Low-cost automobile insurance coverage Ontario Canada is a sizzling subject for drivers wanting to economize. Ontario’s insurance coverage market provides numerous choices, however understanding the elements that affect premiums is vital. This information explores the complexities of the market, from frequent coverages to methods for locating inexpensive insurance policies.

Discovering the best automobile insurance coverage in Ontario entails evaluating suppliers, understanding the affect of your driving historical past, and exploring out there reductions. This complete useful resource will equip you with the data wanted to navigate the method and safe the very best deal.

Introduction to Low-cost Automotive Insurance coverage in Ontario, Canada: Low-cost Automotive Insurance coverage Ontario Canada

Securing inexpensive automobile insurance coverage in Ontario, Canada, requires understanding the market dynamics and out there methods. Ontario’s automobile insurance coverage panorama is a posh interaction of things, from driver demographics to car sorts. Navigating these complexities can result in substantial financial savings if approached strategically.Ontario’s automobile insurance coverage market is aggressive, with quite a few suppliers vying for purchasers. Understanding the elements influencing premiums and exploring numerous protection choices are essential for locating one of the best deal.

This consists of recognizing how driving historical past, car sort, and placement all play a major function in figuring out the ultimate value.

Components Influencing Automotive Insurance coverage Premiums in Ontario

A number of elements contribute to the price of automobile insurance coverage in Ontario. These elements immediately affect the danger evaluation performed by insurers. Understanding these parts is crucial to discovering inexpensive choices.

- Driving historical past:

- Site visitors violations and accidents considerably affect premiums. A clear driving report interprets to decrease premiums, whereas a historical past of violations or accidents ends in increased charges.

- Car sort:

- Sure automobiles are inherently riskier to insure than others, resulting in increased premiums. Excessive-performance vehicles, for example, could include increased premiums on account of their potential for extra pricey repairs or accidents.

- Location:

- Geographic location performs a task in insurance coverage premiums. Areas with increased accident charges or increased theft charges typically have increased premiums.

- Age and gender:

- Youthful drivers and male drivers typically face increased premiums in comparison with older drivers and feminine drivers. This is because of perceived increased accident danger in these demographic teams.

Frequent Kinds of Automotive Insurance coverage Protection in Ontario

Ontario’s automobile insurance coverage system provides numerous protection choices. Understanding a lot of these protection is significant for selecting the right coverage on your wants.

- Legal responsibility protection:

- This protects you if you happen to trigger injury to a different particular person’s car or injure one other particular person. It’s necessary in Ontario. It covers the price of damages to the opposite celebration’s property and accidents.

- Collision protection:

- Covers injury to your car in an accident, no matter who’s at fault. That is necessary to contemplate if you wish to shield your car in any sort of accident.

- Complete protection:

- Covers injury to your car from incidents aside from collisions, reminiscent of theft, vandalism, or climate occasions. Complete protection provides a further layer of safety past collision.

- Uninsured/Underinsured Motorist Protection:

- Protects you in case you are concerned in an accident with an uninsured or underinsured driver. This can be a essential layer of safety to contemplate for added peace of thoughts.

Methods for Discovering Reasonably priced Automotive Insurance coverage Choices in Ontario

A number of methods may also help you discover inexpensive automobile insurance coverage in Ontario. These strategies may end up in appreciable financial savings.

