Prudential insurance coverage long run care – Prudential insurance coverage long-term care gives important safety in opposition to the escalating prices of future care. This information delves into the intricacies of Prudential’s insurance policies, inspecting protection choices, prices, and the claims course of. Understanding your wants and out there selections is essential when going through potential long-term care bills.

From understanding completely different coverage sorts and advantages to evaluating Prudential with different insurers, this complete overview empowers you to make knowledgeable selections. We’ll navigate the complexities of long-term care insurance coverage, guaranteeing you may have the data to plan for the long run.

Introduction to Lengthy-Time period Care Insurance coverage

Lengthy-term care insurance coverage is an important monetary instrument for safeguarding your self and your family members in opposition to the numerous prices related to extended healthcare wants. It gives a security internet when conventional assets are inadequate to cowl the escalating bills of caregiving, nursing houses, or in-home help. This safety is especially invaluable in a world the place healthcare prices proceed to rise.Understanding the varied elements of long-term care insurance coverage is crucial for making knowledgeable selections about your monetary safety.

This data empowers you to safeguard your future well-being and peace of thoughts.

Definition of Lengthy-Time period Care Insurance coverage

Lengthy-term care insurance coverage is a kind of insurance coverage coverage designed to cowl the prices of long-term care companies. These companies can embrace help with actions of day by day dwelling (ADLs), corresponding to bathing, dressing, and consuming, in addition to medical care and expert nursing. It is distinct from different sorts of insurance coverage, corresponding to medical health insurance, specializing in the long-term care side of growing older or incapacity.

Kinds of Lengthy-Time period Care Insurance coverage Insurance policies

Completely different long-term care insurance coverage insurance policies cater to various wants and budgets. These insurance policies range of their profit constructions, premiums, and protection durations. The commonest sorts embrace:

- Mounted Profit Insurance policies: These insurance policies provide a predetermined greenback quantity per day or per 30 days of care. This enables for predictable payouts whatever the particular care required.

- Indemnity Insurance policies: These insurance policies reimburse a share of the particular prices of care. These can provide extra flexibility however could require a better out-of-pocket expense.

- Care Administration Insurance policies: These insurance policies usually embrace companies that join the policyholder with care suppliers. This will embrace help with choosing the proper care choices and coordinating caregiving.

Frequent Advantages and Options

Lengthy-term care insurance coverage insurance policies usually embrace a variety of advantages and options. These components are essential for assessing the coverage’s suitability in your particular person wants. Key options embrace:

- Protection for varied care settings: Insurance policies could cowl care in nursing houses, assisted dwelling amenities, in-home care, and even grownup day care facilities.

- Selection of profit quantities: Policyholders can choose day by day or month-to-month profit quantities that align with their anticipated wants and funds.

- Coordination of advantages: Insurance policies usually combine with different present insurance policy to keep away from overlapping funds and guarantee environment friendly use of assets.

- Waiver of premium choices: Some insurance policies provide the choice of waiving premiums after a sure interval of care is obtained.

Prices Related to Lengthy-Time period Care Insurance coverage

The prices of long-term care insurance coverage range considerably primarily based on elements such because the coverage sort, protection quantity, and the policyholder’s age and well being. Premiums are usually calculated primarily based on these elements.

- Premiums: Premiums are the periodic funds made to the insurance coverage firm. They rely on particular person circumstances and the chosen protection.

- Ready intervals: Most insurance policies have ready intervals earlier than advantages start, which may range considerably.

- Annual evaluation: Policyholders ought to fastidiously evaluation their coverage yearly to make sure that it aligns with their evolving wants and circumstances.

Key Variations Between Coverage Sorts

The next desk Artikels the important thing distinctions between completely different long-term care insurance coverage coverage sorts:

| Coverage Kind | Advantages | Premiums |

|---|---|---|

| Mounted Profit | Predetermined day by day/month-to-month profit quantities | Typically decrease premiums in comparison with indemnity insurance policies |

| Indemnity | Reimbursement primarily based on precise care prices | Typically greater premiums in comparison with fastened profit insurance policies |

| Care Administration | Help to find and coordinating care suppliers | Premiums can range, usually together with administrative charges |

Prudential Lengthy-Time period Care Insurance coverage: Prudential Insurance coverage Lengthy Time period Care

Prudential Monetary, a famend title within the insurance coverage business, affords a variety of long-term care insurance coverage merchandise designed to assist people navigate the monetary complexities of future care wants. Understanding their particular choices and the way they examine to different main insurers can empower you to make knowledgeable selections. This part delves into Prudential’s historical past, product options, aggressive panorama, and total worth proposition.Prudential’s long-term care insurance coverage merchandise present an important security internet in opposition to the rising prices of long-term care.

