UK automotive rental insurance coverage defined is essential for a clean and stress-free journey. Navigating the assorted insurance policies, coverages, and potential pitfalls will be daunting. This information supplies a complete overview of UK automotive rental insurance coverage, empowering you with the information to make knowledgeable selections and keep away from expensive errors.

Understanding the various kinds of insurance coverage, obligatory coverages, and non-compulsory extras obtainable within the UK is significant. This doc will cowl important features from defining phrases to evaluating rental firms and navigating the declare course of. Armed with this information, you may confidently hire a automotive within the UK, figuring out your monetary safety is in place.

Introduction to UK Automobile Rental Insurance coverage

Automobile rental insurance coverage within the UK protects renters from monetary liabilities arising from accidents, injury, or theft of a rented car. It is a essential part of the rental settlement, safeguarding each the renter and the rental firm. Understanding the assorted forms of insurance coverage obtainable is crucial for making knowledgeable selections and guaranteeing peace of thoughts through the rental interval.A complete understanding of UK automotive rental insurance coverage insurance policies is significant.

This information permits renters to pick out probably the most applicable protection, stopping sudden prices and potential monetary burdens. By rigorously reviewing the coverage particulars, renters can successfully handle dangers and guarantee a clean and stress-free rental expertise.

Completely different Sorts of UK Automobile Rental Insurance coverage

Numerous automotive rental insurance coverage choices can be found within the UK. These insurance policies differ when it comes to protection, exclusions, and related prices. Understanding the specifics of every sort helps renters make knowledgeable selections aligned with their wants and finances.

Frequent UK Automobile Rental Insurance coverage Insurance policies

The next desk Artikels frequent forms of automotive rental insurance coverage insurance policies obtainable within the UK, together with their descriptions. This permits for a fast comparability and understanding of the protection provided by every.

| Coverage Sort | Description |

|---|---|

| Primary Insurance coverage | This sometimes covers the minimal required insurance coverage, often offering legal responsibility safety for injury to different autos or accidents to others. It typically has excessive extra quantities (the quantity the renter is answerable for paying). |

| Tremendous/Full Insurance coverage | This coverage supplies complete protection, together with injury to the rental automotive, third-party legal responsibility, and potential theft. It often has a decrease extra quantity in comparison with primary insurance coverage. |

| Collision Injury Waiver (CDW) | CDW protects the renter from injury to the rental automotive, sometimes excluding injury from vandalism or pre-existing injury. It’s typically provided as an add-on to primary insurance coverage. |

| Loss Injury Waiver (LDW) | LDW protects the renter from loss or injury to the rental automotive, typically together with theft. It’s typically provided as an add-on to primary insurance coverage. |

| Third Social gathering Insurance coverage | Third occasion insurance coverage covers legal responsibility for injury to different autos or accidents to different folks. It doesn’t sometimes cowl injury to the rental car itself. |

Important Coverages: Uk Automobile Rental Insurance coverage Defined

Understanding the assorted insurance coverage coverages for UK automotive leases is essential for a clean and safe expertise. Realizing the obligatory and non-compulsory protections obtainable ensures you might be adequately lined in case of unexpected circumstances. Correct planning and consciousness of those coverages can stop monetary burdens and stress throughout your travels.

Necessary Coverages

These are the minimal necessities stipulated by UK regulation for automotive leases. Failure to safe these coverages may end up in penalties or limitations on the rental settlement.

The obligatory coverages typically embody Third Social gathering Legal responsibility insurance coverage. This protects you from claims arising from damages induced to different folks or their property throughout your rental interval. It basically covers the monetary tasks in case your car is concerned in an accident that causes hurt to others.

Non-compulsory Coverages, Uk automotive rental insurance coverage defined

Past the obligatory necessities, quite a few non-compulsory coverages can be found. These lengthen the safety provided, providing extra peace of thoughts.

These typically embody Loss Injury Waiver (LDW) or Collision Injury Waiver (CDW). LDW covers damages to the rental automotive itself, and CDW particularly covers collision injury. The provision and particular phrases of non-compulsory coverages differ between rental firms and will be tailor-made to particular wants.