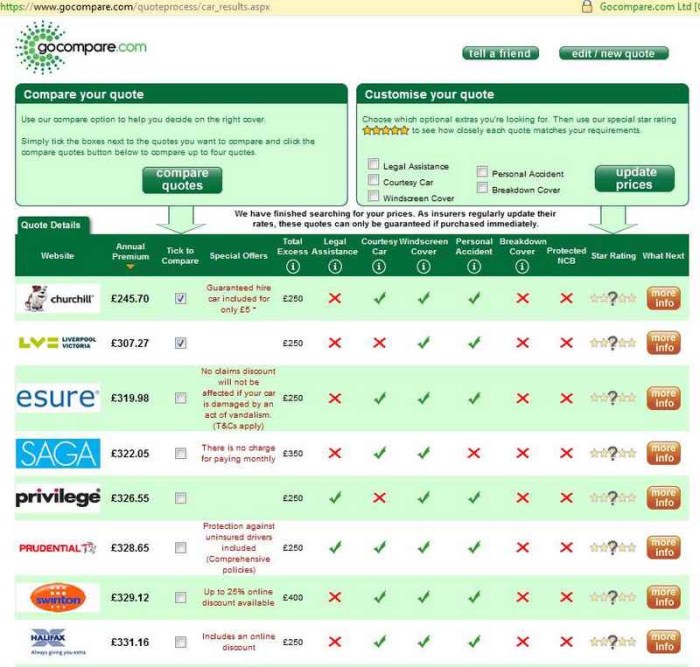

- Examine quotes from a number of suppliers:

- Use on-line comparability instruments to get quotes from numerous insurance coverage corporations. This enables for a complete comparability of value and protection.

- Bundle your insurance coverage:

- Combining your auto insurance coverage with different insurance coverage merchandise, reminiscent of house or life insurance coverage, can typically result in discounted charges.

- Keep a great driving report:

- Avoiding visitors violations and accidents is essential to sustaining a great driving report and consequently a decrease premium.

- Contemplate reductions:

- Many insurance coverage suppliers provide reductions for numerous elements, reminiscent of secure driving, anti-theft units, or good scholar standing. Making the most of these reductions can result in vital financial savings.

Comparability of Insurance coverage Suppliers in Ontario

The next desk supplies a simplified comparability of insurance coverage suppliers in Ontario, highlighting value ranges and protection particulars. This desk is for illustrative functions solely and doesn’t represent a complete comparability. Precise charges and protection differ relying on particular person circumstances.

| Insurance coverage Supplier | Common Value Vary (per yr) | Key Protection Particulars |

|---|---|---|

| Firm A | $1,500 – $2,500 | Aggressive legal responsibility, good collision, and complete protection. Presents reductions for good college students. |

| Firm B | $1,200 – $2,000 | Glorious customer support scores, complete protection, and reductions for bundled insurance coverage. |

| Firm C | $1,800 – $2,800 | Sturdy status for claims dealing with, complete protection, and reductions for anti-theft units. |

Components Affecting Automotive Insurance coverage Premiums in Ontario

Securing inexpensive automobile insurance coverage in Ontario requires understanding the intricate elements influencing premiums. Varied parts, from driving historical past to car traits, play a major function in figuring out the price of your coverage. This part delves into the important thing elements impacting your insurance coverage charges, offering perception into how one can doubtlessly scale back your premiums.

Driving Historical past Influence on Premiums

Driving historical past is a major determinant in automobile insurance coverage premiums. A clear driving report, free from accidents and violations, usually ends in decrease premiums. Conversely, accidents, visitors violations, and even transferring violations considerably improve premiums. Insurance coverage corporations assess the frequency and severity of previous incidents when figuring out a driver’s danger profile. This evaluation immediately impacts the premium charged.

For instance, a driver with a historical past of a number of minor collisions will doubtless face increased premiums in comparison with a driver with no prior incidents.

Car Kind and Mannequin Influence on Premiums

The sort and mannequin of your car considerably have an effect on your automobile insurance coverage premium. Excessive-performance automobiles, luxurious vehicles, and sports activities vehicles usually have increased premiums on account of their elevated danger of theft, injury, or involvement in high-impact accidents. Equally, older fashions, significantly these missing fashionable security options, can result in increased premiums. Insurance coverage corporations use statistical information to find out the danger related to particular car sorts and fashions.

This data is used to set premiums that mirror the potential monetary burden if an accident happens.

