure following distance, and avoiding distractions like mobile phone use. Prioritizing defensive driving methods, resembling anticipating potential hazards and sustaining situational consciousness, helps to forestall accidents and protect your good driving report. Moreover, often inspecting your automobile to make sure correct functioning and addressing any mechanical points promptly reduces the chance of accidents.

Assets to Enhance Driving Information and Get hold of Reductions

Quite a few sources can help you in bettering your driving report and securing reductions in your insurance coverage. Driver schooling programs can improve your expertise and information, doubtlessly resulting in lowered premiums. Secure driving apps can monitor your driving habits and supply suggestions to enhance your methods. These apps may assist determine potential downside areas in your driving, serving to you to deal with them.

Reviewing your driving report often can determine any potential areas of concern and assist you to take steps to enhance.

Desk Evaluating Insurance coverage Charges for Totally different Driving Information

| Driving Report | Estimated Insurance coverage Premium Improve/Lower | Description |

|---|---|---|

| Clear Report | -15% to -30% | No accidents or violations prior to now 3-5 years. |

| Minor Violations (e.g., rushing tickets) | +10% to +25% | Occasional site visitors violations, resembling rushing tickets. |

| Accidents (with or with out fault) | +25% to +50% | Automotive accidents, whether or not the driving force is at fault or not. |

| A number of Accidents/Violations | +50% or larger | A number of accidents and/or critical violations. |

Be aware: Insurance coverage premiums usually are not solely decided by driving information. Different elements, resembling automobile sort, protection decisions, and site, can affect prices. The desk offers a common guideline. Precise will increase or decreases could differ based mostly on the particular circumstances.

Protection Choices and Selections

Unlocking the potential of your automotive insurance coverage journey begins with understanding the various tapestry of protection choices accessible. Every alternative represents a fastidiously crafted defend, designed to guard your monetary well-being and peace of thoughts on the highway. The proper protection is not nearly minimizing monetary danger; it is about constructing a basis of confidence and safety for each drive.Navigating the complexities of automotive insurance coverage protection can really feel daunting, however with a transparent understanding of the varied choices, you may make knowledgeable choices that align completely along with your wants and finances.

Selecting the best stability between safety and value is paramount. This empowers you to embrace the open highway with confidence, figuring out your monetary future is shielded from unexpected occasions.

Sorts of Automotive Insurance coverage Protection

Several types of automotive insurance coverage protection present various levels of safety. Understanding the particular particulars of every protection sort is essential for making your best option. Legal responsibility protection is the basic constructing block of most insurance policies, defending you from monetary duty within the occasion of an accident the place you might be at fault.

- Legal responsibility Protection: This important protection protects you from monetary duty if you happen to trigger an accident and are discovered at fault. It covers damages to the opposite occasion’s automobile and medical bills for accidents sustained by them. Legal responsibility protection sometimes is available in completely different limits, resembling $25,000, $50,000, or larger, reflecting the utmost quantity you would be held answerable for.

An important facet of legal responsibility protection is the understanding that it does not shield your individual automobile. Contemplate legal responsibility insurance coverage as a defend in opposition to the monetary penalties of your actions on the highway.

- Collision Protection: This protection steps in to compensate for damages to your automobile in case you are concerned in an accident, no matter who’s at fault. It basically pays for repairs or substitute of your automobile, guaranteeing you are not left with a big monetary burden. Collision protection is a crucial safeguard, defending your funding in your automotive.

- Complete Protection: This safety extends past accidents, masking damages to your automobile from perils apart from collisions, resembling theft, vandalism, fireplace, hail, and even climate occasions. It offers a security web in opposition to a wide selection of sudden occasions that may negatively impression your automotive’s worth. Complete protection is a crucial layer of safety, mitigating the dangers past the realm of a typical collision.

Significance of Coverage Phrases

Understanding coverage phrases is essential for making knowledgeable decisions. Coverage paperwork typically embody exclusions and limitations. Studying and understanding these particulars is important to make sure you are getting the suitable safety on your wants. For instance, sure occasions like utilizing your automobile for industrial functions or for particular actions could also be excluded.

- Exclusions: Understanding the particular conditions excluded from protection is important. This ensures you are not paying for defense that won’t apply to your distinctive driving circumstances. Reviewing your coverage for express exclusions is important to make sure you are totally conscious of the restrictions.