Their choices are tailor-made to deal with varied particular person wants and monetary conditions, providing a variety of choices for policyholders. This detailed evaluation explores the strengths and weaknesses of Prudential’s insurance policies in comparison with different main insurers available in the market.

Prudential’s Historical past and Popularity in Lengthy-Time period Care

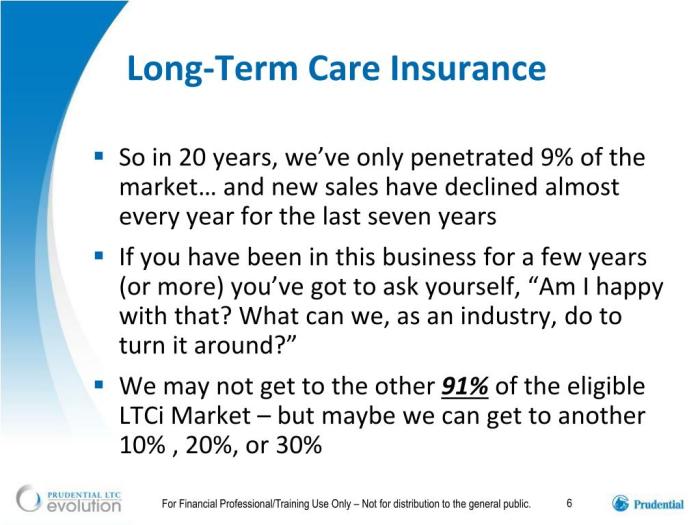

Prudential has an extended and established presence within the insurance coverage market, with a confirmed monitor document of offering complete protection options. Their fame is constructed on years of expertise and a dedication to offering dependable and safe merchandise for his or her policyholders. Prudential has a considerable market share in long-term care insurance coverage, indicating a acknowledged stage of belief and credibility.

Particular Options of Prudential’s Lengthy-Time period Care Insurance policies

Prudential’s long-term care insurance coverage insurance policies usually provide a wide range of customizable choices. These embrace completely different profit quantities, day by day care protection, and varied fee choices. Protection choices usually embrace particular care sorts corresponding to nursing residence care, assisted dwelling, and residential care. Coverage phrases are versatile, and a few insurance policies enable for riders to reinforce the protection, corresponding to inflation safety or growing profit quantities.

Many Prudential insurance policies have clear definitions of eligible bills, guaranteeing policyholders perceive the extent of their protection.

Comparability with Different Main Insurers

The long-term care insurance coverage market contains quite a few rivals, every with their very own strengths and weaknesses. Prudential’s choices are sometimes in comparison with these of MetLife, AIG, and different main gamers within the area. Key distinctions lie in coverage phrases, profit quantities, premiums, and the precise sorts of care coated. Understanding these nuances is vital for potential policyholders.

Benefits and Disadvantages of Selecting Prudential

Prudential’s long-term care insurance coverage merchandise provide a complete array of advantages, usually with enticing premiums and customizable options. Nonetheless, policyholders ought to pay attention to potential limitations, corresponding to ready intervals, profit limitations, and restrictions on sure care sorts. Prudential’s fame and monetary stability are vital benefits, however the price of premiums can range relying on particular person circumstances.

Coverage Comparability Desk

| Function | Prudential | MetLife | AIG |

|---|---|---|---|

| Profit Quantity (day by day) | $200-$500 | $150-$400 | $250-$550 |

| Ready Interval | 90 days | 60 days | 90 days |

| Inflation Safety | Sure (adjustable) | Sure (fastened charge) | Sure (variable charge) |

| Premiums (instance – $500 day by day profit) | $50-$100/month | $45-$90/month | $60-$110/month |

Prudential’s insurance policies regularly provide adjustable inflation safety, permitting policyholders to adapt their protection to altering care prices over time.