Location and Demographics Influence on Premiums

Location and demographics are essential elements influencing automobile insurance coverage premiums in Ontario. Areas with increased charges of accidents or theft, or areas with identified high-risk driving patterns, usually have increased premiums. Equally, demographics like age, gender, and occupation additionally play a task in insurance coverage calculations. Insurance coverage corporations analyse claims information, police reviews, and different related statistics to evaluate the danger profile of particular areas.

Driver Age and Expertise Influence on Premiums

Driver age and expertise immediately affect automobile insurance coverage premiums. Youthful drivers, usually these underneath 25, are thought of higher-risk on account of their lack of expertise and doubtlessly increased chance of accidents. Insurance coverage corporations acknowledge that this age group typically has much less driving expertise and should interact in riskier driving behaviours. Conversely, skilled drivers with an extended driving historical past and a clear report typically qualify for decrease premiums.

This demonstrates how insurance coverage corporations contemplate driving expertise and maturity when calculating premiums.

Premium Variations Primarily based on Driver Profiles

| Driver Profile | Potential Premium Variation | Reasoning |

|---|---|---|

| Younger driver (underneath 25) with a clear driving report, economical car, suburban location | Average | Whereas clear report is optimistic, youth is a danger issue. Location and car sort mitigate a few of this danger. |

| Skilled driver (over 55) with a clear driving report, luxurious car, city location | Excessive | Expertise is a optimistic, however luxurious automobiles and concrete areas typically have increased accident charges. |

| Driver with a historical past of accidents, high-performance car, rural location | Very Excessive | A number of accident historical past considerably will increase danger. Excessive-performance automobiles and rural areas might need distinctive danger elements. |

Evaluating Insurance coverage Suppliers in Ontario

Navigating the Ontario automobile insurance coverage market can really feel like a maze. Quite a few suppliers provide various merchandise and pricing methods. Understanding these variations empowers customers to make knowledgeable choices, in the end securing the very best protection at a aggressive charge. A comparability of key points, from pricing to customer support, helps customers discover the best match for his or her wants.

Pricing Methods of Insurance coverage Suppliers

Totally different insurers make use of numerous pricing fashions. Components reminiscent of driving historical past, car sort, and placement affect premiums. Some suppliers provide reductions for secure driving habits, whereas others emphasize bundled companies like house and auto insurance coverage. Understanding these fashions helps in evaluating provides. As an illustration, an organization that focuses on usage-based insurance coverage could provide decrease premiums for drivers with a confirmed observe report of secure driving.

Conversely, an organization prioritizing bundled packages would possibly appeal to prospects searching for a complete insurance coverage resolution.

Status and Buyer Service

Insurer status and customer support play a crucial function within the decision-making course of. Constructive evaluations and testimonials point out an organization’s dedication to buyer satisfaction. An organization with a historical past of immediate claims processing and useful buyer assist is a major asset. Contemplate evaluations on impartial platforms and testimonials from previous shoppers to guage an organization’s reliability and responsiveness.

For instance, a supplier identified for glorious customer support throughout declare settlements could also be a extra engaging possibility than one with a status for prolonged delays.

Distinctive Protection Choices

Every insurance coverage supplier in Ontario provides a novel suite of protection choices. Some would possibly specialise in particular varieties of automobiles or provide add-ons like roadside help or rental automobile protection. It is important to guage these choices in opposition to particular person wants. For instance, a younger driver would possibly profit from an organization specializing in complete protection for first-time drivers. One other driver would possibly choose for an organization that emphasizes custom-made protection choices to deal with particular dangers related to their way of life.

Claims Dealing with Procedures

Claims dealing with procedures are a crucial facet of the insurance coverage expertise. An organization identified for environment friendly and clear claims processes is crucial. Search for particulars on declare submission strategies, estimated processing instances, and the provision of devoted declare representatives. A immediate and well-managed claims course of generally is a vital benefit when dealing with surprising incidents. This consists of analyzing the insurer’s on-line portals and buyer testimonials concerning the claims course of.

