Is long run care insurance coverage advantages taxable – Is long-term care insurance coverage advantages taxable? Navigating the complexities of long-term care insurance coverage and its tax implications can really feel daunting. This exploration delves into the intricacies of this important subject, shedding mild on the potential tax advantages and liabilities related to these important insurance policies. From understanding protection choices to deciphering tax guidelines, we intention to empower you with the data wanted to make knowledgeable choices about your monetary future.

Lengthy-term care insurance coverage is designed to offer important help throughout a interval of prolonged care wants. Understanding the tax implications of premiums paid and advantages acquired is paramount. This information will assist you to make clear your rights and obligations on this necessary space. This complete information gives an in depth overview of long-term care insurance coverage and its taxation. It covers every part from premium deductions to the tax remedy of assorted advantages, together with in-home care, assisted dwelling, and different related providers.

Defining Lengthy-Time period Care Insurance coverage Advantages: Is Lengthy Time period Care Insurance coverage Advantages Taxable

Lengthy-term care insurance coverage gives monetary safety in opposition to the substantial prices related to extended caregiving wants. These insurance policies intention to offset bills incurred as people require help with actions of day by day dwelling (ADLs) or instrumental actions of day by day dwelling (IADLs). Understanding the nuances of protection is essential for people searching for to mitigate the monetary pressure of long-term care.Lengthy-term care insurance coverage insurance policies provide various levels of protection, from primary help with day by day duties to complete care in specialised services.

Coverage advantages are usually triggered when an insured particular person meets particular standards associated to purposeful limitations, demonstrating a necessity for ongoing care past the scope of short-term help.

Protection Choices

Lengthy-term care insurance coverage insurance policies ceaselessly provide completely different protection choices, catering to various wants and monetary conditions. These choices could embody particular advantages for in-home care, assisted dwelling services, or expert nursing services. Particular person coverage buildings decide the kinds and ranges of care included.

Kinds of Lengthy-Time period Care Companies Coated

Insurance policies usually cowl a spread of providers designed to help people requiring help with day by day actions. This encompasses private care duties resembling bathing, dressing, and transferring, in addition to managing medicines and family chores. Insurance policies might also embody protection for specialised therapies, resembling bodily, occupational, or speech remedy, if these providers are deemed medically essential for sustaining or bettering the insured’s well being and well-being.

Methods Lengthy-Time period Care Insurance coverage Advantages Can Be Used, Is long run care insurance coverage advantages taxable

Lengthy-term care insurance coverage advantages will be utilized in numerous settings to offer complete care. These settings can embody in-home care providers supplied by nurses, aides, or different caregivers, assisted dwelling services providing a supportive atmosphere with various ranges of help, and expert nursing services providing intensive medical care. Insurance policies usually element particular necessities and situations for using these choices, guaranteeing that advantages are directed towards acceptable care settings.

Typical Bills Coated by Lengthy-Time period Care Insurance coverage

| Expense Class | Description |

|---|---|

| In-home care | Bills for caregivers offering help with private care, medicine administration, and family duties. |

| Assisted dwelling services | Prices related to residence and care in services providing various ranges of help, together with help with actions of day by day dwelling. |

| Expert nursing services | Bills for complete medical care and expert nursing providers in services offering intensive care. |

| Medical provides and tools | Prices associated to sturdy medical tools, mobility aids, and different assistive units. |

| Respite care | Quick-term caregiving providers permitting main caregivers to relaxation and recuperate. |

Insurance policies range within the particular bills coated and the reimbursement quantities. It’s important to rigorously evaluate the coverage’s phrases and situations to grasp the complete extent of protection.

Tax Implications of Lengthy-Time period Care Insurance coverage

Lengthy-term care insurance coverage premiums and advantages usually have advanced tax implications, considerably affecting policyholders’ monetary planning. Understanding these implications is essential for making knowledgeable choices relating to insurance coverage protection and optimizing monetary outcomes. This part delves into the tax remedy of premiums and advantages, contemplating numerous eventualities and varieties of protection.

Tax Therapy of Premiums Paid

Premiums paid for long-term care insurance coverage are usually not tax deductible, much like different varieties of insurance coverage. Nevertheless, there are exceptions. Tax deductions for premiums are contingent on the precise circumstances of the policyholder and their earnings.

- Deductibility in Sure Circumstances: In restricted circumstances, premiums could also be deductible. For instance, if the policyholder is self-employed and the premiums are thought of a enterprise expense, or if the policyholder is eligible for a particular tax credit score or deduction underneath relevant rules, these premiums is likely to be deductible. Additional, sure states could have particular legal guidelines associated to deductibility. It’s important to seek the advice of with a certified tax advisor to find out eligibility.