Protection and Advantages

Securing your future well-being requires a complete understanding of the long-term care insurance coverage protection you are contemplating. Prudential’s insurance policies provide a spectrum of advantages designed to deal with the various wants of people going through potential long-term care necessities. This part delves into the scope of protection, outlining particular advantages and essential concerns.Prudential’s long-term care insurance coverage insurance policies are structured to offer monetary assist in periods of prolonged care wants.

These insurance policies, tailor-made to completely different circumstances and monetary conditions, provide various ranges of protection. Understanding the precise protection and advantages is crucial to creating an knowledgeable determination about your monetary safety.

Scope of Protection

Prudential’s long-term care insurance coverage insurance policies usually cowl a variety of companies, from expert nursing care to assisted dwelling and residential well being care. The precise companies coated rely on the chosen coverage and its choices.

Particular Advantages in Coverage Choices

The advantages inside every coverage possibility range. Some insurance policies could cowl expert nursing amenities, whereas others could embrace residence well being care or assisted dwelling amenities. Elements like day by day profit quantities, profit intervals, and most protection quantities considerably affect the general worth of the coverage.

Examples of Important Protection

Lengthy-term care insurance coverage is essential for conditions the place people require help with day by day actions as a result of continual diseases or disabilities. For instance, an individual with Alzheimer’s illness could require in depth care, making long-term care insurance coverage a significant monetary useful resource. One other instance is a stroke survivor needing rehabilitation and ongoing care; insurance coverage can considerably ease the monetary burden. Equally, people experiencing a progressive sickness like Parkinson’s illness or a number of sclerosis could discover the protection invaluable.

Exclusions and Limitations

Whereas Prudential’s long-term care insurance coverage goals to offer complete protection, it is important to pay attention to exclusions and limitations. These exclusions and limitations range by coverage. Elements like pre-existing situations, particular diagnoses, and the kind of care required can affect the protection. It is essential to evaluation the coverage particulars completely to know any exclusions or limitations which will apply.

This contains understanding the ready intervals, profit intervals, and any situations which will affect protection.

Kinds of Care Lined, Prudential insurance coverage long run care

| Kind of Care | Description |

|---|---|

| Expert Nursing Amenities | Care supplied by licensed professionals, together with nurses and therapists, for people requiring intensive medical supervision and remedy. |

| Assisted Dwelling Amenities | Supportive dwelling environments providing help with day by day actions, corresponding to dressing, bathing, and meal preparation. |

| House Well being Care | In-home companies supplied by educated professionals, together with nurses, bodily therapists, and occupational therapists, to keep up or enhance useful skills. |

| Grownup Day Care | Care supplied in the course of the day to people requiring help with day by day actions, permitting relations to keep up their work and private schedules. |

This desk gives a common overview of the sorts of care coated by Prudential’s long-term care insurance coverage insurance policies. A complete evaluation of the coverage paperwork is important to make sure that the precise wants of the insured particular person are absolutely addressed.

Coverage Choice and Elements to Contemplate

Selecting the best long-term care insurance coverage coverage is an important step towards securing your future. It is not merely about deciding on a product; it is about aligning a monetary safeguard together with your particular wants and circumstances. This course of calls for cautious consideration, thorough analysis, and a proactive method to understanding the complexities of long-term care insurance coverage.Understanding your distinctive wants and circumstances is paramount when evaluating long-term care insurance coverage insurance policies.

A one-size-fits-all method isn’t efficient. Every particular person’s monetary scenario, well being historical past, and anticipated care necessities will form the optimum coverage design. A complete evaluation ensures the chosen coverage successfully addresses your particular issues.

Assessing Particular person Wants and Monetary Scenario

A vital preliminary step includes evaluating your present monetary scenario and future care wants. Contemplate elements like your projected lifespan, well being situations, and potential for continual sickness. The anticipated price of care in your space can also be a major issue. A practical evaluation of your monetary assets will assist decide the extent of protection you want and the premiums you possibly can comfortably afford.

Detailed monetary planning is crucial for knowledgeable decision-making.

Evaluating Coverage Choices

Evaluating completely different coverage choices is an important side of the choice course of. Fastidiously study protection particulars, premiums, and advantages to determine one of the best match. Understanding the coverage’s particular phrases and situations is important for a transparent comprehension of your rights and tasks.

