Is pressing care coated by insurance coverage Blue Cross Blue Defend? This complete information dives into the intricacies of pressing care protection below Blue Cross Blue Defend plans, offering a transparent understanding of what is coated, potential prices, and essential concerns.

We’ll discover the several types of Blue Cross Blue Defend plans, how protection may fluctuate, and what components can affect your protection quantity. We’ll additionally focus on potential out-of-pocket bills and the best way to navigate the claims course of. Understanding your rights and tasks is essential to getting the very best care.

Protection Overview

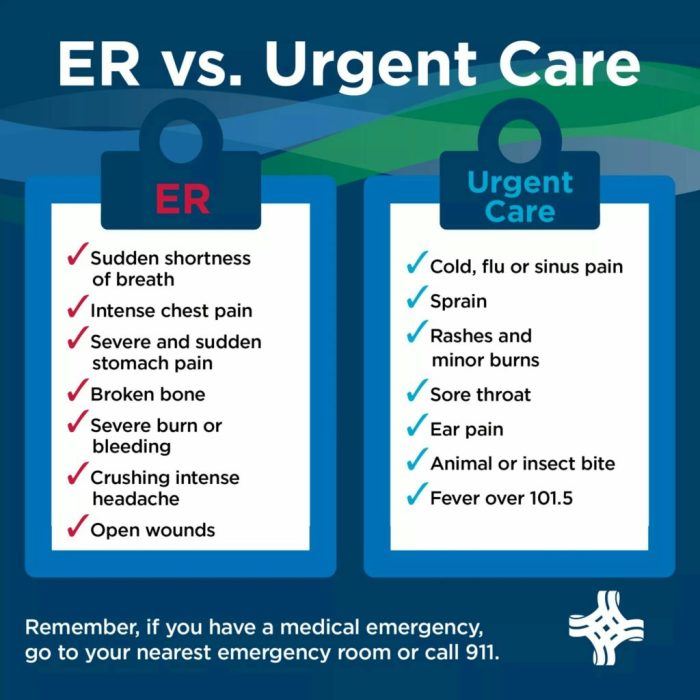

Understanding insurance coverage protection for pressing care companies is essential for managing healthcare bills properly. This part offers a complete overview of pressing care protection below Blue Cross Blue Defend plans, together with typical stipulations, plan variations, and particular service protection. Understanding your protection particulars helps you make knowledgeable selections about your healthcare wants.Pressing care companies are sometimes crucial for treating surprising sicknesses or accidents that require rapid medical consideration.

Blue Cross Blue Defend insurance coverage sometimes present protection for these companies, although the extent of protection can fluctuate considerably between totally different plans and the character of the pressing care go to.

Protection Stipulations

Blue Cross Blue Defend plans sometimes have particular stipulations relating to pressing care protection. These stipulations typically embody deductibles, co-pays, and protection percentages. Deductibles symbolize the quantity you have to pay out-of-pocket earlier than your insurance coverage begins overlaying prices. Co-pays are fastened quantities you pay every time you obtain a service. Protection percentages decide the portion of the associated fee your insurance coverage will cowl.

Completely different Sorts of Blue Cross Blue Defend Plans

Blue Cross Blue Defend gives varied plans, every with its personal nuances when it comes to pressing care protection. The kind of plan (e.g., HMO, PPO, EPO) can have an effect on the extent of protection, community entry, and out-of-network prices. Understanding the distinctions between these plan sorts is crucial for choosing a plan that meets your wants and monetary circumstances.

Pressing Care Providers and Protection

Pressing care companies embody a variety of medical wants, every with its personal potential protection below Blue Cross Blue Defend plans. The protection for companies like minor accidents, sicknesses requiring rapid consideration, or follow-up care after an emergency room go to, is commonly coated. Nonetheless, the particular particulars of protection might differ based mostly on the particular plan and the extent of the service required.

The extent of protection additionally varies relying on the character of the service.

Desk of Widespread Blue Cross Blue Defend Plans and Pressing Care Protection

| Plan Identify | Pressing Care Protection (%) | Deductible | Copay |

|---|---|---|---|

| Instance Plan A | 80% | $50 | $25 |

| Instance Plan B | 90% | $100 | $15 |

| Instance Plan C | 70% | $25 | $30 |

Be aware: This desk offers examples; precise protection percentages, deductibles, and co-pays might differ based mostly on the particular plan and placement. All the time seek the advice of your Blue Cross Blue Defend plan paperwork for exact particulars.

Components Affecting Protection

Understanding pressing care protection below Blue Cross Blue Defend plans requires cautious consideration of a number of components. Insurance coverage insurance policies are advanced, and protection specifics fluctuate considerably relying on the plan kind, location of the power, and the character of the companies rendered. Recognizing these nuances is essential for making knowledgeable selections about healthcare utilization.