Tax Implications of Receiving Lengthy-Time period Care Advantages

Lengthy-term care advantages acquired from a coverage are usually tax-free, much like different varieties of insurance coverage advantages that cowl medical bills. This can be a essential facet to grasp for people planning their retirement and long-term monetary safety.

- Taxation of Advantages: The receipt of long-term care advantages is often not taxable earnings. Nevertheless, the precise tax implications rely upon the character of the profit. Some advantages could also be topic to particular tax guidelines or necessities, resembling sure reimbursements or different monetary preparations associated to the advantages. Policyholders ought to seek the advice of with a certified tax skilled for steering.

Variations in Tax Therapy for Numerous Kinds of Advantages

Several types of long-term care insurance coverage advantages could have various tax remedies. As an illustration, advantages acquired for custodial care, resembling help with day by day actions, could also be handled in another way from advantages acquired for expert nursing care.

- Categorization of Advantages: The character of the care acquired, whether or not it is custodial or expert nursing care, performs a major function within the tax remedy. Several types of advantages usually have particular rules governing their tax implications.

Comparability to Different Insurance coverage Advantages

The tax remedy of long-term care insurance coverage advantages usually contrasts with that of different varieties of insurance coverage, resembling medical insurance. Whereas medical insurance premiums are usually not deductible, long-term care premiums could have exceptions underneath particular circumstances.

- Distinct Therapy: The tax remedy of long-term care insurance coverage differs from medical insurance in that the premiums will not be usually deductible, though exceptions exist. The advantages acquired from long-term care insurance policies are usually tax-free, contrasting with potential tax implications related to medical insurance reimbursements or different advantages.

Tax Deductions for Lengthy-Time period Care Insurance coverage Premiums

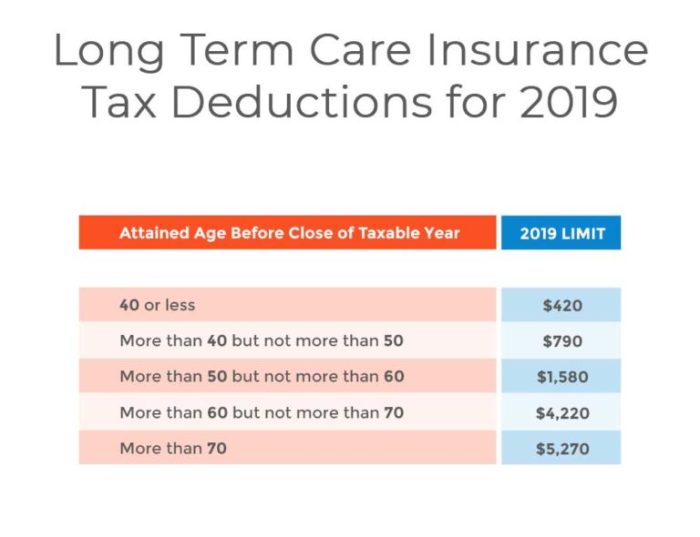

The next desk illustrates potential tax deductions for long-term care insurance coverage premiums, contemplating completely different eventualities and earnings ranges. It’s essential to notice that this isn’t an exhaustive checklist, and particular conditions could have completely different implications. Tax legal guidelines are topic to vary. Seek the advice of with a tax skilled for customized recommendation.

| State of affairs | Earnings Degree | Potential Tax Deduction |

|---|---|---|

| Self-employed particular person | $50,000 – $100,000 | Probably deductible as a enterprise expense |

| Worker with medical insurance | $75,000 – $150,000 | Not usually deductible |

| Excessive-income particular person with important property | Over $200,000 | Restricted deductibility, topic to particular rules |

Taxability of Lengthy-Time period Care Advantages

Lengthy-term care insurance coverage advantages, whereas supposed to offer essential monetary help in periods of prolonged care, will not be all the time exempt from taxation. The taxability of those advantages hinges on the precise nature of the advantages acquired and the person’s circumstances. Understanding the intricacies of tax implications is important for beneficiaries to precisely assess the web worth of their long-term care insurance coverage insurance policies.