Extra Coverages

Sure leases might necessitate extra coverages, relying on the precise circumstances. These might embody extras comparable to theft safety, private accident cowl, or particular forms of injury safety for sure areas.

For instance, a rental in a high-risk space or for an extended period may require extra cowl for theft or vandalism. Particular rental phrases and situations will at all times specify any extra coverages required.

Comparability of Coverages

| Protection Sort | Description | Necessary/Non-compulsory |

|---|---|---|

| Third Social gathering Legal responsibility | Covers damages to others or their property. | Necessary |

| Loss Injury Waiver (LDW) | Covers injury to the rental automotive, together with collisions, accidents, or theft. | Non-compulsory |

| Collision Injury Waiver (CDW) | Covers injury to the rental automotive particularly brought on by collisions. | Non-compulsory |

| Theft Safety | Protects in opposition to the theft of the rental car. | Non-compulsory |

| Private Accident Insurance coverage | Covers medical bills for you and your passengers in case of an accident. | Non-compulsory |

Understanding Extra

The idea of extra in UK automotive rental insurance coverage is a vital part to know. It represents a monetary safeguard for the rental firm, overlaying potential losses or damages past the coverage’s primary protection. Understanding how extra works helps renters handle their monetary accountability and anticipate potential prices.Extra is the quantity you, because the renter, are answerable for paying if injury or loss happens to the rental car.

This quantity is usually stipulated within the rental settlement and might differ considerably primarily based on the rental firm, car sort, and the precise rental phrases. It’s important to evaluation the rental settlement rigorously to grasp the exact extra quantity.

Defining Extra

Extra within the context of UK automotive rental insurance coverage is the predetermined quantity of economic accountability you, because the renter, are responsible for in case of an incident. This quantity is often stipulated within the rental settlement and is designed to mitigate potential losses for the rental firm.

How Extra Works in Completely different Rental Eventualities

Extra works equally throughout completely different rental eventualities. The surplus quantity is a set determine and is due whatever the circumstances main to wreck or loss. If an accident happens, or if the car is broken, you may be answerable for paying the surplus quantity, and any additional prices can be borne by the renter’s insurance coverage.

Decreasing or Eliminating Extra Fees

A number of methods may also help scale back or remove extra expenses. A typical method is to buy extra insurance coverage protection, often known as extra waivers or loss injury waivers (LDWs). This protection will cowl the surplus quantity in case of harm or loss. An alternative choice is to have complete automotive insurance coverage that extends to rental autos. In some circumstances, bank cards might provide journey insurance coverage that features rental automotive protection, which could embody extra safety.

Desk of Extra Eventualities

| State of affairs | Extra Impression | Mitigation Methods |

|---|---|---|

| Unintended injury to the car, comparable to a minor scratch or dent. | You’re responsible for the surplus quantity. | Buy extra waivers, guarantee your complete automotive insurance coverage covers rental autos. |

| Car theft. | You’re responsible for the surplus quantity. | Buy extra waivers, guarantee your complete automotive insurance coverage covers rental autos, evaluation safety measures. |

| Injury brought on by a 3rd occasion (e.g., a collision with one other car). | You’re responsible for the surplus quantity. | Buy extra waivers, guarantee your complete automotive insurance coverage covers rental autos, think about third-party legal responsibility insurance coverage. |

| Injury brought on by a pure catastrophe (e.g., flooding). | You’re responsible for the surplus quantity. | Buy extra waivers, guarantee your complete automotive insurance coverage covers rental autos. |

| Returning the car with gas degree beneath the agreed upon quantity. | Chances are you’ll be responsible for the surplus quantity relying on the rental settlement. | Examine the rental settlement rigorously, replenish the tank to the extent specified. |