- Deductibles: A deductible is the quantity you pay out-of-pocket earlier than your insurance coverage firm begins masking the prices of repairs or damages. A better deductible sometimes leads to decrease premiums, however you bear the monetary duty for the deductible quantity within the occasion of a declare.

- Coverage Limits: The utmost quantity your insurance coverage coverage pays for damages or accidents is called the coverage restrict. Understanding these limits is important for ensuring your protection aligns along with your danger tolerance and potential liabilities.

Selecting the Proper Protection

Choosing the suitable protection relies on particular person circumstances and monetary capability. Contemplate your automobile’s worth, your driving habits, and your monetary scenario. A radical evaluation of those elements will assist you to decide the optimum stability between protection and value.

- Car Worth: The worth of your automobile considerably influences the quantity of protection you want. Larger-value automobiles sometimes require extra complete protection to guard in opposition to potential monetary losses.

- Driving Habits: A driver with a historical past of accidents or site visitors violations may want extra in depth protection to replicate their larger danger profile. Contemplate elements such because the frequency of driving, the realm during which you drive, and any potential publicity to accidents.

- Monetary State of affairs: Your private funds play a crucial position in figuring out your insurance coverage wants. Assess your potential to deal with potential out-of-pocket bills in case of a declare.

Value Comparability of Protection Choices

The price of automotive insurance coverage protection varies considerably relying on the chosen choices. The desk beneath offers a common overview, however precise prices could differ based mostly on particular person circumstances.

| Protection Sort | Description | Approximate Value (Instance) |

|---|---|---|

| Legal responsibility | Covers damages to others’ property and accidents to others in case you are at fault. | $100 – $500 per yr |

| Collision | Covers injury to your automobile no matter who’s at fault. | $150 – $750 per yr |

| Complete | Covers injury to your automobile from perils apart from collisions. | $100 – $500 per yr |

Be aware: These are instance prices and don’t replicate particular conditions or particular person circumstances. At all times seek the advice of with an insurance coverage supplier for customized value estimations.

Reductions and Methods to Save

Unlocking financial savings on automotive insurance coverage in North Little Rock is a journey of good decisions and proactive measures. Understanding the accessible reductions and strategically pursuing them can considerably cut back your insurance coverage premiums, empowering you to allocate extra sources to what really issues. This journey begins with recognizing the quite a few avenues for saving.

Obtainable Reductions

A big selection of reductions are designed to reward accountable drivers and those that reveal sound monetary administration. These reductions can considerably decrease your insurance coverage prices, offering a tangible return on accountable driving habits and monetary planning.

- Secure Driver Reductions: Insurance coverage corporations typically present substantial reductions for drivers with clear driving information, freed from accidents and violations. These reductions replicate a dedication to secure driving practices and reveal a historical past of accountable highway use.

- Multi-Coverage Reductions: Combining your automotive insurance coverage with different insurance policies, resembling dwelling or renters insurance coverage with the identical supplier, can result in important financial savings. This bundled strategy acknowledges the worth of a complete insurance coverage technique, demonstrating belief and dedication to a single insurance coverage supplier.

- Defensive Driving Programs: Finishing defensive driving programs may end up in decrease insurance coverage premiums. This displays the funding in bettering driving expertise and information, finally contributing to safer roads.

- Anti-theft Gadgets: Putting in authorized anti-theft gadgets can cut back your premiums, recognizing the proactive strategy to automobile safety and demonstrating a dedication to defending your funding.

- Good Pupil Reductions: College students with good educational information typically qualify for reductions. This acknowledges the significance of schooling and the worth of sustaining a superb educational report.

Qualifying for Reductions

Navigating the method of qualifying for reductions is simple. Insurance coverage suppliers have particular standards for every low cost, and understanding these standards is vital to maximizing your financial savings. Diligence and transparency in offering the required info will assist in securing the reductions.

- Secure Driver Reductions: Preserve a clear driving report with no accidents or violations to qualify for this priceless low cost. A clear driving report is a testomony to accountable driving practices.

- Multi-Coverage Reductions: Contact your insurance coverage supplier to inquire about multi-policy reductions. Inquire concerning the specifics and eligibility necessities to make sure you can profit from these financial savings.

- Defensive Driving Programs: Analysis native driving faculties and packages to search out one which aligns along with your schedule. Finishing the course and offering the mandatory documentation to your insurance coverage supplier will unlock this low cost.