Digital Instruments and Assets

Trendy insurance coverage suppliers typically provide complete digital instruments for coverage administration. On-line portals for coverage entry, fee, and claims reporting can considerably streamline the method. Consider the insurer’s digital platform’s ease of use and accessibility. For instance, an organization that gives a cell app for managing insurance policies and accessing data is a substantial benefit.

Comparability Desk of Insurance coverage Suppliers, Low-cost automobile insurance coverage ontario canada

| Insurance coverage Supplier | Pricing Technique | Status/Buyer Service | Distinctive Protection Choices | Claims Dealing with | Digital Instruments | Strengths | Weaknesses |

|---|---|---|---|---|---|---|---|

| Firm A | Worth-based, reductions for secure driving | Excessive, optimistic buyer evaluations | Complete protection for numerous automobiles | Immediate, environment friendly | Person-friendly cell app | Aggressive pricing, glorious customer support | Restricted distinctive protection choices |

| Firm B | Bundled packages, house and auto | Common, combined evaluations | Specialised protection for luxurious automobiles | Variable, relies on case | Fundamental on-line portal | Aggressive for bundled packages | Inconsistent claims dealing with |

| Firm C | Utilization-based, telematics | Excessive, buyer testimonials | Customization for particular wants | Extremely environment friendly | Superior on-line dashboard | Tailor-made protection, cutting-edge expertise | Potential for increased premiums for high-risk drivers |

Methods for Discovering Reasonably priced Automotive Insurance coverage

Securing inexpensive automobile insurance coverage in Ontario requires proactive methods. Understanding the elements that affect premiums and using comparability instruments and negotiation techniques are essential steps in reaching cost-effective protection. This part particulars confirmed strategies to navigate the insurance coverage market and discover one of the best offers.

Evaluating Quotes from Varied Suppliers

Evaluating quotes from a number of insurance coverage suppliers is crucial for locating the very best charges. Every insurer employs totally different pricing fashions, factoring in numerous standards reminiscent of driving historical past, car sort, and protection decisions. A radical comparability means that you can determine the most suitable choice primarily based in your particular wants and price range.

Significance of Acquiring A number of Quotes

Acquiring a number of quotes is paramount within the quest for inexpensive automobile insurance coverage. A single quote could not mirror probably the most aggressive charge out there available in the market. By gathering quotes from numerous suppliers, you acquire a complete perspective of obtainable choices and might make an knowledgeable determination. As an illustration, a driver with a clear driving report would possibly discover considerably totally different charges from insurer to insurer.

Utilizing On-line Comparability Instruments for Automotive Insurance coverage

On-line comparability instruments provide a streamlined method to acquiring quotes from a number of insurers. These instruments mixture quotes from numerous suppliers, permitting you to rapidly examine charges and determine potential financial savings. They typically incorporate superior search filters that allow you to refine your search primarily based on particular standards like protection choices and deductible quantities. This eliminates the necessity for handbook quote gathering, saving you worthwhile effort and time.

Advantages of Bundling Insurance coverage Merchandise

Bundling insurance coverage merchandise, reminiscent of house and automobile insurance coverage with the identical supplier, can regularly result in discounted charges. Insurers typically provide bundled reductions to reward prospects who consolidate their insurance coverage wants. This technique not solely simplifies administration but additionally supplies potential price financial savings. For instance, a home-owner who additionally owns a automobile may even see a diminished total premium by bundling each insurance policies.

Recommendations on Negotiating Insurance coverage Premiums

Negotiating insurance coverage premiums generally is a viable technique for securing a greater charge. Be ready to debate your driving report, car particulars, and desired protection ranges. If doable, discover reductions supplied by the insurer, like secure driving incentives or reductions for good scholar standing. Understanding the elements that affect premiums may also help you successfully negotiate and doubtlessly scale back your total insurance coverage prices.