Plan Sort Affect

Completely different Blue Cross Blue Defend plan sorts have various ranges of protection. Particular person plans typically supply much less complete protection than household plans, reflecting the differing wants and monetary conditions of policyholders. Household plans sometimes embody a broader vary of advantages, together with a better extent of protection for pressing care companies. This distinction in protection immediately pertains to the monetary burden and healthcare entry wants of the insured people inside the household unit.

Location of Pressing Care Facility

The placement of the pressing care facility can influence protection. Pressing care services situated inside a community of suppliers contracted with Blue Cross Blue Defend plans typically have higher protection charges. Out-of-network services might have decrease protection or require increased out-of-pocket funds. This distinction stems from the contractual agreements between the insurance coverage firm and collaborating suppliers, designed to handle prices and preserve an inexpensive degree of protection for insured people.

Particular Providers Rendered

The kind of companies rendered on the pressing care middle can have an effect on the extent of protection. Preventive care, like routine check-ups, typically has the next protection fee in comparison with pressing look after circumstances requiring extra specialised therapy. This distinction is as a result of various complexity and necessity of care supplied. Diagnostic testing and procedures is likely to be coated in a different way relying on the plan and the particular want.

For instance, imaging companies might have a decrease protection fee in comparison with routine medical consultations.

Protection Comparability Desk

| Plan Identify | Routine Test-up Protection (%) | Pressing Care Protection (%) |

|---|---|---|

| Instance Plan A (Particular person) | 90% | 80% |

| Instance Plan B (Household) | 100% | 90% |

| Instance Plan C (Excessive Deductible) | 95% | 75% |

This desk offers a simplified comparability. Precise protection percentages can fluctuate considerably based mostly on the specifics of every plan and the companies rendered. Components reminiscent of deductibles, co-pays, and out-of-pocket maximums additionally play a task within the remaining value to the insured particular person.

Out-of-Pocket Bills: Is Pressing Care Lined By Insurance coverage Blue Cross Blue Defend

Understanding the potential prices related to pressing care visits is essential for sound monetary planning. Understanding these bills empowers us to make knowledgeable selections about healthcare selections. This part particulars the out-of-pocket bills generally encountered when looking for pressing care below Blue Cross Blue Defend insurance coverage.

Potential Deductible Impacts

Deductibles symbolize a predetermined quantity a person should pay out-of-pocket earlier than the insurance coverage firm begins to cowl bills. Completely different insurance coverage have various deductible quantities. Assembly this deductible threshold is a crucial step earlier than the insurance coverage begins to pay its portion of the invoice. A better deductible means a bigger quantity you have to pay initially earlier than insurance coverage advantages kick in.

Copay Impacts

Co-pays are fastened quantities you pay every time you go to pressing care. They’re typically related to physician visits, pressing care, and different medical companies. Co-pays are typically smaller quantities than deductibles, however their frequency can influence your total out-of-pocket bills.

Coinsurance Impacts

Coinsurance is a share of the price of a service you are answerable for after the deductible is met. For instance, if a service prices $100 and your coinsurance is 20%, you may pay $20, whereas the insurance coverage firm pays $80. The precise quantity of coinsurance varies by the particular plan.

Pattern Situation of Out-of-Pocket Prices

The next desk demonstrates a possible state of affairs of out-of-pocket prices for varied pressing care companies. It is essential to keep in mind that these are estimates, and precise prices can differ based mostly in your particular plan and the companies acquired.

| Service | Estimated Value | Deductible Impression | Copay Impression |

|---|---|---|---|

| X-ray | $100 | $50 (if deductible not met) | $15 |

| Prescription | $50 | $0 | $10 |

| Pressing Care Go to (with examination and primary checks) | $250 | $150 (if deductible not met) | $25 |

| Pressing Care Go to (with specialist session) | $400 | $200 (if deductible not met) | $50 |

Understanding the High quality Print

Understanding the high-quality print of your Blue Cross Blue Defend insurance coverage coverage relating to pressing care is essential for guaranteeing you obtain the suitable protection. It helps you keep away from surprises and monetary burdens when looking for care. Fastidiously reviewing these particulars ensures your understanding of what is coated and what’s not.

Significance of Reviewing Coverage High quality Print

Reviewing the coverage’s high-quality print relating to pressing care is crucial to keep away from surprising prices. The particular phrases and circumstances dictate what companies are coated and below what circumstances. This proactive method lets you plan your healthcare expenditures successfully and perceive your monetary tasks.

Typical Clauses Associated to Pressing Care Protection

Insurance coverage insurance policies typically comprise clauses outlining the standards for pressing care protection. These clauses sometimes outline “pressing” conditions, specify the varieties of companies coated, and element the required pre-authorization procedures if crucial. Understanding these clauses is paramount to navigating the insurance coverage system effectively.

Widespread Exclusions or Limitations, Is pressing care coated by insurance coverage blue cross blue protect

Widespread Exclusions: Pressing care visits for pre-existing circumstances, non-emergency conditions, or companies not deemed medically crucial.