Conditions The place Lengthy-Time period Care Advantages Are Taxable

Lengthy-term care insurance coverage advantages are usually taxable when they’re thought of to be fee for providers or reimbursement for bills incurred. That is in distinction to conditions the place the advantages are solely for private wants or bills, resembling a lump-sum payout for a pre-existing situation. Taxability usually arises when the advantages cowl providers or bills instantly associated to the recipient’s care, and never merely the substitute of misplaced earnings.

Particular Circumstances Resulting in Taxability

A number of particular circumstances can result in the taxability of long-term care advantages. These embody, however will not be restricted to, conditions the place the advantages cowl expert nursing facility care, residence well being aides, or different skilled care providers. Moreover, if the advantages are used to compensate for bills that may in any other case be deductible as medical bills, they’re usually deemed taxable earnings.

Crucially, advantages acquired in trade for a service, resembling a caregiver’s wage, will likely be thought of taxable.

Tax Charges Relevant to Lengthy-Time period Care Advantages

The tax charges relevant to long-term care advantages are per the recipient’s general tax bracket. The recipient’s taxable earnings, together with some other earnings sources, is used to find out the relevant tax charge. That is per common earnings tax ideas. Lengthy-term care advantages will not be topic to particular tax charges.

Elements Influencing the Taxability of Lengthy-Time period Care Advantages

A number of elements affect the taxability of long-term care advantages. The kind of care coated by the advantages, the precise provisions of the insurance coverage coverage, and the recipient’s general monetary state of affairs are essential concerns. The character of the providers supplied, the quantity of bills coated, and the fee technique used can all affect the tax remedy of the advantages.

Categorization of Taxable Lengthy-Time period Care Advantages

| Circumstance | Taxability | Rationalization |

|---|---|---|

| Advantages used for expert nursing facility care | Typically Taxable | These advantages usually cowl bills that may in any other case be deductible medical bills. |

| Advantages used for residence well being aides | Typically Taxable | Funds to residence well being aides are thought of compensation for providers rendered. |

| Advantages used for custodial care | Doubtlessly Taxable | The taxability of advantages for custodial care is determined by the precise coverage and the character of the care. |

| Advantages used to exchange misplaced earnings | Typically Taxable | These advantages are sometimes thought of an alternative to misplaced earnings and thus taxable. |

| Advantages used to cowl bills that may in any other case be deductible | Typically Taxable | If the advantages are used to pay for bills that may in any other case be deductible medical bills, they’re usually thought of taxable earnings. |

Deductibility of Lengthy-Time period Care Bills

Lengthy-term care bills will be important monetary burdens for people and households. Understanding the circumstances underneath which these bills are deductible is essential for managing tax liabilities and guaranteeing acceptable monetary planning. This part delves into the precise guidelines and rules governing the deductibility of long-term care bills, outlining eligible varieties of bills, calculation strategies, and offering illustrative examples.

Circumstances for Deductibility

The deductibility of long-term care bills is ruled by particular statutory provisions and rules. These provisions usually stipulate that bills are deductible solely underneath sure situations, resembling the character of the care acquired, the person’s well being standing, and the kind of care supplier.

Kinds of Deductible Lengthy-Time period Care Bills

A wide range of bills associated to long-term care providers could also be deductible. These bills usually embody these incurred for skilled medical care, such because the providers of nurses, bodily therapists, and occupational therapists, in addition to associated provides and tools. The bills should be instantly associated to the supply of long-term care providers and should be cheap in quantity.

Additional, prices for residence modifications to accommodate long-term care wants might also qualify for deductions in sure conditions.

Calculation of Deductible Quantities

The calculation of deductible long-term care bills usually includes particular guidelines and limitations. Deductible quantities are usually restricted by a share of the taxpayer’s adjusted gross earnings or by different prescribed limits. Moreover, any bills exceeding these limitations will not be deductible. The exact calculation technique depends on the precise statutory provisions and rules in impact.

Examples of Deductible and Non-Deductible Bills

Illustrative examples can make clear the standards for deductibility. Bills for expert nursing care supplied in a licensed facility are usually deductible, supplied they meet the necessities. Conversely, bills for routine private care providers, resembling assist with dressing or bathing, are usually not deductible. Bills for luxurious lodging or providers unrelated to the supply of long-term care are additionally not deductible.

Standards for Deducting Lengthy-Time period Care Bills

| Standards | Qualifying Bills | Non-Qualifying Bills |

|---|---|---|

| Nature of Care | Bills for expert nursing care, bodily remedy, occupational remedy | Bills for routine private care, housekeeping |

| Supplier Standing | Bills for care supplied by licensed professionals | Bills for care supplied by untrained people |

| Relationship to Lengthy-Time period Care | Bills for medical tools and residential modifications essential for long-term care | Bills for common family repairs or upgrades |

| Affordable Quantities | Bills for medically essential care at cheap prices | Bills for extravagant or pointless care |

Word: This desk gives a common overview. Seek the advice of with a certified tax skilled for customized recommendation relating to particular conditions.