Coverage Comparability Methodology

A structured method to evaluating insurance policies will guarantee a transparent understanding of every possibility. A desk format can successfully illustrate the variations between varied insurance policies.

| Coverage Supplier | Protection Quantity | Premium Quantity | Profit Interval | Exclusions |

|---|---|---|---|---|

| Firm A | $5,000 per 30 days | $500 per 30 days | Limitless | Pre-existing situations, psychiatric care |

| Firm B | $4,000 per 30 days | $400 per 30 days | 5 years | Actions of day by day dwelling (ADLs) not coated |

| Firm C | $6,000 per 30 days | $650 per 30 days | 10 years | Expert nursing facility care solely |

This desk affords a simplified comparability. A extra complete evaluation will necessitate reviewing every coverage’s nice print and understanding the precise particulars of protection, exclusions, and limitations.

Coverage Exclusions and Limitations

It is important to fastidiously scrutinize coverage exclusions and limitations. These clauses outline conditions the place the coverage could not present protection. Understanding these provisions is essential to make sure that the coverage aligns together with your wants and avoids potential pitfalls. Reviewing coverage exclusions and limitations intimately is vital to avoiding disagreeable surprises. For instance, some insurance policies could exclude protection for pre-existing situations, or restrict protection for sure sorts of care.

This cautious analysis is important for a sound monetary technique.

Prices and Premiums

Unlocking the long run usually requires a monetary dedication, and long-term care insurance coverage isn’t any exception. Understanding the prices and premiums concerned is essential for making knowledgeable selections about your future well-being. By comprehending the elements influencing these prices, you possibly can strategically select a coverage that aligns together with your funds and desires.Premiums for long-term care insurance coverage usually are not static; they’re dynamic, responsive to numerous elements.

This dynamic nature requires a proactive method to understanding the interaction between these components and the ensuing affect in your total monetary technique.

Elements Affecting Premiums

Premiums for long-term care insurance coverage are influenced by a number of essential elements. These elements assist insurers assess the chance related to offering protection for future care wants.

- Age: Your age is a major determinant of premiums. Youthful people typically pay decrease premiums in comparison with older people, reflecting the diminished probability of needing long-term care at a youthful age.

- Well being Standing: Your present well being standing performs a major function. People with pre-existing well being situations or continual diseases usually face greater premiums. Insurers fastidiously assess the potential danger of long-term care wants related to these situations.

- Protection Quantity: The quantity of protection you choose instantly impacts the premium. Insurance policies providing greater protection ranges usually end in greater premiums.

- Coverage Options: Particular coverage options, corresponding to the kind of care coated (e.g., expert nursing, assisted dwelling), the period of protection, and profit fee choices, affect the premium. Contemplate the vary of care choices provided and select a coverage that meets your anticipated wants.

- Ready Durations: Insurance policies with shorter ready intervals usually include greater premiums, reflecting the insurer’s evaluation of elevated danger with expedited protection.

Premium Examples

Insurance coverage firms use actuarial information and varied danger evaluation fashions to find out premium quantities. These fashions are designed to mirror the potential prices related to offering long-term care, making an allowance for elements like age, well being, and coverage options.

Contemplate two people, each 65 years previous. Particular person A has wonderful well being and chooses a coverage with a modest protection quantity and an extended ready interval. Particular person B has a pre-existing situation and selects a coverage with a better protection quantity and a shorter ready interval.

Predictably, Particular person B’s premium could be greater than Particular person A’s because of the mixed elements of pre-existing situation and better protection.

Premium Comparability Desk

The next desk illustrates how premiums can range primarily based on coverage sort and protection quantity. This comparability is illustrative and never exhaustive; precise premiums will range primarily based on particular person circumstances.

| Coverage Kind | Protection Quantity (per 12 months) | Estimated Annual Premium |

|---|---|---|

| Primary | $50,000 | $2,500 |

| Customary | $100,000 | $4,000 |

| Complete | $200,000 | $6,500 |

Lengthy-Time period Value Concerns

Evaluating the long-term price of long-term care insurance coverage includes extra than simply the preliminary premium. It is vital to think about the cumulative price over the coverage’s period.

Insurance policies with greater premiums may provide extra complete protection or quicker profit entry, doubtlessly saving you cash in the long term should you require substantial care. A coverage with a decrease premium could also be extra reasonably priced initially, however the cumulative price over time might be larger if the protection is inadequate to satisfy your wants.