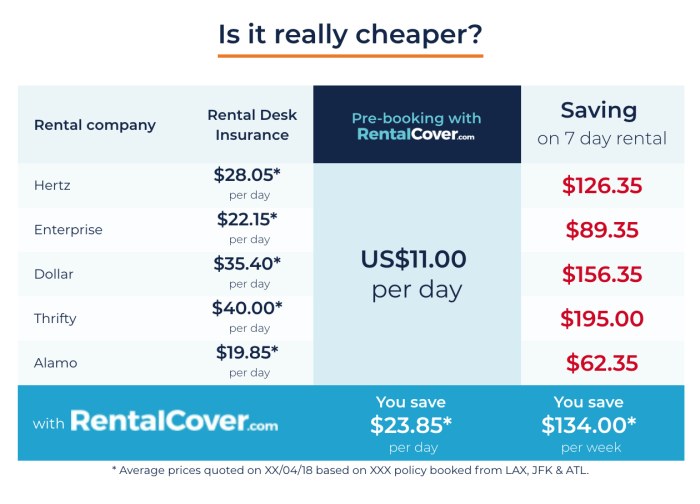

Evaluating Rental Firms

Cautious comparability of insurance coverage insurance policies provided by completely different UK automotive rental firms is essential for securing appropriate protection at the very best value. Understanding the nuances of every coverage helps you make an knowledgeable resolution that aligns together with your wants and finances. That is important for safeguarding your monetary pursuits and guaranteeing a clean rental expertise.

Components to Contemplate When Evaluating Insurance policies

Rental firms typically current their insurance coverage insurance policies in quite a lot of methods. Due to this fact, it is important to completely evaluation the precise phrases and situations of every coverage. Key elements to think about embody the extent of extra payable in case of harm or theft, the extent of the extra coverages offered, and the general value of the insurance coverage bundle. These elements can differ considerably between completely different rental firms.

Insurance coverage Coverage Examples from Completely different Firms

Evaluating insurance coverage insurance policies side-by-side permits for a clearer understanding of the protection provided by completely different rental firms. This direct comparability highlights the variations in extra quantities and extra protection choices. Every firm has distinctive insurance policies with particular exclusions and limitations.

| Rental Firm | Coverage Sort | Extra | Extra Protection |

|---|---|---|---|

| Firm A | Normal Insurance coverage | £1000 | Covers injury to the car, theft, and third-party legal responsibility. |

| Firm A | Premium Insurance coverage | £500 | Contains all customary coverages plus windscreen and tire injury safety. |

| Firm B | Primary Insurance coverage | £1500 | Covers injury to the car, theft, and third-party legal responsibility. Restricted protection for windscreen injury. |

| Firm B | Complete Insurance coverage | £750 | Covers all customary coverages plus windscreen and tire injury safety, and breakdown help. |

| Firm C | Economic system Insurance coverage | £1200 | Covers injury to the car, theft, and third-party legal responsibility. Doesn’t embody windscreen or tire safety. |

| Firm C | Full Insurance coverage | £250 | Covers all customary coverages plus windscreen, tire, and lack of keys safety. |

Comparability of Insurance coverage Insurance policies from Three Main Firms

The desk above supplies a simplified comparability of insurance coverage insurance policies from three main UK automotive rental firms. The offered information is a snapshot and doesn’t embody all attainable coverage variations. At all times check with the official coverage paperwork from every firm for exact particulars and full phrases.

Insurance coverage Claims Course of

Understanding the automotive rental insurance coverage claims course of is essential for navigating any potential incident whereas renting a car. A transparent understanding of the steps concerned, documentation necessities, and timeframes will present peace of thoughts and a structured method to resolving any points. This part particulars the process for submitting a declare within the UK.

Declare Initiation

The preliminary step in submitting a declare includes promptly reporting the incident to the rental firm. That is important because it triggers the declare course of and ensures the rental firm has fast information of the occasion. Thorough documentation of the circumstances surrounding the incident can also be important.

Documentation Necessities

Correct documentation is paramount for a clean declare course of. The required paperwork differ relying on the character of the incident. Usually, the next paperwork are needed:

- An in depth report of the incident, together with the date, time, location, and an outline of the occasion. This report ought to embody all related particulars comparable to witnesses’ contact info and any supporting proof, comparable to images of the injury or the accident scene.