Particular Situations and Concerns

The tax implications of long-term care insurance coverage advantages are multifaceted and rely upon numerous particular person circumstances. Understanding these nuances is essential for people to precisely assess the monetary affect of those advantages. This part delves into particular eventualities, highlighting the interaction between earnings ranges, employment standing, state residency, and the supply of the advantages themselves.

Tax Implications for Various Earnings Ranges

The taxability of long-term care advantages is instantly tied to the recipient’s general earnings. Increased earnings ranges usually lead to a better portion of the advantages being topic to taxation. That is because of the progressive nature of the tax system, the place increased earners pay a bigger share of their earnings in taxes. For instance, a person within the highest tax bracket would possibly discover a considerably bigger portion of their long-term care advantages taxed in comparison with somebody with a a lot decrease earnings.

Tax Therapy for Self-Employed People

Self-employed people face distinctive tax concerns relating to long-term care advantages. As a result of self-employed people usually have extra advanced tax conditions, together with self-employment taxes, the taxation of long-term care advantages should be analyzed inside the context of their whole tax image. These people should rigorously account for the potential tax implications of each the advantages acquired and any deductions associated to the premiums they paid.

As an illustration, if the premiums are thought of a enterprise expense, the tax deduction will scale back the general tax burden.

Tax Implications Primarily based on State Residency

State-level tax legal guidelines can affect the taxability of long-term care advantages. Totally different states have various tax charges and buildings. This may increasingly have an effect on how a lot of the advantages are topic to state earnings taxes. For instance, a state with the next state earnings tax charge would possibly result in a bigger portion of the advantages being taxed on the state degree.

Cautious consideration of the recipient’s state of residence is important in calculating the whole tax legal responsibility.

Taxation of Employer-Sponsored Plan Advantages

Employer-sponsored long-term care insurance coverage can provide important tax benefits. In lots of circumstances, premiums paid by the employer are usually not thought of taxable earnings for the worker. Conversely, the advantages acquired are usually tax-free if they’re used for certified long-term care providers. This creates a good tax atmosphere for workers collaborating in such plans. Additional, the employer’s contribution could also be tax-deductible, impacting the general monetary image of the corporate.

Tax Implications for Particular Well being Circumstances

The tax remedy of long-term care advantages could range based mostly on the recipient’s particular well being situation. For people with pre-existing situations, the calculation of the advantages is likely to be barely completely different. For instance, if a pre-existing situation considerably impacts the recipient’s potential to work, this would possibly have an effect on the tax implications.

Desk: Impression of Earnings Degree on Taxability of Lengthy-Time period Care Advantages

| Earnings Degree | Tax Implications |

|---|---|

| Low | A smaller portion of the advantages is often taxable, or doubtlessly no portion is taxed, as a result of decrease general tax bracket. |

| Center | A average portion of the advantages is likely to be topic to taxation, relying on the precise tax charges and brackets relevant to the person. |

| Excessive | A bigger portion of the advantages will probably be taxable because of the increased tax brackets. |

Illustrative Examples

Lengthy-term care insurance coverage premiums and advantages are topic to advanced tax guidelines, various considerably relying on particular person circumstances and particular coverage provisions. These illustrations exhibit the sensible software of those guidelines throughout numerous conditions, highlighting the nuances of tax remedy in long-term care insurance coverage.

Premium Cost Tax Implications

Premiums paid for long-term care insurance coverage are usually not deductible as an itemized expense for federal earnings tax functions. This implies the premiums paid are thought of private bills and don’t scale back taxable earnings. Nevertheless, sure conditions could provide exceptions. As an illustration, some employers could provide long-term care insurance coverage as a profit, and the premiums paid by way of the employer-sponsored plan may not be taxable to the worker.

Taxation of Lengthy-Time period Care Advantages

Lengthy-term care advantages acquired from an insurance coverage coverage are usually taxable as abnormal earnings. This implies the recipient might want to report the profit quantity on their earnings tax return, and will probably be topic to straightforward earnings tax charges. The precise quantity included within the recipient’s gross earnings will range in accordance with the phrases of the coverage and relevant rules.