Claims Course of and Administration

Unlocking the peace of thoughts that comes with long-term care insurance coverage hinges on a easy and environment friendly claims course of. Prudential’s dedication to streamlined administration ensures a swift and clear journey for you and your family members when the time comes. Understanding the declare course of empowers you to navigate this vital side with confidence.The Prudential long-term care insurance coverage claims course of is designed to be simple and supportive, guiding you thru every step with readability and effectivity.

This part particulars the method, administrative assist, and typical timeframes, equipping you with the data to confidently pursue your declare.

Declare Submitting Process

Submitting a declare for long-term care advantages is a structured course of designed to make sure accuracy and effectivity. Initiating the declare course of includes gathering the mandatory documentation and meticulously finishing the declare types. This meticulous method ensures that your declare is processed appropriately and effectively.

- Collect Required Documentation: Compile all crucial supporting paperwork, together with medical information, doctor statements, and related monetary data. Correct documentation is essential for a swift declare processing. Make sure the paperwork are clear, concise, and available.

- Full Declare Kinds Precisely: Fastidiously evaluation and full all sections of the declare type, offering all requested data. Finishing the types with precision minimizes delays and ensures the declare is processed precisely.

- Submit Declare to Prudential: Comply with the directions Artikeld in your coverage doc to submit the finished declare type and supporting documentation to Prudential. Use the designated channels for submission to keep up a transparent audit path.

Administrative Help

Prudential affords complete administrative assist to make sure a easy claims course of. This contains devoted declare representatives, entry to on-line portals, and ongoing communication updates. This assist is vital for guaranteeing a constructive expertise all through the method.

- Devoted Declare Representatives: Prudential’s declare representatives are educated to help you with any questions or issues you will have in the course of the declare course of. They act as your level of contact for steering and updates.

- On-line Portals: Entry to safe on-line portals means that you can monitor the standing of your declare, submit paperwork, and talk with declare representatives effectively. This streamlined method retains you knowledgeable and in management.

- Communication Updates: Prudential gives common updates on the standing of your declare. You’ll obtain well timed notifications about any crucial follow-up actions, guaranteeing you’re well-informed all through the method.

Declare Processing Timeframe

The processing time for a long-term care insurance coverage declare can range relying on a number of elements, together with the complexity of the declare and the provision of supporting documentation. Prudential strives to course of claims effectively, usually inside an outlined timeframe. Examples embrace 30 to 60 days for routine claims, whereas extra advanced claims may prolong to 90 days.

“Prudential’s dedication to well timed declare processing displays our dedication to supporting policyholders throughout difficult instances.”

Declare Course of Flowchart

The next flowchart illustrates the everyday declare course of for long-term care insurance coverage.[Imagine a simple flowchart here. It would start with “Policyholder submits claim” and proceed through steps like “Gathering documentation,” “Form completion,” “Submission to Prudential,” “Review by claim representative,” “Potential follow-up requests,” “Claim approval/denial,” and “Payment.” Each step would have arrows connecting them.]The flowchart visually represents the sequential steps concerned, highlighting the important thing phases and potential interactions with Prudential representatives.

This visible help helps to know the method’s linearity and effectivity.

Buyer Critiques and Testimonials

Understanding buyer experiences with Prudential’s long-term care insurance coverage is essential for evaluating its effectiveness and worth. Buyer critiques and testimonials provide direct insights into policyholder satisfaction, highlighting each constructive and detrimental elements of the product. Analyzing this suggestions permits us to higher comprehend the coverage’s strengths and weaknesses from the angle of those that have utilized or thought-about it.

Abstract of Buyer Suggestions

Buyer critiques on varied platforms, corresponding to on-line boards and insurance coverage comparability web sites, present a combined bag of opinions concerning Prudential’s long-term care insurance coverage. Some policyholders specific profound satisfaction with the protection and claims course of, whereas others voice issues in regards to the complexity of the coverage or the perceived price.

Constructive Suggestions Examples

Constructive suggestions usually facilities across the perceived reliability of the insurance coverage firm’s claims dealing with. Many testimonials emphasize a easy and environment friendly claims course of, with policyholders expressing gratitude for immediate and honest reimbursements for care companies. Some additionally commend the comprehensiveness of protection, noting it adequately addressed their particular long-term care wants. Moreover, the readability of coverage paperwork and responsive customer support representatives are regularly cited as strengths.

“I used to be extremely impressed with the pace and effectivity of the claims course of. Prudential dealt with all the things with care and professionalism, making a tough time a lot simpler.”