Steps to Discover Reasonably priced Insurance coverage

| Step | Motion |

|---|---|

| 1 | Collect crucial data (driving report, car particulars, desired protection). |

| 2 | Use on-line comparability instruments to acquire quotes from a number of insurers. |

| 3 | Examine quotes fastidiously, contemplating all points of protection and pricing. |

| 4 | Contemplate bundling insurance coverage merchandise to doubtlessly scale back total premiums. |

| 5 | Actively search out out there reductions, and if doable, negotiate for a greater charge. |

| 6 | Select the insurance coverage supplier and coverage that greatest meets your wants and price range. |

Reductions and Advantages for Ontario Drivers

Ontario drivers can leverage numerous reductions and advantages to scale back their automobile insurance coverage premiums. Understanding these choices can considerably affect the price of your protection. This part particulars the out there reductions, highlighting how they’ll prevent cash.

Protected Driver Reductions

Ontario’s insurance coverage suppliers typically reward secure driving habits. These reductions incentivize accountable driving behaviors and mirror the decrease danger related to drivers who preserve a clear driving report. Particular standards for these reductions differ by supplier, however usually contain a sure interval of accident-free driving. Some insurance coverage corporations could provide reductions for drivers who take part in defensive driving programs or have accomplished driver security coaching applications.

Reductions for College students, Seniors, and Different Demographics

Particular demographics typically qualify for reductions. Scholar drivers, for example, could obtain decrease premiums on account of their perceived increased danger in comparison with established drivers. Seniors can also qualify for reductions on account of their usually decrease accident charges. Different demographic reductions, like these for particular professions or those that dwell in sure areas, may be present in some insurance policies.

These reductions differ relying on the insurance coverage supplier and the particular circumstances.

Reductions for Particular Car Sorts or Security Options

Car sort and security options play a task in figuring out insurance coverage premiums. As an illustration, automobiles with superior security options, reminiscent of airbags or anti-lock brakes, would possibly qualify for reductions. Likewise, sure car sorts, reminiscent of electrical automobiles, could have decrease insurance coverage premiums on account of their decrease danger of accidents. This can be a complicated space and the specifics of the low cost differ significantly.

Driver Coaching Applications and Insurance coverage Prices

Collaborating in driver coaching applications can typically result in decrease insurance coverage premiums. Finishing these applications demonstrates a dedication to secure driving practices, and insurance coverage suppliers regularly reward this dedication. Many applications present licensed coaching that teaches defensive driving strategies, bettering total driving abilities. This, in flip, typically ends in a discount in accident charges and insurance coverage prices.

Insurance coverage Suppliers Identified for Providing Vital Reductions

A number of insurance coverage suppliers in Ontario are identified for providing a variety of considerable reductions. These embrace corporations with established reputations for customer support and aggressive pricing. The particular reductions supplied could differ relying on particular person circumstances and driving historical past. Direct comparability of various suppliers is essential to maximise financial savings.

Abstract Desk of Reductions

| Insurance coverage Supplier | Protected Driver Low cost | Scholar Low cost | Senior Low cost | Security Characteristic Low cost |

|---|---|---|---|---|

| Firm A | As much as 15% | 10% | 5% | As much as 10% |

| Firm B | As much as 12% | 8% | 4% | As much as 8% |

| Firm C | As much as 10% | 7% | 3% | As much as 5% |

Be aware: Reductions are examples and should differ primarily based on particular person circumstances. All the time affirm with the insurance coverage supplier for particular particulars and eligibility.

Understanding Ontario’s Insurance coverage Laws

Navigating the complexities of automobile insurance coverage in Ontario requires a agency understanding of the regulatory framework. This information empowers you to make knowledgeable choices, making certain you are compliant and ready for any eventualities. Ontario’s system, whereas complete, is designed to guard each drivers and the general public.Ontario’s regulatory framework for automobile insurance coverage is powerful and detailed, making certain honest practices and standardized protection throughout the province.