Deductibility of Lengthy-Time period Care Bills

In sure conditions, long-term care bills could also be deductible. These bills usually come up when people pay for care outdoors of their insurance coverage protection, and a few circumstances allow a deduction for these bills as itemized deductions. Examples embody medical bills exceeding a sure share of adjusted gross earnings.

Taxation of Lengthy-Time period Care Advantages for Self-Employed People

Self-employed people face distinctive tax concerns relating to long-term care insurance coverage. Premiums paid for self-employed people are usually not deductible as a enterprise expense. Nevertheless, the self-employed particular person could possibly deduct the premiums paid as a enterprise expense underneath sure circumstances, resembling when the insurance coverage is taken into account a essential enterprise expense to help the enterprise proprietor’s well being.

The self-employed particular person’s advantages acquired could be taxed as abnormal earnings.

Variability in Tax Therapy Primarily based on State Legal guidelines

State legal guidelines can affect the tax remedy of long-term care advantages. For instance, some states could provide particular deductions or credit for long-term care bills, whereas others could not. The presence or absence of such state-level provisions can affect the general tax burden on people receiving long-term care advantages.

Comparability of Tax Implications Throughout Profit Sources

| Profit Supply | Tax Therapy of Premiums | Tax Therapy of Advantages |

|---|---|---|

| Personal Lengthy-Time period Care Insurance coverage | Typically not deductible | Taxed as abnormal earnings |

| Employer-Sponsored Lengthy-Time period Care Insurance coverage | Could or is probably not taxable to the worker | Taxed as abnormal earnings |

| Authorities Packages (e.g., Medicaid) | Not relevant | Typically not taxable, relying on the precise program and profit |

This desk illustrates the overall tax implications related to long-term care advantages from completely different sources. The precise tax remedy will rely upon the precise coverage, plan, and relevant rules. People ought to seek the advice of with a certified tax skilled for customized recommendation.

Illustrative Instance: Premium Funds

A single particular person, Jane Doe, pays $2,500 yearly in premiums for a long-term care insurance coverage coverage. This quantity just isn’t deductible as an itemized expense for federal earnings tax functions.

Illustrative Instance: Advantages Acquired

Mr. Smith receives $4,000 per 30 days in long-term care advantages from his insurance coverage coverage. This quantity is taken into account abnormal earnings and is topic to federal and doubtlessly state earnings tax.

Illustrative Instance: Deductible Bills

A retired particular person, Ms. Brown, incurs $10,000 in long-term care bills in a 12 months. If these bills exceed a sure share of her adjusted gross earnings, a portion of those bills is likely to be deductible as itemized medical bills.

Illustrative Instance: Self-Employed Particular person

A self-employed contractor, Mr. Jones, pays $3,000 in premiums for a long-term care insurance coverage coverage. On this state of affairs, the premiums will not be deductible as a enterprise expense except the insurance coverage is deemed a essential enterprise expense. Any advantages acquired could be taxed as abnormal earnings.

Illustrative Instance: State Variations

A resident of State X receives long-term care advantages and experiences a distinct tax remedy in comparison with a resident of State Y. State X would possibly provide a tax credit score for long-term care bills, whereas State Y doesn’t. This demonstrates the variation in tax implications throughout completely different jurisdictions.

Epilogue

In conclusion, understanding the tax implications of long-term care insurance coverage is important for making knowledgeable monetary choices. The tax remedy of premiums, advantages, and bills varies considerably based mostly on particular person circumstances, earnings ranges, and state rules. We have explored the nuances of this subject, highlighting the important thing elements influencing taxability and offering a complete overview. This information goals to empower you to navigate these advanced concerns, guaranteeing you’re well-equipped to guard your monetary well-being in periods of prolonged care.

FAQ Useful resource

Are premiums paid for long-term care insurance coverage tax deductible?

In some circumstances, premiums paid for long-term care insurance coverage could also be tax-deductible. Particular guidelines and rules relating to deductibility range based mostly on particular person earnings ranges and different elements.

What varieties of long-term care providers are usually coated?

Protection choices usually embody in-home care, assisted dwelling services, and expert nursing care. Particular providers range relying on the coverage.

How do state legal guidelines affect the tax remedy of long-term care advantages?

State legal guidelines can have an effect on the taxability of long-term care advantages. There could also be variations within the tax implications relying on the state of residence.

Can long-term care bills be deductible?

Sure long-term care bills could also be deductible, however eligibility is topic to particular guidelines and rules. Detailed pointers and particular examples will likely be supplied within the complete information.