John Smith

Damaging Suggestions Examples

Damaging suggestions usually focuses on the perceived complexity of the coverage’s phrases and situations. Some prospects specific frustration with navigating the coverage’s intricacies and the executive burden related to managing their claims. Others cite the comparatively excessive premiums as a major downside. Often, issues are raised concerning the provision of sure protection choices or the perceived inflexibility of the coverage.

“The coverage was too sophisticated to know, and the preliminary paperwork was overwhelming. I felt misplaced within the particulars and anxious about making errors.”

Jane Doe

Total Sentiment Evaluation

The general sentiment expressed in buyer critiques is mostly constructive, but nuanced. Whereas many shoppers reward the effectivity and reliability of the claims course of and the comprehensiveness of the protection, a major minority voices issues in regards to the complexity and price. This means a necessity for doubtlessly clearer coverage explanations and extra accessible buyer assist.

Options and Comparisons

Embarking on the journey to safe your future well-being usually includes contemplating varied avenues. Understanding the spectrum of long-term care insurance coverage choices empowers you to make knowledgeable selections, aligning your safety together with your distinctive wants and monetary circumstances. This exploration delves into various choices past Prudential, highlighting their strengths and weaknesses.Evaluating various long-term care insurance coverage choices is a vital step in securing complete safety.

This comparability course of means that you can tailor your technique to maximise advantages and decrease prices. Analyzing the professionals and cons of every various helps you choose the coverage that most closely fits your long-term care wants.

Different Lengthy-Time period Care Insurance coverage Choices

Quite a few choices exist past Prudential’s insurance policies. These various choices could embrace these provided by different insurance coverage suppliers, authorities applications, and even self-funding methods. Understanding these alternate options permits for a extra thorough analysis of your total safety technique.

- Different Personal Insurers: Many personal insurers provide long-term care insurance coverage insurance policies with various protection choices and premiums. Evaluating insurance policies throughout completely different insurers, like contemplating completely different suppliers for medical health insurance, means that you can discover essentially the most appropriate match in your particular person wants.

- Authorities Applications: Authorities applications, corresponding to Medicaid, can doubtlessly cowl long-term care bills. Nonetheless, eligibility necessities and protection limits range considerably. Remember that eligibility for presidency applications could also be affected by your belongings and revenue ranges.

- Self-Funding Methods: People could select to self-fund long-term care bills via financial savings or investments. This method requires cautious monetary planning and a major monetary reserve, given the potential unpredictability of long-term care prices.

Comparability of Prudential Insurance policies to Opponents

This comparative evaluation gives a concise overview of key options and concerns, aiding within the choice of essentially the most applicable coverage. It is important to match not simply the premiums, but additionally the protection particulars, because the specifics of protection can range enormously.

| Function | Prudential | Firm A | Firm B |

|---|---|---|---|

| Month-to-month Premium (Instance, $100,000 Profit) | $500 | $450 | $550 |

| Every day Profit Quantity | $250 | $200 | $300 |

| Elimination Interval (Days) | 90 | 180 | 30 |

| Profit Interval Restrict (Years) | 5 | 10 | 7 |

| Coverage Rider Choices | Sure (e.g., inflation safety) | Sure (e.g., supplemental protection) | Sure (e.g., prolonged care) |

| Buyer Service Ranking | 4.5/5 | 4.2/5 | 4.7/5 |

“Evaluating insurance coverage insurance policies includes extra than simply worth; contemplate protection limits, elimination intervals, and profit interval limits. Thorough analysis is essential for locating essentially the most appropriate long-term care plan.”

Professionals and Cons of Every Different

A complete understanding of the benefits and drawbacks of every possibility is essential. Analyzing the strengths and weaknesses of various methods can assist you align your selections together with your monetary objectives.

- Different Personal Insurers: Professionals: Number of plans, doubtlessly decrease premiums, and doubtlessly higher protection choices. Cons: Premiums should be substantial, and protection could range considerably throughout insurance policies.

- Authorities Applications: Professionals: Potential for cost-free or low-cost protection. Cons: Strict eligibility necessities, restricted protection, and potential lengthy wait instances for approval.

- Self-Funding Methods: Professionals: Potential for full management over funds and adaptability. Cons: Vital monetary dedication, potential for inadequate funds, and lack of insurance-related safeguards.