- The rental settlement, which serves as an important doc outlining the phrases and situations of the rental. This doc will embody details about the insurance coverage protection.

- Police report, if relevant. In circumstances of accidents involving one other occasion or injury requiring police involvement, a police report is usually required.

- Proof of id, comparable to a driver’s license and passport. These paperwork confirm the id of the driving force and the renter.

- Proof of any injury to the car, comparable to pictures and movies. Detailed photographic documentation of the injury to the car, together with the extent and nature of the injury, is essential.

Timeframes for Declare Processing

Declare processing occasions within the UK can differ relying on the complexity of the incident and the insurance coverage supplier. A typical timeframe for processing a simple declare is round 14 to 21 days, though extra advanced conditions might lengthen the method. Insurance coverage firms sometimes present an estimated timeframe upon declare submission.

Step-by-Step Declare Submitting Information

The next steps Artikel the method of submitting a declare:

Step 1: Report the incident to the rental firm instantly and full the mandatory varieties.

Step 2: Collect all required documentation, together with the rental settlement, any police reviews, and proof of the injury.

Step 3: Submit the finished declare kind and all supporting documentation to the rental firm.

Step 4: The rental firm will assess the declare and phone the insurance coverage supplier.

Step 5: The insurance coverage supplier will examine the declare and decide on the protection.

Step 6: The rental firm will inform you of the end result and the following steps, together with any fee or compensation.

Avoiding Frequent Errors

Understanding the intricacies of UK automotive rental insurance coverage is essential to make sure a clean and hassle-free expertise. Nevertheless, frequent errors can result in vital monetary burdens and pointless stress. This part highlights frequent pitfalls and supplies preventive measures to safeguard your pursuits.Many renters overlook vital features of the rental settlement and insurance coverage insurance policies, resulting in unexpected penalties. By understanding potential errors and implementing proactive measures, you may keep away from these points and keep peace of thoughts throughout your rental interval.

Misinterpreting Insurance coverage Protection

A elementary mistake is failing to completely comprehend the scope of the insurance coverage provided. Rental insurance coverage insurance policies typically have exclusions and limitations. A complete understanding of the precise protection, together with what’s and is not included, is crucial to keep away from sudden monetary accountability. For instance, injury brought on by pre-existing situations on the car won’t be lined, or particular forms of incidents like deliberate injury may be excluded.

Neglecting Extra Data

Understanding the surplus quantity is significant. The surplus is the portion of the injury that you’re answerable for if a declare is made. Incorrectly assessing the surplus can result in substantial out-of-pocket bills. An intensive evaluation of the surplus quantity and the fee choices is crucial. This ensures a transparent understanding of your monetary dedication in case of an accident or injury.

Insufficient Documentation

Correct documentation is essential in case of a declare. This consists of the rental settlement, insurance coverage coverage particulars, and any proof of the injury or incident. Failure to correctly doc occasions can considerably hinder a declare course of. Detailed information of the situation of the car at first and finish of the rental interval, together with any proof of harm, are important for a clean declare course of.

Failing to Report Injury Promptly

Reporting injury promptly is essential for a clean declare course of. Delays in reporting can result in problems and rejection of claims. You will need to instantly report any injury, regardless of how minor it appears, to the rental firm and to maintain information of all communications. Immediate reporting and thorough documentation are vital for a profitable declare.

Ignoring Pre-existing Injury

Failing to notice pre-existing injury on the car at first of the rental can result in disputes and problems if that injury is later claimed as an incident throughout your rental interval. Rigorously examine the car completely upon pick-up and doc any present injury, scratches, or dents on the rental settlement and in pictures. This preventative measure ensures that pre-existing situations are clearly documented and avoids disputes.