- Anti-theft Gadgets: Confirm that the put in anti-theft machine is authorized by your insurance coverage supplier. That is essential to make sure the low cost is legitimate and will be claimed.

- Good Pupil Reductions: Current documentation of fine educational standing to your insurance coverage supplier. Present transcripts or educational information to reveal your good standing.

Evaluating and Discovering the Greatest Offers

Evaluating automotive insurance coverage quotes from numerous suppliers is important to discovering the absolute best charges. Taking the time to match quotes from completely different suppliers can considerably impression your financial savings.

- On-line Comparability Instruments: Make the most of on-line comparability instruments to match quotes from a number of suppliers concurrently. These instruments streamline the method, permitting you to rapidly evaluate completely different insurance policies and charges.

- Contact Native Suppliers: Do not hesitate to contact native insurance coverage suppliers straight to debate your wants and discover potential financial savings. Native suppliers can provide customized recommendation and tailor-made options.

- Contemplate Totally different Protection Ranges: Adjusting your protection ranges can impression your premiums. A complete understanding of your wants is important for figuring out the optimum protection on your scenario.

Guaranteeing Optimum Charges

Guaranteeing you obtain the absolute best charges requires a proactive strategy. By persistently reviewing and updating your coverage, you’ll be able to safe favorable charges and maximize financial savings.

- Common Coverage Overview: Repeatedly evaluation your coverage to make sure it aligns along with your present wants. Modifications in your circumstances, resembling a way of life adjustment or a change in driving habits, could warrant a evaluation of your coverage.

- Bundle Companies: Discover the opportunity of bundling your automotive insurance coverage with different insurance coverage merchandise provided by the identical supplier. This typically leads to important financial savings.

- Preserve a Clear Driving Report: Constant secure driving practices are essential for securing probably the most favorable charges. This demonstrates your dedication to accountable driving habits and reduces your danger profile.

Potential Reductions and How one can Declare Them

| Low cost | Description | How one can Declare |

|---|---|---|

| Secure Driver Low cost | Reward for a clear driving report. | Preserve a clear driving report for a time frame. |

| Multi-Coverage Low cost | Mixed financial savings for a number of insurance policies. | Contact your insurance coverage supplier to debate choices. |

| Defensive Driving Course | Financial savings for finishing a defensive driving course. | Present completion certificates to your insurance coverage supplier. |

| Anti-theft Gadget | Financial savings for putting in an authorized anti-theft machine. | Present proof of set up to your insurance coverage supplier. |

| Good Pupil Low cost | Financial savings for college students with good educational information. | Present educational information to your insurance coverage supplier. |

Ideas for Selecting an Insurance coverage Firm

Navigating the world of automotive insurance coverage can really feel like charting uncharted territory. Nevertheless, with cautious consideration and a strategic strategy, you will discover the proper coverage to guard your automobile and your peace of thoughts. Selecting the best insurance coverage firm is not about merely selecting the bottom worth; it is about discovering a associate who understands your wants and provides the safety you deserve.Choosing the best automotive insurance coverage supplier calls for a discerning eye and a radical understanding of the nuances concerned.

Components resembling monetary stability, protection choices, and the corporate’s status are essential to creating an knowledgeable determination. This course of empowers you to select that aligns along with your monetary targets and driving habits.

Important Components to Contemplate, Automotive insurance coverage north little rock

Understanding the important thing elements that form your insurance coverage expertise is paramount. This empowers you to pick out a supplier who aligns along with your particular necessities and values. Discovering an organization that understands your wants is important to a optimistic insurance coverage expertise.

- Monetary Energy: A financially sound insurance coverage firm is essential. A robust monetary score signifies the corporate’s potential to pay claims. That is important for guaranteeing that you’re going to obtain compensation if you happen to ever must file a declare.

- Protection Choices: Totally different corporations provide various protection choices. Rigorously consider the kinds of protection, resembling legal responsibility, collision, complete, and uninsured/underinsured motorist safety, to make sure they meet your particular wants. A radical analysis of protection choices ensures you might be adequately protected.

- Buyer Service Popularity: An organization’s status for dealing with claims effectively and resolving disputes successfully is important. Studying evaluations and testimonials can present perception into the corporate’s customer support practices. Consider the corporate’s status by means of testimonials and evaluations to gauge the general buyer expertise.

- Claims Course of: Figuring out the claims course of and the way rapidly the corporate handles claims is crucial. Understanding the procedures for reporting and submitting claims will assist in a clean course of when wanted.