The framework is designed to advertise accountability, transparency, and shopper safety inside the insurance coverage business.

Regulatory Framework Governing Automotive Insurance coverage

The Ministry of the Legal professional Normal, particularly its Insurance coverage Department, oversees the insurance coverage business in Ontario. This department enforces the rules set forth by the provincial authorities, making certain that insurance coverage corporations adjust to the established requirements. The rules cowl all the pieces from coverage phrases to say dealing with procedures. The target is to create a system the place customers obtain the protection they want, and insurance coverage corporations function with integrity.

Position of the Insurance coverage Bureau of Canada (IBC) in Ontario

The Insurance coverage Bureau of Canada (IBC) performs an important function within the Ontario insurance coverage panorama. The IBC acts as a voice for the insurance coverage business, offering business information and analysis to tell the federal government and the general public. In Ontario, the IBC works with the federal government to deal with points and considerations associated to insurance coverage services. Additionally they present instructional supplies to assist customers perceive their rights and duties.

The IBC is a major stakeholder within the province’s insurance coverage regulatory system.

Obligatory Protection Necessities

Ontario mandates particular varieties of protection for all automobiles. This consists of legal responsibility insurance coverage, which covers damages you trigger to others in an accident. Collision protection is one other key requirement, defending your car if it is broken in an accident, no matter who was at fault. Complete protection supplies additional safety in opposition to non-collision injury to your car. Understanding these necessary protection sorts is significant for accountable driving.

Submitting a Declare in Ontario

Submitting a declare in Ontario usually entails a number of steps. First, you will need to report the accident to the police if required by regulation. Then, you need to collect all related documentation, together with your insurance coverage coverage particulars, police report (if relevant), and restore estimates. Subsequent, you need to notify your insurance coverage firm instantly, offering all of the required data. Thorough documentation and immediate communication are essential within the declare course of.

Dispute Decision Mechanisms

Ontario supplies avenues for resolving disputes associated to insurance coverage claims. Mediation is commonly a primary step, the place a impartial third celebration helps each events attain an settlement. Arbitration is another choice, the place a panel of arbitrators makes a binding determination. Litigation is a closing recourse if mediation or arbitration fail to resolve the problem. Understanding these choices is vital to navigating potential disagreements.

Important Laws and Procedures for Insurance coverage Claims

| Regulation/Process | Particulars |

|---|---|

| Obligatory Protection | Legal responsibility, collision, and complete protection are required. |

| Accident Reporting | Report accidents to the police when required. |

| Declare Documentation | Collect coverage particulars, police report (if relevant), and restore estimates. |

| Declare Notification | Notify your insurance coverage firm instantly. |

| Dispute Decision | Mediation, arbitration, and litigation can be found choices. |

| Time Limits | Claims should be filed inside an inexpensive timeframe as Artikeld by the insurer. |

Illustrative Case Research

Navigating the intricate panorama of Ontario automobile insurance coverage may be difficult. Understanding how numerous elements affect premiums and methods to leverage out there reductions is vital to securing inexpensive protection. This part presents illustrative case research to light up these ideas, showcasing real-world eventualities and quantifiable price financial savings.Ontario’s automobile insurance coverage market provides numerous choices and insurance policies, catering to numerous driving profiles and desires.

The examples beneath reveal how particular decisions can affect premium prices, highlighting the importance of correct evaluation and proactive measures in reaching optimum protection.

Decreasing Prices By means of Protected Driving Practices

Drivers with a clear driving report and a historical past of secure driving habits typically get pleasure from decrease premiums. Constant secure driving practices, reminiscent of avoiding dashing tickets and sustaining a great driving report, contribute considerably to price reductions.

- A driver with a clear report for 5 years, avoiding any at-fault accidents or transferring violations, can count on a major discount of their insurance coverage premiums in comparison with a driver with a latest accident or visitors violations.