Unfamiliar with Native Legal guidelines

Navigating native legal guidelines and rules is vital. Particular legal guidelines and rules regarding driving within the UK can affect insurance coverage protection. Familiarizing your self with these native legal guidelines is significant for a clean expertise and to make sure that your actions are compliant. This consists of checking for any particular rules relevant to your vacation spot and driving habits.

Potential Issues and Preventive Measures

- Drawback: Misinterpreting insurance coverage protection, resulting in sudden monetary accountability.

- Prevention: Rigorously learn and perceive the phrases and situations of the insurance coverage coverage, together with exclusions and limitations. Search clarification from the rental firm if any facet is unclear.

- Drawback: Neglecting extra info, leading to substantial out-of-pocket bills.

- Prevention: Totally evaluation the surplus quantity and obtainable fee choices. Perceive the implications of various extra choices.

- Drawback: Inadequate documentation, hindering declare processing.

- Prevention: Doc the situation of the car upon pickup with pictures and detailed notes. Hold copies of all communication associated to the rental and any reported injury.

- Drawback: Delaying injury reporting, doubtlessly main to say rejection.

- Prevention: Report any injury instantly, regardless of how minor, to the rental firm. Keep detailed information of all communication relating to the incident.

- Drawback: Failing to notice pre-existing injury, resulting in disputes.

- Prevention: Totally examine the car upon pickup, doc any pre-existing injury with images and the rental settlement. Be meticulous within the documentation course of.

- Drawback: Ignorance of native legal guidelines, doubtlessly affecting insurance coverage protection.

- Prevention: Analysis native driving legal guidelines and rules earlier than your rental interval. Seek the advice of with a authorized skilled if wanted for clarification on particular points.

Authorized Implications

Driving a rental automotive within the UK with out satisfactory insurance coverage carries vital authorized ramifications. Failing to adjust to insurance coverage necessities can result in critical penalties, affecting not solely your private funds but in addition your freedom. Understanding these implications is essential for accountable and compliant automotive rental practices.Comprehending the authorized implications of inadequate automotive rental insurance coverage is paramount. This part Artikels the potential penalties and authorized repercussions that may come up from working a rental car with out correct insurance coverage protection.

This information equips people with the attention wanted to navigate the complexities of UK rental automotive insurance coverage, fostering accountable and lawful driving practices.

Potential Authorized Penalties

Driving a rental automotive with out ample insurance coverage violates UK regulation and carries substantial penalties. Failure to stick to those rules may end up in varied authorized repercussions, starting from monetary penalties to felony prosecution in extreme circumstances. The severity of the penalties typically will depend on the extent of the injury induced and the circumstances surrounding the incident.

Fines and Penalties

The UK has a system of penalties for violating site visitors legal guidelines, together with these associated to insurance coverage. These penalties can vary from substantial fines to potential imprisonment. The particular quantity of a high-quality will depend on the character of the offense and the severity of the circumstances. For instance, driving with out insurance coverage might end in a big high-quality, and the courtroom might impose extra expenses primarily based on the precise particulars of the case.

Legal Prosecution

In circumstances of reckless driving, a scarcity of insurance coverage generally is a contributing issue that intensifies the severity of the authorized penalties. If a driver causes vital injury or harm whereas working a car with out insurance coverage, they might face felony expenses. That is very true if the reckless driving includes negligence or intentional hurt. Examples embody conditions the place a driver is concerned in a critical accident, inflicting vital injury or hurt to others, and it is decided that their driving conduct contributed to the incident.

The authorized course of might contain intensive investigations and hearings, doubtlessly resulting in substantial fines, imprisonment, and a felony file.

Potential Penalties for Completely different Sorts of Injury

| Injury Sort | Potential Penalties |

|---|---|

| Minor injury (e.g., scratches, dents) | Important fines, potential courtroom look, and potential driving disqualification. |

| Reasonable injury (e.g., injury to different autos, vital property injury) | Greater fines, doubtlessly extra extreme courtroom proceedings, and the next threat of driving disqualification. |

| Severe injury (e.g., accidents involving accidents or fatalities) | Doubtlessly very excessive fines, substantial imprisonment, felony prosecution, and a felony file. |

Word: The particular penalties for every sort of harm are topic to the severity of the circumstances, as judged by the courtroom. This desk supplies a basic overview, and the precise penalties might differ.