- Reductions and Promotions: Insurance coverage corporations continuously provide numerous reductions, resembling these for secure driving, a number of automobiles, or sure driver demographics. Profiting from these reductions can considerably cut back your premiums.

Evaluating Insurance coverage Choices

Evaluating numerous insurance coverage choices successfully is a cornerstone of creating knowledgeable choices. Rigorously consider the completely different insurance coverage choices to find out which most closely fits your wants.

- Use Comparability Instruments: On-line instruments let you evaluate insurance policies from a number of corporations concurrently. This streamlined strategy simplifies the method of evaluating numerous insurance coverage choices, saving you effort and time.

- Request Quotes: Do not hesitate to request quotes from a number of insurance coverage suppliers. This simple course of lets you evaluate pricing and protection choices. Requesting quotes from numerous suppliers is essential for acquiring a complete overview of accessible choices.

- Analyze Protection Particulars: Examine not simply the worth but in addition the particular protection particulars. Consider the specifics of every coverage to make sure it aligns along with your wants and expectations.

Studying Coverage Paperwork Rigorously

Thorough evaluation of insurance coverage insurance policies is important. It is vital to completely perceive the phrases and circumstances Artikeld in your coverage doc.

Understanding your insurance coverage coverage is essential for avoiding future surprises.

- Perceive Terminology: Familiarize your self with the terminology used within the coverage. Make clear any unclear phrases or circumstances with the insurance coverage supplier. Understanding the terminology used within the coverage ensures that you just totally grasp the nuances of your protection.

- Study Exclusions: Rigorously evaluation the coverage’s exclusions. Understanding exclusions lets you anticipate conditions the place your protection may not apply. Exclusions are a crucial facet of insurance coverage insurance policies, so thorough examination is essential.

- Search Clarification: Do not hesitate to ask questions if you happen to do not perceive one thing. A radical understanding of the coverage ensures you are totally protected.

Evaluating Monetary Stability

Assessing the monetary stability of insurance coverage corporations is essential for making an knowledgeable determination. Evaluating the monetary energy of an insurance coverage firm is important to make sure long-term safety.

- Test Rankings: Respected score companies assess the monetary energy of insurance coverage corporations. Reviewing these scores can present insights into the corporate’s stability. Reviewing scores from unbiased companies provides priceless perception into the monetary stability of the corporate.

- Assess Claims-Paying Historical past: Analyze the corporate’s historical past of fulfilling claims. Reviewing the corporate’s declare fee historical past offers perception into their dedication to fulfilling obligations. Scrutinize the corporate’s historical past of paying claims to gauge their reliability.

Abstract Desk

| Issue | Significance |

|---|---|

| Monetary Energy | Ensures claims are paid |

| Protection Choices | Meets particular wants |

| Buyer Service Popularity | Clean claims course of |

| Claims Course of | Effectivity and responsiveness |

| Reductions and Promotions | Potential premium financial savings |

Closing Notes

In conclusion, securing the suitable automotive insurance coverage in North Little Rock includes cautious consideration of assorted elements, from protection choices to native suppliers. By understanding the market, your wants, and accessible reductions, you’ll be able to select a coverage that provides ample safety whereas minimizing prices. This information serves as a priceless useful resource that can assist you make knowledgeable choices, guaranteeing your peace of thoughts on the highway.

Important Questionnaire

What are the everyday insurance coverage wants and issues of drivers in North Little Rock?

Drivers in North Little Rock, like elsewhere, face issues about accident protection, legal responsibility safety, and potential monetary losses. The precise wants differ based mostly on driving habits, automobile sort, and private circumstances.

How do I discover probably the most aggressive insurance coverage charges in North Little Rock?

Evaluating quotes from a number of insurance coverage suppliers is essential. On-line comparability instruments, unbiased brokers, and referrals might help you discover aggressive charges. Do not hesitate to ask for a number of quotes from completely different corporations.

What reductions can be found for automotive insurance coverage in North Little Rock?

Varied reductions can be found, together with secure driver reductions, multi-policy reductions, and reductions for particular automobile varieties or driver profiles. Test along with your insurance coverage supplier for particulars and make sure you meet the factors for qualifying.

What are the steps to soak up case of a automotive accident?

Instantly after an accident, prioritize security, change info with the opposite driver(s), and doc the scene. Notify your insurance coverage firm promptly and comply with their tips for submitting a declare.