- Drivers who take part in defensive driving programs can typically obtain a reduction on their premiums, demonstrating a dedication to secure driving strategies and doubtlessly lowering the danger of accidents.

Influence of Car Kind and Options

The kind of car and its security options immediately have an effect on insurance coverage premiums. Autos with superior security applied sciences, reminiscent of airbags and anti-lock brakes, are sometimes related to decrease premiums.

- A driver proudly owning a more moderen, fuel-efficient car with superior security options, like computerized emergency braking, will doubtless pay lower than a driver proudly owning an older, much less fuel-efficient car with out these options.

- Using anti-theft units can additional scale back premiums, reflecting the decreased danger of auto theft or injury. As an illustration, a automobile outfitted with an alarm system and monitoring system will doubtless have a decrease premium in comparison with a automobile with out such security measures.

Affect of Deductible Decisions

Drivers can alter their premiums by deciding on totally different deductibles. A better deductible usually ends in decrease premiums, whereas a decrease deductible implies a better premium.

- A driver choosing a better deductible, reminiscent of $1,000, will expertise a decrease premium in comparison with a driver choosing a decrease deductible, reminiscent of $500. The upper deductible represents a larger monetary duty for the motive force within the occasion of a declare, which is mirrored within the decrease premium.

- Understanding the trade-offs between deductible quantity and premium price is essential for optimum insurance coverage planning.

Case Research and Financial savings

| Case Research | Components Influencing Premium | Estimated Value Financial savings |

|---|---|---|

| Driver A: Clear Document, Protected Driving | 5 years accident-free, defensive driving course | $200-$400 per yr |

| Driver B: Newer Car with Security Options | New automobile with superior security options, anti-theft system | $150-$350 per yr |

| Driver C: Increased Deductible | Elevated deductible from $500 to $1000 | $50-$150 per yr |

Be aware: Estimated financial savings differ primarily based on particular person circumstances and insurance coverage supplier.

Claims Dealing with Course of

The claims dealing with course of varies amongst insurance coverage suppliers. Understanding the procedures and timelines related to every supplier may also help drivers navigate claims effectively.

- Insurance coverage suppliers typically have on-line portals for submitting claims, monitoring progress, and accessing declare standing data. This facilitates streamlined communication and effectivity.

- Immediate and efficient communication between the motive force and the insurance coverage supplier is crucial all through the claims dealing with course of.

Remaining Conclusion

In conclusion, securing low cost automobile insurance coverage in Ontario Canada requires cautious consideration of assorted elements. By understanding the nuances of the market, evaluating suppliers, and figuring out out there reductions, drivers can considerably scale back their insurance coverage prices. Keep in mind to prioritize acquiring a number of quotes and leveraging comparability instruments to make knowledgeable choices.

FAQ Nook

What are the frequent varieties of automobile insurance coverage protection in Ontario?

Frequent coverages embrace legal responsibility, collision, complete, and uninsured/underinsured motorist safety. Legal responsibility covers damages you trigger to others, whereas collision and complete cowl injury to your individual car no matter who’s at fault. Uninsured/underinsured motorist safety is essential if somebody with out insurance coverage causes an accident.

How can I examine quotes from totally different insurance coverage suppliers?

Use on-line comparability instruments to get quotes from a number of suppliers concurrently. These instruments typically consider your driving historical past, car particulars, and placement to offer personalised estimates. Do not hesitate to contact insurers immediately for additional particulars or to ask particular questions.

What reductions can be found for Ontario drivers?

Reductions typically embrace these for secure driving data, college students, seniors, particular car sorts, or security options. Some insurers additionally provide reductions for bundling your own home and auto insurance coverage.

What are the important rules governing automobile insurance coverage in Ontario?

Ontario’s insurance coverage rules mandate particular coverages, and the Insurance coverage Bureau of Canada performs a major function in overseeing these necessities. Drivers should adjust to these rules to keep up their insurance coverage protection.