Insurance coverage for Particular Car Sorts

Insurance coverage insurance policies for rental vehicles typically differ primarily based on the car sort. Understanding these variations is essential for choosing applicable protection and avoiding monetary dangers. Completely different car sorts typically have completely different insurance coverage wants attributable to various ranges of vulnerability to wreck or theft.

Luxurious Automobile Insurance coverage

Luxurious vehicles, attributable to their greater worth, sometimes include the next insurance coverage premium. This elevated value displays the larger monetary accountability for potential injury or theft. Insurance coverage insurance policies for luxurious autos typically embody complete protection, together with safety in opposition to injury from accidents, vandalism, and even pure disasters. They typically embody enhanced options like 24/7 roadside help and better legal responsibility limits.

Moreover, the insurance coverage insurance policies typically embody an intensive guarantee or safety plan, safeguarding in opposition to unexpected mechanical failures and guaranteeing the automotive’s situation.

Van Insurance coverage

Van insurance coverage insurance policies are designed to deal with the distinctive traits of vans. These insurance policies typically embody extra protection for cargo safety, guaranteeing that the contents of the van are additionally insured in case of theft or injury. Legal responsibility protection can also be vital, as vans are sometimes used for business functions. The coverage will even take into accounts the car’s measurement and the character of the deliberate utilization.

Insurance coverage firms assess the chance profile of van utilization, contemplating elements just like the frequency of journeys and the forms of items transported.

Motorbike Insurance coverage

Motorbike insurance coverage insurance policies sometimes have completely different protection ranges in comparison with automotive insurance coverage. The particular wants of bikes are taken under consideration in these insurance policies, which could not cowl each facet of a automotive coverage. Protection for bikes often emphasizes legal responsibility and collision, because of the elevated threat of accidents given their smaller measurement and lack of a protecting cage.

The protection additionally typically consists of safety in opposition to theft. An in depth evaluation of the coverage is essential to grasp the constraints and exclusions, which may differ significantly.

Desk Evaluating Insurance coverage Prices for Completely different Car Sorts

| Car Sort | Insurance coverage Value | Extra Concerns |

|---|---|---|

| Luxurious Automobiles | Greater | Greater worth, complete protection, enhanced options |

| Vans | Variable, typically greater than vehicles of comparable measurement | Cargo safety, legal responsibility protection, measurement and utilization issues |

| Bikes | Variable, typically decrease than vehicles | Legal responsibility, collision, theft protection, smaller measurement, lack of a protecting cage |

Concluding Remarks

In conclusion, understanding UK automotive rental insurance coverage is paramount to a protected and hassle-free automotive rental expertise. By greedy the ideas of various insurance policies, important coverages, extra expenses, and the claims course of, you are well-equipped to make sound selections. Bear in mind to check insurance policies between rental firms, and thoroughly evaluation the phrases and situations. With this information, you will be able to hit the highway with confidence.

Knowledgeable Solutions

What’s the typical extra quantity for a UK automotive rental?

Extra quantities differ considerably relying on the rental firm and the kind of car. It is essential to examine the precise coverage particulars of the rental firm you select.

What if I injury the automotive past the surplus quantity?

You may be answerable for the total value of the injury past the agreed extra. Thorough analysis and comparability of rental firms are key to figuring out the very best worth and safety.

Are there any hidden charges related to UK automotive rental insurance coverage?

At all times evaluation the high-quality print. Some insurance policies might embody extra charges for particular conditions, comparable to injury to particular automotive elements or mileage restrictions. Rigorously scrutinize the phrases and situations earlier than confirming your reserving.

How lengthy does it sometimes take to course of a UK automotive rental insurance coverage declare?

Processing occasions for insurance coverage claims differ primarily based on the rental firm and the complexity of the declare. It is sensible to contact the rental firm on to inquire about estimated processing occasions.