Understanding the exclusions is equally essential as understanding what’s coated. Some insurance policies might exclude visits for circumstances that have been current earlier than the insurance coverage protection started. Others might have limitations on non-emergency conditions, like routine check-ups or follow-up appointments that may very well be dealt with by a major care doctor. Moreover, the coverage might solely cowl companies thought of medically crucial by the insurance coverage supplier.

Examples of Restricted or Denied Protection

A coverage may deny protection for an pressing care go to to deal with a chilly, if the coverage defines “pressing” as requiring rapid intervention to stop critical well being dangers. Equally, a pre-existing situation, reminiscent of bronchial asthma, is likely to be excluded from protection if the pressing care go to is said to a flare-up of that situation. In conditions the place a service is just not deemed medically crucial, protection could also be denied, even when the go to was deemed pressing by the attending doctor.

Understanding Pre-Present Situations

Insurance coverage insurance policies typically have particular clauses associated to pre-existing circumstances. These clauses might outline how pre-existing circumstances have an effect on protection for pressing care. It’s important to grasp these provisions intimately, to find out if the pre-existing situation will have an effect on the pressing care go to.

Navigating the Claims Course of

Understanding the claims course of is essential for receiving rightful compensation for pressing care companies coated by your Blue Cross Blue Defend insurance coverage. A well-understood course of ensures a smoother expertise and minimizes potential delays in receiving fee. Understanding the steps concerned, required documentation, and typical processing occasions can drastically help on this course of.The claims course of, whereas seemingly advanced, is designed to make sure correct and environment friendly reimbursement.

Thorough documentation and adherence to the rules Artikeld beneath will allow you to navigate this course of efficiently.

Declare Submitting Course of Overview

The declare course of entails submitting crucial info to Blue Cross Blue Defend for overview and processing. Correct and full submission is significant for well timed processing. This entails gathering required documentation, finishing the declare type, and guaranteeing all info is correct.

Required Documentation for Claims

Submitting correct and full documentation is crucial for processing your declare. This consists of the next:

- A accomplished declare type, precisely crammed out with all crucial particulars, together with the date of service, the kind of service acquired, the supplier’s info, and your insurance coverage info.

- Copies of any medical payments or receipts associated to the pressing care go to. This consists of prices, dates, and a abstract of the companies rendered.

- A replica of your insurance coverage card or coverage particulars. Guarantee the data on the shape and paperwork matches precisely for accuracy.

- If relevant, any pre-authorization or referral types required by your plan.

Typical Declare Processing Timeframe

The processing time for pressing care claims below Blue Cross Blue Defend sometimes ranges from 7 to 21 enterprise days, relying on the complexity of the declare and the provision of all required documentation. In some circumstances, claims might take longer.

Contacting Blue Cross Blue Defend Buyer Service

For inquiries or help with claims, you possibly can contact Blue Cross Blue Defend customer support by means of varied channels. This features a devoted telephone quantity, a web-based portal, or an e-mail deal with. These assets are designed to deal with any questions or considerations throughout the declare course of.

Flowchart of the Declare Submitting Course of

This flowchart Artikels the steps concerned in submitting an pressing care declare with Blue Cross Blue Defend:

- Collect crucial documentation: Gather all required medical payments, receipts, insurance coverage info, and the declare type.

- Full the declare type: Precisely fill out the declare type, guaranteeing all info is full and correct.

- Submit the declare: Submit the finished declare type and all supporting paperwork to Blue Cross Blue Defend by means of the designated methodology.

- Monitor the declare: Monitor the standing of your declare utilizing obtainable monitoring instruments or by contacting customer support.

- Obtain fee: As soon as the declare is authorised, fee will likely be issued in line with the phrases of your plan.

Closure

In conclusion, understanding pressing care protection below Blue Cross Blue Defend insurance coverage is essential for making knowledgeable selections. By inspecting plan particulars, potential prices, and the claims course of, you could be higher ready for any pressing care wants. This information goals to supply readability, so you possibly can confidently method medical conditions, understanding your protection particulars.

FAQ Insights

Does Blue Cross Blue Defend cowl routine check-ups?

Protection for routine check-ups sometimes varies by plan, however typically it is 100% coated.

What are the frequent exclusions for pressing care?

Widespread exclusions embody pressing care visits for pre-existing circumstances, non-emergency conditions, or companies not deemed medically crucial. All the time overview the high-quality print of your coverage.

How lengthy does it sometimes take to course of a declare?

The timeframe for processing claims can fluctuate relying on the particular declare and Blue Cross Blue Defend’s processing occasions. Contacting their customer support is one of the simplest ways to search out out the precise timeline.

What paperwork are wanted for a declare?

The required documentation for claims sometimes consists of the declare type, medical data from the pressing care facility, and proof of fee if relevant.