Lengthy-Time period Care Planning

Embarking on a journey towards monetary safety requires a proactive method, notably when contemplating long-term care. Proactive planning ensures your future well-being and peace of thoughts, safeguarding your independence and family members from unexpected circumstances. This includes not solely understanding your choices but additionally creating a method tailor-made to your particular wants and objectives.Lengthy-term care planning is not nearly insurance coverage; it is about orchestrating a complete technique in your future well-being.

It is about anticipating potential wants, safeguarding your belongings, and guaranteeing your high quality of life stays excessive all through your later years. This proactive method transforms uncertainty right into a manageable pathway, fostering a way of management and confidence.

Significance of Lengthy-Time period Care Planning

Lengthy-term care planning is essential for sustaining monetary stability and preserving independence throughout doubtlessly prolonged intervals of care. Unexpected well being crises can result in substantial monetary pressure if not anticipated. Failing to plan can lead to depleting financial savings, jeopardizing retirement funds, and doubtlessly burdening relations with sudden bills. A well-defined plan alleviates these issues, offering a security internet for each you and your family members.

Steps in Growing a Complete Lengthy-Time period Care Plan

Creating a strong long-term care plan requires a structured method. Start by assessing your present monetary scenario, together with belongings, liabilities, and projected revenue streams. Understanding your anticipated long-term care wants is paramount. This includes contemplating potential well being situations, dwelling preparations, and the extent of care required. Consider varied care choices, corresponding to assisted dwelling, nursing houses, or residence healthcare.

This evaluation is essential for correct planning and choice of applicable protection.

- Monetary Evaluation: Consider present belongings, liabilities, and projected revenue. Contemplate anticipated future revenue adjustments and potential bills.

- Wants Evaluation: Determine potential well being situations and dwelling preparations. Contemplate the extent of care possible wanted, together with medical, private, and day by day dwelling help.

- Care Choices Analysis: Discover completely different care choices, corresponding to assisted dwelling, nursing houses, and residential healthcare. Assess prices related to every possibility.

- Insurance coverage Analysis: Analysis and examine long-term care insurance coverage insurance policies. Perceive protection particulars, premiums, and claims processes.

- Authorized and Property Planning: Seek the advice of with authorized and monetary professionals to make sure your property plan aligns together with your long-term care objectives.

- Evaluation and Adjustment: Commonly evaluation and regulate your plan as your circumstances change. Life occasions, corresponding to job adjustments or well being developments, require periodic changes.

Function of Lengthy-Time period Care Insurance coverage in a Broader Monetary Plan

Lengthy-term care insurance coverage performs a significant function in a complete monetary plan. It acts as an important security internet, mitigating the monetary affect of prolonged care. By offering a pre-funded useful resource, insurance coverage protects retirement financial savings and belongings, guaranteeing that these assets can be found for different life objectives. It additionally helps households keep away from vital monetary burdens, lowering the pressure on family members.

Flowchart: Making a Lengthy-Time period Care Plan

A easy flowchart illustrating the important thing steps in making a long-term care plan:

[Start] --> Monetary Evaluation --> Wants Evaluation --> Care Choices Analysis --> Insurance coverage Analysis --> Authorized and Property Planning --> Evaluation and Adjustment --> [End]

Finish of Dialogue

In conclusion, prudential insurance coverage long-term care is usually a essential part of a complete monetary plan. By understanding the completely different coverage choices, prices, and claims processes, you can also make well-informed selections about your future care wants.

Keep in mind to fastidiously contemplate your particular person circumstances and search skilled recommendation when crucial.

Query & Reply Hub

What are the everyday prices related to Prudential’s long-term care insurance policies?

Premiums range primarily based on elements like age, well being, and the chosen protection stage. An in depth desk within the information Artikels premium comparisons for various coverage sorts and protection quantities.

What are some alternate options to Prudential’s long-term care insurance coverage?

The information explores various choices, evaluating their options and advantages with Prudential’s insurance policies. This lets you assess the professionals and cons of every various and select one of the best match in your wants.

How do I examine completely different long-term care insurance coverage insurance policies?

The information gives a structured technique for evaluating insurance policies primarily based on protection, premiums, and advantages. A desk format facilitates simple comparability of key options.

What are the frequent exclusions and limitations in long-term care insurance coverage insurance policies?

Particular exclusions and limitations range by coverage. The information particulars these elements that will help you perceive the scope of protection and potential gaps in safety.